damedeeso/iStock via Getty Images

Reader Selections

Since May 2017, any dividend-paying stock mentioned in a message, e-mail or comment to the author is fair game for a reader favorite listing in this series of articles. Thus, it is possible that only rogues and discontinued, or dreadful, doubtful, dividend issues may appear.

Frequently readers and other contributors have questioned the intent, purpose, validity, and usefulness of my daily stock lists. Most, however, praise the effort to sort promising opportunities out of the thousands of dividend offers. After all, yield counts when searching for dividend winners.

Furthermore, dog catching is, by method, a contrarian investing strategy which is known to rub some investors the wrong way. It is most useful for new buyers; intended to guide readers to new purchases of dogs on the dips. These lists are suggestions, or warnings, not recommendations.

Most valuable to the writer, however, are reader comments that truly catch errors in calculations or changes in direction.

In June 2022, high yields were alleged, by one reader, to be sure signs of Roguishness. Not true, high yields are sure signs of high yield, how long the elevated yield lasts depends on share price and corporate directors. High Beta is the most accurate measure of Roguishness.

Reader suggestions of buy and hold dividend stocks are most welcome and sure to be reported on my ReFa/Ro posts. That’s my ultimate goal, of course, to find ten or twenty sure-fire long-term dividend payers purchased when their single share prices are lower than the dividend paid from $1K invested. Suggestions, please! We’re trying to predict the future here, Kings and Aristocrats might hold up but may be too old and feeble to last.

In February 2022, one reader suggested an option strategy for monthly-paying dividend stocks:

“You should identify where options are available on the Monthly dividend stocks. What I do is find mo-pay stocks with options, I buy and write covered calls about 6 – 12 months out. I look for a scenario where I collect the dividend and get my stock bought back at a much lower price than I pay, but pocket a premium that makes up the loss. This gives me a dividend boost, since my cost is lower. It’s like a guaranteed CD with little risk.”

Another reader suggested I dial-back my blatant opinion that high-yield equates to high-risk:

“The article says “high dividends are a sure sign of high risk”.

It should be “high dividends might be a sign of high risk”.

“If a good stock/ETF/CEF with a 5% dividend drops simply because the whole market dropped, the dividend could get to 8 or 9%. I think that’s a great time to buy because the high dividend and low price makes it a low risk investment.”

More than one writer has decried my favoritism for low-priced stocks. They especially dislike my “ideal” stocks whose dividend returns from a $1k investment equal or exceed share price. A prime example is Sirius XM Holdings Inc. (SIRI), the satellite radio and Pandora music catalog owner, priced recently at $2.69 easily passes my test (of dividends from $1k invested exceeding share price) with a forward dividend yield of 4.02%! A little under $1k investment now buys 372 shares, and they’ll throw the owner a return (from that $1k invested) almost 11 times the share price. Assuming all things remain equal, SIRI dividends alone will pay back their purchase price in 24.9 years (and that assumes the satellite radio and subscription music services can survive that long)!

Last year, in December 2023, a reader suggested my share price equal or less than the income from a $1k investment was too low. I agree with him that opportunities are lost and that many strong stocks exist at higher prices. For example, even the dividend from $10k invested in Apple Inc. could not buy one share of that stock. Plainly, nobody buys Apple for the dividend, just growth.

However, I was reminded by a comment last month that some readers take “dividends from one $1K invested” to mean the annual return from just one share. If the single share price of a stock is $20 and the annual yield is 3.00%, the dividend paid from $1k invested is $30.00 or 1.5 times the single share price.

In January 2023, the following exchange occurred:

Sorry, but I’m confused. Why does it matter if a stock is $1000 per share and pays a $50 dividend, or $20 per share and pays a $1 dividend. Isn’t that the same 5% yield?

But if I’m following your logic, you would like the latter because the total dividend from $1,000 invested is more than the individual share price, but you wouldn’t like the former because it isn’t.

Am I missing something?

You’re right. Both the $1000 stock paying a $50 dividend and the $20 stock paying a $1.00 dividend cost $20 per dollar of dividend. Thus, neither is preferable because you’ve still spent $1000 to get $50 in dividends. The difference is entirely in the share count. One share versus 50. Which would you prefer to own?

Should the return from $1k invested exceed single share price? The debate rages, meanwhile dividend investors crave an easy to locate starting point for their initial dividend investment. What price are you paying for your dividend? It’s a simple rule of retailing, and the lowest cost per dividend dollar wins (or goes out of business).

The dogcatcher ideal balance point is a sweet spot to use for reference. A rule of thumb, so to speak.

Six months ago, a reader made a prediction that PACW would be the next bank to collapse. You heard it here first!

Late summer, a pause in Fed interest rate hikes left PACW close to surrender, but could it hang in when the hikes returned? Its assets, as of December 16, 2023 were acquired by Banc of California. The new entity is now traded under the ticker BANC. PACW is no longer an entity to trade. PAC is gone. Long-live BANC!

Every month, readers grumble that they can’t find my nine Dog of the week portfolios.

This year, SA has listed all the postings on my service by date. So to find the summary and reference guide to each portfolio, look at:

August 22, 2015 for I

October 13, 2016 for II

September 12, 2017 for III

September 13, 2018 for IV (Ivy)

September 8, 2019 for V (Volio)

September 12, 2020 for VI (Vista)

October 10, 2021 for VII (Viital)

October 8, 2022 for VIII (Viking)

October 7, 2023 for IX (Ignition).

Incidentally, the VIII (Viking) portfolio of Dividend Dogs for each week launched on October 3, 2022. The Viking ‘safer’ stock reports have been gathering since November 4, 2022, and will post its last return on October 4, 2024.

My Ignition (DOTW IX) portfolio, launched October 6, 2023, will have all its selections in place by October 4, 2024, and post its last return on October 3, 2025.

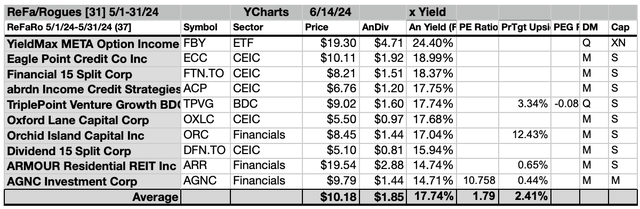

Last winter, a reader asked what the XN rating in the Market Cap column of my Yield and Target Price charts means. Here is my summary of those codes:

Dogcatcher Market Cap Codes

L= $10B+

M= $2B-$10B

S= $200M-$2B

XN=<$200M

An observation from April 2023:

“Mr. Arnold, I enjoy reading your many articles and get some great ideas from them. However I find the number of charts are a bit of overkill, many duplicating the info. I’m sure you have your set format and reasons why, but I’d be happy with only two charts; your sort by target gains and your sort by div yield. It would make it a much easier read. Thank You -pmbrandt 15Apr2023”

I’d gladly just submit those two charts and ditch all the verbiage. However, fourteen years ago, when I started submitting articles, the SA editorial team said they needed text to go with the graphics and topsy was born.

Still, there are complaints of too many words for little information. No doubt, less is more! I’ll be sure to make my Dividend Kings and all the other articles less obfuscating.

Foreword

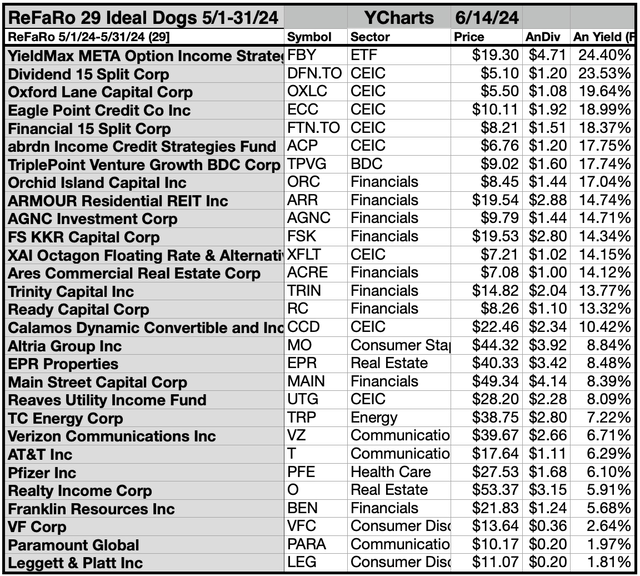

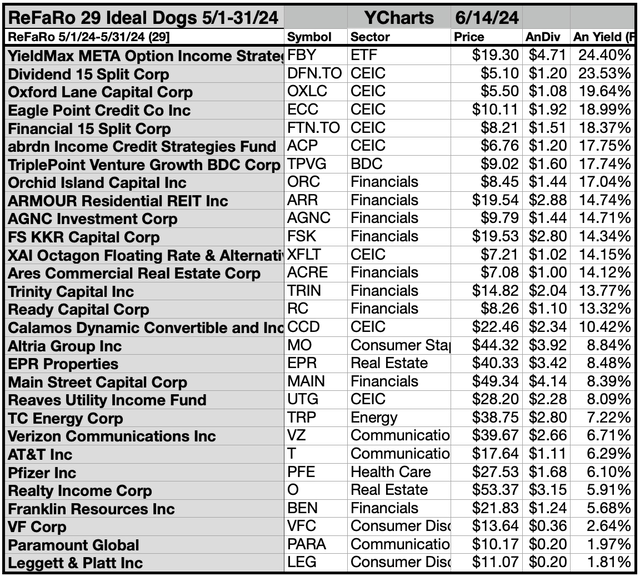

Note that in May 2024 readers mentioned 29 stocks whose dividends from a $1K investment exceeded their single share prices. These are listed below by yield:

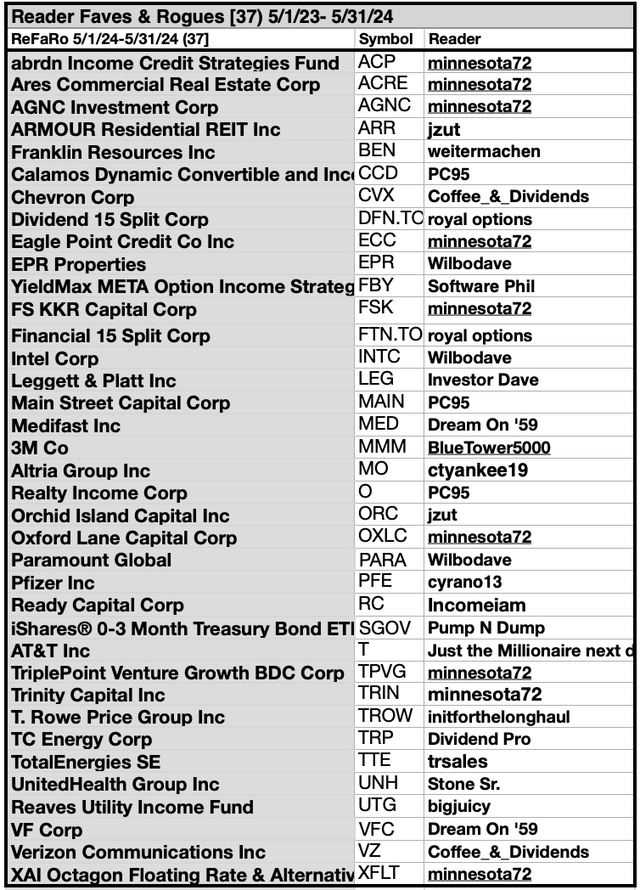

The ReFa/Ro May Ideal Dividend Dogs

Above are the 29 ideal candidates derived from the 37 tangible results from reader favorite & rogue equities received prior to May 31, 2024. YCharts data for this article was collected as of 6/14/24.

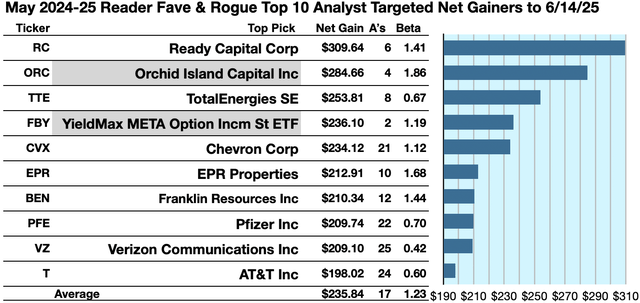

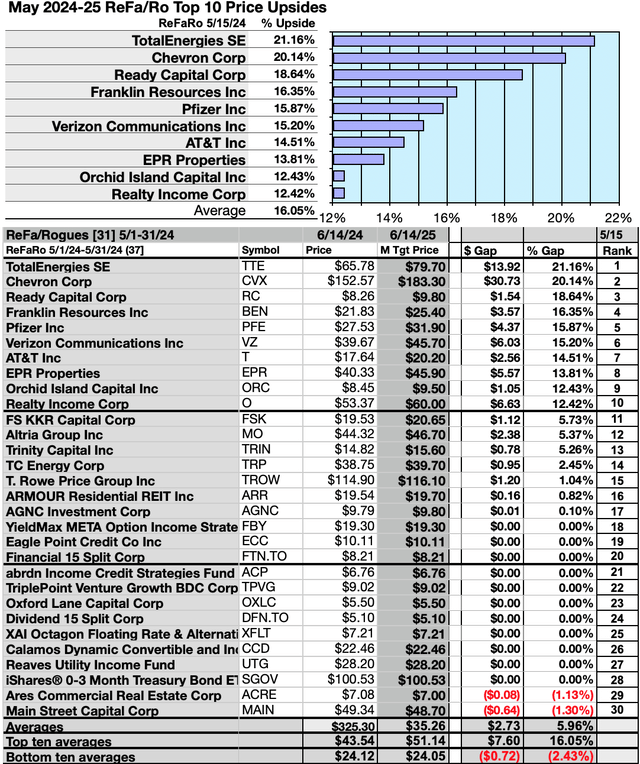

Actionable Conclusions (1-10): Brokers Estimated 19.8% To 30.95% Net Gains From 10 ReFa/Ro Stocks To May 2025

Two reader-favored top-yield May stocks were verified as being among the top 10 gainers for the coming year based on analyst one-year target prices. (They are tinted gray in the chart below). Thus, this yield-based forecast for reader-fave stocks, as graded by Wall St. wizards, was deemed 20% accurate.

Estimated dividend returns from $1k invested in each of the highest yielding stocks, plus the median one-year analyst target prices, as reported by YCharts, created the 2024-25 data points which identified probable profit-generating trades. (Note: one-year target prices by lone analysts were not counted.) Thus, ten probable top March profit-generating trades projected as-of June 14, 2025 were:

Ready Capital Corp. (RC) was projected to net $309.64, based on the median of target price estimates from 6 analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 41% greater than the market as a whole. RC is a rogue.

Orchid Island Capital, Inc. (ORC) was projected to net $284.66 based on the median of target price estimates from 4 analysts, plus the projected annual dividend, less broker fees. The Beta number showed this estimate subject to risk/volatility 86% over the market as a whole. A Rogue.

TotalEnergies SE (TTE) netted $253.81 based on the median of target price estimates from 8 analysts, plus the projected annual dividend, less broker fees. The Beta number showed this estimate subject to risk/volatility 33% under the market as a whole. It is a fave.

YieldMax META Option Income Strategy ETF (FBY) was projected to net $236.10 based on the median of target price estimates from 2 analysts, plus the projected annual dividend, less broker fees. The Beta number showed this estimate is subject to risk/volatility 19% greater than the market as a whole. A Rogue.

Chevron Corp. (CVX) was projected to net $234.12, based on the median of target price estimates from 21 analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 12% over the market as a whole. A rogue.

EPR Properties (EPR) was projected to net $212.91, based on the median of target price estimates from 10 analysts, plus the projected annual dividend, less broker fees. The Beta number showed this estimate subject to risk/volatility 68% over the market as a whole. A rogue.

Franklin Resources, Inc. (BEN) was projected to net $210.34, based on the median of target price estimates from 12 analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 44% over the market as a whole. It’s a rogue.

Pfizer Inc. (PFE) netted $209.74 based on the median of target price estimates from 22 analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 30% under the market as a whole. It’s a fave.

Verizon Communications Inc. (VZ) was projected to net $209.10, based on the median of target price estimates from 25 analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 58% under the market as a whole. It’s a fave.

AT&T Inc. (T) netted $196.02 based on the median of target price estimates from 24 analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 40% under the market as a whole. A fave.

The average net gain in dividend and price was estimated at 22.94% on $10k invested as $1k in each of these ten stocks. This gain estimate was subject to average risk/volatility 36% over the market as a whole. May 2024, top-ten gainers counted six rogues, and four favorites.

Source: Open source dog art from dividenddogcatcher.com

The Dividend Dogs Rule

The “dog” moniker was earned by stocks exhibiting three traits: (1) paying reliable, repeating dividends, (2) their prices fell to where (3) yield (dividend/price) grew higher than their peers. So, the highest yielding stocks in any collection have become affectionately known as “dogs.” More precisely, these are, in fact, best called, “underdogs.”

37 For the Money

Yield (dividend/price) results from YCharts.com verified by Yahoo Finance for ReFa/Ro stocks as of market closing prices 6/14/24 for 37 equities and funds revealed the actionable conclusions discussed below.

See any Dow 30 article for an explanation of the term “dogs” for stocks reported based on Michael B. O’Higgins book “Beating The Dow” (HarperCollins, 1991), now named Dogs of the Dow. O’Higgins’ system works to find bargains in any collection of dividend paying stocks. Utilizing analysts’ price upside estimates expanded the stock universe to include popular growth equities, as desired.

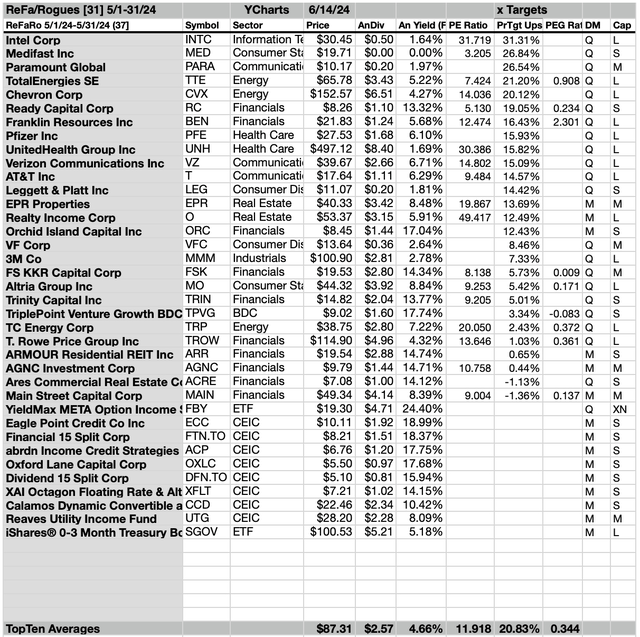

37 ReFa/Ro By Target Gains & Losses

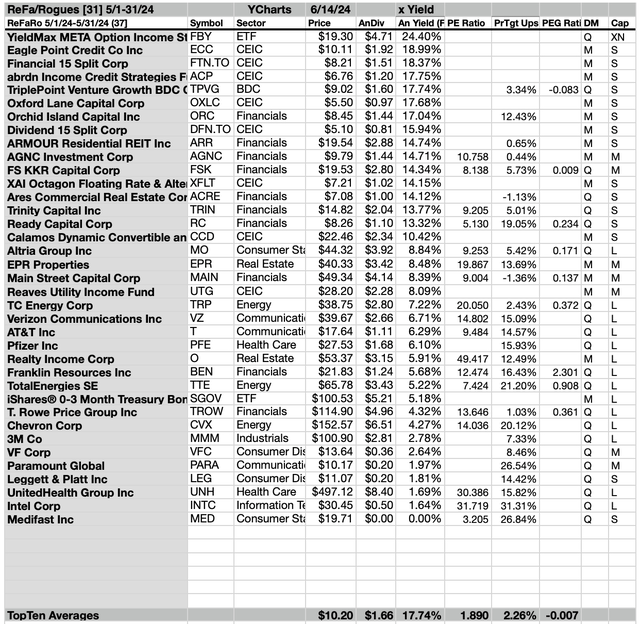

Actionable Conclusions (11-20): ReFa/Ro Top Rogue Dog, FBY, Led 37 By Yield Through May

The 37 ReFa/Ro sorted by yield included 10 of 11 Morningstar sectors, eight closed end investment companies, and two ETFs.

Ten top reader-mentions by yield in May were led by one ETF, YieldMax META Option Income Strategy [1]. Then second place went to the first of five CEICs, Eagle Point Credit Co Inc. (ECC) [2]. The other four CEICs placed third, fourth, sixth, and eighth: Financial 15 Split Corp. (FTN:CA) (OTCPK:FNNCF) [3]; abrdn Income Credit Strategies Fund (ACP) [4]; Oxford Lane Capital Corp (OXLC) [6]; Dividend 15 Split Corp. (DFN:CA) (OTCPK:DVSPF) [8].

Fifth place belonged to the lone Business Development Company in the top ten, TriplePoint Venture Growth BDC Corp (TPVG) [5].

Finally, three financial services members placed seventh, ninth, and tenth: Orchid Island Capital [7]; ARMOUR Residential REIT, Inc. (ARR) [9]; AGNC Investment Corp. (AGNC) [10], to fill-out the top 10 May ReFa/Ro by yield per June 14, 2024 data.

Actionable Conclusions: (21-30) Top 10 ReFa/Ro By Price Upsides Showed 12.42% To 21.16% Increases To May 2025

To quantify top dog rankings, analysts’ median price-target estimates provided a “market sentiment” gauge of upside potential. Added to the simple high-yield metrics, analysts’ median price-target estimates became another tool to dig out bargains.

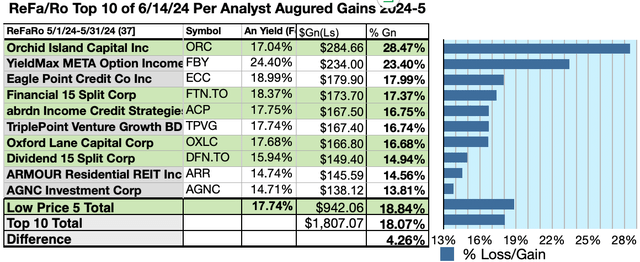

Analyst Targets Revealed A 4.26% Advantage For 5 Highest-Yield, Lowest-Priced ReFa/Ro Stocks Through May 2025

10 top ReFa/Ro were culled by yield for their monthly update. Yield (dividend/price) results verified by YCharts made the ranking.

As noted above, top 10 ReFa/Ro selected 6/14/24, showing the highest dividend yields in May represented four financials, an ETF and five closed end investment companies.

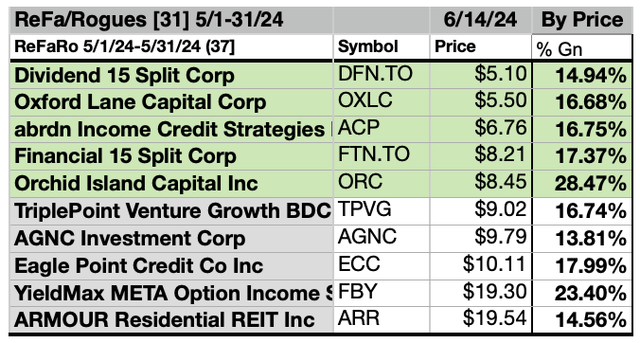

Actionable Conclusions: Analysts Predicted 5 Lowest-Priced Of 10 Top -Yield Reader Favorites & Rogues To (31) Deliver 18.84% Vs. (32) 18.07% Net Gains by All 10 Through May 2025

$5k invested as $1k in each of the five lowest-priced stocks in the top 10 ReFa/Ro kennel by yield were predicted by analyst one-year targets to deliver 4.26% more net gain than $5k invested as $.5K in all 10. The fifth lowest-priced ReFa/Ro top-yield equity, Orchid Island Capital, was projected to deliver the best net gain of 28.47%.

Five lowest-priced ReFa/Ro top-yield dogs for May, as of June 14 data, were: Dividend 15 Split Corp; Oxford Lane Capital Corp; abrdn Income Credit Strategies; Financial 15 Split Corp; Orchid Island Capital Inc, with prices ranging from $5.10 to $8.45 per share.

Five higher-priced ReFa/Ro as of May 15 were: TriplePoint Venture Growth BDC Corp; AGNC Investment Corp; Eagle Point Credit Co Inc; YieldMax META Option Income Strategy ETF; ARMOUR Residential REIT Inc, whose prices ranged from $9.02 to $19.54.

The distinction between five low-priced dividend dogs and the general field of 10 reflected Michael B. O’Higgins’ “basic method” for beating the Dow. The scale of projected gains, based on analysts’ targets, added a unique element of “market sentiment” gauging upside potential.

It provided a here-and-now equivalent of waiting a year to find out what might happen in the market. Caution is advised, since analysts are historically only 15% to 85% accurate on the direction of change and just 0% to 15% accurate on the degree of change.

The 37 equities and funds discussed in this article were submitted within comments from Seeking Alpha members noted below.

Afterword

Here is the full pack of 37 May ReFa/Ro

(Listed alphabetically by ticker symbol, the pack includes the nicknames of recommending readers.)

Note that this month readers mentioned twenty-three Dogcatcher Ideal stocks that offer annual dividends from a $1K investment exceeding their single share prices.

29 Dogcatcher Ideal ReFa/Ro Dogs from May

The net gain/loss estimates above did not factor in any foreign or domestic tax problems resulting from distributions. Consult your tax advisor regarding the source and consequences of “dividends” from any investment.

Stocks listed above were suggested only as possible reference points for your ReFa/Ro dog stock purchase or sale research process. These were not recommendations.

Disclaimer: This article is for informational and educational purposes only and should not be construed to constitute investment advice. Nothing contained herein shall constitute a solicitation, recommendation or endorsement to buy or sell any security. Prices and returns on equities in this article except as noted are listed without consideration of fees, commissions, taxes, penalties, or interest payable due to purchasing, holding, or selling same.

Graphs and charts were compiled by Rydlun & Co., LLC from data derived from www.indexarb.com; YCharts.com; Yahoo Finance – Stock Market Live, Quotes, Business & Finance News; analyst mean target price by YCharts. Open source dog art from dividenddogcatcher.com.

se