shironosov/iStock via Getty Images

Thesis

Pluri (NASDAQ:PLUR) is a biotech company that focuses on establishing transformative collaborations in agriculture and cell-based food growth. Those are big money industries where Pluri can make a difference if it moves ahead well and lands partnerships, which, I believe, should happen given the inevitable future consequences of climate change.

Additionally, Pluri focuses on cell-therapy based regenerative medicine, and as a contract development and manufacturing organization it offers a large GMP-grade manufacturing facility to other cell-based biotech companies.

Pluri currently has a market cap of about $30 million, which, I believe, is probably far below its actual value, already looking at its still-growing IP estate. As the company will be building collaborations and making transformations in either of the industries listed above, I assume more investors will eventually flock in. The ambitions are huge, but which sector or patent will eventually move the needle is as of now still unclear.

I believe the potential is theoretically almost limitless, as many industries may stand to benefit from mass cell cultivation for commercial usage.

Pluri’s recent 1 for 8 reverse share split made the stock Nasdaq-compliant, so that hurdle is also behind the company.

At a ~$30 million market cap, Pluri trades close to its current cash and deposits level. I believe investors should be using a sum-of-the-parts approach, and that the company warrants a much higher valuation.

The company

Introduction

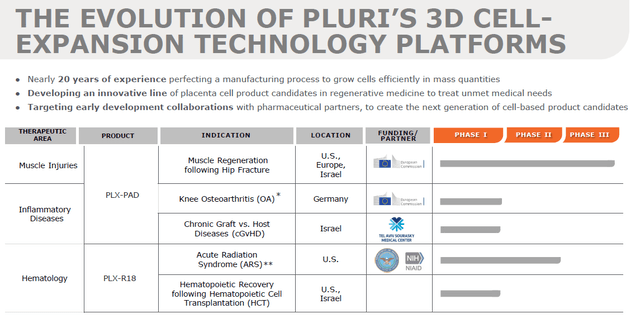

Pluri, originally Pluristem, has been around for about twenty years. Previously one of several companies that focused on cell-based medicine to treat diseases, the company has state-of-the-art 3D cell expansion technology and has built a novel cell-based platform called Plurimatrix for scalability and commercialization of cell expansion.

Pluri has accumulated 140 patents counting IP estate, and built a good manufacturing practices-based facility in Israel. In 2022, after a trial had failed to reach its primary endpoint in a study on muscle regeneration after hip fracture surgery, although seeing significantly increased hip strength, accelerated muscle strength and regeneration, the company made a strategic turnaround including a name change.

Pluri converted to its current form, four divisions, all based on the same innovative 3D cell expansion technology, any of which and potentially several may eventually lead to transformations across industries: plurifood, pluriagtech, plurihealth and pluricdmo. As plurifood, pluri is collaborating with Israël’s largest food manufacturer Tnuva, in a joint venture called Ever After Foods, to grow meat not in a petri dish but in a bioreactor using its specific technology. As pluriagtech, the company intends to grow coffee and potentially other plants in the lab, in an effort to counter future coffee shortages due to higher demand and global warming effects on global coffee production. As plurihealth, Pluri is focusing on treatment of radiation sickness and knee ostheoarthritis and immunotherapy. As pluricdmo, Pluri is a contract development and manufacturing organization offering cell expansion services to third parties.

Pluri overview (Corporate Presentation)

Its main assets for all of this are multiple and include a large patent estate, the accompanying know-how, a GMP-grade facility with manufacturing processes approved by key regulators, and proven batch-to-batch consistency.

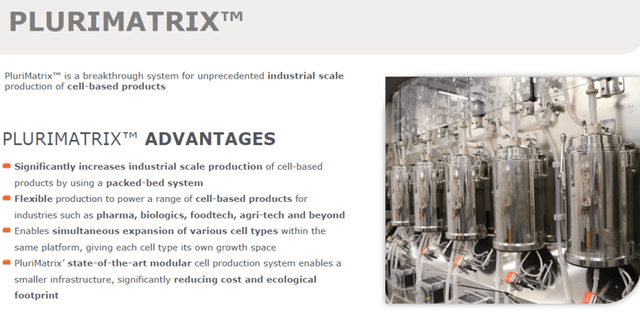

For the purpose of cell expansion, Pluri has innovative 3D Bioreactor technology and Plurimatrix, not your typical cell expansion vat, but rather a bioreactor-type industrial scale production system allowing cells to expand as tissue on scaffolds in a 3D environment. The 3D aspect is huge here, as it differs from petri dishes, which are typically used to create petri dish meat. Pluri’s solution is scalable and creates meat in a much more natural way, reducing manufacturing facility size, cost and ecological footprint, which in my opinion is a good solution that could enable industrial scale production.

Plurimatrix (Corporate Presentation)

Pluri’s goal is to collaborate and forge alliances with companies that are determined to make changes in the sectors they are working in, and/or find partners to enable commercialization (such as Tnuva) for opportunities Pluri is seeing (such as coffee). The way to commercialization will be that of out-licensing technology and IP and building joint ventures.

The background here is that in years to come, the shift to cell-based products may become appropriate and potentially inevitable both from an environmental, ethical and consumer point of view. Cell-based products cause less burden on the environment as they use significantly less water and land than land conventionally used for farming and breeding, emit much fewer greenhouse gases – which is a real issue for cattle, for example – and reduce agriculture-related pollution. For the consumer, cell-based food growth could facilitate natural flavor modification and enable safer food modification for more nutritious and healthier food.

Pluri’s technology can allow a cell to multiply into billions of cells. So far, there is nothing new: other technologies have also enabled cells to multiply. The novelty Pluri has lies in the industrial-scale manufacturing facility where the cell multiplication takes place in a 3D micro-environment that can mimic different cell growth environments. The right environment, depending on cell type, should allow fast growth in all directions (not just mostly left and right like in a petri dish). Such a design should enable commercial-scale manufacturing.

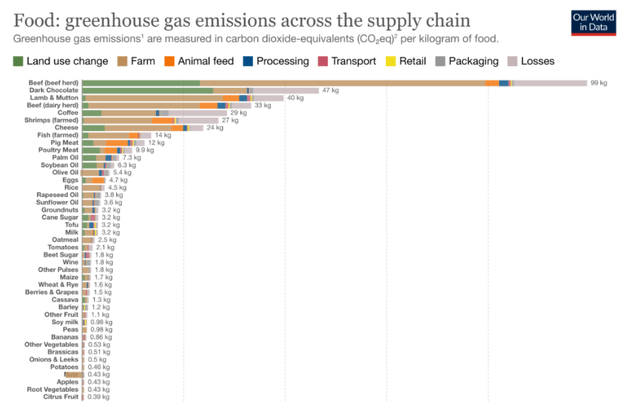

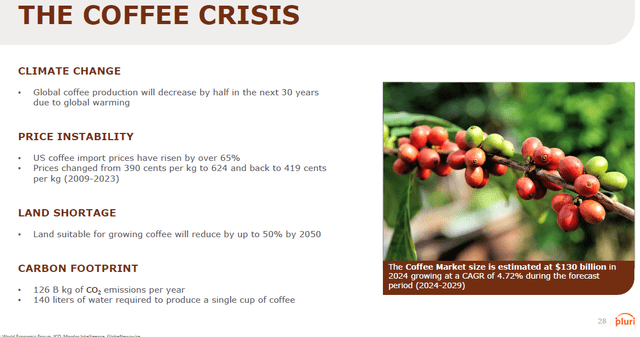

PluriAgtech: cell-based coffee

PluriAgtech’s goal is to use plant cell culture technology to make farming more efficient and eco-friendly. Among several projects, the furthest-advanced is one to develop cell-based coffee at the commercial level, using Pluri’s patent estate, know-how and facility. This department addresses a major challenge of a changing world. Optimal growing temperatures for arabica and robusta are 18-22°C, and are grown in a belt that due to climate change and extreme heat is expected to diminish by 50% by 2050. Arabica may go extinct by 2080. At the time of writing, the price of robusta beans is at an all-time high, with prices of cocoa and arabica beans following suit. Global demand and climate change are considered to be essential causes. Additionally, coffee production is one of the largest emitters of greenhouse gases, behind herd and dairy beef, dark chocolate and lamb. The production of one cup of coffee also requires 140 liters of water to grow, process and transport it to the consumer.

Greenhouse emissions across the supply chain (Nutrients, Recommendations for Integrating Evidence-Based, Sustainable Diet Information into Nutrition Education)

Emissions regulations may tighten in years to come, drought may become an issue, and alternatives to regular coffee beans will probably have to be found. Recent years have seen projects and start-ups of all kinds to address those challenges, such as coffee extracted from other foods, from coffee byproducts, genetically modified varieties, or lab-grown solutions. That’s where Pluri comes in.

Pluri recently announced the grant of a patent entitled ‘A System for 3D Cultivation of Plant Cells and Methods of Use’, which should allow cultivation of plant cells. The possibilities are vast. One example could be cultivation of plants that are not easily cultivated or even endangered; apparently one-fifth of the 50,000 medical plants used today are on a list of threatened species. That would create major opportunities for the medical sector. The prime example of use of such patent for Pluri will be the production of cell-based coffee, using 98% less water and 95% less growing area, and being able to be grown all year round.

Cell-based production slide (Corporate Presentation)

Logically, that will present its own challenges in order to develop the recipe for cell-based coffee, potentially roast it, to taste similar to our daily cup.

In a $130 billion market, given climate change and quickly changing and diminishing territories in which coffee beans can – still – be cultivated naturally, this may again be a particularly interesting solution. Global warming may reduce the availability for land to grow coffee beans by up to 50% by 2050, which could present a major challenge for this very large industry. Actual coffee beans may become a luxury or at least more expensive, but insofar as that can be solved by high quality alternative coffee, that should be a viable commercial solution. Additionally, the carbon footprint and water usage for coffee production may become more tightly regulated as emission regulations come into place and/or water supply in certain warm and/or dry areas may become problematic.

Coffee crisis slide (Corporate Presentation)

The FDA’s GRAS regulation – Generally Regarded As Safe – is applicable here, which provides a relatively easy process and timeframe of about a year to work towards approval.

I assume those are the reasons why Pluri’s current focus for its AgTech division is in that direction. In 2021, the global market for cellular agriculture was valued at $133 billion and is expected to grow ~4x to about $515 billion in about six years. That is a tremendous expected growth trajectory where a transformative play such as Pluri can make contributions.

I find this actually a very smart move; it’s a thought out of the box that you rarely see from a healthcare-focused company.

Eventually, Pluri should partner with commercial partners. Chances are high, in my eyes, that it eventually will.

PluriFood

3D meat production

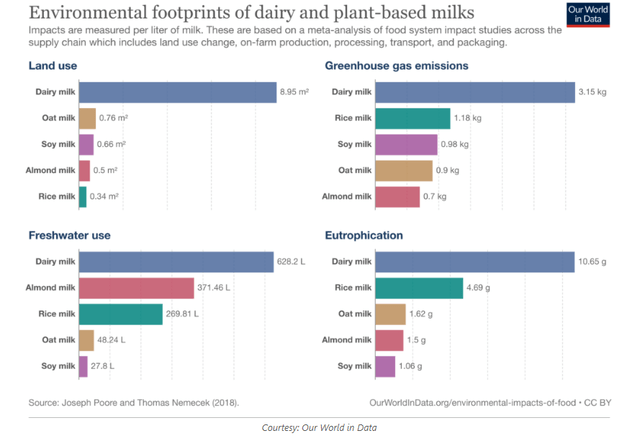

Food production is responsible for 25% of all greenhouse emissions worldwide. Cattle is responsible for the majority of that. A shift will eventually need to be made to either much less meat consumption – which will be difficult – or meat alternatives with much lower greenhouse gas footprint. Water consumption for meat production is another issue, as well as use of antibiotics, e.g. to breed salmon or shrimp in too populated territories. There is a huge environmental footprint for dairy products.

Environmental impact dairy and plant-based milks (Our World In Data)

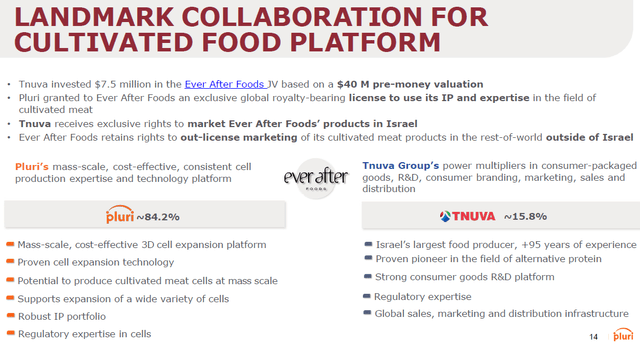

In 2022, Pluri launched its subsidiary Ever After Foods, a joint venture with Israel’s biggest food producer Tnuva. Tnuva invested $7.5 million on a $40 million valuation. The deal is built around the exchange of Pluri’s IP and knowledge for a commercialization exclusivity for Tnuva for the Israeli market. Ever After Foods / Pluri retains commercialization rights for the rest of the world. Pluri is focusing on the U.S. market first. The U.S. is also the territory where the first cultivated meat – poultry – has been greenlighted for safety in 2022, then approved for commercialization in 2023 by a company called Upside Foods. That should trigger a policy change, with other companies to follow in Upside Foods’ footsteps. The regulatory process is thereby also laid out, and shows approval can be obtained in about two years’ time.

Ever After Foods is Pluri’s subsidiary (~84% owned) working on the commercialization of cell-based meat products that use significantly less water and land than land conventionally used for farming and breeding, emit much fewer greenhouse gases – which is a real issue for cattle, for example – and reduce agriculture-related pollution. For the consumer, cell-based food growth could facilitate natural flavor modification and enable safer food modification for more nutritious and healthier food.

Different to several other companies that are trying to grow meat in stir tank bioreactors, Pluri uses smaller packed bed vessels in which cells are grown on edible carriers from which they are detached with a patented vibration technology and then transferred to production bioreactors where they seed, differentiate and mature into meaty tissue. That process should lead to a 700% increase in productivity compared to other cultivated meat platforms and significantly lower capital expenditures and production costs. More than 10 kilos of meat mass can be produced with a 35-liter production bioreactor. A 1,400 liter bioreactor can thus produce 400 kilos of meat, which other technologies would need a +10,000 liter bioreactor for the same.

TNUVA collaboration (Corporate Presentation)

Tnuva is Israel’s largest food producer, with nearly 100 years of experience developing, selling and marketing consumer goods. It has clear ambitions that expand beyond traditionally made food. Ever After Foods’ ambitions with this partnership is to combine Pluri’s science with Tnuva’s culinary and consumer knowledge, to create well-tasting and nutritionally superior meat.

On June 18, 2024, Pluri announced a $10 million investment from U.S.- and E.U.-based investors in Ever After Foods, which again underscores the collaborative potential with Ever After Foods.

Again, Pluri is looking at opportunities here. There is a global need for alternative solutions to traditional meat production. At the same time, the different cultivated food markets are expected to explode in the years to come. Cultivated meat, fish and dairy respectively are expected to become $140 billion, $8.7 billion and $6.94 billion markets respectively by 2030-2032.

Breast milk-derived food production

On May 20, 2024, Pluri announced a collaboration with Wilk Technologies to develop human breast milk-derived food to be produced on a commercial scale. The parties would use Wilk’s unique cell lines and leverage Pluri’s 3D cell expansion technology. The elderly food market is a multi-billion market, estimated at $25 billion at present and poised to grow to almost $40 billion in the next ten years.

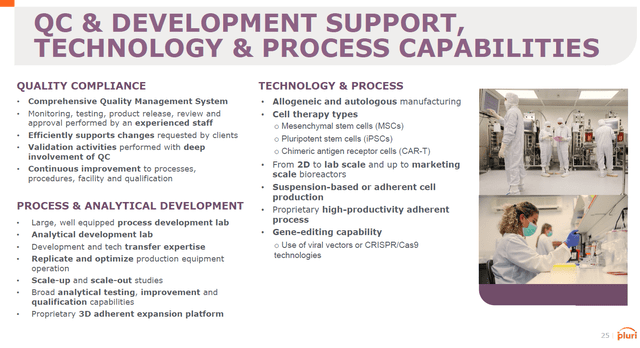

PluriCDMO – contracting manufacturing for cell and gene therapies

The PluriCDMO division is the youngest of all of Pluri’s departments, launched in January 2024. It provides services to biotech companies building on the expertise gained after years of working in the space with its GMP-certified facility with mass scale production possibilities. The company can assist other companies with preclinical development and advise on clinical trials, potential commercialization, and logistics. The biotech space is fast-evolving, and cell and gene therapy development can be outsourced to facilities such as Pluri’s, with a 1,800m² production level area, 1000 m² of process and analytical labs and 600 m² of clean rooms.

Pluri facility (Corporate Presentation)

PluriCDMO™ will offer manufacturing support from the preclinical and development stages to late stage clinical and commercial production, including fill and finish and logistics. Pluri can additionally license or use its own IP and 3D cell-expansion technology.

PluriCDMO Services slide (Corporate Presentation)

PluriCDMO already generates revenue for Pluri and in the latest February 2024 update, a month after its inception, the company stated that it was negotiating several CDMO agreements.

Under this umbrella, Pluri has also signed a deal with Remedy Cell for the manufacturing of a clinical-grade Working Cell Bank and GMP batches of Remedy Cell’s drug candidate RC-0315, derived from mesenchymal stem cells, for their Phase Ib trial in Idiopathic Pulmonary Fibrosis.

PluriHealth

Introduction

PluriHealth is the division closest to what Pluri set out to do with Pluristem, namely finding innovative cell-therapy and cell-expansion-based treatments for several diseases.

Pipeline and progress (Corporate Presentation)

PluriHealth takes it a step further, focusing on mass production for future commercialization and strategic partnerships with parties who understand the market and provide funding for the development.

Pluri’s most recently announced patent grant, enabling mass scale production of a variety of immune cell therapies, can be seen in that light.

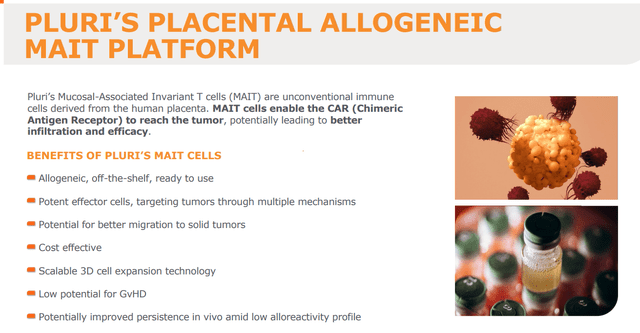

Expansion of MAIT cells for the treatment of solid tumors

The most recent announcement with regard to Pluri’s health platform is Pluri’s launch of an immunotherapy platform for the treatment of solid tumors using placental mucosal associated invariant T cells, or MAIT cells. These cells are isolated from human placenta and have a phenotypic profile that makes them good to potentially target tumors and migrate to tumor sites. Additionally, their engraftment comes with lower risk of graft-versus-host disease, a problem often seen with current T-cell therapies.

MAIT platform (Corporate Presentation)

CAR-T-cell based therapies, whether autologous or allogeneic, have had successes in liquid tumors, but challenges remain in solid tumors, which form 90% of all tumors.

The added value of Pluri here should lie in its ability, novel and patented, to expand these high-potential immune cells for use on a commercial scale.

Two renowned cancer researchers, Dr. Richard L. Kendall and Dr. Prasad S. Adusumilli, have joined Pluri’s SAB in that regard.

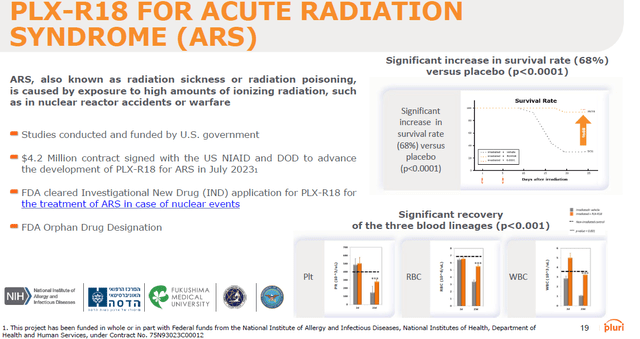

PLX-R18 for acute radiation syndrome

Pluri is also advancing its own therapies under this umbrella, one of which is backed by the U.S. department of defense as a treatment for acute radiation syndrome. The company has signed a $4.2 million contract in July 2023 with the U.S. National Institute of Allergy and Infectious Diseases, part of the NIH, for the development of a cell therapy called PLX-R18 as a potential treatment for Hematopoietic Acute Radiation Syndrome (H-ARS). The National Institutes of Health have recently exercised their $1.4 million option of further funding.

If successful, PLX-R18 may be purchased for the U.S. Strategic National Stockpile to treat acute exposure to nuclear radiation, following U.S. Food and Drug Administration (FDA) approval.

PLX-R18 for Acute Radiation Syndrome (Corporate Presentation)

In light of the ever-rising threat of a potential nuclear fallout, wherever in the world, due to increasing geopolitical tensions and repeated threats from different countries – mostly Russia – this is an undeniable necessity. A nuclear attack or incident may be one-off, with a fallout allowing rescue and treatment of a high number of individuals.

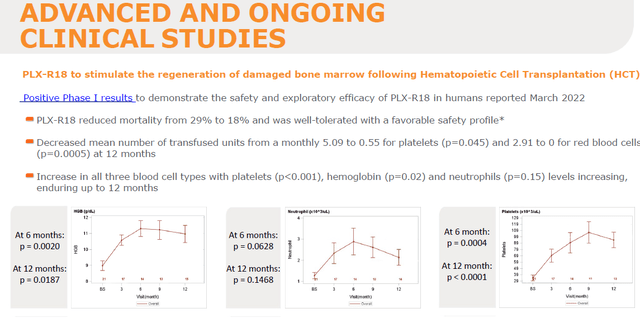

PLX-R18 for the regeneration of damaged bone marrow

Pluri’s pipeline further includes PLX-R18 for the regeneration of damaged bone marrow following Hematopoietic Cell Transplantation, after having reported tolerability, safety, a ~10% reduction in mortality in 2022 and a lower number of necessary transfused units.

PLX-R18 for damaged bone marrow (Corporate Presentation)

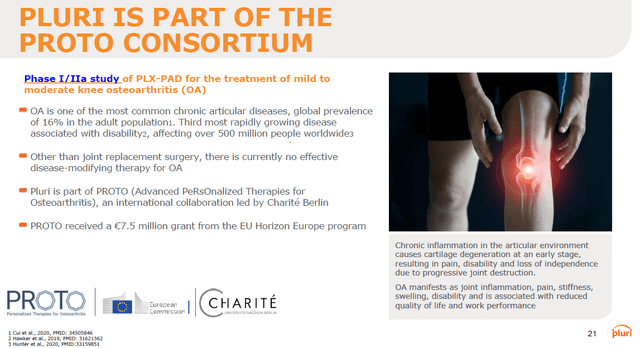

PLX-PAD for the treatment of knee ostheoarthritis

Pluri also has a Phase I/IIa study for PLX-PAD for the treatment of knee ostheoarthritis ongoing. Chronic joint inflammation lies at the heart of that indication, for which there is no effective disease modifying therapy other than joint replacement surgery.

PLX-PAD for knee ostheoarthritis (Corporate Presentation)

PLX cells for the treatment of cocaine addiction

Pluri inked a deal with BIRAD – Research & Development Company, to use PLX cells to treat cocaine addiction, an unexplored area where there is no FDA-approved treatment to treat cocaine addiction. In case of commercialization, Pluri is entitled to a 20% revenue share from future sales of any product.

Valuation

Pluri’s collaboration with Tnuva for production of meat is in a market that will likely grow to $140 billion. The global coffee business is a $130 billion business right now, expected to grow 4x in six years. Time to approval, that could be only two years. I expect Pluri to out-license commercialization and have a partner take over commercialization for a license fee based on sales or revenue, e.g. at 20% of revenue. A 0.25% market share for this business in relation to meat and coffee production, after having discounted 30% EBITDA margin, would be $473 billion, potentially generating $95 million in license revenues.

For PluriHealth, I take into account a $500 million market for ARS based on the potential for the US Strategic National Stockpile, with an initial estimate of $50 million in annual revenue. I would expect similar revenue from the knee osteoarthritis and immunotherapy businesses. Discounting a 30% EBITDA margin would lead to $105 million valuation here.

I give the PluriCDMO business a revenue estimate of $30 million within two years, or $21 million after a 30% EBITDA margin reduction.

That would total $221 million in potential revenue. I apply a 50% discount as revenues are not yet being generated. Applying a 10x EV/EBITDA multiple would lead to a $1,105 million valuation. Adding the value of the patent estate, encompassing more than 140 patents, which I modestly value at $50 million. In that light, I believe Pluri is fundamentally undervalued at the time.

Financials

As of March 31, 2024, Pluri had cash and cash equivalents of about $7 million, and short-term bank deposits of $18.9 million, totalling about $27 million. Pluri’s cash burn rate is about $16 million per year or $4 million per quarter. Net loss for the quarter ending March 31, 2024, was $5 million. For the six months ended December 31, 2023, net loss was $10 million. That burn rate may go down if the company generates more revenue from either of its businesses. Pluri believes that its current resources, together with its existing operating plan, are sufficient for the Company to meet its financial obligations for the coming year. I think that projection may be optimistic only with the current cash, but could be possible given the short-term deposits, and Pluri has a shelf registration in place effective since February 13, 2024 under which it can issue shares at-the-market worth up to $10 million.

Pluri is now trading with only 5.2 million shares, after a 1-for-8 reverse stock split that took place in the beginning of April 2024.

Risks

The main risk here, I believe, may come from Pluri not being able to land revenue-generating projects for the missions it has now embarked upon. Pluri is a complex company with a lot under the hood at this stage. If things do not get managed well, they may fail, or the company’s cash burn may be too high for lack of focus given the provided budget.

Regulatory risks are another element to take into account. Pluri has not yet obtained the necessary approvals to produce and commercialize end products for any of the PluriAgTech, PluriHealth and PluriFood divisions. This is not only true for cell-based coffee or cell-based meat, for example, but also for PLX-R18 or PLX-PAD. The regulatory path for food-production is shorter than for treatments of diseases, though. In light of Upside Foods’ example, it could take about two years to receive the approval to market foods, if the appropriate documents have been filed before the regulatory authorities.

Finally, there is a competitive risk to take into account. Though I believe Pluri is uniquely positioned both from a point of view of its technology, Plurimatrix and its large GMP-certified facility, other players may also plan to embark on similar or identical missions as those Pluri has set out for themselves.

Conclusion

Pluri is a reconverted biotech company with an attractive valuation that is putting its IP estate and PluriMatrix platform out there for use in different sectors.

Across the food and agriculture industry, Pluri’s cell-based meat and coffee could impact the future of these multi-billion industries, as they increasingly become impacted by climate change challenges and/or regulations addressing emissions and water usage. The future of cell-based products is now visible, certainly after the first U.S. approval of Upside Foods’ approval for commercialization of cultivated poultry meat. Pluri’s technology seems to allow meat production in a more efficacious and more cost-efficient way than before.

In light of its 140 patent large IP estate, including the patents that have recently been granted for 3D-cultivation of plants and to produce immune therapies on mass scale, the applications of Pluri’s technology are large. They may allow for solutions to what the world may need in terms of sustainability, reduction of greenhouse gases and water usage. Eventually, I see Pluri either landing further major partnerships or contracts, as it has already with Tnuva for its joint venture Ever After Foods, or finding a way to commercialization themselves.

The PluriHealth division’s most promising assets are probably PLX-R18 for acute radiation syndrome and its MAIT cell program. PluriCDMO is building partnerships with different biotech players, allowing Pluri’s large and qualitative GMP-certified facility to be put to use as it is supposed to.

My sum of the parts approach leads me to conclude that a $30 million valuation is particularly low for this stock, which is possibly still seeing the leftovers of a recent reverse stock split. At this valuation below the level of the last-disclosed cash and deposits, I do not think the market is correctly pricing Pluri’s potential. Catalysts such as further cooperations, further regulatory or other progress or good revenues may drive the stock up further, or the lack thereof may do otherwise.

For all of the above, I am adding Pluri to my vault of potential biotech breakthrough stocks.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.