Stock splits have become increasingly popular over the last few years, and the retail sector is beginning to take note.

The stock market is roaring so far in 2024. Both the Nasdaq Composite and S&P 500 have gained approximately 11% thanks to tailwinds in the technology, energy, and pharmaceutical industries.

While steady growth and strong business fundamentals are often correlated with a rising stock price, there are other things that can happen to influence buying and selling activity. More often than not, stock splits lead to abnormal, yet brief, volatility in share prices. Many prominent businesses including Nvidia, Amazon, Alphabet, Tesla, Apple, and Novo Nordisk have completed splits in recent years.

Furthermore, in just the last few months, many businesses in the retail sector have also announced stock splits. Let’s explore why splits occur and how they can affect a stock. Moreover, I’ll explain why I see Costco Wholesale (COST 1.68%) as a potential stock split candidate.

Why do stock splits occur?

Stock splits can be a little tough to understand. When a company splits its stock, the number of outstanding shares rises by the number in the proposed split. For example, if a company announced a 3-for-1 split and you owned 100 shares in that company prior to the split, you would own 300 after the split.

At the same time, while the outstanding share count rises by the ratio in the split, the stock price falls by that same factor. Following the example above, let’s say you owned 100 shares at a price point of $30 before the split. Once the split goes into effect, you would own 300 shares but at a price of $10.

Since the share count rises and the stock price decreases by the same ratio, the overall market cap of the company remains unchanged.

Generally, stock splits occur because a company’s share price has risen exponentially. As such, a rising stock price could lead to depressed trading activity as shares seem out of reach for the average investor.

While a stock split does not inherently change the value of the business, many investors will perceive the lower price as an opportunity to buy shares at a better value.

In essence, stock splits theoretically allow a broader base of investors to buy shares who otherwise were avoiding the stock due to its unaffordable-looking price.

Image source: Getty Images.

Why might Costco split its stock?

In the past year, notable stock splits outside of big tech and healthcare include beverage maker Celsius and big-box retailer Walmart.

More recently, other businesses adjacent to the retail sector have proposed stock splits. Specifically, fast-casual restaurant chain Chipotle Mexican Grill is waiting on shareholder approval for a 50-for-1 split. Meanwhile, Sony also recently announced its intention to pursue a stock split.

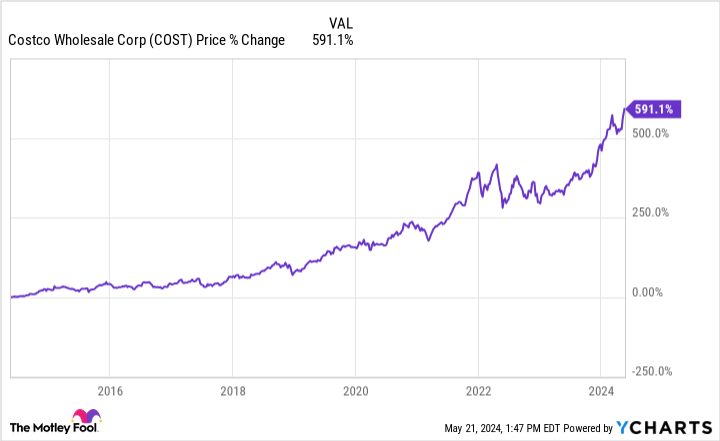

Looking at the chart below, investors can see that Costco has been a tremendous stock over the last decade. Shares have soared nearly 600%, reaching a current price of $795, near its all-time high.

Considering Costco hasn’t had a stock split since 2000, combined with its soaring returns and seemingly pricey shares, I would not be surprised to see management announce a split sometime.

Costco is a buy no matter what happens

As I expressed previously, looking at the share price alone won’t do much to help investors determine if a stock is overvalued or not. In order to really get a glimpse of a stock’s relative value, investors should benchmark the company against a peer set.

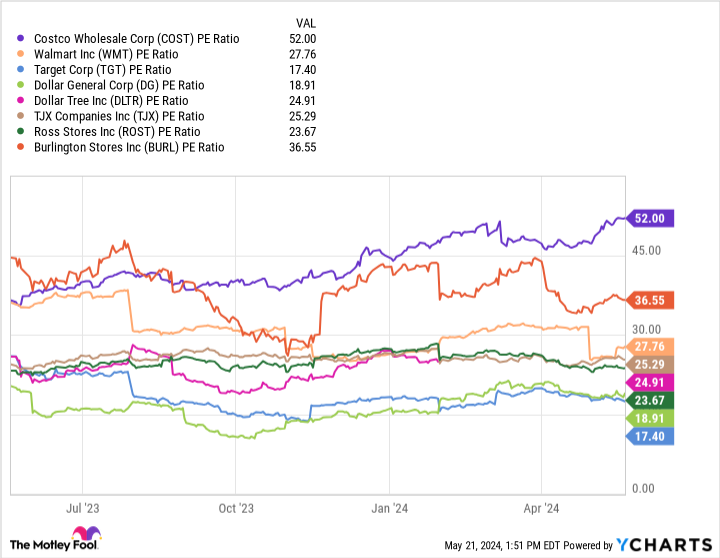

COST PE ratio data by YCharts.

The chart above compares Costco to a cohort of other big-box retailers as well as cost-conscious brick-and-mortar stores by their price-to-earnings (P/E) ratio. With a P/E of 52, Costco is the most expensive stock among its peers based on this valuation metric. Despite the pricey nature of its shares, I still view Costco as a compelling opportunity.

While physical retail faces stiff competition from e-commerce and online marketplaces, Costco is unique. The company boasts an enormous volume of consumer staples — the kinds of goods and services that people will need regardless of economic conditions.

Despite lingering inflation and high borrowing costs, Costco’s business is still in a position of strength. Moreover, the notable valuation premium above its competition could signal that investors see the company as a superior stock among leading retailers.

Although a stock split could make a lot of sense, investors shouldn’t sit on the sidelines and wait for one. It might never happen. Instead, given Costco’s position among big-box and cost-conscious retail, combined with its ability to actually benefit during inflationary environments and otherwise, I think scooping up shares right now and holding for the long term makes a lot of sense.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Apple, Novo Nordisk, Nvidia, and Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Celsius, Chipotle Mexican Grill, Costco Wholesale, Nvidia, Target, Tesla, and Walmart. The Motley Fool recommends Novo Nordisk and Tjx Companies. The Motley Fool has a disclosure policy.