Olga Kazakova/iStock via Getty Images

You may have heard the expression, “make hay while the sun shines.” In essence, it means to take advantage of an opportunity while conditions are favorable. In terms of investing in the stock market, we currently have a unique opportunity to take advantage of a bull market before that chance slips away. One way for income investors such as myself to take advantage of the strong US economy along with growth in AI cloud infrastructure and consumer spending that has remained robust despite rising inflation is to buy the YieldMax AMZN Option Income Strategy ETF (NYSEARCA:AMZY).

In my recent article that reviewed several high yield income ETFs from YieldMax, I mentioned how the Magnificent 7 stocks and growing investment in AI is propelling some of the YieldMax ETFs forward resulting in continued strong monthly income generated by options premiums from the underlying reference asset. In this review, I would like to examine how AMZY stands to benefit from the continuing outperformance of its reference asset, Amazon (AMZN) stock.

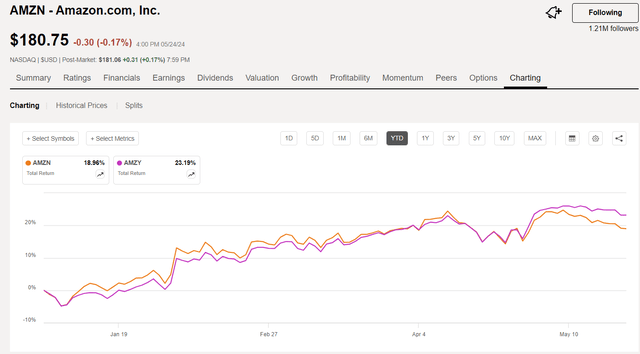

Amazon is seeing its stock continue to outperform in 2024, rising more than 54% over the past year and up about 19% YTD. According to fellow SA analyst Beth Kindig, whose research I respect, AMZN could soon join the $2T Club due to growth from AWS and ads.

Meanwhile, Amazon is well positioned to capitalize on surging generative AI demand quickly, with a multi-billion dollar run rate in AWS from AI products already. Combined with advertising, the two are driving strong margin expansion and aiding in both top and bottom-line growth; and in turn, this growth is creating an attractive valuation on the bottom line.

Making Hay from AMZY

From the YieldMax website:

The YieldMax™ AMZN Option Income Strategy ETF is an actively managed fund that seeks to generate monthly income by selling/writing call options on AMZN. AMZY pursues a strategy that aims to harvest compelling yields, while retaining capped participation in the price gains of AMZN.

The Fund does not invest directly in AMZN. Investing in the fund involves a high degree of risk. Single Issuer Risk. Issuer-specific attributes may cause an investment in the Fund to be more volatile than a traditional pooled investment which diversifies risk or the market generally. The value of the Fund, which focuses on an individual security AMZN, may be more volatile than a traditional pooled investment or the market as a whole and may perform differently from the value of a traditional pooled investment or the market as a whole.

The Fund’s strategy will cap its potential gains if AMZN shares increase in value. The Fund’s strategy is subject to all potential losses if AMZN shares decrease in value, which may not be offset by income received by the Fund. The Fund may not be suitable for all investors.

Shareholders of the Fund are not entitled to any dividends paid by AMZN.

AMZY generates income from buying and selling call options on AMZN stock without actually owning any AMZN common stock. Therefore, the price of AMZN stock only indirectly affects the price of AMZY. AMZY is intended to provide monthly income as opposed to capital gains from a rising share price. If you want growth, buy AMZN, and if you want income buy AMZY, while the sun shines (bull market).

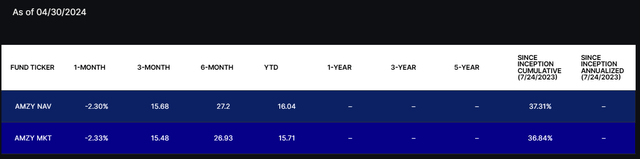

The total return performance for AMZY over the past 9 months (as of 4/30/24) is impressive with about 37% total return at market price since inception (7/24/23).

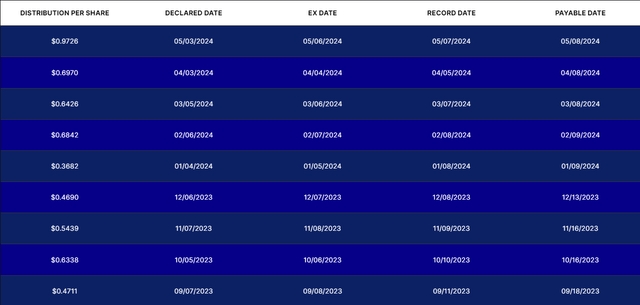

While AMZN stock on its own has already risen in price by nearly 20% this year, AMZY has delivered an even better YTD total return of 23% (assuming dividends reinvested). For income investors like me, I am even more interested in the income generated from AMZY since inception in July 2023. The Distribution Details for AMZY are shown in the snippet from their website:

The website shows a Distribution Rate of 51%, which is simply based on the latest distribution of $0.9726 times twelve, assuming a level distribution. But the dividends are variable and are based on how much income was captured from options trades that month. The Distribution rate and 30-day SEC yield is explained in a footnote, which is also worth reading for those who may be interested in this fund.

**The Distribution Rate and 30-Day SEC Yield is not indicative of future distributions, if any, on the ETFs. In particular, future distributions on any ETF may differ significantly from its Distribution Rate or 30-Day SEC Yield. You are not guaranteed a distribution under the ETFs. Distributions for the ETFs (if any) are variable and may vary significantly from month to month and may be zero. Accordingly, the Distribution Rate and 30-Day SEC Yield will change over time, and such change may be significant. The distribution may include a combination of ordinary dividends, capital gain, and return of investor capital, which may decrease a fund’s NAV and trading price over time. As a result, an investor may suffer significant losses to their investment. These distribution rates caused by unusually favorable market conditions may not be sustainable. Such conditions may not continue to exist and there should be no expectation that this performance may be repeated in the future. Additional fund risks can be found below.

AMZY = High Risk High Reward

The primary reason why income investors may want to buy some AMZY now is because everything is roses and sunshine with AMZN, but it may not last. Even with the big boost in AI spending driving margin growth at Amazon and other big tech companies, the impact of a slowdown in consumer spending will impact everything, including tech spending. This quote from the Morningstar article summarizes that concern:

It’s also worth remembering that for tech giants like Amazon AMZN, Meta Platforms META, Alphabet GOOGL/GOOG, and Microsoft MSFT, a large chunk of today’s revenue comes from digital advertising, not artificial intelligence. And ads are only profitable if consumers keep spending.

If you do wish to invest in AMZY for the income, I would not consider it a “buy and hold” investment. You should only buy AMZY if you believe that AMZN will continue to rise in value for the foreseeable future. I believe that AMZN is poised to continue higher as consumer spending remains robust, and the AI revolution is just getting started.

Robust Consumer Spending

My wife and I just returned from a vacation to Zion National Park and on Monday, May 20 (while local kids in Las Vegas and southern Utah were still in school), the park was swarming with tourists from all over the world. We had to wait 30 minutes for a shuttle ride up to the Narrows, which had elbow to elbow hikers when we arrived.

Zion Riverside Hike to Narrows Entrance (author photo)

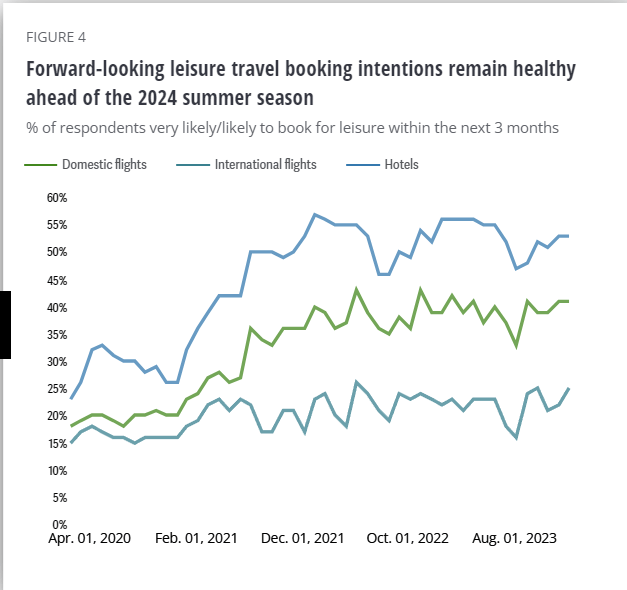

Now I realize that is just one perspective from one person that may not be typical in other parts of the country or the world, but it does appear to me at least that the US economy is strong, and people are spending. According to this insight from Deloitte, as of April 2024, the consumer is resilient and leisure travel sentiment is particularly strong right now.

Deloitte

From the April 26, 2024, article from Axios, the consumer appears “unstoppable”:

The economic surprise in recent years is the resilience of the American consumer: high borrowing costs and lingering inflation are not crimping overall spending.

By the numbers: For the second straight month, personal consumption expenditures rose 0.8% in March, the strongest in more than a year.

Even adjusted for sticky inflation, spending still rose notably, with an increase of 0.5%.

Results from the AMZN Q124 earnings report suggest that sales have remained strong heading into 2024.

Sales at the company’s online stores increased by 7% while physical stores saw a 6% gain in sales. Third party seller services saw 16% growth while advertising sales were up 24% attributed to growth of stores and Prime Video businesses. Subscription services sales increased 11%.

AI Revolution Still in Early Innings

Meanwhile, AMZN is just getting going, and the AI revolution is expected to propel earnings for AWS even further based on Nvidia earnings that are blowing past estimates.

For every $1 cloud service providers such as Amazon, Google and Microsoft spend on Nvidia AI infrastructure, they could earn $5 in GPU instant hosting revenue over four years, Huang added.

In fact, Amazon is investing billions in Europe to boost AWS revenues, including €15.7B (about $17B) in Spain to expand its cloud computing infrastructure by setting up data centers in the country. Amazon intends to invest €7.8B ($8.44B) in Germany through 2040 and about $1.3B in France.

From the AMZN Q124 earnings report, AWS revenues drove strong results with a 17% increase in AWS revenues, beating estimates of 14.7% growth.

“The combination of companies renewing their infrastructure modernization efforts and the appeal of AWS’s AI capabilities is reaccelerating AWS’s growth rate now at a $100B annual revenue run rate,” CEO Andy Jassy said.

However, softer guidance for Q2 dampened investor enthusiasm somewhat. Any potential slowdown in consumer spending could lead to lower than expected revenues from the consumer side of the business in Q2, which may cause the price of AMZN stock to retreat in the second half of the year.

For Q2, Amazon expects revenue to be between $144B to $149B, missing expectations of $150.1B. Q2 sales incorporate an unfavorable impact of ~60 basis points from foreign exchange rates.

AMZN Stock Health and Ratings

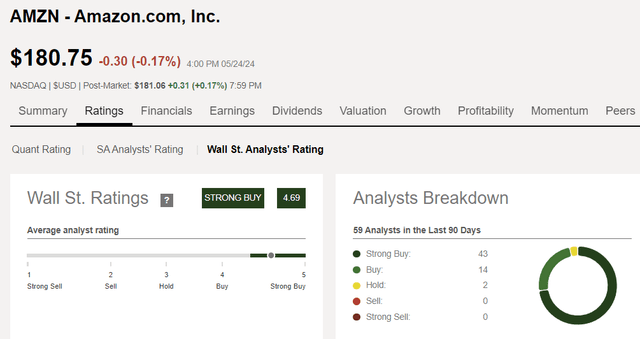

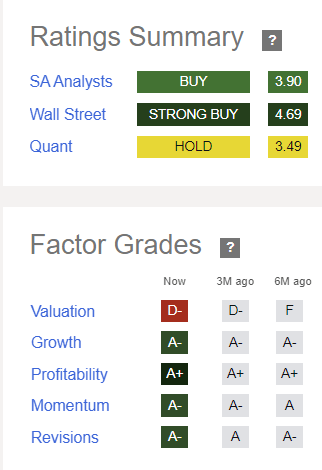

Although the SA Quant rating system only gives AMZN stock a Hold rating, 43 Wall Street analysts give it a Strong Buy, 14 rate it Buy with only 2 Hold ratings, and SA analysts rate the stock a Buy.

The Valuation is the only bad factor grade, and that is somewhat understandable with a forward P/E of nearly 40x. However, AMZN continues to surprise to the upside when they report earnings, and they keep upwardly revising forward estimates.

Amazon Delivers, Might as Well Enjoy the Ride

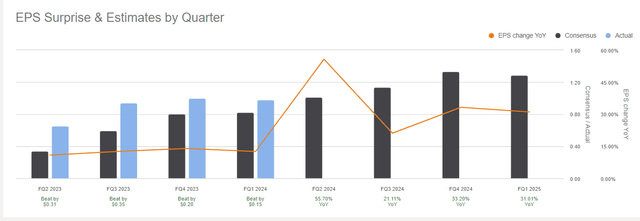

Like the remainder of the magnificent 7 (except Tesla) AMZN reported an excellent Q1.

Amazon said its first quarter EPS was $0.98, while revenue of $143.3B easily soared past estimates. Wall Street believed that Amazon’s quarterly results were indicative that any headwinds AWS had experienced in the past were over, aided in part by generative artificial intelligence.

If you have ever been on a hayride, it can be fun, bumpy, noisy, and at times exhilarating! Buying AMZY would be like the stock market investing version of a hayride, in my opinion. Fun while it lasts, but you need to know when to get off. As it appears that AMZN is firing on all cylinders and should continue to do so for the rest of 2024 at least, I would consider taking a speculative position in your income portfolio for AMZY to “juice” your distributions with its very high monthly yield of around 50% currently. If you do, be sure to keep an eye on consumer spending trends and Amazon’s health as a company, which appears to be very strong right now, but could change if the economy should turn south.