bin kontan

Dear subscribers,

Generally speaking, when something yields 10%+, you’re well-served to stay away from it, or at the very least be very aware of what you’re getting into if you put money to work in such an investment. Highwoods Properties (NYSE:HIW), which currently yields almost 10.2%, is no different from any other company that sees this development.

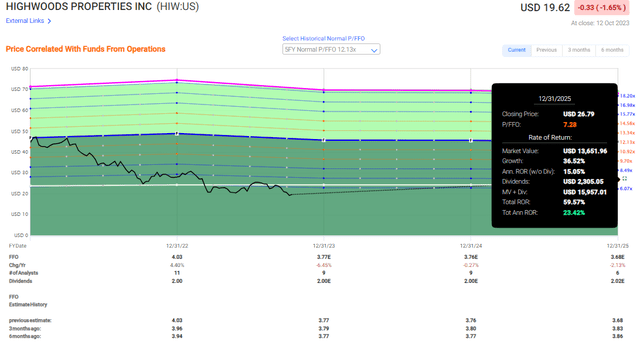

The company has, going from 2016-2018 been trading at a very strong premium of over 13-14x P/FFO, which for this type of office REIT is interesting. That premium has evaporated, leaving Highwoods, like many other office REITs to trade “down” quite a bit. By quite a bit I mean that this REIT, which is BBB rated and with some advantages that I intend to get into and show to you, is now trading close to 5x P/FFO, which is something that I would generally expect from a much less safe company.

The decline we’ve seen for Highwoods, does not, as I see, reflect its underlying qualities. I’ve said before that the office sell-off is overdone. I reiterate this stance as of this article – strongly. However, you need to be careful as to what exactly you buy in the sector, because buying “anything” isn’t a good idea.

But buying some things, that are above-average in quality, is definitely a good idea, provided your investment goals line up with what the company offers and what you need to be ready for.

Highwoods Properties remains a “BUY” on fundamentals.

Highwoods remains a REIT I have long been in. Not only do I remain long, but I remain a buyer of Highwoods shares at this time.

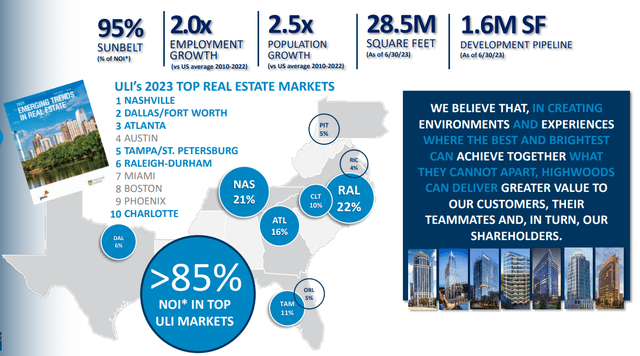

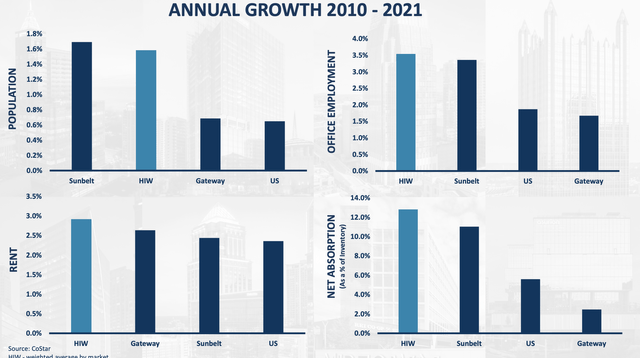

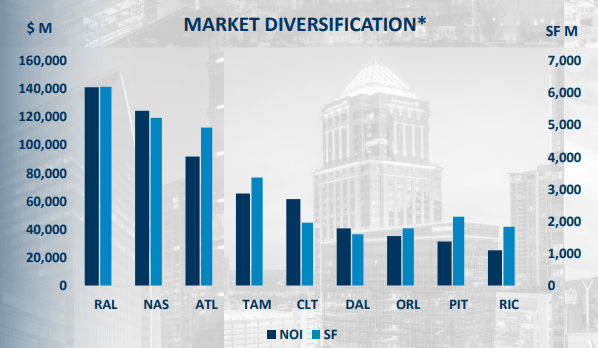

Highwoods Properties remains a REIT with an interesting geographical exposure for its properties – meaning it primarily focuses on the attractive southeast with exposure in areas like Nashville, Atlanta, Raleigh, Tampa, and Orlando, which together account for around 80% of the company’s overall geographic mix of properties. This also means, secondarily, that it focuses on some of the absolutely strongest real estate markets in the entire nation – five out of the ten largest, in fact, if we go by 2022 numbers.

Highwoods IR (Highwood IR)

Highwoods has a market cap of almost $2B and the yield of 10.2% that’s currently being offered is not only well-covered on the basis of FFO, it’s well-covered on the basis of forward FFO. At around $2/share in dividend, with an annual FFO of around $3.77/share (that’s the impaired estimate at a 6% decline for 2023E), or $3.68 which is the impaired 2025E estimate, this still leaves the company with ample dividend safety at current FFO levels.

Are these likely, or are we talking somewhat too-positive numbers or estimates?

I do not think that we are.

The latest results, 2Q23, confirm Highwoods’ overall stability in the larger sense. The main argument against Highwoods here is that in the current market environment, is likely to remain flat for the foreseeable future. Not even many bears are talking about the company facing occupancy issues or downturns.

Why aren’t they?

Because that’s not really within the realistic expectations for what the company owns and focuses on.

The company still has over 88.5% occupancy, a portfolio with an average year built of 2003 for an asset, a WALT of 6 years, and 4% rent CAGR for its 28.5M square feet of properties.

Is it as safe as something as say, Alexandria (ARE)?

No, it’s not. That’s also why I own significantly more in ARE than I do in HIW.

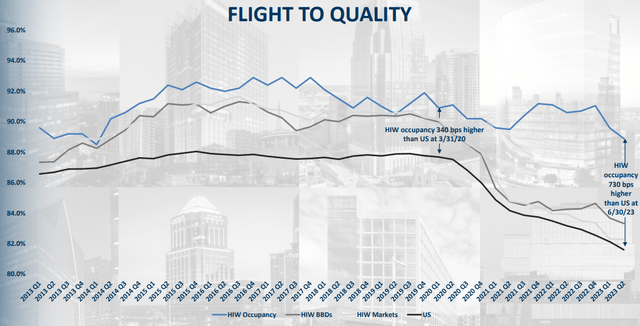

However, the flight to quality that we’re seeing across the office space, is something that Highwoods can confirm as well. In fact, the occupancy spread has widened considerably over the past few quarters and years, which certainly qualifies as an “interesting” sort of trend.

HIW does not have a specific concentration towards any one tenant sector. No subsector is larger than 18%, and the largest is actually finance. Some home-working trends are logical here as well as downsizing, but we’ve already seen that the degree of WFH is declining across the board with people being ordered back into the office. (Source: US Bureau of Labor)

If asked to specify my primary reasons for “liking” this REIT, I would say two things. First off, geography and the geography fundamentals. Secondly, the fundamentals of the company. Both are stellar, and both lack exposure to typical risk areas such as east or west-coast office exposures. HIW has none of that.

HIW IR (HIW IR)

The current occupancy outlook is in fact lower than previous years, no doubt about that. We are in a declining occupancy trend. The current range for 2023E specifies 90% at most, and I would probably be realistic/conservative and estimate it at 88.5-89.5%, which would line up very well with a 5-6% FFO drop for the year.

Does this worry me fundamentally?

No, it does not. The company’s markets and assets are “too good” to see any fundamental downturn without something more serious happening here, and the rent levels confirm this, as do the interest levels for new leases and properties. New leasing is certainly down for the year, and it’s not even as high as in some office REITs – such as ARE – but it’s still at a positive level.

The company’s own guidance specifies a range FFO low of $3.69 and a high of $3.81. But even if we estimate the FFO at the lowest possible level according to the forecast, we don’t even come close to putting a crack or dent in the current payout or yield. That high $3.81 assumes a 90% occupancy, and that $3.69/share assumes the occupancy dropping to $3.69 – which by the way I think is a fairly realistic assumption.

The company has no M&A’s planned, another $150M in disposals planned for the full year ($133M is done), and $100M more in development to announce, with $424 already ongoing.

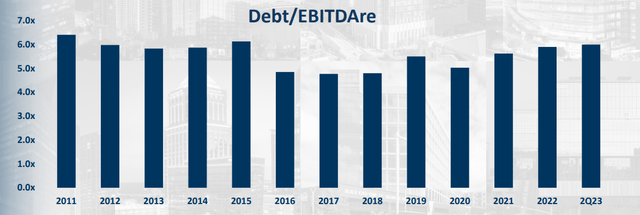

However, despite the activity, the company’s debt, equity, and leverage are very comfortable here. Yes, debt is higher than it was in 2016-2018 and 2020…

..but with a sub-42% debt to gross assets, no higher than 6x net debt/EBITDAre with debt at around 4.3%, this does not worry me. HIW also has extremely conservative maturities.

How conservative?

No maturities at all until 2025, and then it’s less than $200M.

The main maturities are all in 2028 and beyond, which gives this company ample time to work through these trends and this macro and come out the other side stronger – which again, I believe the company will do.

I’m looking at disposals and at what rates these are being done, and I’m looking at the company developments and how these are likely to impact NOI and FFO. For the time being, I don’t see any significant worries here.

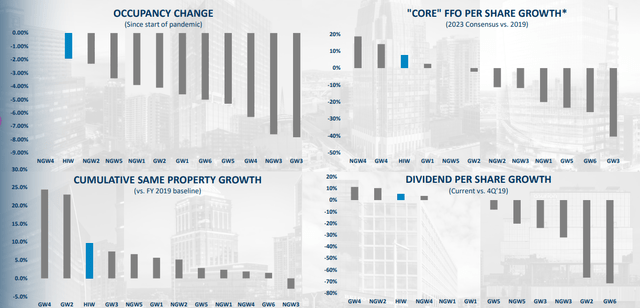

The company’s consistent history of financial outperformance is a strength as I see it. All office REITs have seen changes in occupancy. But HIW is actually the least-impacted, while managing to grow Core FFO as well as the dividend.

I’ve been through these numbers a few times to see if there are impacts or considerations that need to be taken into account when investing here, but my answer ends up being “no” as to.

I view Highwoods as being an undervalued office REIT with a non-trivial upside, even if we’re likely not to see a significant reversal for the next 1-3 years.

This is an expectation you should have when investing here – but you should also be aware of the upside, regardless of this expectation.

Highwoods Valuation – Plenty of upside to consider

So, Highwoods as an investment has plenty of positives. The first is obviously a near record-low valuation with the exception of GFC-like environs.

The upside even only to a 6-7.2x P/FFO is 23% per year.

This is what happens when “things get cheap”. And things here, are cheap. Even cheaper than when I established my first position in late 2022/early 2023. Due to FX, I’m still in the green – but here I am happy to in fact expand my position in the company.

I view HIW realistically trading, for the long term, at 10-11x P/FFO. Due to this, I give the company a price target of $40/share. Yes, that’s right – $40 – at least. And for the long term.

The upside to this PT at an 11x P/FFO valuation is 45% per year, or 127% RoR until 2025E.

Likely? Perhaps not in 2025E. But in the long term? Yes, I believe at that point it becomes likely.

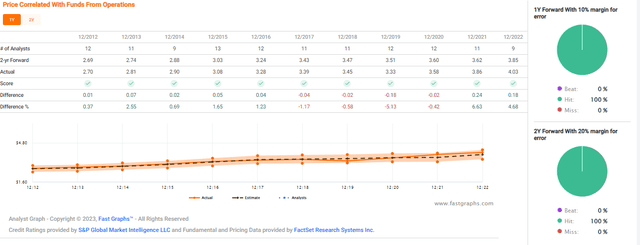

The FFO declines notwithstanding, I want to draw your attention to how forecastable and stable this company is.

S&P Global HIW Forecast accuracy (F.A.S.T graphs)

This is something we can show subscribers of the service. Just look at the sheer degree of accuracy of these forecasts. There isn’t an error higher than 5% except for a single year, other than that, it’s all at a 0.2-1.5% difference. For an Office REIT.

This is amazing, at least how I see it.

And I don’t see a justification for this to be any less likely or forecastable going forward.

So let me make things clear here.

1. Highwoods properties are going to see FFO decline. Of that I am certain. Around 5-6% this year, then a few more percent in 2024 and 2025E.

2. Highwoods Properties is not going to see a dividend cut. Not as things stand now, not with the payout, and not with the fundamentals. Despite it being 10%+, I say that it is safe for what it is.

3. Even if Highwoods is not as qualitatively safe as say, Alexandria, it’s nonetheless a REIT you can invest in and hold in your portfolio. I won’t call it a SWAN. But i’ll call it safe enough for what it is.

4. Even if we see the impact we expect, this does not take away from the company’s appeal, long-term or medium-term. I see a likelihood of a triple-digit return within a 5-7 year timeframe, and that is why I “BUY” Highwoods shares.

I give you my updated thesis for Highwoods, and it’s as follows.

Thesis

-

Highwoods Properties is one of the four strongest Office REITs that I invest in, and I consider it to be one of the office names one should focus on as a conservative investor in the space. The combination of portfolio and geographical quality together with proven management expertise and FFO growth will sustain the company in the face of significant forward pressure in this economy.

-

The eventual upside to the company once things normalize within a 3-5 year period is no less than double digits on an annual basis, with full normalization having the potential to deliver triple-digit growth.

-

For those reasons, I view HIW as a “BUY” here and maintain my price target of $40/share for the long term.

Remember, I’m all about :

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

-

This company is overall qualitative.

-

This company is fundamentally safe/conservative & well-run.

-

This company pays a well-covered dividend.

-

This company is currently cheap.

-

This company has a realistic upside based on earnings growth or multiple expansion/reversion.

The company fulfills every one of my criteria, making it a “BUY” here.