StephanHoerold/E+ via Getty Images

Introduction

Lasertec (OTCPK:LSRCY) is a Japanese developer of semiconductor inspection equipment, in particular, a system for inspecting photomasks that are critical for ASML’s (ASML) EUV process. Lasertec developed and sells the world’s first EUV photomask inspection system, with only early stage competition at the moment, not commercial. Photomasks are the important patterning tools that focus light on wafers so that circuits can be etched. KLA Corporation (KLAC) is the juggernaut of the semi wafer inspection industry, but optical mask inspection has one key issue: photomask inspection comes before the wafer is produced. This prevents unnecessary EUV usage on faulty photomasks, saving costs for Lasertec’s three major clients of Intel (INTC), Samsung, and Taiwan Semi (TSM). While KLA’s solutions are not going extinct, Lasertec has a keen advantage and this is reflected in the financials already, just a few years after the release of the first gen equipment.

However, the financials we see released are under attack by fraud allegations by a short seller. The firm, Scorpion Capital, believes that the firm is entirely fraudulent. As stated in the report:

Lasertec is an extreme, textbook accounting fraud that checks off every box: claiming to have the highest margins in the industry; but alarmingly little cash flow and the lowest cash conversion among its peers; accompanied by the highest inventory level of any semicap equipment supplier in the world.

This is despite listed revenues rising well over 1000% in just a few years, the market cap reaching over $20 billion, and becoming the most actively traded company on the Japanese exchanges. Also, Lasertec recently was a recipient of Intel’s EPIC Supplier Program award alongside peers such as KLA, Lam (LRCX), Applied Materials (AMAT), and Tokyo Electron (OTCPK:TOELY). Despite the lengthy report, shares are only down 15% over the past month, and are actually up a few percent since the report came out. Perhaps the newfound publicity offsets the fairly hyperbolic claims in the short report.

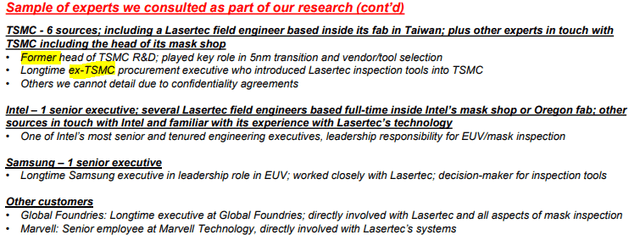

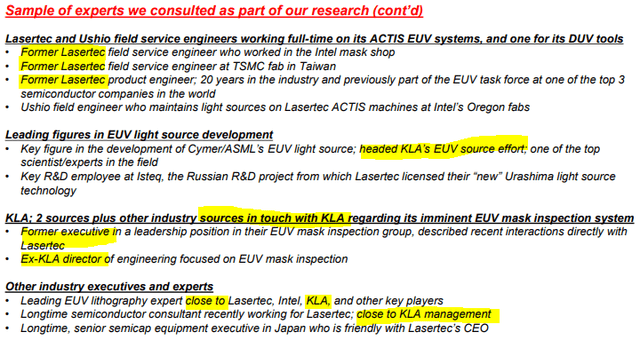

I believe that many of the claims made seem to be disgruntled former employees of either competitors, or former market participants with a fledgling view of the understandable next-gen product R&D process requirements. Below, I highlight some of the wording that shows that there is likely bias in the sources used. This is particularly relevant because the short report goes after ACTIS 300 systems, that were only released in November 2023. I believe that is a short amount of time to jump to the conclusion that major customers do not believe in the products. Also, if they were relevant sources, they should be able to publicly discuss the matter without anonymity, bias, or hyperbole. Insider information and non-disclosure law also may play a role in the use of the information in the short report in my view.

Scorpion Capital Report (Page 20) Scorpion Capital Report (Page 21)

These sources made claims that are listed in the report that I believe used hyperbolic language and go against the presented, audited financials of Lasertec. A selection of the main claims are as follows:

Lasertec has never had an EUV technology that actually works: key customers have stopped buying new ACTIS systems; are refusing to accept shipment with ones like Intel “pushing, pushing, pushing out” purchase orders; inventory is piling up; the head of Intel’s EUV mask shop is allegedly so angry that he has been banned from meetings for blowing up at Lasertec; TSMC, Global Foundries, and Marvell laugh at the product; the “new” ACTIS A300 failed inspection at TSMC, per 4 sources; and key customers told us that Lasertec is quietly offering them ~75% discounts, trade-in’s, and other inducements and concessions – proof that Lasertec’s reported inventory is worthless.

It is perfectly normal for the EUV focused ACTIS 150 to be replaced with the 300 version as the next generation equipment comes out. Many of the comments are not dated, so it seems questionable when the issues were brought up by customers. For example, as of last quarter, Lasertec earned US$411 million in revenues, so that is against the fact that “key customers have stopped buying new ACTIS systems”. Also, claims of being “allegedly so angry”, enough to be banned from meetings, or entire companies laughing at a product they spent a cumulative US$1.5 billion on in one year, are hyperbolic and do not provide a constructive view of the issues that may be present.

A blog post by Project Q Sydney after Scorpion issued a short report on a separate company, IonQ (IONQ), highlights the problem of most short seller theses. I am not stating the facts inside the report made by Scorpion are false, I am just using the quote to highlight many short reports may be using psychological, rather than factual approaches:

The Scorpion report is an artful and compelling work of rhetoric and persuasion, not a reasonable presentation of balanced research. The report smacked of Cicero’s Philippicae instead of KPMG – i.e., the art of the defense attorney and nothing of the judge. Whatever ethical position one might take, this approach is perfectly understandable and highly rational given Scorpion’s objective to influence market sentiment regarding IonQ so they can make money.

For that reason, I will be sure to highlight the financials, as reported, in comparison to other peers. With Lasertec in a far different growth position than peers, and inherently speculative, tight-lipped, and innovative, comparing the financials directly, and with a fine toothed comb, to companies like KLA and ASML isn’t meaningful in my opinion. And, as I show in this article, Lasertec’s small flaws can easily be explained and compared favorably to these exact peers in a positive light. Essentially, despite the small size and innovative nature, Lasertec shows financial maturity that may reduce volatility for investors in the short to intermediate term.

Sales and Profits of Lasertec vs Peers

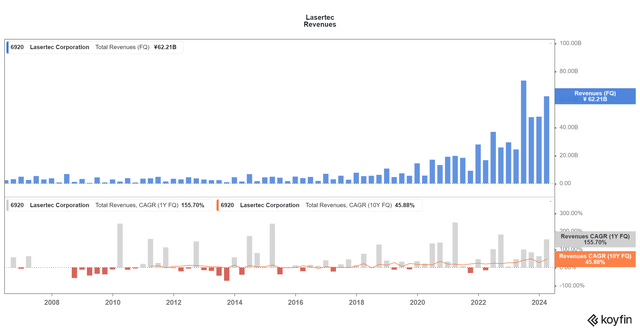

It is clear that much of the distrust of Lasertec comes from the fact that they are a relatively new growth entrant to the semiconductor equipment market. While it is true Lasertec has been a manufacturer of niche products for some time, the groundbreaking EUV mask inspection system is on a new scale. Prior to the ACTIS release, growth fluctuated based on the release of the niche products, but were lumpy and led to flat revenues over decades.

Now, a secular opportunity has been found in leading edge products, with growth jumping to a 45% annualized rate over the past 10 years. Quarterly, there have been three month periods where growth exceeded 200%. As such, Lasertec cannot be blindly compared to companies like KLA that are only growing revenues at a modest 12% annualized rate over 10 years. In fact, Lasertec has the best revenue growth pattern of the entire semiconductor equipment and materials industry for the trailing five year period.

Unfortunately, the speculative nature of Lasertec’s future leads to the company being an easy target. Growth will naturally fluctuate based on large orders by the small numbers of customers in the market. A better comparison would be ACM Research (ACMR), a developer of a new range of cleaning and wafer processing equipment. Revenues have grown between 0 and 200% on a YoY in various quarters over the past five years, highlighting the cyclicality. Revenue growth through new product lines entering the market is where the comparisons end as ACMR’s exposure to lower margin services and the Chinese market hinder the financial viability of the investment.

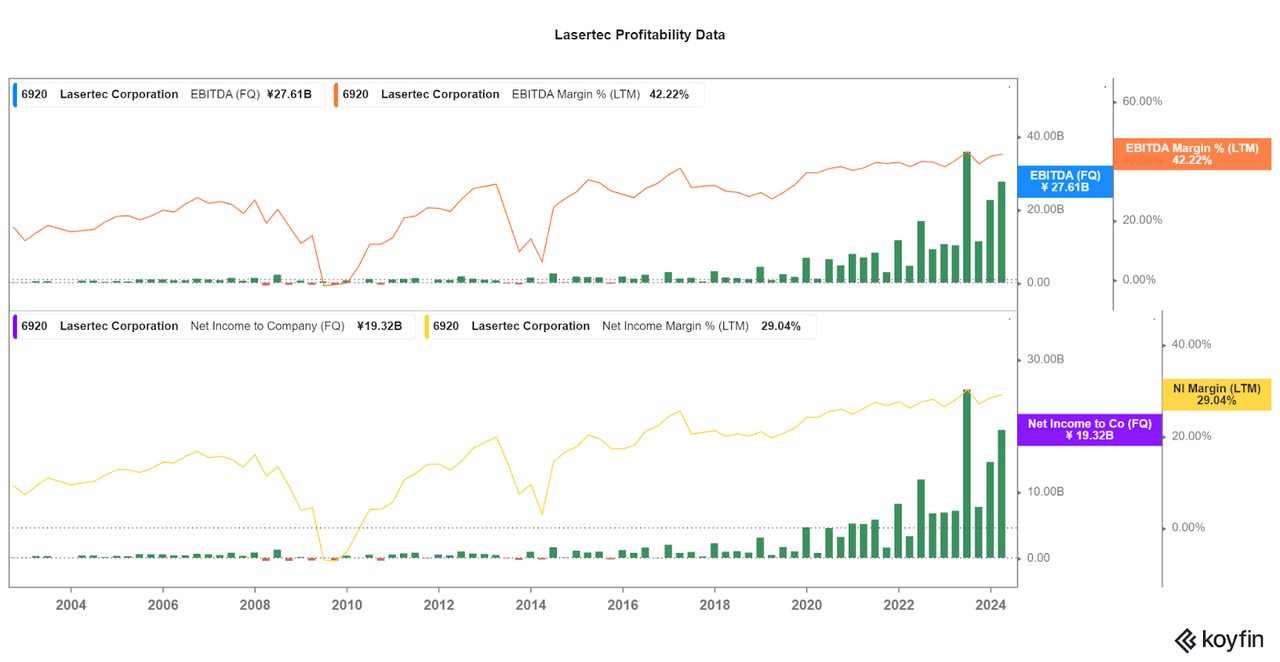

Being exposed to high value services through EUV process testing is where Lasertec can stand out through one key financial metric: profitability. To fund the ground breaking product line, profitability from the small legacy products that have generated the cash available for the R&D investments in ACTIS. The short report has taken issue with low free cash flow despite higher sales. The problem with this claim is that investments have continued in both expanding production to meet demand, and bringing about the new generations of equipment just like before.

Currently, Lasertec has extremely competitive margins at 42% EBITDA and 30% Net Income, compared with ACM’s 20%/14% split. While unusually high for an early stage company, one of the reasons for short-seller skepticism, these margins are comparable to the well performing equipment maker Lasertec is directly competing against: KLA, at 31/25% EBITDA and NI margin for the prior quarter. And, margins are also similar to the company developing the necessary EUV machinery, ASML, at 34/27%, although Lasertec is gaining a slight premium as foundries load up on the tools.

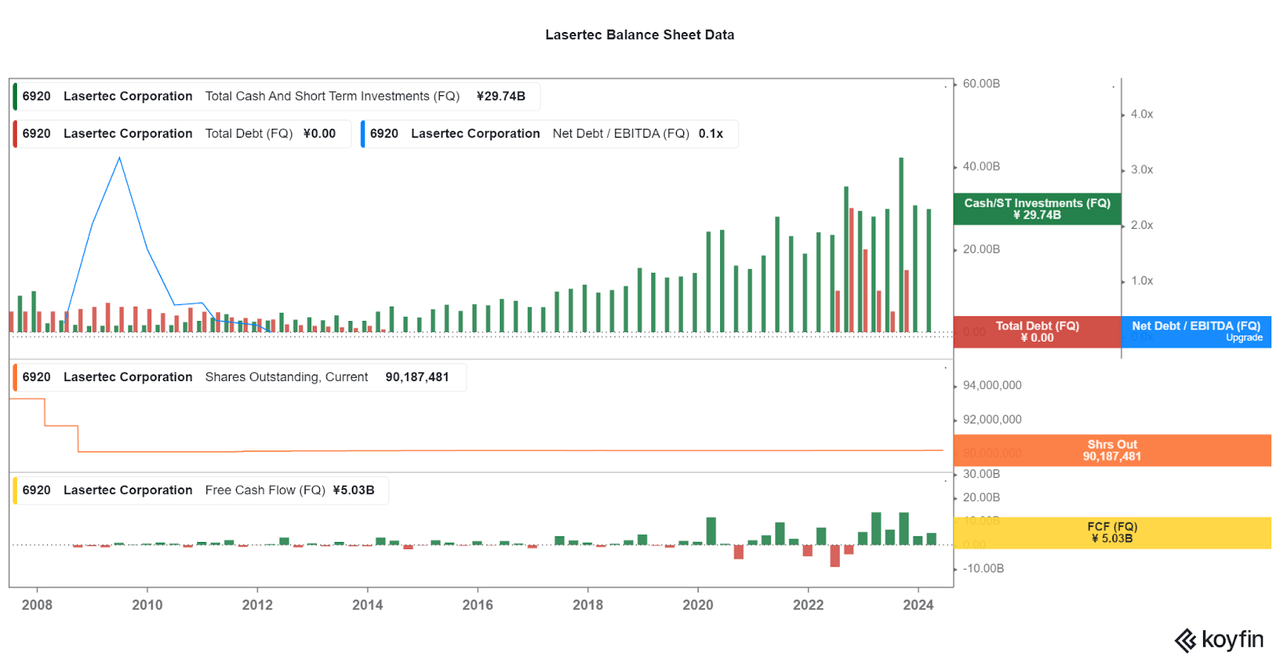

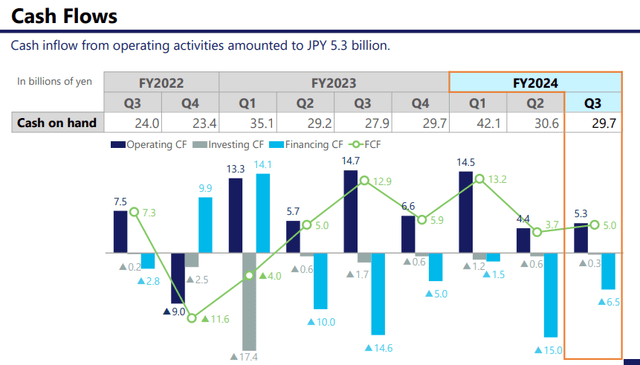

The issue for the shorts is that free cash flow is not reflecting the same industry leading margins as EBITDA/NI. But, investments can be listed on both the income statement or free cash flow statement. Lasertec has invested in new properties (such as the R&D facility in Yokohama for 16 billion yen) and debt reduction, and this is reflected as low or negative free cash flow each quarter. The short-report also states that the newly purchased facility from Q1 FY23 is only used as a storage facility, but it is unknown when they went and whether the facility’s operations were ramped up at that point. So, whether these facilities and investments were used at the time of the short-seller’s facility inspections could be a moot point.

For more clarity on cash flows, Lasertec had 17.4 billion in investing cash flow during Q1 FY23, but was still operationally FCF positive. Also, after a small debt issuance in 2023, FCF has been lowered as the company pays off the debt, which is listed as negative Financing FCF in the chart below. The accounting is similar at ASML, who have at least six negative free cash flow quarters since 2019 on the books. KLA would also have a similar pattern, but have offset capex spending losses on a FCF basis through issuing debt financing (and they hold the highest leverage ratio for that reason).

Lasertec Investor Presentation

Now that Lasertec does have a large lead in EUV-based inspection at the photomask level, it is understandable for increased spending to maintain the advantage, unlike before when the company was unsure whether their products would find demand and maintained conservative investments. It is also meaningful in this current market that the cash Lasertec has generated has primarily come from operations, and not excessive debt or dilution outside IPO in years prior.

So, while free cash flow growth may not be the focus for management, the company remains conservative with their expansionist path. There are no surprises or red flags in the financials, as long as the reported numbers are indeed correct, but there is no evidence of that, especially based on Scorpion’s prior allegations that have been swept off by companies they have targeted. Below are just a few of the companies that have shrugged off the claims made by Scorpion:

- IonQ – a Quantum computing company labelled as an alleged hoax and “side-hustle” to executives’ academic careers.

- Twist Bio – compared to the fraudsters Theranos back in 2022.

- Berkeley Lights – Claimed fraudulent company acquired by leading healthcare instrument maker Bruker.

- Fanhua – No fraud and remains financially sound despite China-stock valuation weakness.

- Allakos – Biotech company that had an unsuccessful Phase 3 clinical trial and collapsed, but was not a fraud.

Timing is everything, as most of the company’s shorts occurred during the peak of the market in 2021/22 and had very plausible valuation issues. Although most companies remain alive today, and none have been frauds in the eye of the law, a short was likely quite profitable for most at some point after Scorpion released a report. This means that while I do not believe Lasertec is a fraud, I do believe there will be share price volatility based on the natural ebbs and flows of investor sentiment.

Short Case Was Likely Valid In Terms of Backlog Underperformance

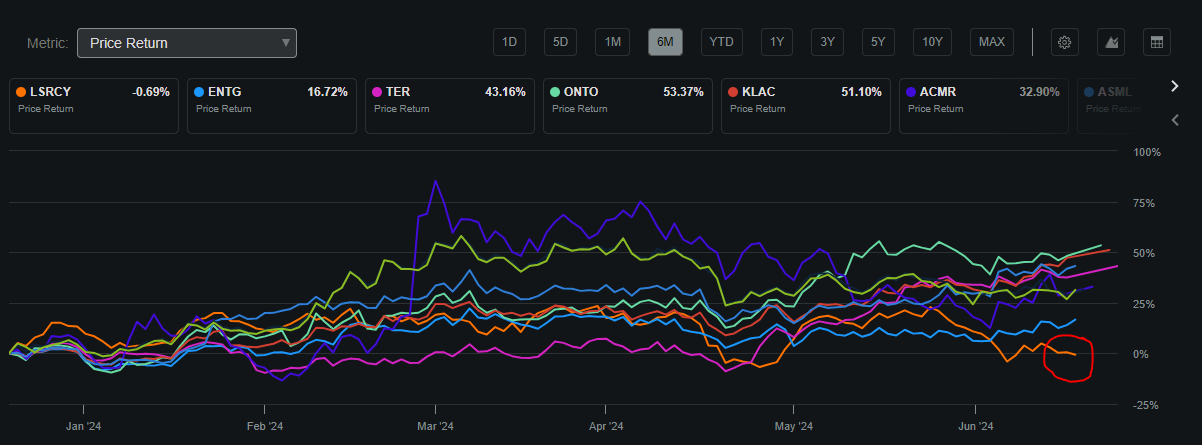

Despite the financials likely being verifiable and reasonable, there is no doubt plenty of risk when investing in Lasertec. And, despite being one of the best performing companies in the industry financially, Lasertec has been one of the worst performers of the past six months. While most peers are continuing their tremendous bull market since Oct 23, Lasertec shares are essentially flat over the past six months. Remember, this is even as Lasertec has recorded 98% YoY revenue growth.

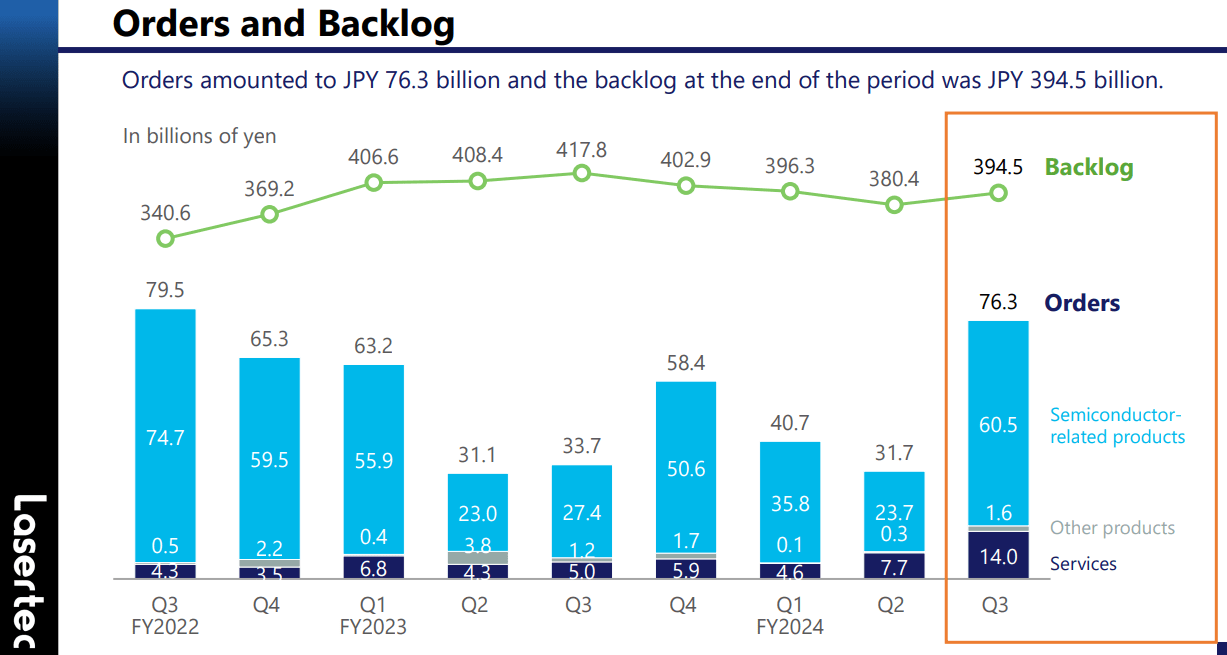

Most of the share price weakness can be attributed to the pullback in orders that were seen between Q2 of FY23 and Q2 of FY24. During that time Lasertec’s backlog fell from a high of 418 billion yen to a low of 380 billion. So as the market continues investing in chip making equipment thanks to the AI movement, investors expected the backlog to continue rising as Lasertec’s products should only be of increasing demand.

Instead, weakness in consumer/low value chips allowed the foundries to have plenty of capacity for high end chips, leading to reduced orders. I believe this is especially true for Lasertec’s legacy sales, which should still account for at least 50% of sales and are most at risk of lagging demand. But as of the last quarter, partially spurred on by NVIDIA’s immense data center sales growth, foundries are again investing in Lasertec products with a sharp increase in orders, most likely ACTIS. Now the backlog is growing again, and this should bode well for continued future revenue growth.

Seeking Alpha

Lasertec Investor Presentation

Company Response

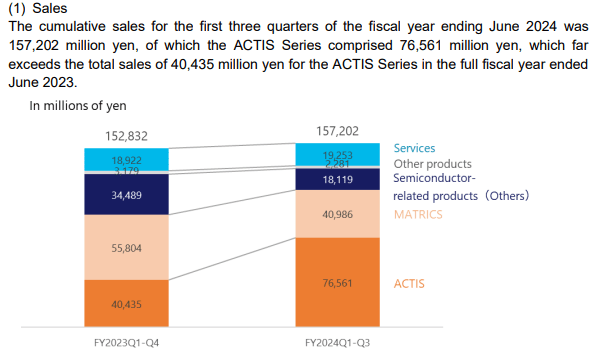

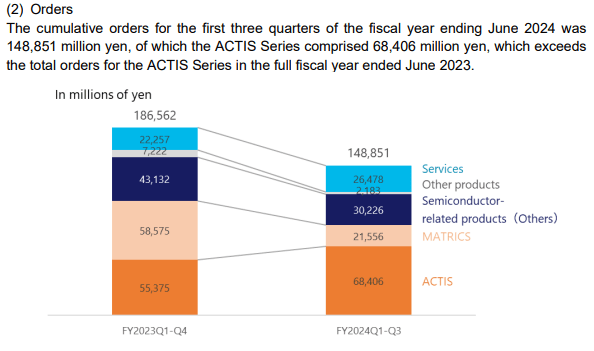

Shortly after the short report was released, Lasertec management released information on the accounting issues brought up by Scorpion Capital. Suffice to say, the company clarifies most issues brought up by the report and can be summarized by the two images below. Essentially, despite MATRICs, or legacy product sales are falling, ACTIS sales are increasing, unlike what is discussed in the short report. At the same time, ACTIS orders are only increasing YoY, while backlog weakness can be attributed to declining sales in legacy services and equipment, as I expected. As stated by management:

On June 5, 2024, Scorpion Capital LLC issued a report alleging that Lasertec committed improper accounting practices. Their allegations mainly suggest 1) negative customer evaluation of our ACTIS-series actinic EUV pattern mask inspection (“ACTIS Series”) and poor market demand, and 2) improper accounting practices of willfully not booking finished goods. However, Lasertec has been receiving a high level of demand for the ACTIS Series, and we have been engaged in proper accounting practices as described below.

Lasertec PR Lasertec PR

I am not the only one with a more skeptical view of the fraud allegations. According to a news post on Investing.com, JPMorgan maintained their Neutral rating, and shared the following commentary:

In response, Lasertec immediately issued a denial of these allegations on Wednesday.

The company went further to address concerns by releasing sales and order data by product on Thursday, which indicated a consistent growth in orders for its ACTIS series. This move was aimed at countering the claims presented in the Scorpion Capital report and to provide reassurance to stakeholders. Despite the release of this data, the firm acknowledges that some skepticism may persist regarding technical issues at Lasertec.

JPMorgan’s commentary highlighted that while the true impact of the accusations on Lasertec’s performance remains uncertain, the sustained high level of orders and sales since the announcement of the ACTIS series implies that no significant problems have surfaced. The analyst’s position reflects a cautious outlook in light of the recent controversy surrounding the company.

Instead of fraud, it is far more likely that expected investor sentiment volatility and influence on a high valuation is the true risk factor to the share price.

Value

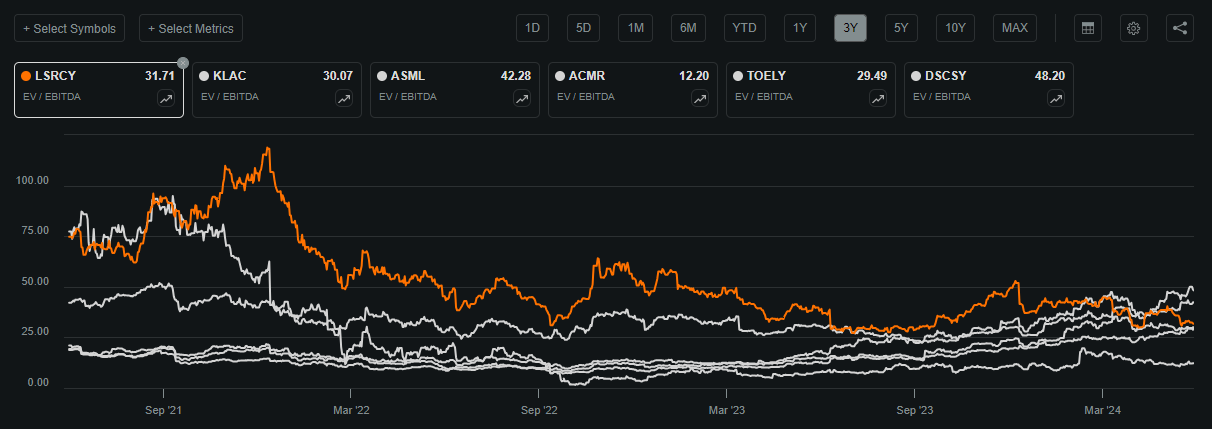

We now come to valuation. As should be expected, Lasertec holds a very high valuation by most metrics. However, the weak price action has allowed the valuation to fall to levels below some peers, such as Disco (OTCPK:DSCSY) and ASML. The EV/EBITDA is also approaching major peers KLA and Tokyo Electron, at around 30x EV/EBITDA. So investors now have the choice to either add shares of a company growing revenues at least 30% per year, or go for the well established, profitable, but slower moving companies.

Considering valuations are moving towards record highs for most, I prefer to offset the valuation risk with the growth opportunity present in Lasertec. I also am keen to limit my exposure to the semi industry at the moment by trimming my holdings, although momentum remains steady. By shifting assets to Lasertec, I believe I will get the best of both worlds: a temporarily low valuation and secular growth opportunity.

Seeking Alpha

Conclusion

While Lasertec will be just one small part of my portfolio, I do believe the company has the opportunity to become a diversified testing player with time. Until then, I believe that the secular growth of photomask testing earlier in the EUV process will be a key criteria for the longevity of the company, and revenue growth will offset high semiconductor equipment industry valuations. I will continue to watch the success of NVIDIA as the main bellwether of the industry, and in-roads by competitors will only be a benefit for Lasertec as numerous foundries invest in equipment to meet their inspection needs. But as always, I will continue to stress the value of diversification and recurring investments to negate short-term and long–term price volatility.

Thank you for reading. Feel free to share your thoughts in the comments.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.