Bega9000/iStock Editorial via Getty Images

Cost inflation and immense competition

Keurig Dr Pepper (NASDAQ:KDP) has been significantly impacted by supply chain disruptions leading to higher input costs, logistics and manufacturing and labor costs. This is partially due to geopolitical uncertainty and its impact on commodity and energy prices. We believe that the current headwinds are putting high pressure on not only KDP but also on its rivals. These costs not only reduce profit margins but also put pressure on consumer demand as price increases are passed along to customers. Furthermore, KDP faces immense competition from its rivals. Competitors such as Coca-Cola, PepsiCo, The Kraft Heinz Company and Nestlé S.A. all offer a similar product portfolio and have significant financial resources and scale which they may use to rapidly respond to competitive pressures by changing their route to market, reducing prices or increasing promotional activities.

Still, KDP has managed to strengthen its market position in the CSD segment during the past 10 years and currently holds a robust market share of 21.7% as of 2021. However, the 2022 years’ market share for KDP remained unchanged and the global market for carbonated soft drinks has been stalling lately. We see the shift in consumer preferences as a plausible cause here that will put a spoke in the wheels for not only KDP but for the sector as a whole as we move forward.

Shifting consumer preferences

We expect consumer preferences to continue to change with consumers getting more health and wellness centric and it will affect not only KDP but also their major rivals Coca-Cola and PepsiCo. Consumers will get more wary about the calorie intake of regular carbonated soft drinks (CSDs) and the use of artificial sweeteners in diet CSDs. There is an ongoing shift towards more natural alternatives, and we expect consumers will be increasingly turning to healthier alternatives such as naturally flavored water, natural juices and other sugar and artificial sweetener-free alternatives.

A recent study from Innova Market Insights reveals an increase in consumers’ preferences for clean labels (products with short ingredient lists, natural ingredients, and no artificial ingredients), with more than 50% of consumers saying they are willing to pay more for a clean label.

There’s also the ongoing debate regarding weight loss in the U.S. with the CEO of shopping giant Walmart recently saying a new class of weight loss products is causing consumers to cut down on calorie-high products, putting further pressure on the sector. This statement alone had leading CSD providers KDP, Coca-Cola and PepsiCo all experience a sharp drop in their share prices. It’s a warning sign of how fragile this business is to public opinion and the ongoing shift in consumer preferences.

Fact is, the U.S. CSD market has been shrinking for the last ten years. Seems share prices are finally catching up to this reality.

Investors need to ask themselves where we will be in the next 20-30 years. What are the long-term growth prospects for KDP? Indeed, the company does offer healthy alternatives, doing their best to embrace the shift in consumer preferences, but fact is that carbonated soft drinks are historical cash cows and having consumers turn to more healthy alternatives will be a big loss.

The health aspect

It’s actually surprising CSD shares haven’t met any major resistance until now. So, why healthier products? Just take the issue with diabetes in the US where a vast 37.3 million adults live with diabetes. Diabetes is an issue also for the American youth. Furthermore, the issue with obesity in the US is another struggle that favours healthier alternatives. A change in consumer preferences is really needed where we move away from sugar-based products towards more healthy alternatives and although producers of carbonated soft drinks do offer sugar-free alternatives with their “Zero” branding even artificial sweeteners and other sugar substitutes come with a risk.

Financials

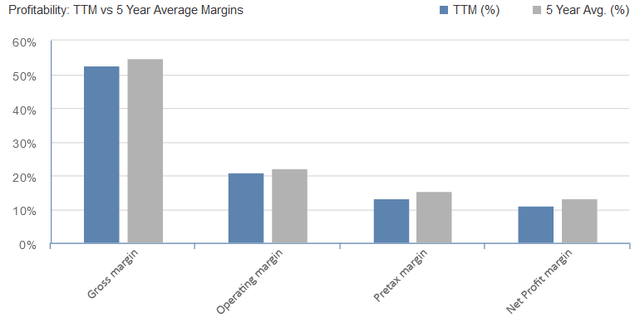

As you can see from the above chart not one of our four key metrics for profitability has TTM above its 5-year average. It’s apparent that something is going on. Tight competition is nothing new but geopolitical uncertainty together with a continued shift in consumer preferences is surely adding to the pressure on KDP. With that said, Coca-Cola, and PepsiCo are facing worsening Gross and Operating Margins too. It’s apparent that the situation is affecting not only KDP but is an issue on the sector level.

Valuation

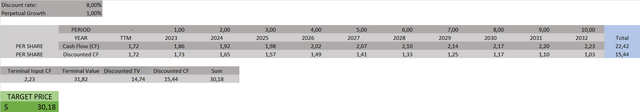

So, let’s turn to the valuation of KDP. We are using adjusted cash flow, logarithmic growth rates and a simple but efficient DCF model to evaluate the target price of KDP.

HedgeMix

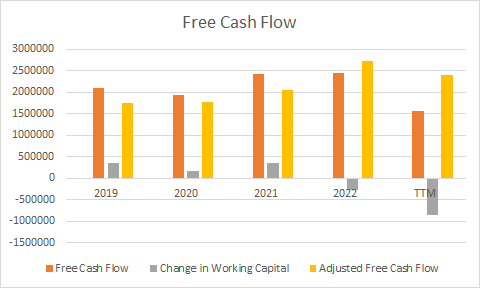

One thing we notice when examining the free cash flow of KDP is that there are high fluctuations in working capital. We believe that the most reliable valuation would be to adjust free cash flow to the change in working capital to get a fair estimate of the free cash flow, using adjusted free cash flow to predict the logarithmic growth rate.

HedgeMix

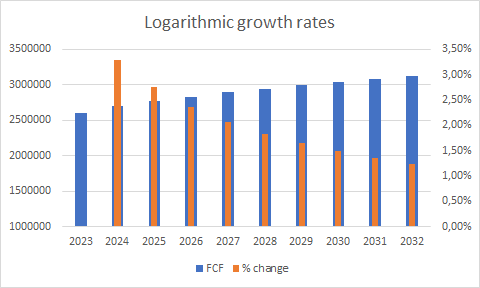

The above logarithmic growth rates are used to fade out growth over time with a growth rate of 3.28% for 2023 and successively decreasing towards 1.24% by 2032. The long-term growth rate is set to 1%. This is really a worst-case scenario taking into account the shift in consumer preferences.

Moving to our DCF model (using our logarithmic growth rates as input) we get a target price of $30 per share. As you may notice KDP shows no major upside, and this is after the sharp decline exhibited in the past few months. It’s apparent that the market is pricing in a lot of uncertainty. As outlined in this article there is high uncertainty regarding future demand and consumer behavior in this sector – uncertainty that apparently is worrying investors.

Our expectations on Q3 2023 results

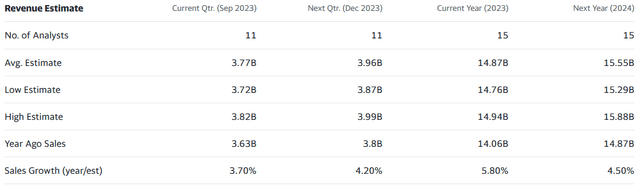

KDP Analyst Consensus, Yahoo Finance

KDP’s results for Q3 2023 are coming out on Thursday next week. Analyst consensus for the current quarter has revenues ranging between 3.72 – 3.82. We expect Q3 revenues to be in the middle of the guided range. This is all in accordance with our valuation of the share price. Our DCF model is based on current consensus around near-term fundamentals and we don’t need the actual numbers to surprise in Q3. The investment thesis expects a successive slowdown in growth taking place over the next years.

Summary

KDP shares have dropped sharply by 20 percent in the past six months. And KDP is not alone. The shares of Coca-Cola and PepsiCo have seen a similar drop over the same period. The market is successively adapting to the continuous shift in consumer preferences towards more healthy alternatives and KDP, Coca-Cola and PepsiCo are all up for a tough challenge in the coming years. We expect related shares to exhibit a bumpy road with high volatility and high uncertainty around returns. Unfortunately, the CSD segment is a key pillar to their success. If the confidence in this segment starts to rattle, anything can happen. No doubt, carbonated soft drinks are great products, with a loyal consumer base and strong revenue streams, but we are doubtful about their ability to generate future growth. And it’s simply not the right time to hold CSD-related shares.