Zave Smith Photography/Stockbyte via Getty Images

Deckers Outdoor Corporation (NYSE:DECK), together with its subsidiaries, designs, markets, and distributes footwear, apparel, and accessories for casual lifestyle use and high-performance activities in the United States and internationally. The most well-known brands that DECK owns are UGG and HOKA.

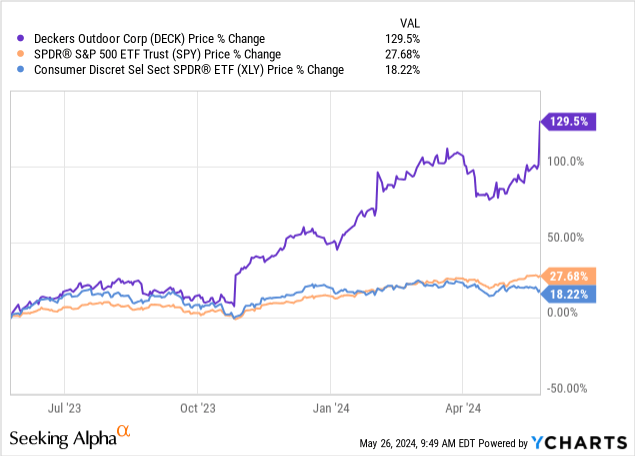

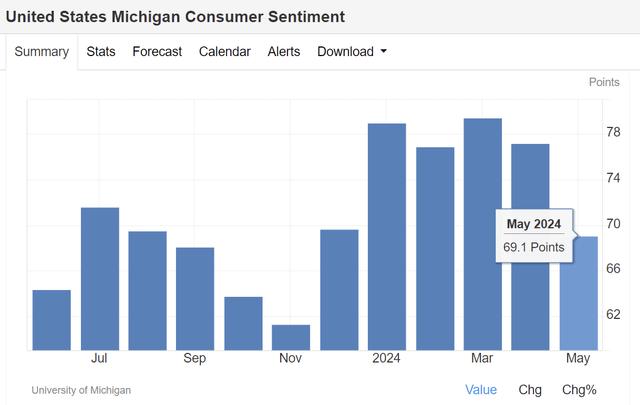

We decided to write about DECK today, as their stock has shown exceptional performance in the past 12 months. The firm’s share price has increased by roughly 130%, by far outperforming the broader market and the consumer discretionary sector. Our aim today is to take a look at the company’s fundamentals, using the latest annual report, published on the 24th of May, and assess whether after this strong run, could there still be upside potential left for prospective investors or not. Along with the financial figures, we are also going to be commenting briefly on the macroeconomic environment, primarily the consumer confidence, which we believe often has a material impact on the demand for discretionary products.

Let us jump right into the latest results.

Financial results

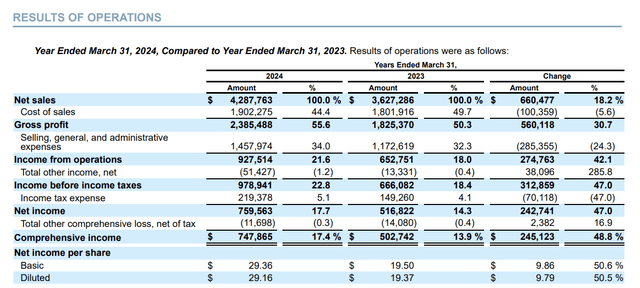

Deckers Outdoor has beaten both revenue and EPS estimates in the fiscal fourth quarter of 2024 by achieving a revenue of $959.76 million and EPS of $4.95. The full-year results of 2024 have also been record-breaking with a revenue of $4.29 billion – representing an 18% increase YoY, and diluted EPS of $29.16 – representing a 51% increase compared to the prior year.

These figures look indeed impressive at first sight and appear to warrant the sharp jump in the share price after the announcement. But let us now delve a bit deeper into these figures and examine what factors/ brands have been actually driving this performance and discuss whether this performance is likely to last in the future or not.

Revenue

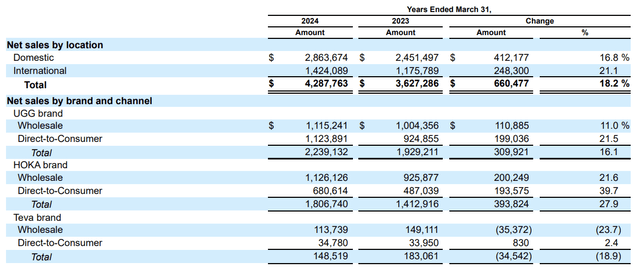

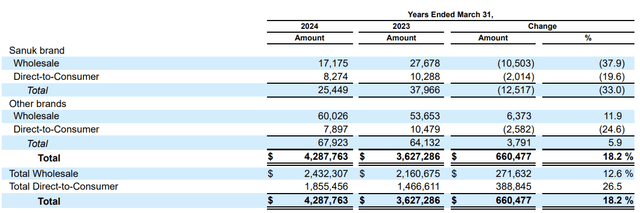

Net sales in fiscal 2024 have come in 18% higher than in the prior year. It is important, however, to break down this growth. We are going to be focusing on three factors: channel, brand and geography. In order to conclude that the growth is of high quality, we would like to see that across all/most channels, brands and geography there is growth present.

First, let us look at the sales by geography. In the following tables, we can see that DECK’s popularity has grown both domestically and internationally. They have managed to achieve strong double-digit revenue growth in both areas.

Sales (DECK) Sales (cont’d) (DECK)

If we continue our breakdown by channel and brand, we can see that the company’s two most popular brands – UGG and HOKA – have done extremely well and have shown significant growth in both wholesale and DTC. The firm’s smaller and less-known brands, on the other hand, have done relatively poorly and have partially offset the growth achieved by UGG and HOKA.

There are a few key points in the annual report that we would find especially important to highlight here:

There has been a 2.8% increase in the total volume of units sold. This means that the firm has managed to sell more items for a higher price, leading to the material revenue growth that we are seeing. We believe this is especially impressive considering the challenging macroeconomic environment, including the volatile consumer confidence.

U.S. Consumer confidence (tradingeconomics.com)

Following this thought, we also have to highlight that DECK has managed to acquire and retain customers online. In our opinion, this proves customer loyalty and strong brand recognition.

Looking at the wholesale side of things, the firm has reported that the net sales for HOKA have increased domestically and also in Asia, due to the high demand for certain performance products. Lower sales in Europe have partially offset the growth. When looking at the UGG brand, it has performed well globally. Higher level of full-price selling and selective price increases have contributed to the higher revenue.

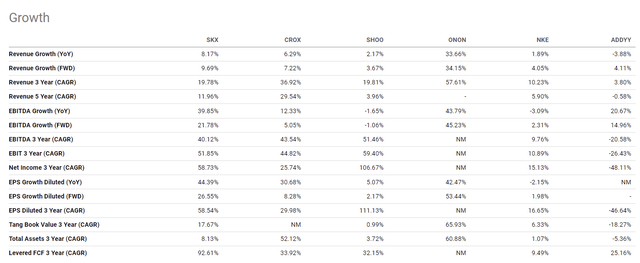

All in all, we find these results impressive. We believe that increasing the total volume of units sold, while increasing prices, shows how strong and robust the demand is for DECK’s products. And all this with despite the headwinds generated by the poor consumer sentiment. Looking forward, the firm also appears to be optimistic, despite expecting growth to somewhat slow. Fiscal year 2025 revenue growth is foreseen to be approximately 10%. Comparing this expectation with that of DECK’s peers also highlights how strong DECK’s performance is.

Profitability

Not only higher revenues have been generated, but also the profitability of the firm has improved, which is a key to long-term success. The gross margin has expanded to 55.6% compared to 50.3% in the prior year. The operating margin has expanded to 22.8% from 18.4% and last but not least, the net income margin has also expanded to 17.7% from 14.3%.

The higher margins have been primarily driven by:

[…] favorable full-price selling for the UGG brand, favorable changes in freight costs, favorable HOKA brand mix and UGG brand product mix shifts, including benefits from selective price increases, and favorable mix of sales into the DTC channel.

The higher full price selling, while reducing the inventory and increasing overall sales, we find particularly attractive. Often, when firms need to reduce their inventory to avoid products becoming obsolete, they use significant discounting. This has not been the case for DECK.

These benefits have been partially offset by the high SG&A expenses, driven by higher employee headcount and performance-based compensation, increased advertising and promotion expenses, higher rent and occupancy expenses and finally by investments into infrastructure.

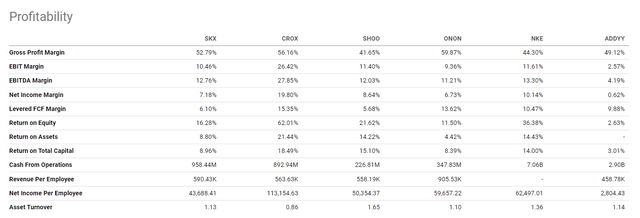

Now, comparing these figures once again with those of DECK’s peers and competitors, we can see that DECK is one of the strongest players in the field.

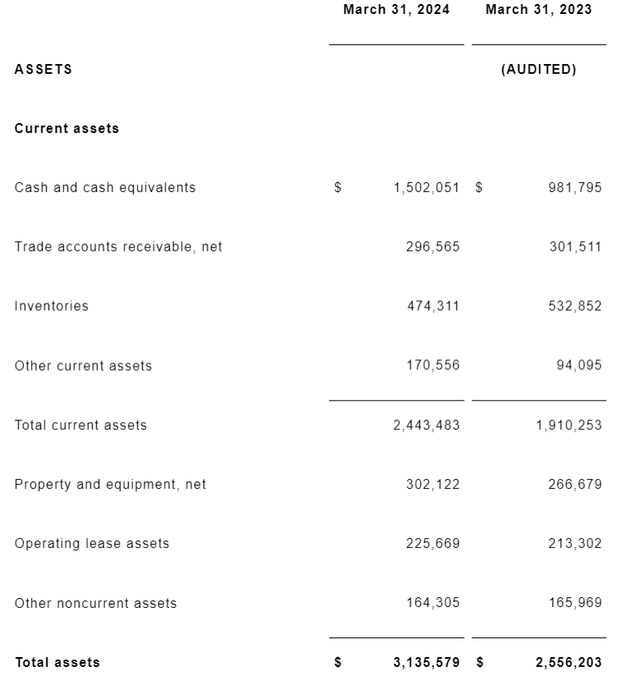

Liquidity

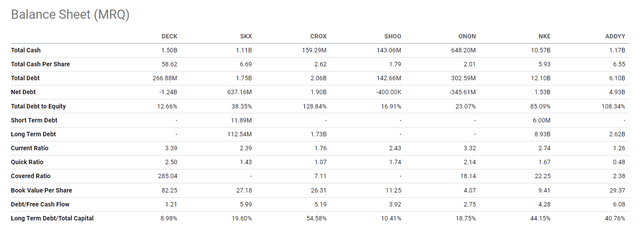

From a liquidity point of view, we also do not have much to complain about. The firm has barely any debt, and it has its liquidity ratios – current ratio and quick ratio – well above one. Compared to the peers, DECK’s figures once again look attractive.

Strong liquidity means that the firm has financial flexibility and can easily cover its current liabilities with its current assets. This can be particularly important when the macroeconomic environment is uncertain, as it is now.

For all these reasons, we find DECK attractive from a fundamental point of view. Strong revenue growth, driven by high demand and significant pricing power, accompanied by expanding profitability are all positive signs looking forward. The most important question that remains now, whether the current share price is attractive or not.

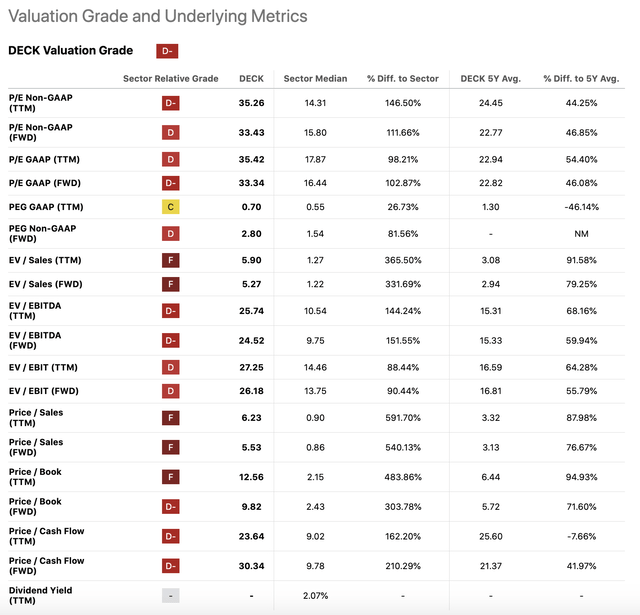

Valuation

To answer this question, we are going to take a look at a set of traditional price multiples and compare the firm’s figures to the consumer discretionary sector median as well as to its own historic averages.

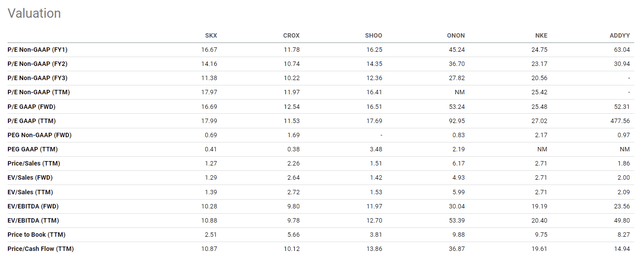

All these metrics indicate overvaluation. If we narrow down the peer group to the firms that we used above for comparison, we can still see that DECK’s stock appears to be at the higher end of the valuation range.

On one hand, we believe that the premium is justified because of the outstanding growth. On the other hand, we do not believe that the current share price is an attractive one for a value investor. Even growth investors, who may be less concerned about the valuation, need to be aware of a set of risks that could derail DECK’s growth story in the near future and could lead to a significant share price decline. We would like to highlight two primary risks that we find important to consider before investing now:

1. Recently, a container crunch has led to a skyrocketing of sea freight costs. If this continues, this may have a significant negative impact on DECK’s costs, potentially leading to a margin contraction and declining EPS.

2. Competition is fierce. Companies are constantly coming up with new concepts and new products to make sure that they get the largest piece of the pie. New firms are also entering the arena, trying to challenge more established players. While DECK appears to be doing well now, keeping the demand and interest high for its products, one may ask how long it is sustainable. Potential knock-off products or cheaper alternatives, especially when consumer sentiment is poor, could reduce the demand for DECK’s products.

Conclusion

DECK has reported outstanding sales and EPS figures for fiscal 2024. Revenue grew by 18%, while EPS has increased by 51%. The firm also foresees that the double-digit growth of sales will continue into fiscal 2025. The total volume of units sold has also increased, despite the higher level of full price selling and selective price increases, proving that the demand for DECK’s products is robust.

The firm’s margins have also expanded, driven by lower freight costs, selective price increases and a higher level of full-price selling. At the same time, the company has also managed to reduce its inventory levels.

The company is also attractive from a liquidity point of view, with a relatively small amount of debt and with liquidity ratios well above 1.

The valuation of the firm, however, appears to be relatively high. We believe that based on a set of traditional price multiples, there is no significant upside left, and therefore we do not believe that starting a position at these price levels could lead to outperforming the broader market.

For these reasons, we assign DECK a “hold” rating.