PeopleImages

What is infinite? The universe and the greed of men.”― Leigh Bardugo

Today, we put a small fintech concern called OppFi Inc. (NYSE:OPFI) in the spotlight for the first time. The stock of this deeply Busted IPO has been range bound for quite some time and the company reported Q3 results this week. The shares appear cheap on several basic valuation metrics. An analysis follows below.

Seeking Alpha

Company Overview:

This small cap concern is based in Chicago, IL. The company provides and operates a financial technology platform that provides the ability to offer lending products. These include OppLoans, an installment loan product; SalaryTap, a payroll deduction secured installment loan product; and OppFi Card, a credit card product. The stock currently trades just under $2.50 a share and sports an approximate market capitalization of $270 million.

November Company Overview

The company serves the ‘underserved‘ with it loan offerings. The company’s products are innovative and can provide borrowers with the flexibility of structured repayments as well as utilizing payroll deduction as security for installment loans.

Third Quarter Results:

November Company Presentation

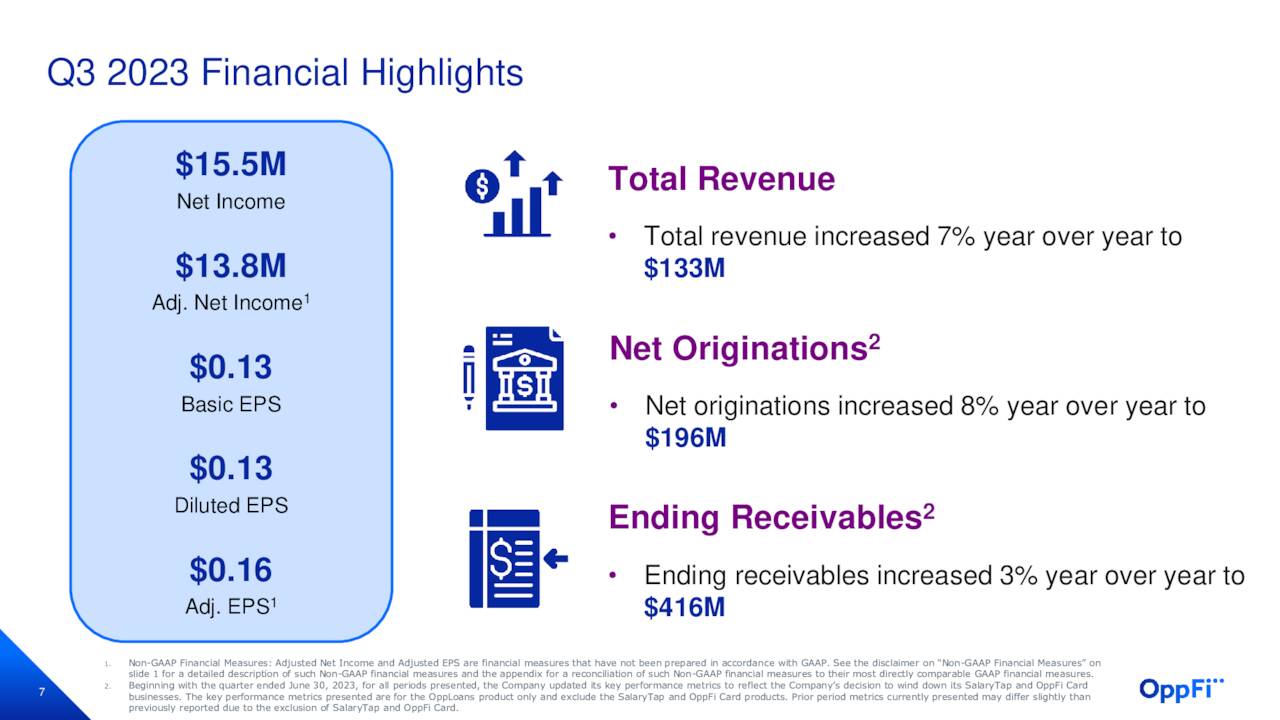

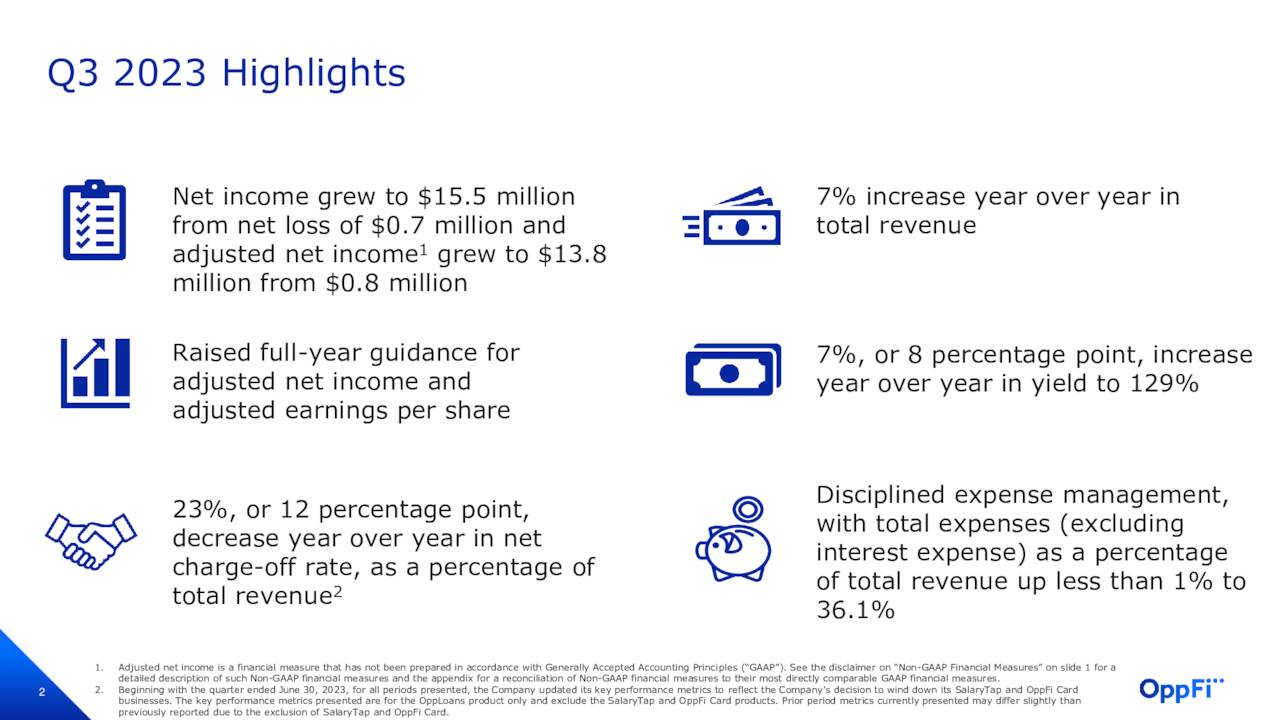

Oppfi, Inc. reported its third quarter numbers on November 9th. The company delivered 16 cents of non-GAAP earnings per share as revenues rose just over seven percent on a year-over-year basis to $133.2 million. Both top and bottom-line results were comfortably above consensus estimates. Impressively, the net charge-off rate as a percentage of total revenue decreased 23% from the same period a year ago to 42% for the quarter. Default rates did increase 410bps from the same period a year ago.

November Company Presentation

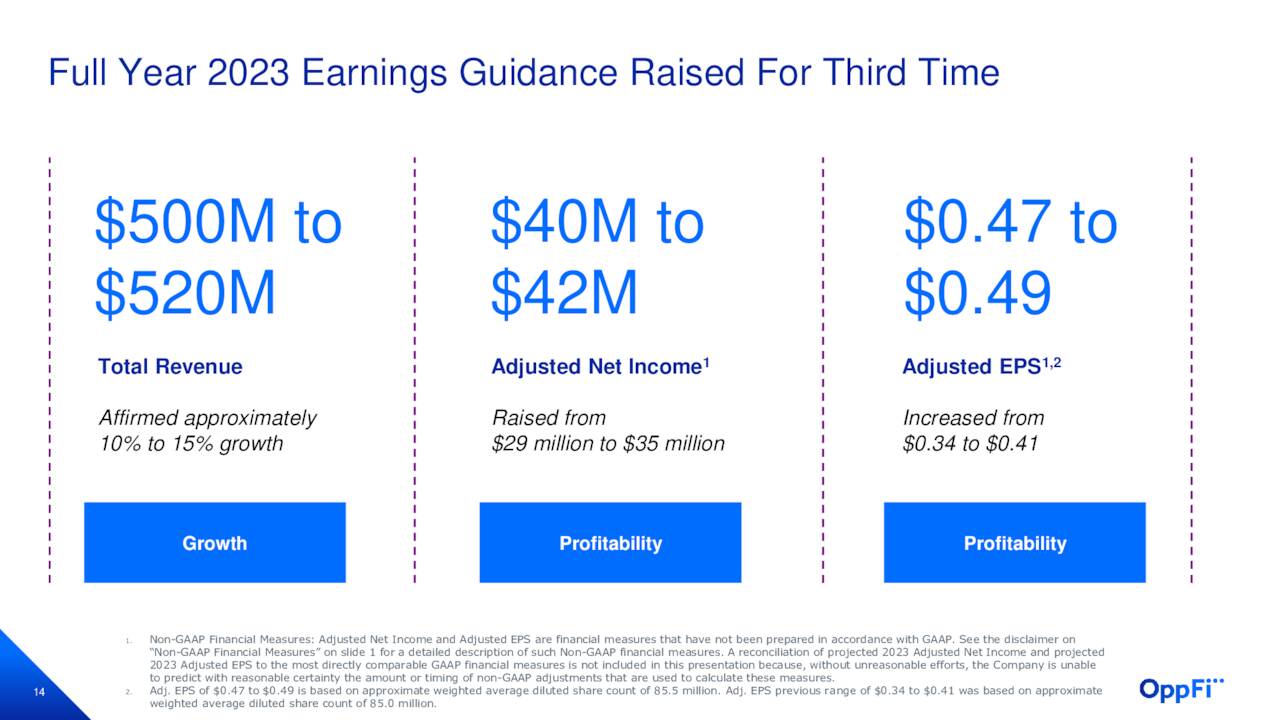

Leadership reaffirmed FY2023 revenue guidance of between $500 to $520 million. Management also boosted its FY2023 for adjusted net income to $40 million to $42 million from $29 million to $35 million previously. This translated in new adjusted EPS projections of 47 to 49 cents a share for this fiscal year from 34 to 41 cents a share previously.

November Company Presentation

Analyst Commentary & Balance Sheet:

Since third quarter results hit this week, both JMP Securities ($3.25 price target) and Northland Securities ($5 price target) have reissued Buy ratings on the stock.

Just over four percent of the outstanding float in the shares are currently held short. Numerous insiders made small purchases between May and June of this year totaling approximately $300,000 collectively. That has been the only insider activity in the shares so far in 2023.

November Company Presentation

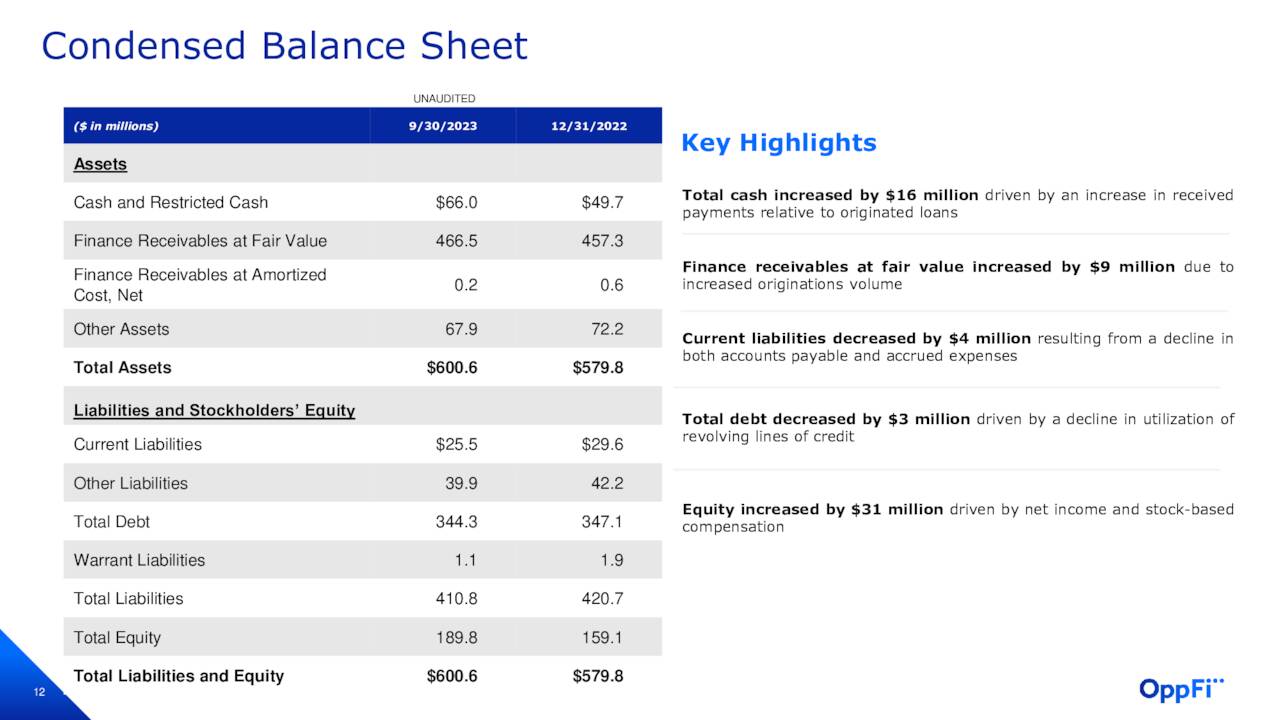

The company ended the third quarter with just over $65 million worth of cash and marketable securities on its balance sheet against just under $345 million in total debt. Operations provided just over $16 million worth of cash flow in the third quarter.

November Company Presentation

Verdict:

OppFi Inc. made six cents a share of profit in FY2022 on just less than $453 million worth of sales. The current analysis firm consensus has the company earning 39 cents a share on just over $510 million worth of revenue in FY2023 followed by EPS of 50 cents in FY2024 on sales growth in the mid-teens.

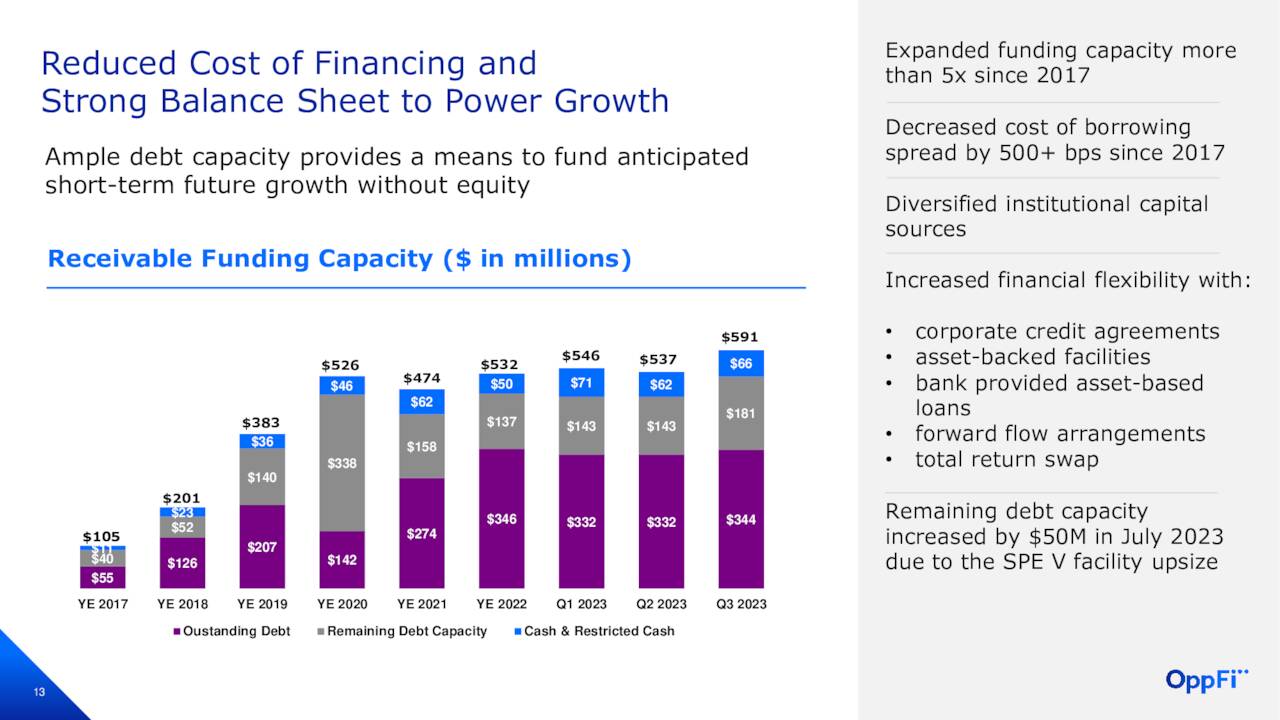

OPFI seems dirt cheap at just under seven times projected forward earnings given its current growth trajectory. The stock also goes for approximately 50% of forward revenues. The problem for a completely bullish stance on the shares is twofold. First, the company does own a good slug of debt. OppFi’s interest expense and amortized debt issuance costs came in at just over $12 million in the third quarter.

The second is the deterioration of the health of the American consumer. This is a topic I have covered frequently since the spring, most recently in an article entitled The Consumer Is Starting To Buckle. The excess savings built up during the pandemic and its aftermath have now been burned through. Consumers are increasingly turning to high interest credit cards to finance their spending. Credit card debt grew $154 billion in the third quarter on a year-over-year basis. This is the largest annual growth this century and took credit debt to an all-time high of $1.08 trillion and Americans paid a record $130 billion in credit card interest over the past 12 months.

Not surprisingly, default rates are rising for all types of consumer debt and are higher on auto loans than during the Great Financial Crisis. It is hard to see the company repeat the improvement in charge off rates it saw in the third quarter given its customer base is made up largely of the 62% of Americans that are living paycheck to paycheck according to recent surveys.

Therefore, given OPFI’s growth and valuation, it probably deserves a small ‘watch item‘ holding but nothing more than that despite the stock’s cheap valuation.

I wondered if children ought to have heroes at all. The men and women we worship are as flawed as the men and women we don’t.”― Eddy L. Harris