Stock markets in India nosedived on Tuesday as vote counting trends indicated less than a “landslide” victory for incumbent Prime Minister Narendra Modi, defying larger analyst expectations and exit poll projections.

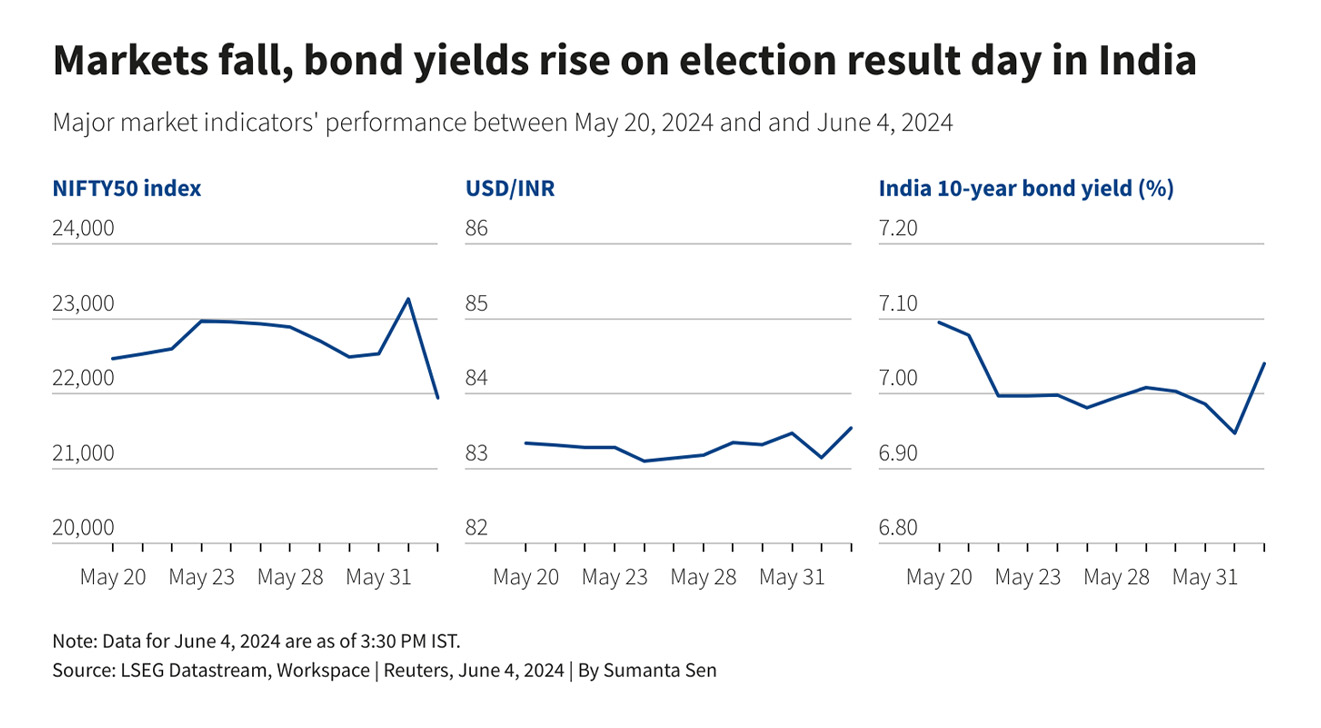

India’s benchmark indexes Nifty 50 and BSE Sensex were both down nearly 6% at the close of trade — their worst session in more than four years — shedding more than 1,300 and 4,300 points respectively, after hitting new all-time-highs a day before.

The Indian rupee also fell 0.47% on the day, its worst fall in more than a year, closing at 83.53 against the US dollar.

Also on AF: Modi Work Reforms Aim to Make India a Global Manufacturing

The Reserve Bank of India (RBI) likely stepped in to limit the rupee’s decline, traders told Reuters. State-run banks were spotted offering dollars near 83.50 levels, likely on behalf of the RBI.

Meanwhile, India’s benchmark 10-year bond was quoted at 100.40 rupees, with the yield up 10 bps at 7.0411%, after hitting their highest in nearly two weeks earlier.

Winds of uncertainty

Investors in the country were expecting a huge margin of victory for Modi — a result that market watchers and fund managers previously said would be a guarantee of political and economic continuity.

Modi ran his entire election campaign on a call for a ‘landslide’ victory, claiming his Bharatiya Janata Party, along with alliance partners, would win 400 out of the 543 seats that the federal elections were contested on.

Most exit polls, released since Saturday, also projected a similar mandate for the prime minister and his National Democratic Alliance (NDA), with many indicating at least a two-thirds majority for the BJP alone.

Latest trends, however, indicate a much more closely contested election, with the Modi-led alliance ahead in less than 300 seats. Meanwhile, its opposition INDIA alliance, led by the Indian National Congress, was leading on more than 230 seats — a result that was not widely anticipated.

Modi is still on track to return to power in India for a rare third-term, but will now be reliant on alliance partners to stake a claim to form and continue running the government. Commentators said on Tuesday that such a scenario would put Modi-led BJP on sticky ground and vulnerable to political uncertainty.

“The key question is whether BJP can retain single party majority. If not, then would its coalition be able to deliver economic development, particularly infrastructure?” Ken Peng, head of Asia investment strategy at Citi Global Wealth said.

The new political uncertainty would likely “cause some moderate de-rating for Indian equities,” Ping added.

Dipan Mehta, founder director at Elixir Equities told Reuters that the lack of a majority for the BJP “opens up Pandora’s box because all the other players … are all quite volatile.”

Panic-selling

The uncertainty seemed to weigh on investor sentiment through the day, with Indian shares sinking more than 8% at one point, reversing all gains of the past six months.

Traders told Reuters that selling by high-frequency traders accelerated the declines and triggered margin calls. One analyst also pointed out that a build-up in fresh short positions also added to volatility.

Another reason for the sharp fall was expensive valuations, with a plethora of stocks near record highs.

“One of the arguments behind India’s rich valuations could have been the political stability, policy certainty that a strong government gave. Some of those assumptions could come under question (with this election outcome),” UBS analysts said in a note.

Investors were also taking their money off the table as early losses spurred panic-selling among those who were hoping instead on bumper gains, based on exit poll projections. Markets on Monday had risen more than 3% on exit poll optimism.

Modi himself, along with the BJP’s second most-powerful leader Amit Shah, had — in the run-up to results — claimed Indian share markets would “break records on June 4”.

Shah went as far as to ask investors to “buy before June 4.”

Those statements from BJP leadership came under fire following the stock market plunge on Tuesday.

“It is scandalous that a top cabinet minister of this govt had publicly urged people to buy stocks. Exit polls acted as further encouragement. The market has crashed today. Who will be responsible for losses of small investors?” MK Venu, founding editor of online new platform The Wire posted on X.

Adani stocks, PSUs biggest losers

The rout of Indian shares was widespread: 12 of the 13 major indexes ended the day lower, while the more domestically focussed small-cap and mid-cap indexes sank 8%.

Shares of government-owned banks, infrastructure and capital goods firms, that gained sharply on Monday, saw the largest falls. State-run companies plunged 16.4% to record their worst day ever.

Among the worst-hit were crude oil giant ONGC, power firm NTPC, petroleum firm BPCL and SBI bank — all ending with double-digit losses.

A meltdown was also seen in stocks of the Adani conglomerate, owned by billionaire Gautam Adani who is alleged to have close ties with Modi.

Adani Ports ended the day down 21.15%, becoming the biggest loser on Nifty 50, closely followed by the group’s flagship Adani Enterprises which plunged 19.31%. Other Adani group stocks were down between 10%-19%.

Neelesh Surana, chief investment officer at Mirae Asset Mutual Fund, told Reuters the plunge in Indian stocks was an “overreaction” that “reflects a sense of disbelief.”

“However, despite the verdict, there will likely be underlying continuity in government policies. Stocks in sectors within industrial, capital goods, and government companies, which surged too rapidly during the last one year, were ripe for correction given that many companies saw their stock prices outpace earnings growth,” Surana added.

The only stocks that saw some gains were the defensive fast moving consumer goods stocks, rising 1.3%. Half of the eight stocks that advanced on the 50-member Nifty 50 were FMCG stocks.

What’s ahead for Indian stocks?

Full results are likely in several hours as polling officers count ballots of 642 million people. But trends as they stand at 1131 GMT are likely to more-or-less hold.

That means that the BJP will depend on allies to form the government, introducing some uncertainty in policy-making as Modi has ruled with an authoritative hold over the last decade.

While that is likely to keep markets volatile this week, experts say the stocks will continue to gain ground.

“We will see the pull pack as a buying opportunity,” Gary Tan, portfolio manager at Allspring Global Investments, said.

“Regardless of the final election count, the India economy will continue to benefit from longer term tailwinds of favourable population demographics and the ongoing geopolitical tensions between China and US.”

What’s ahead for Modi?

The Hindu nationalist BJP won a majority of its own when it swept to power in 2014, ending India’s era of unstable coalition governments, and repeated the feat in 2019.

But “a narrower-than-expected victory for Modi’s alliance may raise doubts about the new government’s ability to push through politically difficult reforms seen as crucial to sustain India’s economic growth, which is already the world’s fastest,” Vasu Menon, managing director of investment strategy at OCBC in Singapore, said.

“Despite this, the fact remains that the BJP-led alliance is still set to win a third term, which means continuity in the government’s infrastructure and manufacturing-led drive to boost economic growth.”

In such a scenario what remains to be seen, and will likely be clear in the next few days, will be the BJP’s ability to hold on to its allies.

The question, as put by civil rights activist and Modi critic Sanjay Hegde to online new platform Mojo Story, will be: “Will the NDA last?”

- Vishakha Saxena, with Reuters

Also read:

India Now the World’s Third Biggest Generator of Solar Power

India Regulator Puts Seven Adani Firms on Notice For Violations

Foxconn to Ramp Up India Operations With $1.5bn Pledge

India Seen Overhauling Japan as World’s No4 Economy – Nikkei

India And China Blocking ‘Pillar 1’ Global Tax Deal, Yellen Says