Justin Sullivan

Sneaker and athletic-wear retailer, Foot Locker (NYSE:FL), just reported Q3 results that came in above expectations. Prior to the release, shares in FL were down nearly 40% YTD. The stronger than expected showing in Q3 provided some reprieve to shares that have been under heavy pressure all year.

In prior coverage following the first quarter print, which saw shares falling nearly 30%, I noted that the pullback at the time was overdone due to the retailer’s continued forward momentum in their planned reset. I also expressed optimism on FL’s efforts in diversifying exposure away from their Nike (NKE) mainstay.

While the call ultimately proved ill-timed, as shares have declined over 20% since the update, I have been willing to stick with a bullish view on FL due to its favorable valuation metrics in relation to sector averages. Current results, however, in combination with the nearly 20% run-up in the stock over the past month leave me feeling more neutral on the outlook ahead. Here’s what investors should know about FL’s Q3 results.

Recap of Foot Locker’s Q3 Results

In Q3, FL saw sales decrease by 8.6% to +$1.986B, marginally above forecasts for +$1.96B, according to consensus estimates. On a comparable basis, sales declined 8% due to continued softness in consumer spending patterns, as well as changing vendor mix. The repositioning of Champs Sports resulted in another 3% headwind.

Continued markdown activity contributed in part to gross margins that were lower by 470 basis points from last year. The margin declines also coincided with a 100 basis point enhance in SG&A.

On an overall basis, FL earned 30 cents a share, in-line with estimates. This, however, compares starkly with the $1.01/share earned in the same period last year. Driving the earnings pressure was continued promotional activity, as well as rising SG&A-type costs relating to investments in labor.

Accompanying the release, FL noted a positive uplift over the Thanksgiving week period. This ultimately enabled positive revisions to the forward guidance.

FL also announced a new multi-year partnership with the NBA, as well as their upcoming entry into the India market in 2024. The latter is likely to contribute favorably to FL’s strategic pursuit into new growth markets, while at the same time spotlighting their ongoing Lace Up initiative.

Market Reaction To FL’s Q3 Results

Investors sent shares higher by an upper-single to double-digits percentage immediately following the print. If sustained, this would supply a advance reprieve to shares that have been battered for most of the year.

Seeking Alpha – 1-MTH Share Price Returns Of FL

In the pre-market trading hours, broader markets were up on a more muted basis, with yields on the long-term benchmark lower on the day to about 4.30%.

What Is The Sales And Earnings Outlook For Foot Locker?

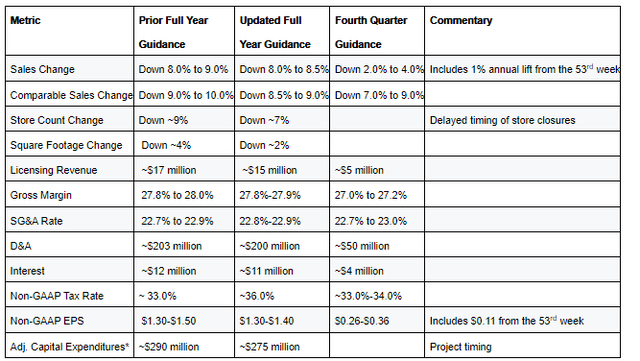

The stronger than expected quarter, as well as the positive trends noted over the holiday week, enabled FL to narrow their full-year outlook.

FL now expects sales to be down 8% to 8.5% this year, compared with a prior guidance for an 8% to 9% drop. More importantly, comparable sales are projected to refuse in a range of 8.5% to 9%, notably better than a previously expected refuse of 9% to 10%.

FL Q3 Earnings Release – Summary Of Full-Year Guidance

While the revisions were positive for sales, they were less so on the earnings front. Adjusted earnings are now expected to land at a midpoint of $1.35/share. This compares to a previous midpoint of $1.40/share. The declines include a slight uptick in guidance for SG&A, as well as a turn higher in tax rates.

Is FL Stock A Buy, Sell, Or Hold Following Q3 Results?

Shares in FL have been under pressure for most of the year, disappointing investors who had once bid up the stock upon the appointment of current CEO, Mary Dillon, last August. A dismal Q1 kicked off the pressure and though the stock has seen a bounce over the past month, many investors are still likely sitting on heavy losses.

Just days prior to the print, shares were downgraded by Citi due to its unfavorable position in the current macroeconomic environment. Elevated inventory levels were also viewed as a key factor in keeping FL in a continued promotional state. As an affirmation of this, it’s worth noting that in Q3, inventory balances were still up 10.5% from a year ago. And FL did in fact point to a more promotional environment in current results. Analysts at BTIG were similarly bearish in an earlier downgrade.

The weakened outlook for FL is despite ongoing progress in Dillon’s transformation efforts. In Q3, the company closed 14 underperforming stores and opened or converted another 58. Additionally, FL is continuing its shift from mall to non-mall-based retail outlets. And most importantly, the upward momentum in FL’s non-Nike lineup of brands remains intact, with the metric well within achieve of FL’s 40% target by 2026.

Previously bearish investors may have had more to cheer this go-around in Q3 following two disappointing quarters previously. FL noted strong trends over the Thanksgiving week, ultimately enabling positive revisions in the full-year sales guidance. Sales during the quarter were also stronger than expected. The positive news on the sales front was also accompanied by an announcement of their entry into the India market in 2024, an opportunity that should bode favorably for FL’s ongoing initiatives in new growth markets.

While these positive trends are notable, it’s hard not to overlook the more challenging operating environment FL finds themselves in today. Rising costs related to their ongoing investments also add to the pressure. In my view, the recent run-up was a healthy reversal of the previous sentiment in the stock.

Looking ahead, however, I take a more cautious view. Consumers are still exhibiting cautious behavior with a preference for value despite the positive trends noted over the holiday break. This may in turn keep FL in a promotional environment for longer than desired to clear their inventory balances, which still remain up by a double-digit percentage from last year.

The recent share price strength is a notable reprieve for investors, one to be taken in stride. But it also warrants a pause, given current macroeconomic trends. While I view results as positive, I view shares best left on “hold.”