Stuart C. Wilson/Getty Images Entertainment

Above: The great Harrison Ford is over 80, Indy is a fading memory to young generations. This diminishes the value of this once great IP.

Paramount Global (NASDAQ:PARA):

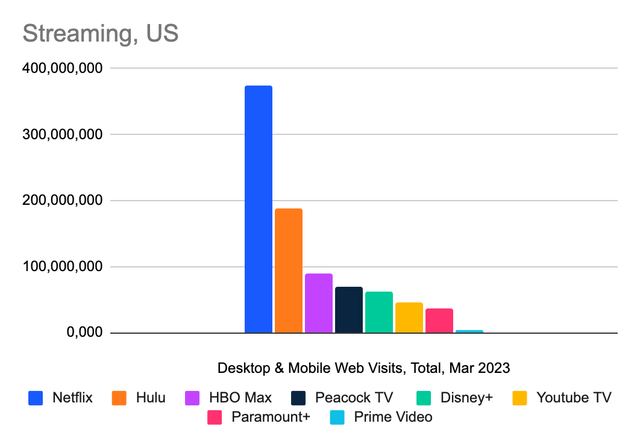

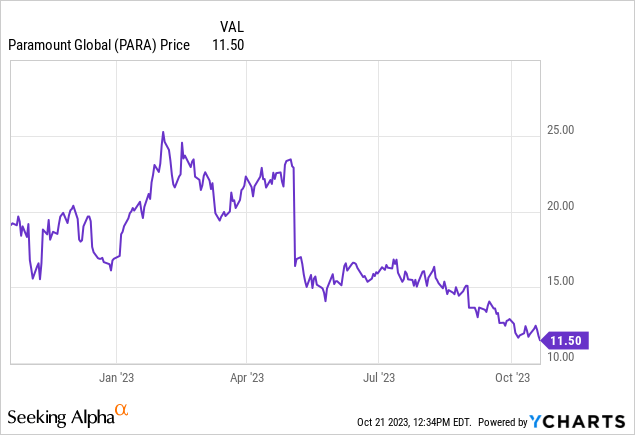

High around January 20, 2023: $24.60, stock has lost over 50% in less than a year. Dividend exit a problem, lingering debt load, and bleeding along with the sector in DTC streaming.

52-week range: $11.39-$25.93

Consensus PT: $16.35

Earnings release: Nov 2. Our take, flat or slight miss ~$0.04.

“It has become cheaper to look for oil on the floor of the New York Stock Exchange than in the ground…”

T. Boone Pickens

If you read the few bullish outlooks on Paramount Global on SA or most anywhere else, you are bound to confront the list of IP gems housed in its jewelry case as supportive evidence that the company and its stock are undervalued. At a bit over $11 a share, you are told here’s the merchandise you are buying: CBS, Showtime, the venerable library of Paramount Pictures, Nickelodeon, Comedy Central, BET, Paramount+, Pluto.

Taken apart in terms of our current chaos in entertainment, here’s a closer appraisal of their IP IMHO:

CBS: Linear woes in ad sales, lagging audiences, just ok programs diminishing news ratings.

Showtime: Excellent quality but still a caddy for HBO to be frank. Probably overvalued.

Paramount Pictures: Amazing 100-year old film library sparkling with gems we all know and love. But even the penultimate masterpiece, The Godfather, it must be noted, was released in 1972 – that’s fifty years ago. How many millennials today can quote why Lucca Brasi sleeps with the fishes. Or, “I’m gonna make him an offer he can’t refuse….” But ask any Gen Zer to name Taylor Swift’s top hit and you’ll get the answers in seconds.

Nickelodeon: Do kids leave their video games long enough to take an occasional peek at content from a TV network that sparked to life in 1979? The answer appears to indicate that viewership decline for that channel continues.

Comedy Central: Tik Tok and X have funnier ticklers for today’s audiences than a succession of standup comics whose avatars you can catch in your neighborhood comedy club.

BET: African-Americans no longer need to shop shows in their long established ethnic TV boutique. Mainstream TV has in effect become a BET super store through a good deal of the broadcast day with heavy programming of shows featuring black actor and themes.

Paramount Plus: No need to elaborate here – along with its streaming peers, it’s a hemophilic love child.

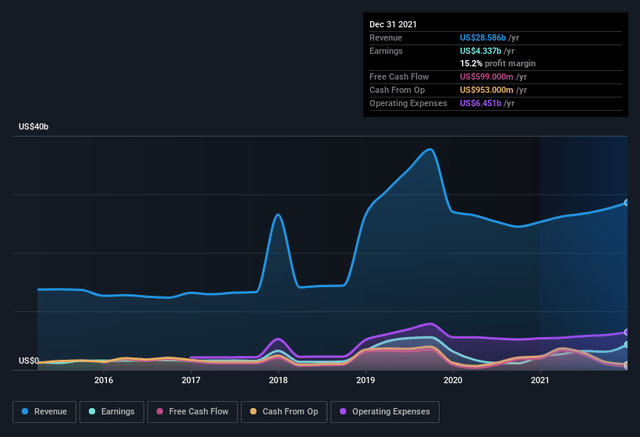

Above: $931m a year in debt service cost. Makes better sense to sell it all at a reasonable price and give investors a rationale to hold.

Pluto: Could be an omen of what’s to come as the final resting place for streaming TV services: low subscription rates, ad supported, nice but not spectacular programming, and perhaps an answer as to how to make money in the sector.

The IP real world value calculation for PARA

As we moved through our analysis of PARA, it occurred to us that the biggest single metric of all that could well entice a potential buyer like content thin Apple (AAPL). That is a real world approach to valuing its IP. Not in terms of what it was, but what it will be moving ahead into the late 2020s and beyond. It seems to us to be something of a fool’s errand to project the value of PARA IP forward, given its aged out origins. It shares that dilemma with all major streamers.

Above: FCF projected trends down, making debt retirement and ever difficult goal to achieve a solid basis for PARA’s future.

Example: The gem Indiana Jones and Raiders of the Lost Ark was released to well-deserved oohs and ahhs in 1981. Its subsequent sequels did nicely but has shown evidence of erosion since. The key point here is this: The demo of the audience that loved the movie probably sprang from people born as early as the late 1930s with movie serial and comic book fandom and as late as the 1970s.

These are people who were ranging in age from childhood, to teens in 1981. Those audiences are now middle aged to elderly. They don’t go to movies in large numbers anymore. Indy is all about nostalgia for them now. What counts in a valuation of an IP’s value to a potential buyer is appeal to audiences born from the late eighties through the nineties and early 2000s. They bring very little pop culture Indy love context to aged out IP. But they lined up big time for Taylor Swift’s concert movie.

With this in mind, we attempted to apply a metric analysis to valuing PARA IP forward over the next decade. We began adapting the DCF method popular for putting future valuation of a stock five years forward, factoring in the realities of age and demos. The goal, reaching a terminal value for the stock – key to any potential buyer of PARA to come.

Our formulae was structured this way: Total current value based on revenue generated over the past five years from demos widely agreed as representative of today’s audiences and age groups. As best as we were able to access audience data, we broke it down by age and demos to derive the percentage contributions to revenues by each key audience.

We then took data from the demo breakdown of current audiences projecting the younger spectrum of audience groups as being the most likely consumers of that IP in the decade ahead. We don’t wish to subject readers to a lengthy MEGO exercise on how the formulae played out. And we readily confess that analysts and investment bankers adept at discovering flaws in such pursuits could have a field day challenging my results.

Bear in mind, our objective was to open a possible new field of thinking to really value forward IP. We believe that much of the analysis we have read from bullish takes makes erroneous assumptions about forward IP values without really knowing how audiences will be constituted in the out years. If you were a bottom fishing buyer of PARA, it would seem to me that valuing the stock must begin with real world expectations as to the forward lifetime value of PARA IP repurposed a half century or even later.

Estimated book value of PARA at writing: $21b; ex of goodwill, it comes down to $4.5b. Most of that springs from how a potential buyer will value the IP component. My analysis – stipulated as imperfect – arrived at discounted value of its IP at 35% less than many bankers have assumed in their calculations of PARA value to a possible bargain bin buyer.

The discount I arrived at entirely springs from what I project as audience composition in the out years. This is an audience that I found bears little resemblance to those of the time when the IP debuted and forward to the present. The audiences ahead are highly unpredictable – I recognize that.

However, certain characteristics are already evident as to what they appear to like, how much they are prepared to spend, etc.

My point being: Analysts who value PARA IP based on past performance only cannot accurately project audience behavior ten years hence as bearing any resemblance to today. Nor can I of course. But my goal is to set the challenge for bankers to present potential buyers with real world-age and demo sensitive forecasts and value the IP in a transaction that would make sense to a possible buyer.

PARA Realty

PARA continues to hold presumably gold plated realty. In Manhattan they own the CBS broadcast center, The Cloud Center on Long Island, the LA studio complex. In normal times, under the long established hyper-value assumptions about New York realty, it would be possible to project a value of such high demand realty. Some bankers we spoke to believe that the PARA realty package is probably worth as much as $2b above what it is carried from on the books. That number doesn’t mean as much as it might have pre-Covid.

The massive disruption to the daily population of office occupants caused by the work from home movement has changed the paradigm of New York real estate values forever. At this point it is estimated that perhaps 45% of office workers in New York have returned to their cubicles. That may trickle up going forward, but not much. Add to that the rising crime rates, homeless encampments, inflationary pressures on transportation, restaurant prices, shop lifting raids and other chaos mentality inducing events tells us that working in Manhattan simply no longer has the glossy appeal it once had for masses of office workers.

PARA also owns its studio facilities in LA, which are vast and very much reflecting the bustling movie factory it once was. With movie production now transformed into a mix of tech applications like CGI and more and more AI, we must question the value of a brick and mortar studio complex going forward.

Our brief here is not imply that PARA realty is vastly overvalued. It is all well-maintained, in good locations. The point here is similar to that we’ve made on PARA IP: On a forward basis, how do you make the case that it may be undervalued by $2b? It’s tough to work out. I tried and failed.

PARA debt

While it appears to be chump change compared with peers like Disney (DIS) and Warner Bros. Discovery (WBD), it is still a massive burden for the company at $15,5b. Its 2022 debt service cost was $931m averaged at 5.09% producing a current ratio (mrq) of 1.17. I believe PARA should be able to produce an unimpressive but steady debt reduction over the next five years. PARA may well eke out a string of decent earnings going forward but in my view not enough to make exponential leaps in performance that could trigger a major upside move for the stock. It is in our view, dead pooled until a serious buyer shows up to get Shari’s attention.

In brief, PARA is capable of hanging in, but not making quantum leaps in valuations that would justify opening a position even at what is clearly a cheap entry point here. Instead, I see an ongoing waiting game for investors. The only reason to hold the shares would be the growing prospects that a bottom fishing buyer with a flint-eyed appraisal of its IP, realty and future integration into its own portfolio makes an offer that Shari considers reflects her own estimates of value.

Such a price may represent a bridge too far for the natural buyers. However, if Shari could get a better real world grasp on her expectations and put out a sale price that included assumption of debt and the realty, she could well find a deal sooner than later. This in my view is a bottom fisher deal at somewhere between $15.85 and $17.00 at best.

Meanwhile at best it’s a hold with a hope.