New York Attorney General Letitia James filed a lawsuit Thursday morning against cryptocurrency companies Gemini Trust, Genesis Global Capital, and Digital Currency Group (DCG) for defrauding over 230,000 investors of over $1 billion.

James says a program run by Tyler and Cameron Winklevoss’s company Gemini, alongside Genesis and its parent company DCG, called ‘Gemini Earn’ promised investors high returns with low risk. However, the New York attorney general’s office found that Gemini ran an internal analysis in 2021 showing Genesis’s finances were risky.

“Hardworking New Yorkers and investors around the country lost more than a billion dollars because they were fed blatant lies that their money would be safe and grow if they invested it in Gemini Earn,” said Attorney General James. “Instead, Gemini hid the risks of investing with Genesis and Genesis lied to the public about its losses.”

The case alleges Genesis’ loans were undersecured and highly concentrated with Sam Bankman-Fried’s Alameda Research. During the FTX crash of digital asset values, Gemini Earn investors were frozen out of their accounts, leaving investors unable to reclaim hundreds of millions of dollars in cryptocurrency, according to the New York Times. It’s estimated Gemini Earn defrauded 29,000 New Yorkers.

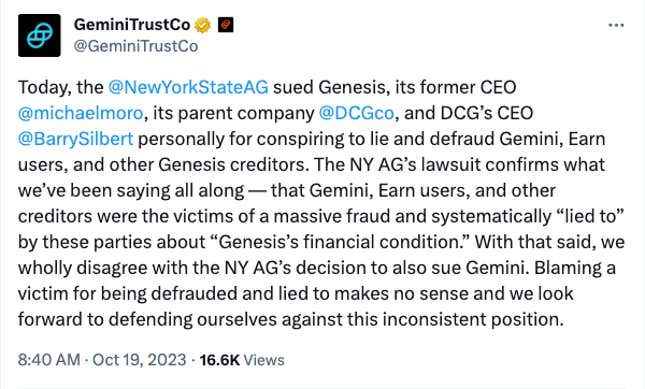

Gemini Trust said they themselves are victims, alongside Earn users, of a massive fraud by Genesis, in a press release Thursday morning posted on X. However, the company disagrees with the decision to also sue Gemini.

Genesis and DCG did not immediately respond to a request for comment.

The case against Gemini hinges on the fact that it was aware of Genesis’ fraud, and continued to take investor money in spite of that. The New York AG says Gemini’s board of managers discussed ending Gemini Earn altogether in July 2022 because of the risks with Genesis. One board member compared Genesis’ financial condition to Lehman Brothers before its collapse, says the OAG. However, none of these internal risk analyses around Gemini Earn were communicated to investors, and Gemini told investors it had vetted Genesis and that it was a trusted company.

The lawsuit against some of cryptocurrency’s biggest players comes at a particularly dire moment for the industry. Sam Bankman-Fried is expected to testify in the coming weeks in his own case with the Department of Justice for defrauding Americans out of billions of dollars with FTX and Alameda Research.

A forensic accountant discovered this week that $9 billion in FTX customer funds were missing in June 2022, five months before the company’s public collapse and bankruptcy filing. This was around the same time that the Attorney General alleges Gemini risk personnel withdrew their own investment from the Earn program.

The OAG says at one point, Sam Bankman-Fried’s Alameda was the borrower for 60% of all outstanding loans from Genesis to third parties. Genesis is also alleged to have concealed and suppressed the true severity of its financial condition from Gemini, as well as investors. The Attorney General is “seeking to permanently stop Gemini, Genesis, DCG, and its executives from engaging in any business related to the purchase and sale of securities and commodities within or from New York,” the office said in a statement.