The Barnfields are among a growing number of Calgary families having to cut back on spending just to keep up with basic costs like groceries, rent, even lunchroom fees for their kids in school

Article content

As doting, dedicated parents, the Barnfields used to treasure taking their young children on their much-loved “monthly dates.”

Article content

Determined to give each of their two kids, aged nine and 11, quality one-on-one time, Krystal Barnfield would stay home with one child, while her husband would take the other child out for a special meal and activities.

The following month, they would switch, with the other child getting a fun date and the other parent and child taking it easy at home.

Advertisement 2

Article content

“It was really very special. One of us would take them for a meal out, and then do all kinds of fun things, bowling, swimming, the movies, or mini golf. Whatever they wanted. It would be their choice.”

But with high inflation and the cost of living skyrocketing in the past few years, monthly dates have had to fall by the wayside, Barnfield says.

The kids are learning to understand that quality fun time is now limited to outdoor play because that doesn’t cost anything, she adds.

“We’ve had to really tighten our belts, we don’t get to go out and do those fun things anymore.

“But at least the kids are getting old enough to understand how careful we have to be with money now. And they’ve been really good about it. They want to do their part to help us save.”

The Barnfields are among a growing number of Calgary families having to cut back on spending just to keep up with basic costs like groceries, rent, even lunchroom fees for their kids in school.

The family has been renting the upper level of a house in Abbeydale for the past five years. But rent has continued to climb rapidly, going from $1,420 before the pandemic to the current $1,875, which includes a $250 spike after they renewed their lease last summer.

Advertisement 3

Article content

“We were really lucky when we first got here five years ago, before the rent went up, we were getting a pretty good rate. But now it’s jumped so much in the last couple of years.”

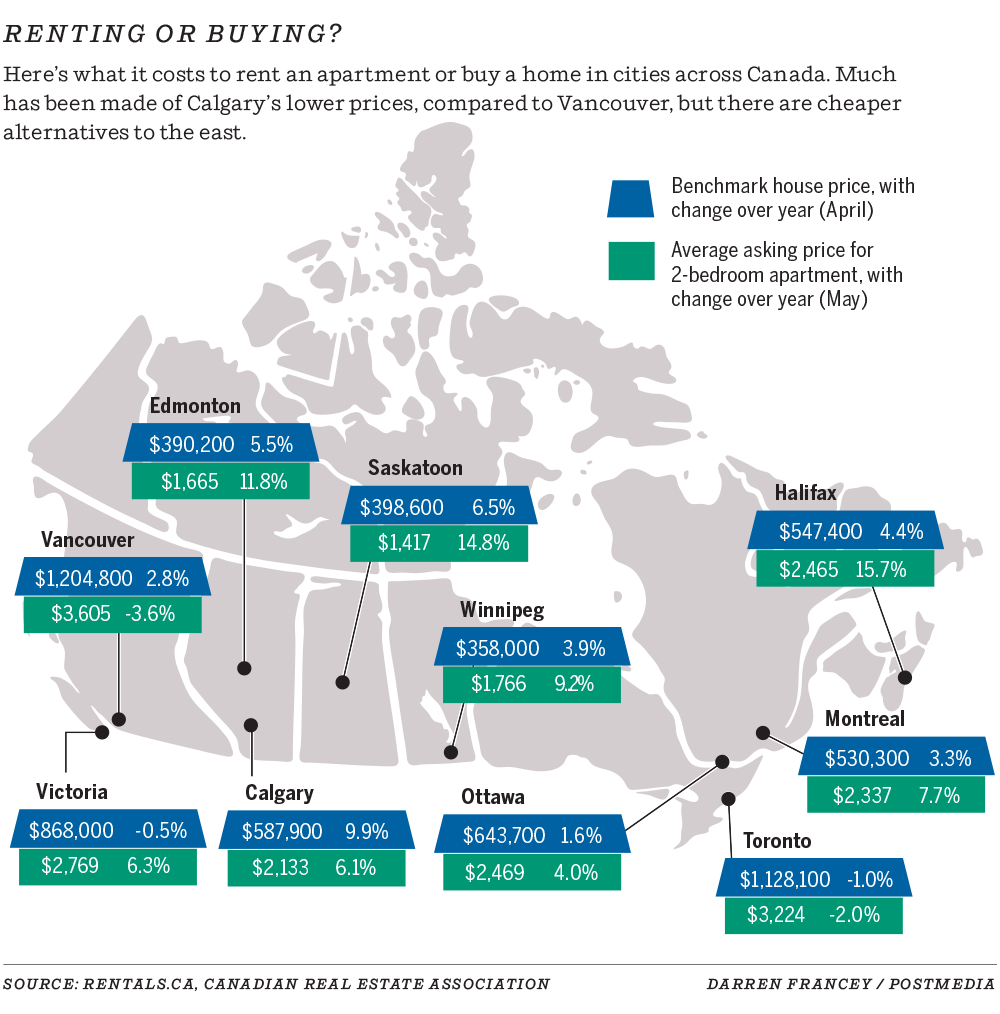

Rents in Calgary, apartments, condos or houses, have continued to rise over the past year amid record migration and a worsening housing crunch.

According to reports from Rentals.ca and Urbanation earlier this year, Calgary posted some of the largest year-over-year rent increases in the national rent rankings, with more spikes expected for 2024 as Canadians from across the country continue to flock to Alberta.

Those rankings saw Calgary as the 25th most expensive city in Canada to rent now, with the average one-bedroom unit going for $1,736 and two-bedrooms going for $2,133. This represents an eight per cent and six per cent year-over-year increase, respectively.

Overall, rents in Alberta grew as much as 15.6 per cent in 2023, up from a 16.8 increase in 2022 — a stark difference from 2021, when rents rose by only 0.2 per cent in Alberta in 2021.

Another report released in early April by Canada Mortgage and Housing Corp. warned that renting a home in Calgary will likely become less available and more expensive over the next two years, with rates approaching Toronto’s current average by 2025.

Article content

Advertisement 4

Article content

The CMHC’s 2024 outlook predicts Calgary’s rental vacancy rate — which ended 2023 at 1.4 per cent — to hit 1.1 per cent in 2024 and one per cent in 2025 and will be matched with substantial increases to average rent.

A two-bedroom in Calgary went for an average $1,695 in 2023, the CMHC estimates, a number projected to hit about $1,859 in 2024 and $1,922 in 2025.

Much of the challenge is due to continued record population growth into Alberta and high interest rates pushing former homeowners back into the rental market.

In 2023, Alberta grew by 202,324 residents, roughly twice the population of Red Deer.

But the Barnfields have been struggling with more than just the rent, Barnfield explains, living off of just one income, her husband’s, who works as a grocery store clerk.

She says they’ve “done the math” on child care, and if she did find a job, she’d have to earn a “pretty high salary” to pay for the cost of before and after school care for two young kids.

Recommended from Editorial

-

Squeezed: Navigating Calgary’s high cost of living

-

Feeling the sting of Calgary’s cost of living? Tell us how you’re managing

-

‘It’s depressing being a 40-year-old stuck at home’: Why the dream of homeownership is fading for many Calgarians

-

Dream home or one-bedroom condo? What will $700,000 buy you in housing markets across Canada

-

Why has shrinkflation run rampant and when will it end? Plus, 11 startling examples

Advertisement 5

Article content

“The last time I checked into it, it would cost us about $1,600 a month for the two of them, and that’s not even all day.

“I can’t imagine what it must be like for families with more than two kids, or kids that aren’t in school all year. It’s just insane.”

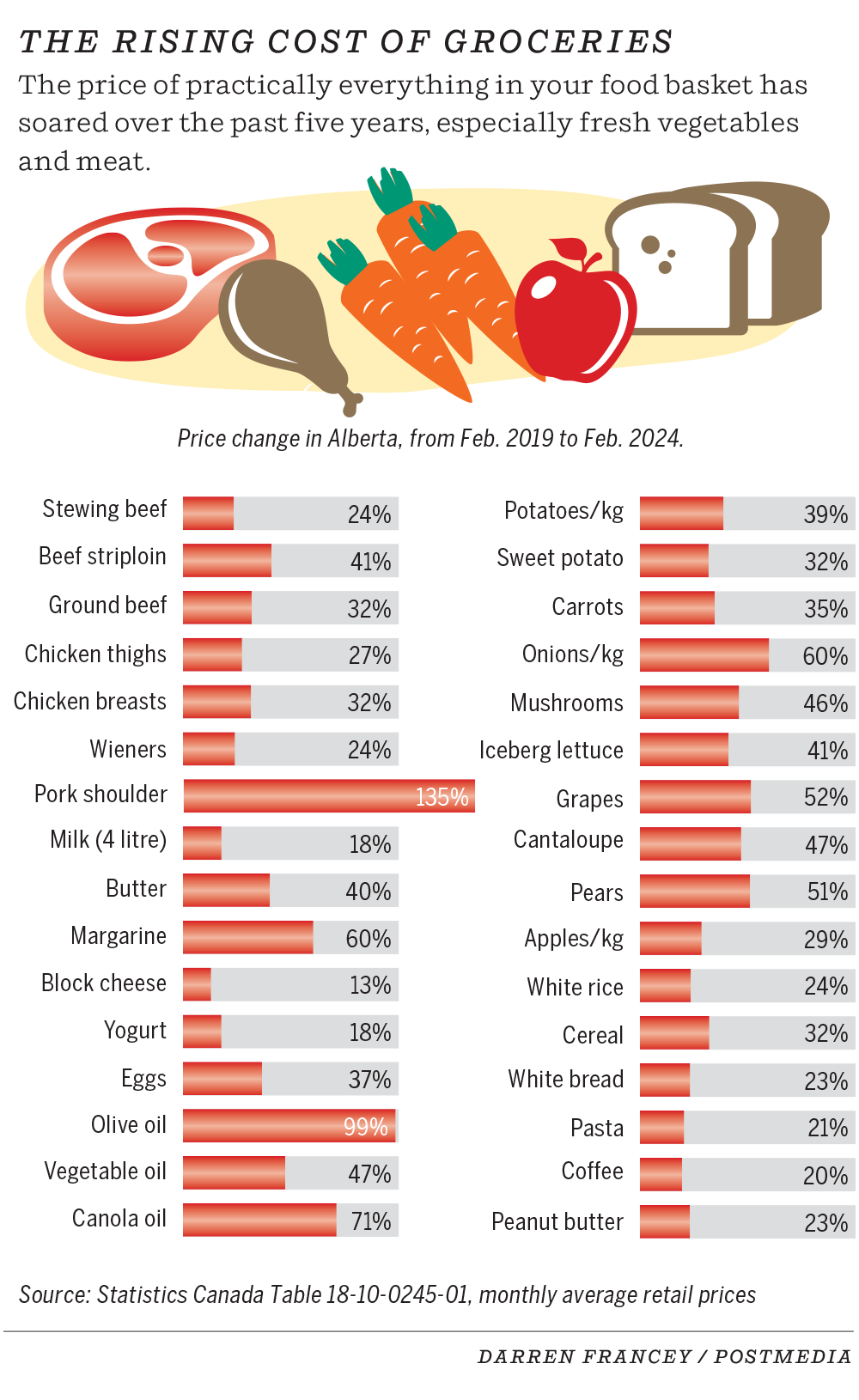

Food affordability has also been a growing challenge for the family.

“I grew up understanding how to budget and take the scraps of things and make more out of it.

“Yet we still, as a family of four, spend $250 to $300 every two weeks on groceries. A year ago, it was about $150, so it’s basically doubled in just one year.”

Barnfield says she sticks to just the cheapest cuts of meat, sometimes ground beef and chicken, but most of the time ground pork because it’s the cheapest.

The family also recently lost their vehicle to engine failure, so they’re taking public transit to shop for groceries. The upside is that the family saves $200 a month on gas bills, which were made worse by the provincial gas tax jumping up again in April.

“We can use what we save to maybe buy a new vehicle. But that might take more than a year.”

Gas prices across the city are already rising heading into the higher travel seasons of spring and summer. And that’s on top of the seven- to eight-cent-per-litre increase a tank fill-up costs due to increases to Alberta’s gas tax and the federal carbon price.

Advertisement 6

Article content

The Alberta government’s 13-cents-per-litre gas tax was fully reinstated at the beginning of April, up from the nine-cent tax that was already reintroduced earlier this year, designed to help the province make up for lower royalty revenues when the price of oil dips.

Not having to pay for gas at all is one of the few financial reliefs the Barnfields are getting, even as they deal with other big costs, that Krystal says are being waived for other families closer to the poverty line.

“The biggest thing for us with school is lunchroom fees, where you have to meet a specific criteria for the cost to be waived.”

Right now, the family is paying $760 for both children to stay at school for lunch at Abbeydale School, where they simply sit at their desks for about 20 minutes while being supervised by paid support staff.

But according to the Calgary Board of Education website, a family of four must be earning less than $54,594 in order to qualify for a waiver.

Barnfield says they don’t qualify, “so we’re at the point where we make too much money to get any help, or have any costs waived. Yet we don’t make enough money to live comfortably.

Advertisement 7

Article content

“So we’re having to choose between paying a bill, or getting food, and that can be really hard. It makes things really difficult.”

Barnfield argues governments at all levels need to reassess the poverty line, and caps on subsidies for low-income earners, adding, “a liveable wage is about $23 right now, which is nowhere near minimum wage.

“So it’s really tough on families like us right now. And I just don’t see any end in sight.”

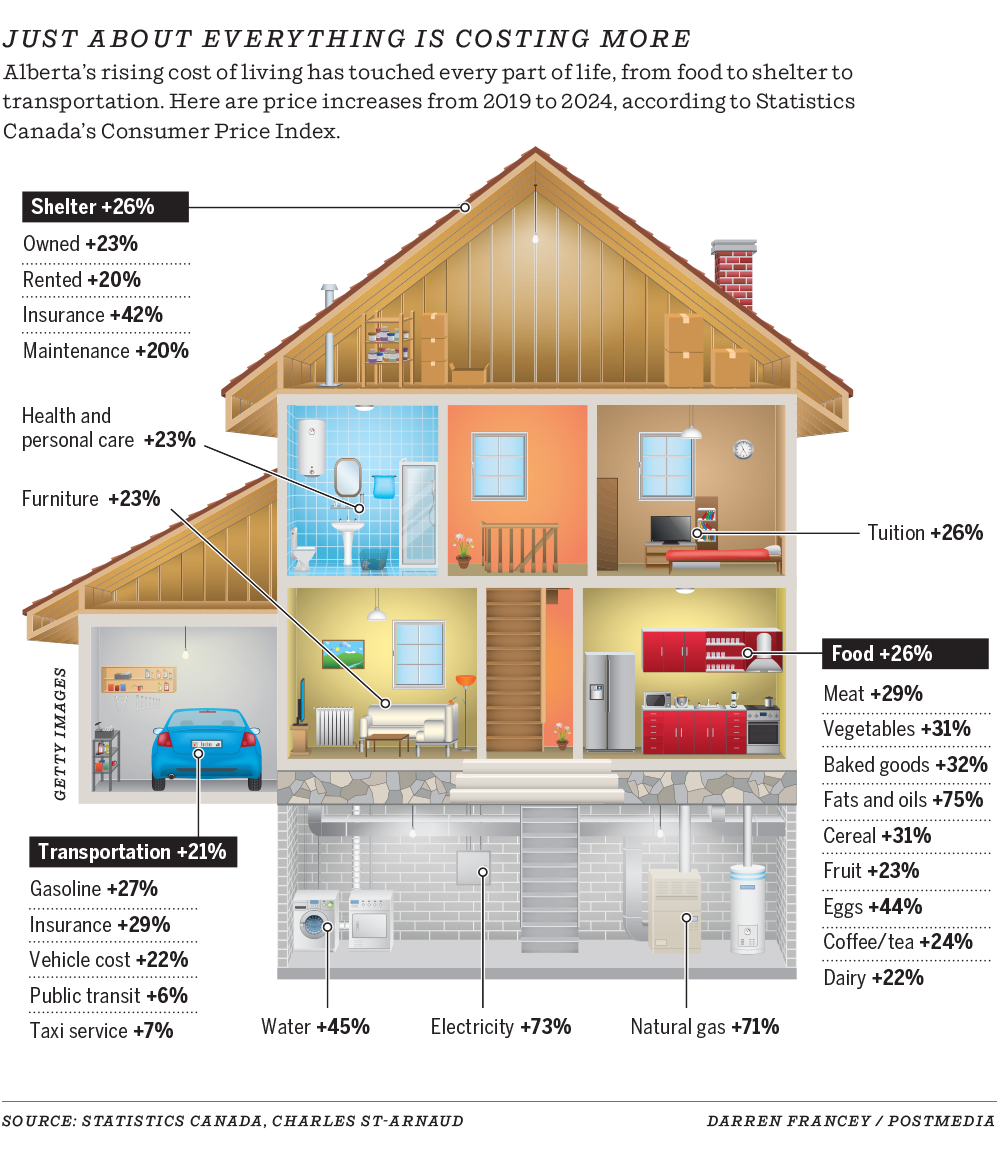

We know the rising costs of groceries, mortgages, rents and power are important issues for so many Calgarians trying to provide for their families. In our special series Squeezed: Navigating Calgary’s high cost of living, we take a deep look into the affordability crisis in Calgary. We’ve crunched numbers, combed through reports and talked to experts to find out how inflation is impacting our city, and what is being done to bring prices back to earth. But, most importantly, we spoke to real families who shared their stories and struggles with us. We hope you will join the conversation as these stories roll out.

This week: Priced Out: The Rising Cost of Housing

Advertisement 8

Article content

Still to come:

- June 3 to 4: The Cost of Doing Business

Our series so far:

Article content