Volatility has been the name of the game on Wall Street for more than three years. Investors enjoyed a period of euphoria in 2021 that was fueled by historically low interest rates and fiscal stimulus. They’ve also navigated two bear markets (2020 and 2022).

When uncertainty picks up, investors of all walks have a tendency to gravitate to profitable, time-tested, industry-leading businesses. Over the past decade, the FAANG stocks have answered investors’ call.

Image source: Getty Images.

When I say “FAANG stocks,” I’m referring to:

- Facebook, which is now a subsidiary of Meta Platforms (META 1.20%)

- Apple (AAPL -0.52%)

- Amazon (AMZN 0.38%)

- Netflix (NFLX 1.80%)

- Google, which is now a subsidiary of Alphabet (GOOGL 1.26%) (GOOG 1.39%)

What makes the FAANGs so special is their well-defined competitive advantages and/or seemingly impenetrable moats.

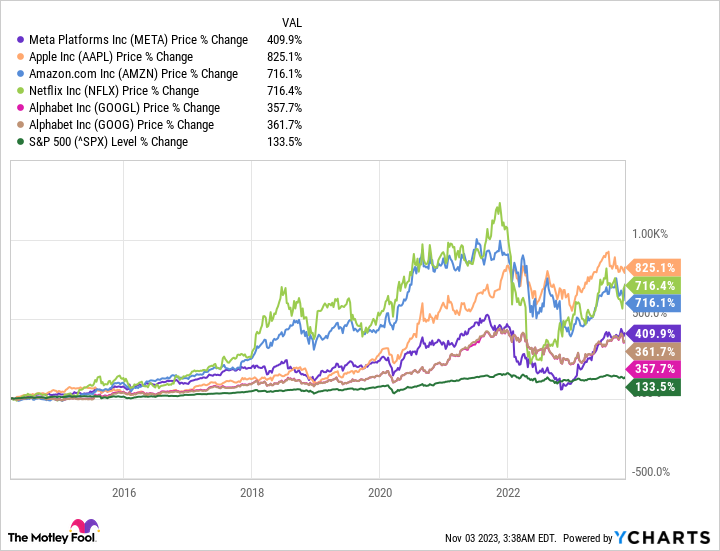

In addition to well-defined competitive edges, the FAANG stocks are outperformers. Over the trailing 10-year period, the benchmark S&P 500 has advanced by a healthy 134%. Comparatively, the worst performer among the FAANGs is a 359% gain for Alphabet’s Class A shares (GOOGL).

But just because these industry leaders are outperformers, it doesn’t mean their outlooks are identical. As we push into November, one FAANG stock stands out as a no-brainer buy, while another is historically expensive and worth avoiding.

The FAANG stock that’s a no-brainer buy in November: Amazon

While buying any of the FAANGs has been a winning proposition for years, e-commerce company Amazon offers a particularly intriguing value proposition in November (and beyond).

The primary reason shares of Amazon have been pressured over the past two years is the growing expectation of a recession in the United States. Most people are familiar with Amazon because of its world-leading online marketplace. If an economic downturn were to take shape, it’s likely that consumers would pare back their discretionary spending. The result would be a decline in online retail sales.

But the interesting thing about Amazon is that its highest-revenue segment (its online marketplace) isn’t all that important when it comes to cash flow generation. With Amazon’s management team focused on reinvesting its cash flow into high-growth initiatives, it’s three of the company’s ancillary operating segments that are responsible for generating the bulk of its cash flow.

The most important of these ancillary segments is Amazon Web Services (AWS). Estimates from tech analysis firm Canalys suggest AWS accounts for 30% of global cloud infrastructure service spending. Although skeptics have pointed to a slowdown in growth for AWS in recent quarters, keep in mind that enterprise cloud spending is still in its early innings. Despite accounting for only a sixth of Amazon’s net sales, AWS frequently generates 50% to 100% of the company’s operating income.

Subscription services is another key cog for Amazon. The company surpassed 200 million global Prime subscribers in April 2021 and has likely built on this figure since gaining the exclusive rights for Thursday Night Football. In exchange for some minor perks, such as free two-day shipping, Amazon maintains exceptional pricing power over its Prime subscribers, and it keeps subscribers loyal to its ecosystem of products and services.

The third ancillary segment of importance is advertising services. Amazon regularly attracts more than 2 billion visitors to its site each month, which makes it a go-to for merchants and gives the company exceptional ad-pricing power.

Collectively, these three segments are expected to more than triple Amazon’s cash flow per share from a reported $4.59 in 2022 to an estimated $15.26 by 2026. Amazon stock was regularly valued at 23 to 37 times year-end cash flow from 2010 through 2019, which means its current multiple of 12.4 times forward-year cash flow is historically cheap and makes the stock a no-brainer buy.

Image source: Apple.

The FAANG stock to avoid like the plague in November: Apple

However, there’s another side to this coin. While Amazon has the tools and intangibles that make it a phenomenal buy in November, tech stock Apple is giving investors multiple reasons to keep their distance and avoid it like the plague.

Before digging into the details, I want to give Apple credit where credit is due. It didn’t become the largest publicly traded company by accident. It’s the largest company because it generates a boatload of operating cash flow, absolutely dominates the U.S. smartphone market, and has led with its innovation for more than a decade.

Over the long run, Apple’s greatest growth opportunity looks to be its evolution as a platforms company. CEO Tim Cook is overseeing this ongoing transition, which should lead to improved customer loyalty, higher operating margin, and more consistent revenue recognition during key iPhone upgrade cycles.

But it’s not all peaches and cream for the largest publicly traded company in the United States.

Three weeks ago, estimates from Counterpoint Research showed that sales of the all-new iPhone 15 were lagging in China. This important overseas market for Apple showed double-digit declines in unit sales of the high-margin Pro Max and Pro in the 17 days following their launch. A roughly $2 billion shortfall in China sales in Apple’s fourth-quarter operating results adds further fuel to the fire that its core physical product isn’t performing well in a key market.

Of course, it’s not just China that’s a problem for Apple. With the worst of the COVID-19 pandemic being put into the rearview mirror and uncertainties about U.S. economic growth taking shape, all of Apple’s physical products — iPhone, Mac, and iPad — endured sales declines in fiscal 2023 (ended Sept. 30, 2023).

The investment thesis with Apple has long hinged on its innovation driving low-double-digit growth. However, Apple has reported four consecutive quarterly sales declines, to go along with virtually flat year-over-year earnings per share (EPS). If Apple were valued at, say, 15 times forward-year earnings with declining sales and flat year-over-year EPS, I doubt anyone would bat an eye. But with Apple trading at 27 times forward-year earnings, it’s about as pricey as it’s been over the past decade.

Furthermore, rapidly rising interest rates take away Apple’s access to cheap capital. Aside from potentially reducing innovation, higher interest rates make it unlikely that Apple will borrow capital to facilitate buybacks. Fewer buybacks may provide less of a boost to Apple’s EPS.

Apple is a solidly profitable company, but it makes for a terrible investment, in my view, at the moment.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Sean Williams has positions in Alphabet, Amazon, and Meta Platforms. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, and Netflix. The Motley Fool has a disclosure policy.