jetcityimage

Shares of Eli Lilly (NYSE:LLY) reached new all-time highs this week, driven by the continued share price and fundamental momentum, and by what some would say is the obesity market hype. The former is true if we just look at the numbers, but there is also some truth to the latter. This can be seen by the formation of a GLP-1 ETF of which Eli Lilly and main competitor Novo Nordisk (NVO) are a big part – the Roundhill Glp-1 & Weight Loss ETF (OZEM).

The name and ticker symbol are short-sighted because the obesity market is already expected to go far beyond the GLP-1 mechanism and the OZEM ticker is actually based on Ozempic, which is the type 2 diabetes brand name of Novo Nordisk’s semaglutide and the actual name of the weight loss drug Wegovy. Still, there is real substance behind the hype and both Eli Lilly and Novo Nordisk would deliver a lot more top and bottom line growth if both of their obesity products were not supply constrained.

Eli Lilly’s valuation is a bit uncomfortable at current levels, but it is one of the fastest-growing and best-positioned big pharma companies in terms of future growth prospects. There is also the potential for growth acceleration and further upside revisions once the company secures enough drug supply.

Supply-constrained growth of tirzepatide (Mounjaro/Zepbound)

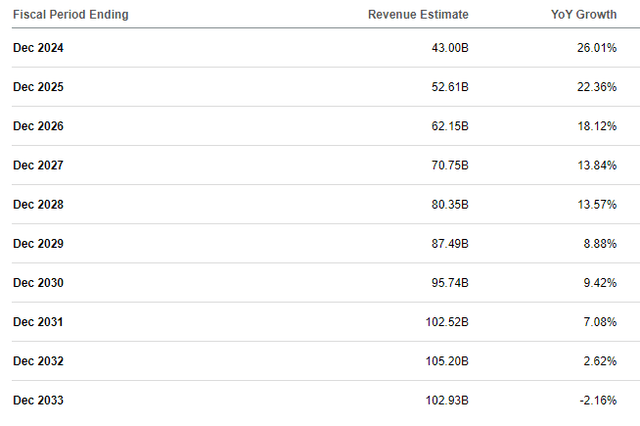

When Eli Lilly reported first quarter results, it slightly missed revenue estimates, but that did not stop the company from raising the full-year revenue guidance range by $2 billion at the mid-point to $42.4-43.6 billion. The new mid-point of the range represents 26% Y/Y growth and 35% Y/Y growth if the numbers are adjusted for the recent divestitures.

The non-GAAP EPS guidance was also increased from $12.20-12.70 to $13.50-14.00, driven by the increased revenue growth guidance range.

The increased revenue guidance was the result of management getting more comfortable about the supply outlook for tirzepatide (Zepbound/Mounjaro), but the growth of the incretin business (consisting of Zepbound, Mounjaro and Trulicity) is still heavily supply constrained. Eli Lilly continues to invest aggressively to expand the manufacturing of tirzepatide across the globe and this includes an additional $5.3 billion announced this week to increase the capacity of its facility in Lebanon, Indiana. The timelines show how ramping production is not easy and takes time – ground was broken in 2023, production will begin toward the end of 2026 and will scale up through 2028.

On the Q1 earnings call, management said that supply constraints will ease in the second half of the year and that, depending on the demand and the company’s ability to get its additional manufacturing sites online, it could last through 2025 as well.

Even though revenue growth estimates have risen considerably in the last few quarters, I believe the market is still underestimating the growth potential in 2025. This despite expectations of continued but less pronounced supply constraints, also for the second half of the decade as supply issues should be addressed by then. As such, I see potential for growth acceleration in 2025 and 2026 as opposed to an estimated growth slowdown from 26% this year to 22.4% in 2025 and 18.1% in 2026.

Eli Lilly’s position in the obesity market and growth prospects

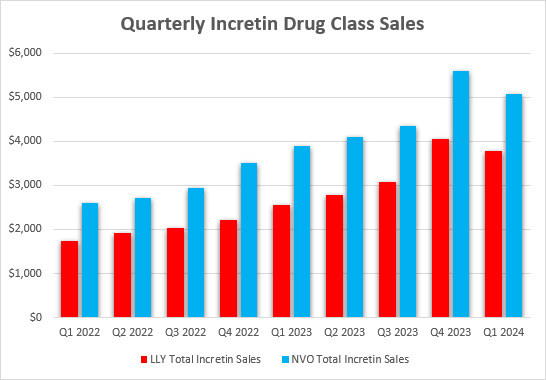

Looking at the growth of the incretin business and the evolution of the market, Eli Lilly is not only keeping up, but also slightly catching up to Novo Nordisk. The important caveat here is the supply constraints for both companies. These market share dynamics in recent quarters are only being driven by the availability of tirzepatide and semaglutide and this will remain the case for the foreseeable future.

Eli Lilly earnings reports, Novo Nordisk earnings reports, author’s calculations for Novo Nordisk incretin drug sales based on USD/DKK exchange rates

As the graph shows, Novo Nordisk is still the obesity and the overall incretin class leader. Novo Nordisk also has an advantage over Eli Lilly in terms of product labels as Wegovy’s label now includes the indication of reducing risks of major cardiovascular adverse events (‘MACE”) which enables Medicare coverage in the US, and Eli Lilly’s cardiovascular outcomes trial of tirzepatide is only expected to complete in 2027.

However, Eli Lilly’s advantages over Novo Nordisk include better topline efficacy of tirzepatide (based on cross-trial comparisons) and this is something the company intends to prove in a head-to-head trial against semaglutide with topline results expected this year.

Eli Lilly also reported positive phase 3 results of tirzepatide in obstructive sleep apnea this year, and the results from a phase 3 trial of tirzepatide in heart failure with preserved ejection fraction (‘HFpEF’) and from the mentioned head-to-head trial of tirzepatide against semaglutide are also expected this year. Positive results will be followed by regulatory submissions to expand the label of tirzepatide to include obstructive sleep apnea and HFpEF. These two indications are not only important from a market expansion perspective, but also because both obstructive sleep apnea and HFpEF will be eligible for Medicare coverage.

And as mentioned, both companies are still struggling to produce enough of tirzepatide and semaglutide, and the current growth trends and market share dynamics are a more a reflection of how much each company can produce rather than their competitive positioning. I would anticipate this to stay the case for at least the next several quarters, and investors of both companies should worry about their ability to ramp production and the supply outlook updates the two companies provide rather than the quarterly sales numbers themselves.

Given all the demonstrated benefits of these drugs, and the emergence of new data and additional potential indications, I expect growth expectations to continue to advance in the next few years.

As far as other competitors are concerned, we are unlikely to see anyone challenge the two companies on the commercial market since all others are well behind. However, we are seeing emerging challenges in the clinic from several competitors, and I covered those in my previous articles on each of these companies, but will summarize quickly here:

- Amgen (AMGN) only made qualitative comments about its MariTide compound but prior data indicate this could be one of the first longer-acting competitors to challenge the two leaders.

- Viking Therapeutics (VKTX) reported significant weight loss at week 13 with once-weekly subcutaneously administered VK2735 and promising 4-week data for the oral version of the same drug. You can see my analysis of the results in the article I published this month.

- Roche (OTCQX:RHHBY) has joined the party thanks to its late 2023 acquisition of Carmot, and reported topline results with significant placebo-adjusted weight loss, which I covered last week.

These are just some of the potential competitors and we should expect many more to emerge in the clinic in the following years. However, all of these candidates have only generated phase 2 data and are yet to even start registrational phase 3 trials, let alone a cardiovascular outcomes trial that take five years or longer to complete.

However, Eli Lilly and Novo Nordisk themselves are not standing still and both have additional pipeline efforts to further solidify their leadership positions.

Next in line for Eli Lilly is orforglipron, the company’s oral nonpeptide GLP-1 agonist, with phase 3 readouts in 2025 from trials in type 2 diabetes, obesity, and a smaller cardiovascular outcomes trial in type 2 diabetes patients. Orforglipron is not as competitive on weight reduction as tirzepatide, but could be a good option for many patients. In the phase 2 trial, orforglipron achieved weight reductions ranging from 8.6% to 12.6% at week 26, or 6.6% to 10.6% placebo-adjusted.

And retatrutide, the company’s once-weekly subcutaneous “triple G” agonist (GLP1/GIP/glucagon) is close behind with most of the phase 3 readouts expected in 2026 and 2027. Retatrutide has an even more powerful weight loss effect than tirzepatide with up to 24% weight loss at week 48.

Beyond the incretin class, Eli Lilly is working on improving the body composition by increasing fat mass loss and retaining lean body mass. Last summer, it acquired Verzenio that brought bimagrumab. I wrote about this in my February article on Regeneron (REGN):

Bimagrumab is a monoclonal antibody that binds activin type II A and B receptors to block activin and myostatin signaling, and it believes that combining with incretins such as Zepbound or retatrutide could preserve muscle mass and may lead to better outcomes for people with obesity and with related complications. Importantly, the addition of a drug like bimagrumab could address the big drawback of incretins – significant loss of muscle mass alongside fat loss.

Bimagrumab generated impressive data in a small phase 2 trial – it led to significant loss in fat mass (7.5kg versus 0.5kg fat mass loss for placebo), a gain in muscle mass (1.7kg gain versus 0.4kg muscle mass loss for placebo) and it also demonstrated metabolic improvements in type 2 diabetes patients who were overweight or obese.

This is an emerging and very interesting area in the obesity market that I covered in greater detail in the above-linked article on Regeneron, and Eli Lilly has been proactive in getting its hands on bimagrumab and advancing these efforts. The next step is to report the phase 2 results of bimagrumab in combination with semaglutide later this year and we should see whether the combination approach leads to better body composition with increased fat loss and minimal or no lean mass loss. And yes, Eli Lilly is doing a combination study with Novo Nordisk’s semaglutide, but this is the trial Eli Lilly inherited when it acquired Verzenio and decided to complete the study to speed up bimagrumab’s development.

There are also other non-incretin approaches to weight loss and one of those is a long-acting amylin candidate eloralintide, but this one is in earlier stages of development and the phase 2 trial was only initiated this year.

Overall, I see Eli Lilly as very well positioned to either keep up with Novo Nordisk and to potentially even to jump ahead in some areas of the increasingly competitive obesity and adjacent markets.

Eli Lilly has a robust pipeline beyond obesity and healthy balance sheet do expand the pipeline and product portfolio through M&A

While the market is largely focused on Eli Lilly’s obesity product portfolio and pipeline (as it should be), Eli Lilly has a robust pipeline in other areas. Some of the near-term growth opportunities are lebrikizumab in atopic dermatitis and donanemab in Alzheimer’s disease, provided they are approved by the FDA, and some are longer-term growth drivers.

I like the long-term potential of RNAi candidates the company in-licensed from Dicerna Pharmaceuticals, which was, interestingly enough, acquired by Novo Nordisk and now Novo Nordisk gets some of the upside from the success of these candidates through milestone payments and royalties on net sales. In particular, I like the long-term prospects of lepodisiran, an RNAi candidate that lowers LPa which is associated with increased risk of cardiovascular disease. This is a really long-term driver since the phase 3 results are not expected before 2029, but we should get a better idea whether reducing LPa works next year when Novartis (NVS) reports the phase 3 results of its LPa-lowering candidate pelacarsen and these results should have direct read-through to lepodisiran.

And an important long-term driver should also be M&A and Eli Lilly should use the profit windfall from the rapidly growing obesity portfolio to expand its pipeline to further strengthen its competitive position in the obesity market and to diversify its pipeline and reduce the long-term risk of overly relying on the obesity portfolio.

Risks

The main risks for Eli Lilly are:

- The company not being able to secure enough supply of tirzepatide and potentially other weight loss compounds in the following quarters and years. I do not anticipate this being a long-term problem given the investments the company is making, but there could be hiccups along the way that cause additional drug shortages or lead to top and bottom-line misses in upcoming quarterly reports.

- Competition is one of the key long-term risks as the obesity market is now probably the most competitive in the whole industry. Nearly every big pharma company will want a piece of the market, and so will many emerging smaller companies with new and innovative approaches. These are, however, longer-term risks as there are unlikely to be any commercial market challenges other than from Novo Nordisk in the next few years.

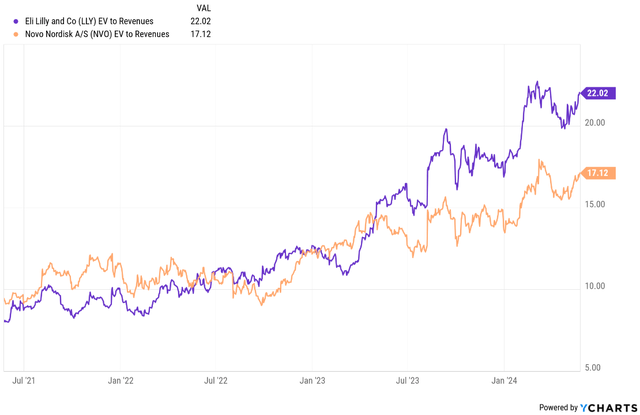

- Valuation is a significant risk here as Eli Lilly is trading at elevated price to sales and price to earnings multiples, even when compared to Novo Nordisk. A lot of growth is priced in at current levels and the company needs not only to deliver in line with current growth expectations, it needs the earnings and revenue estimates to keep trending higher to continue to deliver shareholder value.

- There appears to be no balance sheet risk as of today. Eli Lilly ended Q1 with $5.6 billion in cash and investments and $26.2 billion in total debt, and it should generate double-digit billion cash flows this year and even more in the following years. Longer-term, there is the risk of the company making big M&A bets and stretching the balance sheet on deals that fail to produce the desirable long-term upside.

Conclusion

Eli Lilly’s valuation demands a lot of growth in the following years, but based on the current outlook for the obesity business and the growth being constrained by tirzepatide’s supply constraints, I would still expect the stock to perform well over the next few years. The company also has a healthy clinical pipeline with many additional shots on goal that could significantly expand the revenue base through the rest of this decade and it has the balance sheet to further strengthen its product portfolio and pipeline in the following years.

On the other hand, I am also mindful of the risks and the elevated valuation and do not intend to overstay my welcome if Eli Lilly starts falling behind on both fundamental and price fronts.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.