Klaus Vedfelt

I’ve covered the iShares Preferred and Income Securities ETF (NASDAQ:PFF) several times in the past. I’ve generally been lukewarm on the fund, as it seems inferior to funds focusing on other asset classes, including high-yield corporate bonds. In this article, I’ll give investors three alternatives to PFF, all with stronger returns and higher yields. These are as follows.

The SPDR Portfolio High Yield Bond ETF (NYSEARCA: SPHY). SPHY’s 7.7% dividend yield is quite a bit higher than PFF’s 6.3% figure, and its 0.05% expense ratio a bit lower than PFF’s 0.46%. SPHY is a strong, vanilla choice in this space.

The FlexShares High Yield Value-Scored Bond Index Fund ETF (NYSEARCA: HYGV). HYGV’s 8.8% dividend yield is highest in its peer group, and the fund is not significantly riskier or more volatile than average.

The iShares Fallen Angels USD Bond ETF (NASDAQ: FALN). Although FALN’s 5.8% dividend yield is a bit lower than average, its fallen angel holdings have significantly outperformed since inception. I expect outperformance to continue.

In my opinion, SPHY, HYGV, and FALN are broadly similar, but stronger, investments to PFF. As such, I would not be investing in PFF, and would choose these ETFs instead.

PFF – Basics

- Investment Manager: BlackRock

- Underlying Index: ICE Exchange-Listed Preferred & Hybrid Securities Index

- Expense Ratio: 0.46%

- Dividend Yield: 6.32%

- Total Returns CAGR 10Y: 3.77%

PFF – Overview and Analysis

Index and Portfolio

PFF is an index ETF investing in U.S. preferred shares. It is a broad index, attempting to track the preferred shares market, with some basic set of inclusion and exclusion criteria.

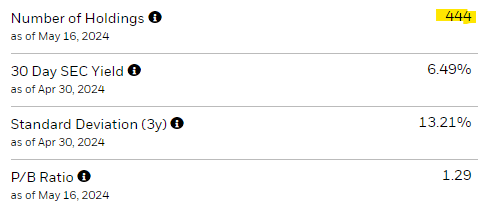

PFF has some diversification, with investments in 444 different securities from hundreds of issuers.

PFF

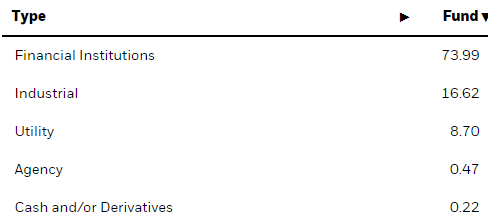

Sector diversification is quite low though, with the fund focusing on financials (banks), with smaller investments in industrials and utilities. Banks are some of the most common issuers of preferred shares, for regulatory reasons.

PFF

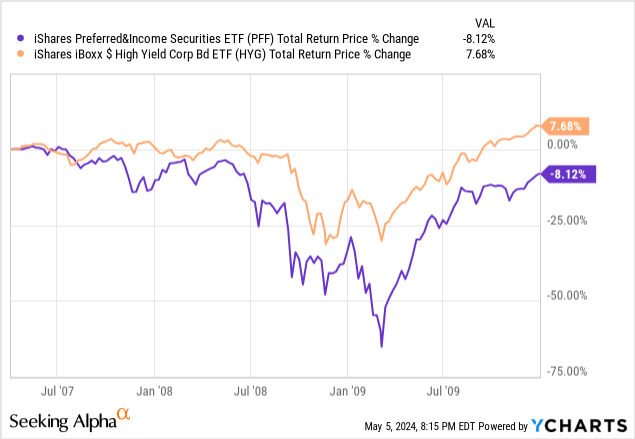

PFF’s lack of sector diversification increases risk, volatility, and the possibility of significant losses and underperformance due to sector-specific weakness. As an example, the suffered a 65% drawdown during the past financial crisis / housing bubble, as banks were hit particularly hard during said crisis. High-yield corporate bonds were down by only 25% and recovered much more quickly.

Data by YCharts

In my opinion, and due to the above, high-yield corporate bond ETFs are broadly preferable to preferred shares ETFs, including PFF. Risks are lower, as is the possibility of outsized losses, while yields and returns remain (roughly) similar.

Credit Quality and Risk

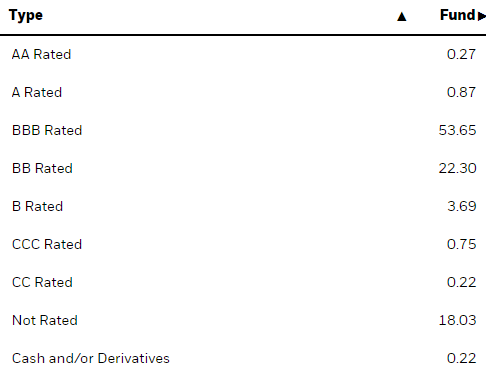

Overall credit quality for the fund seems somewhat above average.

The fund focuses on BBB-rated preferred with significant allocations to non-investment grade securities, as well as those without ratings.

PFF

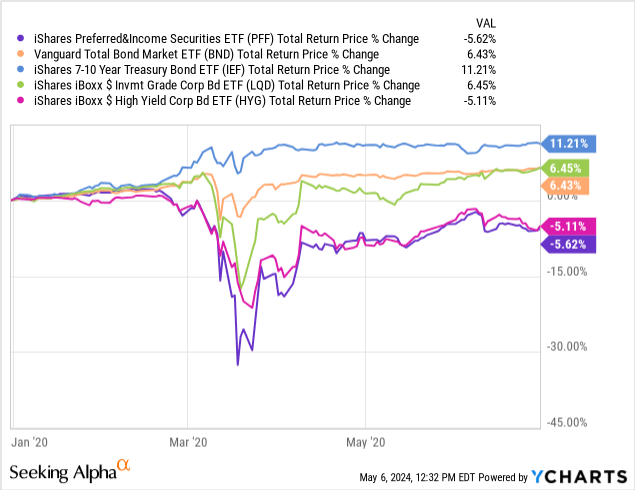

Considering PFF’s credit ratings, and the fact that preferred are junior to bonds, the fund’s credit risk should be comparable to that of high-yield corporate bonds. As such, expect above-average losses during most downturns and recessions, similar to those of high-yield corporate bonds. This was the case during early 2020, the onset of the coronavirus pandemic.

Data by YCharts

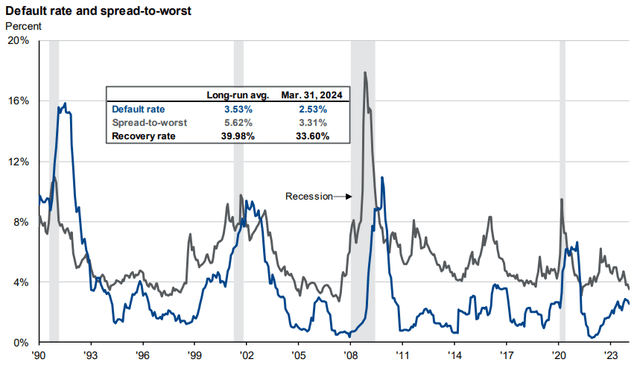

Right now, non-investment grade securities trade with comparatively tight credit spreads, and are seeing higher default rates. Although this is a bad combination, magnitudes matter, and neither of these issues seem significant.

PFF’s above-average credit risk is a negative for the fund and its shareholders. The risk does not seem excessive, nor is it a deal-breaker for me. More risk-averse investors might disagree.

Interest Rate Risk

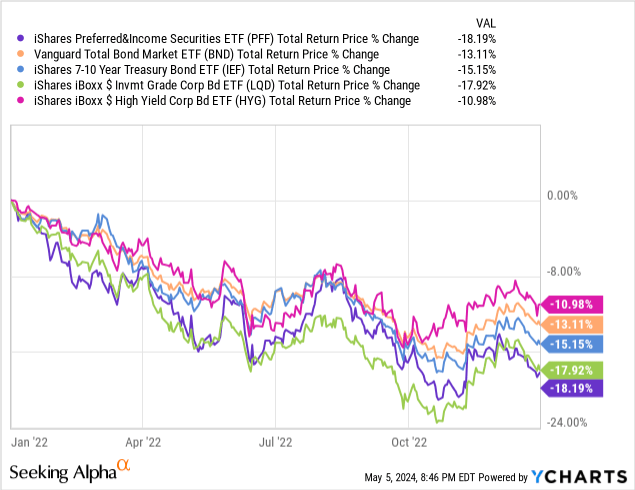

Interest rate risk for the fund seems unclear, and I was unable to find specific figures. PFF saw above-average losses during 2022 when the Fed first started to hike. Although this implies above-average rate risk, the banking sector was more heavily impacted by higher rates than average, so some of the fund’s losses were due to sector weakness.

Data by YCharts

Overall Volatility

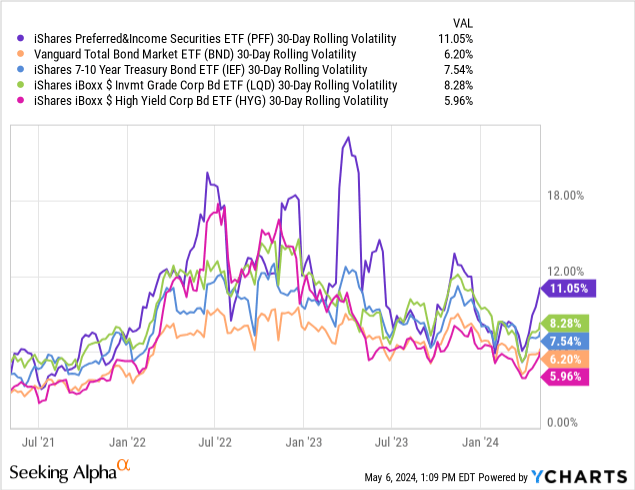

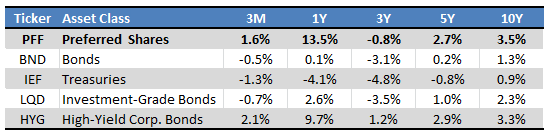

PFF’s overall volatility is higher than that of most bonds and bond sub-asset classes, including high-yield corporate bonds.

Data by YCharts

PFF’s volatility seems a bit higher than expected for a fund with its characteristics, as neither credit nor interest rate risk seems that high. Still, results are not that unexpected either.

Dividend Yield Analysis

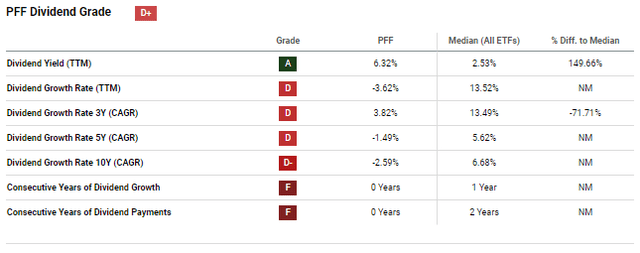

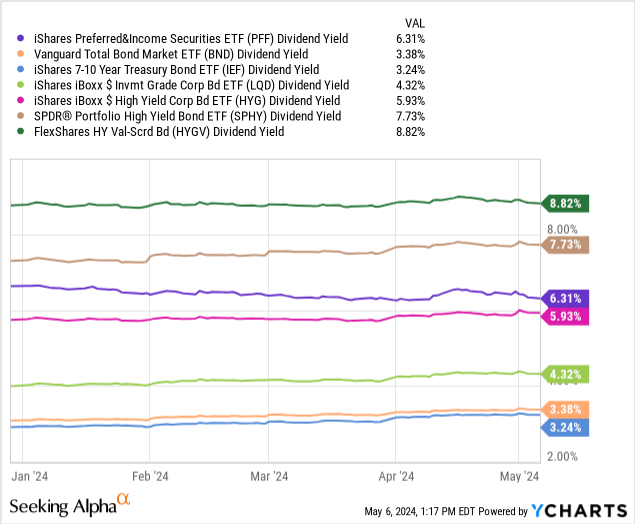

PFF’s 6.3% dividend yield is higher than that of most bonds and bond sub-asset classes, due to the fund’s above-average credit risk. Its yield seems roughly comparable to high-yield corporate bond ETFs, but some of these sport materially higher yields, including SPHY and HYGV.

Data by YCharts

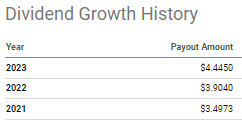

PFF’s dividends have seen steady growth since 2022, when the Fed started to hike, as expected.

Seeking Alpha

Long-term dividend growth has been slightly negative, as rates have declined long-term.

Some high-yield corporate bond ETFs have seen higher, more consistent dividend growth than PFF, including the largest ETF:

and SPHY:

PFF’s dividends seem reasonably good, but definitely not great, and a bit worse than some of its peers.

Performance Track-Record

PFF’s overall performance track-record seems fine, although somewhat below expectations.

Long-term returns are quite weak, as rates were much lower in the past, and preferred are income vehicles.

Medium-term returns are negative, as Federal Reserve hikes led to lower bond prices in the past.

Short-term returns have been quite good, as interest rates have stabilized at a relatively high level.

Seeking Alpha – Table by Author

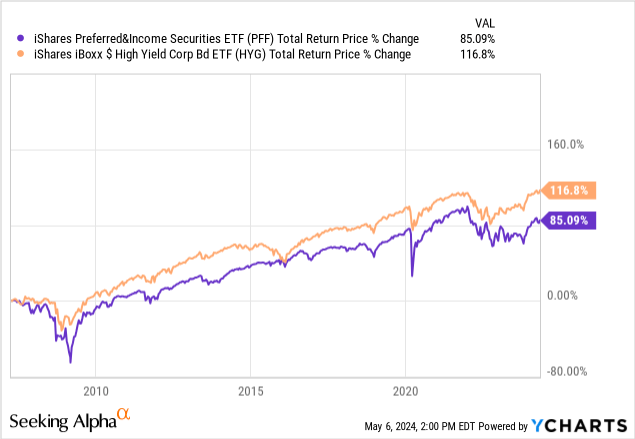

PFF has lagged behind benchmark high-yield corporate bonds since inception, and by quite a large mount. Most of the underperformance occurred during the financial crisis / housing bubble, with PFF only slightly underperforming since.

Data by YCharts

PFF has significantly underperformed some of the best-performing high-yield corporate bond ETFs, including FALN, even after excluding the financial crisis.

Moving forward, returns should track dividend yields, so should be in the 6.0% – 6.5% range. Much will depend on future Fed policy, however. Rate cuts should boost prices and short-term returns, but decrease dividend yields and returns long-term. Rate hikes should have the opposite effect. At current prices and spreads, I expect the fund to continue underperforming most high-yield corporate bond ETFs.

Overall Value Proposition

PFF’s overall value proposition seems fair, perhaps slightly weak.

Yields, returns, risks, and volatility are all higher than average. Risks seem a bit higher than expected for a fund with PFF’s credit quality and returns, but not significantly so. Although long-term returns have been weak in the past, prospective returns are stronger due to recent Fed hikes.

Overall, PFF seems like a fine investment, but investors can do much better than fine. Let’s have a look at some great alternatives to PFF.

PFF – Alternatives

SPHY – Simple High-Yield Corporate Bond ETF

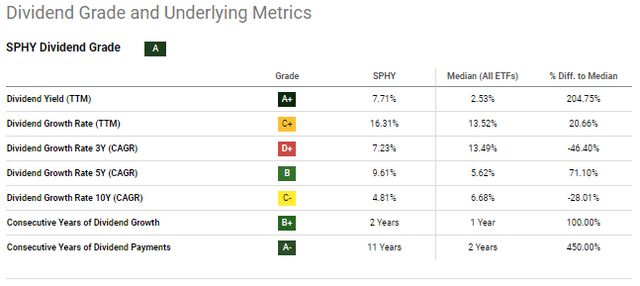

SPHY is one of the largest high-yield corporate bond index ETFs in the market. It has broadly comparable risk to PFF, with three key benefits.

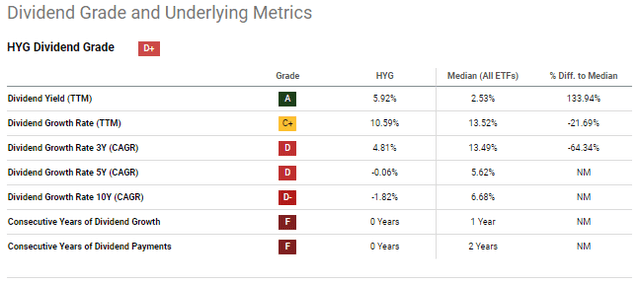

Dividends are higher, with a 7.7% yield, compared to 6.3% for PFF.

Expenses are lower, with a 0.05% expense ratio compared to 0.46% for PFF.

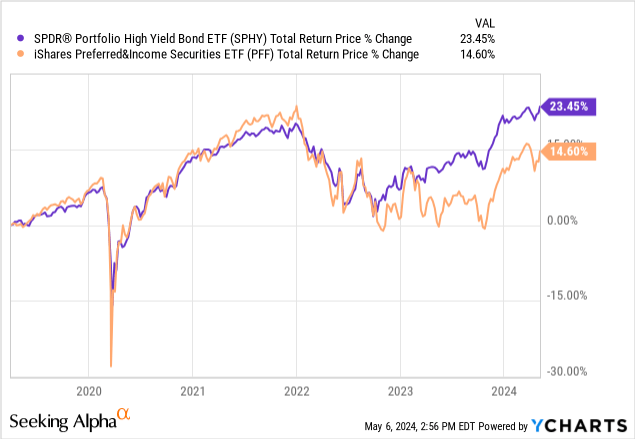

Returns have been higher these past five years, due to the above. Returns have been higher since inception too, but there were some index changes in the past making these figures unreliable / uninformative.

Data by YCharts

In my opinion, SPHY is a strictly superior investment to PFF, with several important advantages, and no significant disadvantages.

HYGV – Highest-Yielding Corporate Bond ETF

HYGV is another high-yield corporate bond ETF, this one actively managed. It has two important benefits relative to PFF.

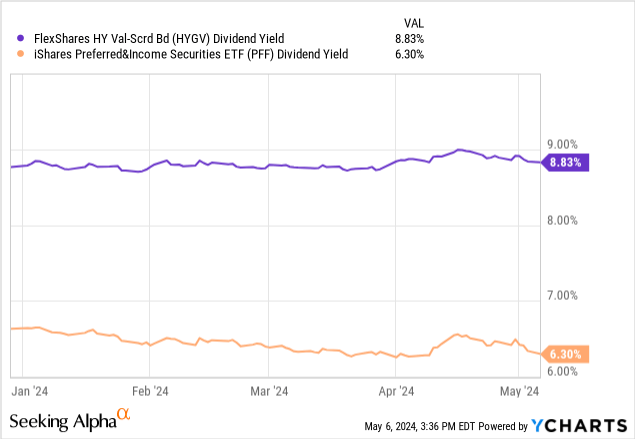

Dividends are higher, with an 8.8% yield, compared to 6.3% for PFF. As per prior coverage, HYGV is the highest-yielding corporate bond ETF in the market.

Data by YCharts

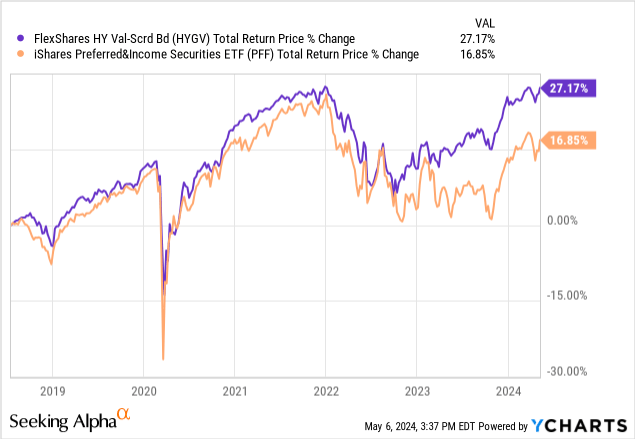

Total returns have been higher, too, due to the above.

Data by YCharts

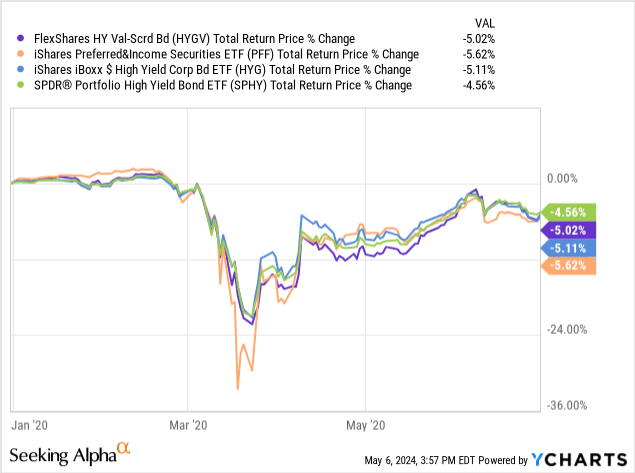

HYGV’s higher yield and returns are due to focusing on bonds with weaker credit quality. Nevertheless, the fund seems about as risky as other high-yield corporate bonds and PFF, with similar losses to these during early 2020. Successful active management / alpha seems a likely reason.

Data by YCharts

In my opinion, HYGV’s higher yield and returns make it a stronger investment opportunity than PFF.

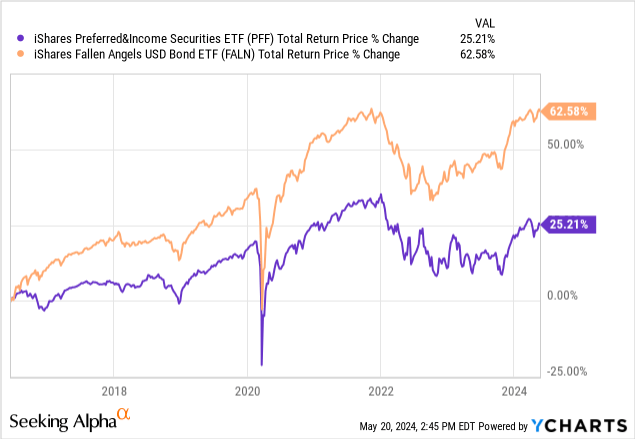

FALN – Fallen Angels Bond ETF

FALN is another high-yield corporate bond ETF. It is an index fund, focusing on fallen angels, or corporate bonds downgraded from investment-grade to non-investment grade. Fallen angels tend to experience forced selling, as lots of institutional investors are constrained from investing in non-investment-grade bonds / forced to sell bonds downgraded to non-investment grade. Forced selling means lower prices and comparatively high yields. Buying fallen angels can lead to strong capital gains as prices recover, leading to outperformance.

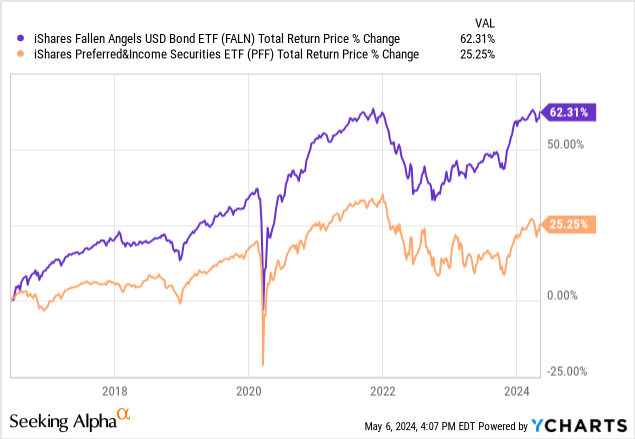

FALN itself has significantly outperformed PFF since inception, as expected.

Data by YCharts

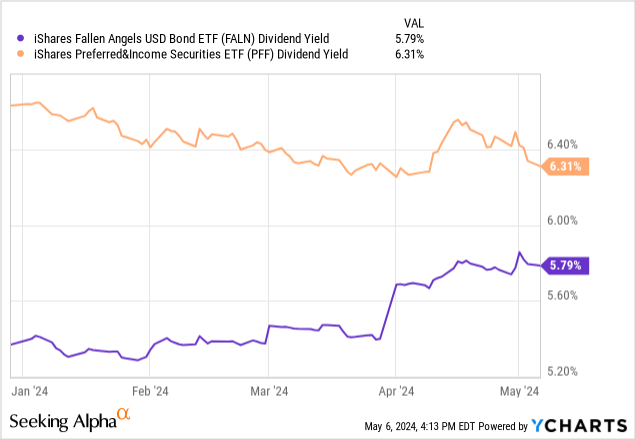

FALN’s 5.8% dividend yield is a bit lower than PFF’s 6.3%, however.

Data by YCharts

In my opinion, FALN’s stronger returns make it a stronger investment than PFF. Some investors might prefer PFF’s higher yield, although SPHY does even better in that regard.

Conclusion

PFF is the largest preferred shares ETF in the market. Although there is nothing significantly wrong with the fund, there are much stronger investment opportunities in the market, including SPHY, HYGV, and FALN. As such, I would not invest in PFF.