zhengzaishuru

Energy and persistence conquer all things. – Benjamin Franklin

Investing in the energy sector can be a lucrative long-term strategy, especially since the underlying dynamics for oil in terms of supply are conducive towards outperformance for stocks in the space. The question is do you play the energy sector domestically or through a global fund like the iShares Global Energy ETF (NYSEARCA:IXC). I tend to broadly favor global investing here, but momentum needs to turn first outside the US to be comfortable with a proper allocation.

ETF Description and Holdings

IXC is designed to track the performance of the S&P Global 1200 Energy Index, which includes companies involved in the production and distribution of oil and gas. With 52 holdings, IXC provides investors with exposure to major energy companies from around the world.

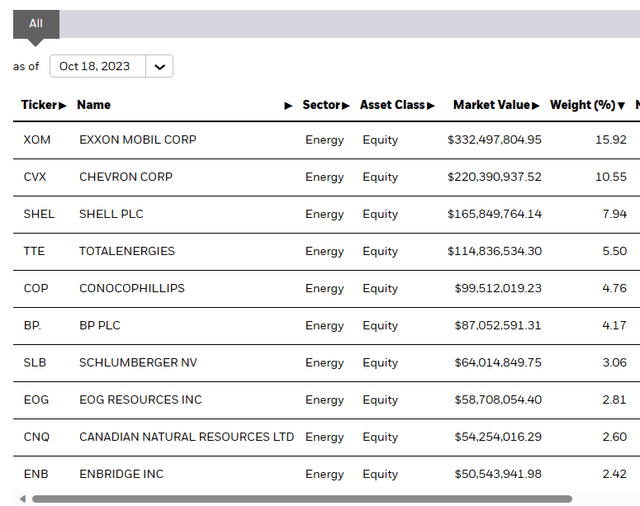

The top holdings of IXC include industry giants such as Exxon Mobil Corp, Chevron Corp, Shell PLC, TotalEnergies, and ConocoPhillips. These companies have a global reach and play a significant role in the energy sector. By investing in IXC, investors can gain exposure to the entire oil value chain, from exploration to refining.

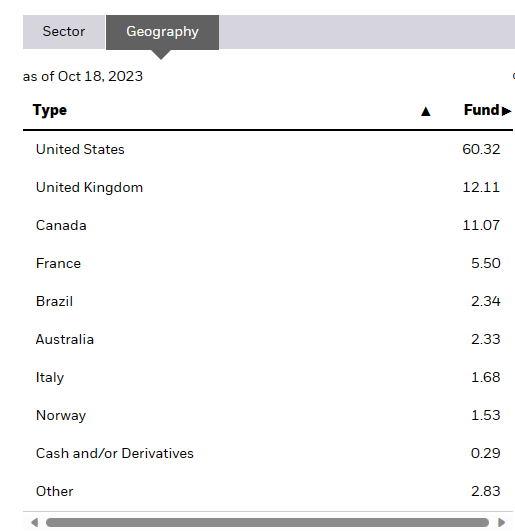

It’s worth noting that this is still primarily a US fund (and that many US energy companies clearly have global operations anyway. Over 60% is US-based, with around 12% in the UK and 11% in Canada.

ishares.com

Performance and Benchmark Analysis

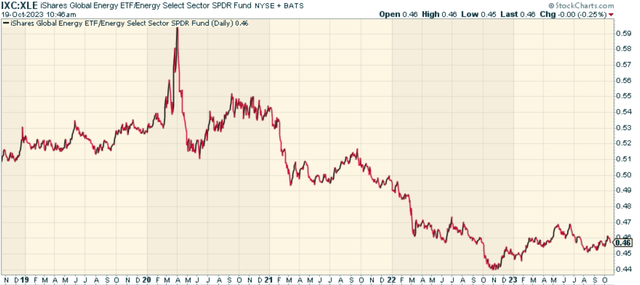

Over the past five years, IXC has delivered decent returns, much of which is attributable to the post-Covid rally. Relative to the S&P 500 (SPY), it still lags over the last 5 years, but momentum is clearly there in terms of overall strength.

When we compare IXC to the energy ETF behemoth XLE, we can see that a global allocation to energy has been underwhelming. It has been far better to invest in Energy through the US than to dilute with anything outside our borders.

Long-Term Outlook for the Energy Sector

While short-term market conditions may fluctuate, the long-term outlook for the energy sector remains promising. On the demand side, global economic growth and the increasing need for energy resources continue to drive demand for oil and gas. Despite the rise of renewable energy sources, oil and gas remain crucial in meeting global energy demands.

Supply-side dynamics also play a significant role in the long-term outlook for the energy sector. The Organization of the Petroleum Exporting Countries (OPEC) and other major oil-producing nations have a significant influence on global oil supply. By carefully managing production levels, these organizations can impact oil prices and create opportunities for investors.

US Energy Stocks: A Better Play?

While the energy sector as a whole offers long-term growth potential, US energy stocks may present a better investment opportunity. The US energy market benefits from technological advancements, regulatory stability, and a diverse range of energy sources.

The shale revolution in the United States has led to a surge in domestic energy production, making the country a leading player in the global energy market. As technology continues to advance, US energy companies are becoming more efficient and cost-effective in extracting and producing energy resources.

Furthermore, the US energy market has weathered various market cycles and demonstrated resilience in the face of uncertainty. There is far more uncertainty when it comes to energy companies internationally by comparison.

Conclusion

Investing in the iShares Global Energy ETF (IXC) can be a strategic move for investors seeking exposure to the energy sector. With its diversified holdings and global reach, IXC provides a comprehensive approach to investing in the energy industry. It’s a good fund, but it’s clear that for now the best way to access energy is by being in the US rather than by diversifying sector exposure globally. This could change, of course, but for now I’d rather consider more domestic exposure.