The stock market rally extends far beyond growth stocks.

The S&P 500 consists of 11 sectors, and Vanguard has a low-cost exchange-traded fund (ETF) for all of them. Each ETF incurs just a 0.1% expense ratio, or a $1 annual fee for every $1,000 invested.

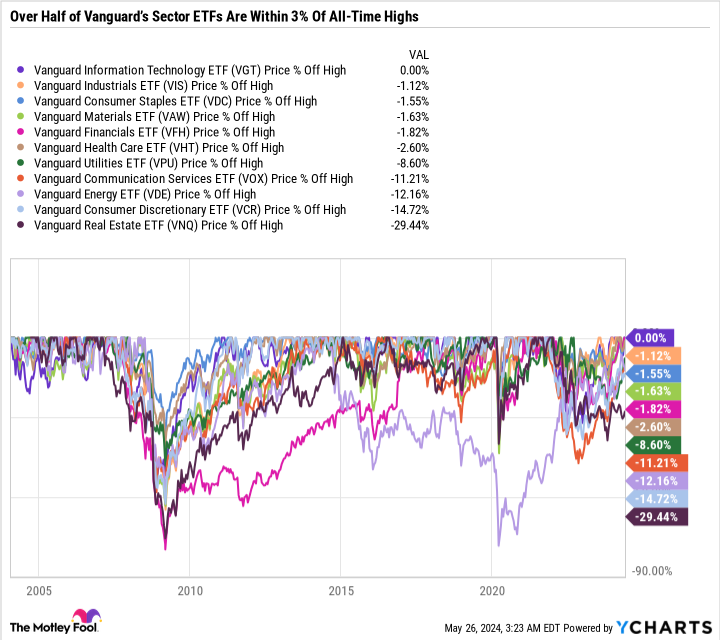

The Vanguard Information Technology ETF, Vanguard Industrials ETF, Vanguard Consumer Staples ETF, Vanguard Materials ETF, Vanguard Financials ETF, and Vanguard Health Care ETF are all down less than 3% from their all-time highs. The strong performance across growth and value-focused sectors showcases the broad-based rally in the stock market.

Each sector has its pros and cons, but my top pick to buy now is the Vanguard Consumer Discretionary ETF (VCR 0.59%), which has been one of the weaker performing sectors year to date and is down nearly 15% from its all-time high. Here’s why it’s worth buying the dip in the consumer discretionary sector.

Image source: Getty Images.

A justifiable sell-off

The consumer discretionary sector is among the easiest to understand because it includes many consumer-facing companies. The five largest holdings are Amazon, Tesla, The Home Depot, McDonald’s, and Lowe’s. Together, they make up 46.9% of the Vanguard Consumer Discretionary ETF.

The fund holds carmakers, restaurants like Chipotle Mexican Grill, hotel and travel companies like Airbnb, apparel brands like Lululemon Athletica, cruise lines, and a variety of retail outlets from Ross Stores to Tractor Supply, O’Reilly Automotive, AutoZone, and more.

The term “discretionary” can be a bit misleading since it implies a choice in spending rather than a need. After all, you could argue that getting a replacement car battery from AutoZone is a necessity rather than a discretionary expense.

However, in general, companies in the sector rely on consumers to spend money on expenses that come after what is absolutely necessary to live (food, basic household goods, etc.) That’s why you’ll find Walmart and Procter & Gamble in the Vanguard Consumer Staples ETF.

Consumer discretionary can be a double-edged sword. When an economic boom is fueled by consumer spending and business growth, there tends to be increased spending on goods, services, travel, etc. That leads to big-ticket purchases like a new vehicle, buying Lululemon apparel instead of a more affordable option, doing a much-needed home renovation — benefiting Home Depot and Lowe’s, etc.

One of the major cracks in the broader market rally is the economic health of the average consumer. Companies with a majority of business-to-business sales have fared generally better than companies with a business-to-consumer focus. For example, Nvidia and Microsoft are growing while Apple‘s earnings are stagnating. General Electric is hovering around a 52-week high, while United Parcel Service is treading water above a 52-week low.

Companies that cater to consumers are more vulnerable if they have a discretionary product mix. For example, Walmart and Target reported earnings recently, with Walmart hitting an all-time high and up over 24% year to date, whereas Target fell 8% the day it reported.

Be wary of near-term headwinds

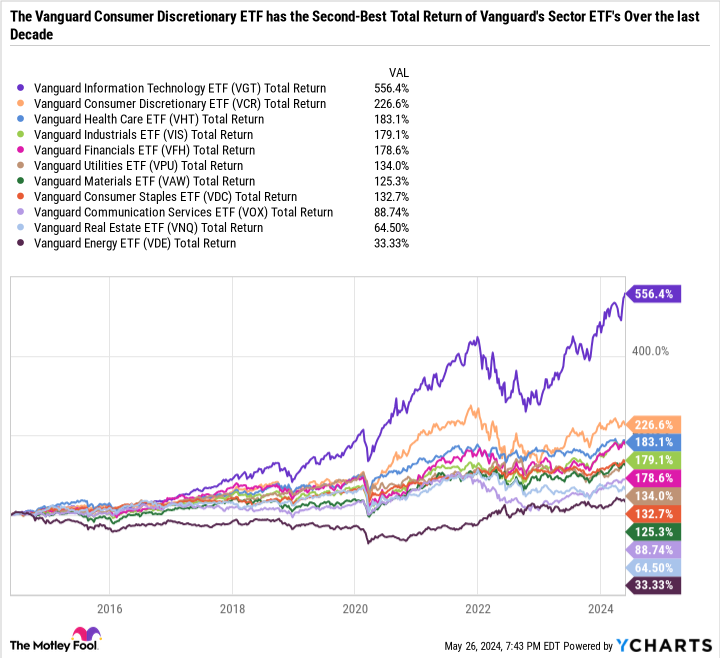

Despite its recent struggles, the Vanguard Consumer Discretionary ETF has been a long-term winner and is second behind only the Vanguard Information Technology ETF in total return over the last 10 years. Total return includes both capital gains and dividends.

VGT Total Return Level data by YCharts

The setup looks bad in the short term, but consumer discretionary is a sector that tends to generate outsized growth during an economic expansion. It’s a major bet on the U.S. economy and top U.S. brands. Many of these companies have expanded overseas and have massive growth potential from consumers in developing countries.

If you’re a believer in a rebound in the strength of the American consumer and global economic development that benefits U.S. companies, then this sector is right up your alley.

Despite the multi-decade tailwinds, the sector could continue to underperform while interest rates remain high. A few months ago, there were hopes that the Federal Reserve would begin cutting interest rates during the first half of the year. But the first half of the year is almost over, and there’s no current timetable on whether the Fed will cut rates at all in 2024.

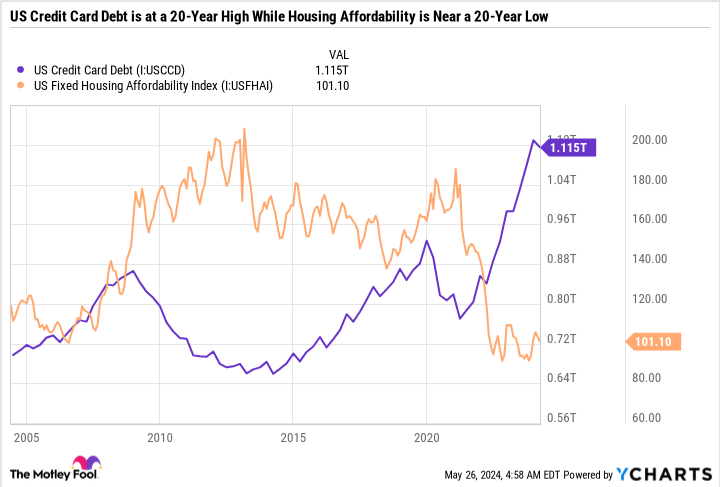

Higher interest rates make borrowing money more expensive, which raises big-ticket items like mortgages, car payments, and credit card fees. I’m a big believer in this sector long-term, but I’ll admit there are some worrying charts out there. The one below shows the 20-year change in U.S. credit card debt and the U.S. fixed housing affordability rate.

US Credit Card Debt data by YCharts

An index level of 100 means that a family earning a median income has exactly enough money to afford a mortgage loan on a median-priced home with a 20% down payment. The level is currently around 100, which means a lot of people cannot afford a home under those conditions. In the chart, you can see that it is around the same level as it was during the housing bubble of 2008.

The U.S. fixed housing affordability rate is a useful metric because it considers mortgage interest rates and home prices. Since mortgage rates and housing prices are both at multiyear highs, the index indicates that the housing market is relatively unaffordable.

Macroeconomic factors, especially consumer-focused ones, are vital to the consumer discretionary sector. Approximately 50% of U.S. household monthly expenses go toward housing and transportation. Throw in food, personal insurance and pensions, and healthcare, and that’s 83% of monthly expenses. The more these expenses increase, the less people can afford discretionary expenses.

An excellent buy-and-hold play

When approaching a long-term investment opportunity, it’s important to understand both the bullish and the bearish argument. The bearish argument for the consumer discretionary sector is compelling and backed by concerning economic data and weak financial results by major sector leaders.

However, the factors weighing on the sector are mostly concerned with interest rates and other near-term challenges. The sector could continue to be volatile and sell off more from here, but if you agree with its long-term growth potential, it’s one to buy or at least add to your watchlist.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Airbnb, Amazon, Apple, Chipotle Mexican Grill, Home Depot, Lululemon Athletica, Microsoft, Nvidia, Target, Tesla, Vanguard Real Estate ETF, and Walmart. The Motley Fool recommends Lowe’s Companies, Tractor Supply, and United Parcel Service and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.