While the cost of almost everything has doubled in just the past year alone, Shlah says the family is especially worried about their upcoming mortgage renewal this fall

Article content

After four years of teaching at an online college, Faya Shlah is suddenly staring down the harsh realities of unemployment after being laid off in late February.

Article content

A former graphic design instructor at ABM College, 30-year-old Shlah is part of a tight-knit family of four, living with her 29-year-old sister and their parents in southwest Calgary, all pooling their resources to pay the bills in a city where costs just continue to rise for food, housing, utilities and gas.

Advertisement 2

Article content

“We’re all living together right now,” Shlah says.

“It just makes sense because everything is so expensive.

“And it’s nice to have that family support, mentally it can be a real relief, where we can all help each other out in different ways.”

According to Statistics Canada’s last census in 2021, up to 35 per cent of Canadian young adults are now living with their parents, and for many it’s because it just makes sense financially.

Shlah’s parents are first-generation Syrians, she says, “and sometimes stuck in their ways as immigrants and it took us a while to get to where we are as a family. But we’re really coming together now as a family.”

In recent weeks, Shlah says she’s applied to dozens of jobs, trying to find anything in graphic design or user interface — but the pickings have been slim, she says, adding, “AI (artificial intelligence) has been decimating my industry right now. My partner is job hunting in the same area and isn’t able to find anything. It’s the same for all of us.”

For now, the family makes ends meet with three combined incomes, with Shlah’s father working as a tailor, her mother as a receptionist in a medical office, and her sister working in marketing.

Advertisement 3

Article content

Together they share the cost of food — a bill they say has doubled in the past year alone — monthly mortgage payments, utilities, a mobile phone plan, Wi-Fi, gas for two shared vehicles and the care of two beloved dogs.

Anxiety, fear around mortgage renewals

While the cost of almost everything has gone up in the past year, Shlah says the family is especially worried about their upcoming mortgage renewal this fall.

They enjoyed a fixed borrowing rate for nearly five years, she says, but now they worry about the fall when they’re due to renew the mortgage.

“Right now we’re paying about $2,400 a month for the mortgage. But come September if we don’t get the same rate, it might go up to at least $3,500 a month, depending on the rate we get.

“Who knows what we’ll be facing then.”

Shortly after COVID hit in March 2020, interest and mortgage rates plummeted to record lows of less than two per cent.

But by 2022, impaired supply chains amid rising demand for goods created an unprecedented rise in commodity prices and inflation, ultimately resulting in lending rates spiking as high as five to seven per cent.

Article content

Advertisement 4

Article content

That’s left homeowners, particularly those with fixed rates coming up for renewal, in panic mode, with some banks pushing lending rates as high as eight per cent in recent months.

Canada’s six largest banks hope the Bank of Canada rate could fall as low as 3.25 per cent by the end of 2024, but inflation continues to be sticky.

The looming spectre of unending inflation has kept things unpredictable for families, and depending on whether a family opts for a variable or fixed mortgage, lending rates can hover anywhere between 4.3 per cent to as high as 7.4 per cent right now.

Recommended from Editorial

Power prices climb

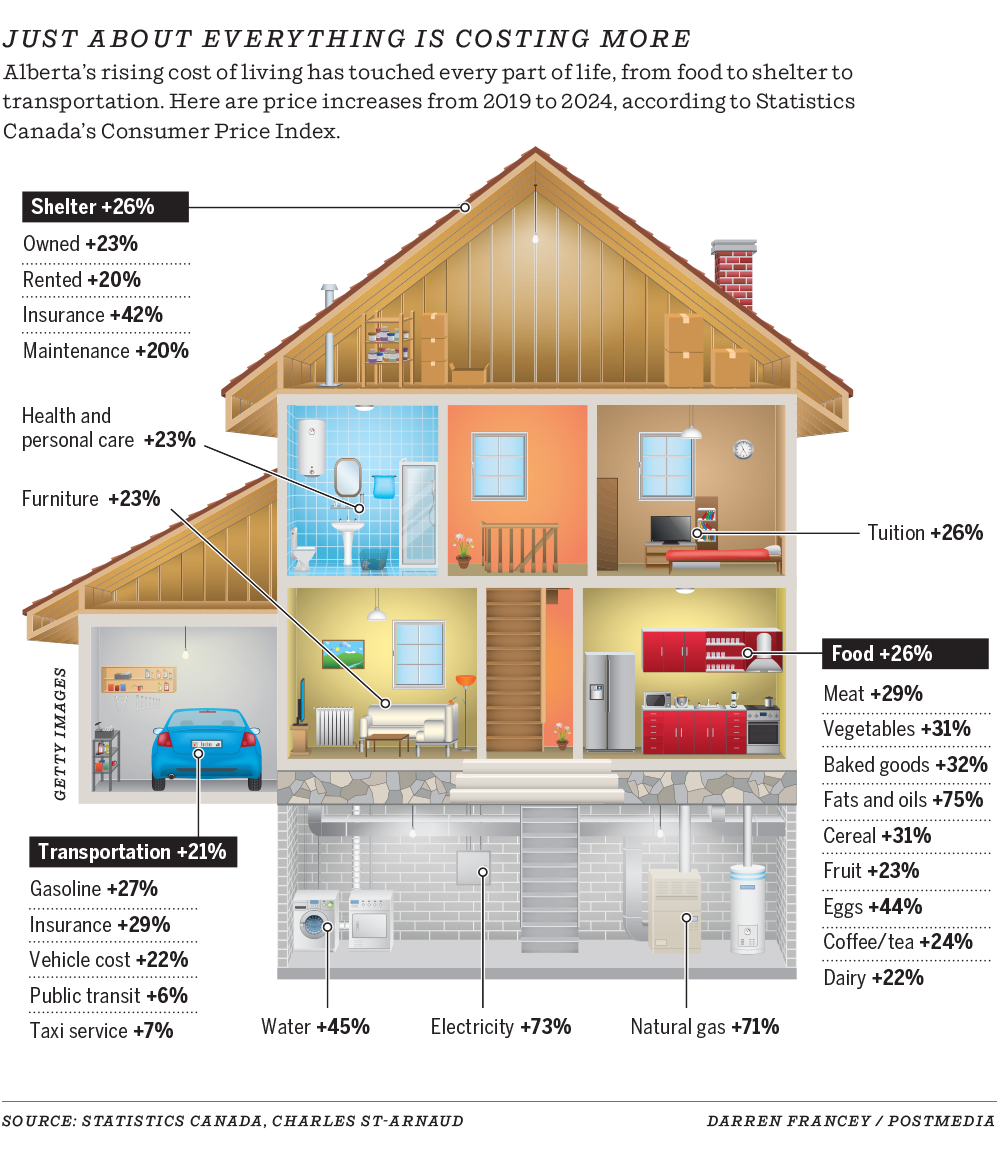

But even before their fall mortgage renewal, the Shlahs are also facing high utility and gas rates that have nearly doubled since the pandemic.

Before 2020, Shlah estimates utilities and natural gas to heat their home cost the family about $300. But now they’re paying $480 a month in the summer, and closer to $600 in the colder winter months.

The cost of electricity in Alberta has also been climbing higher in recent years due to many factors, from higher interest rates, severe weather and a difficult transition to renewable energy.

Advertisement 5

Article content

Consumers faced record highs of 31.9 cents per kilowatt-hour (kWh) last summer, with prices now softening somewhat as the province looks to restructure the provincial power market.

“It’s been a lot for my parents, for all of us really. We’ve had to cut back on a lot of things.

“My mom hasn’t bought any new clothes in years. We never go to the movies anymore. And I’ve stopped going to get my nails done.

“All we can do is just pay for the basic necessities right now.”

‘Obscene what has happened to food prices’

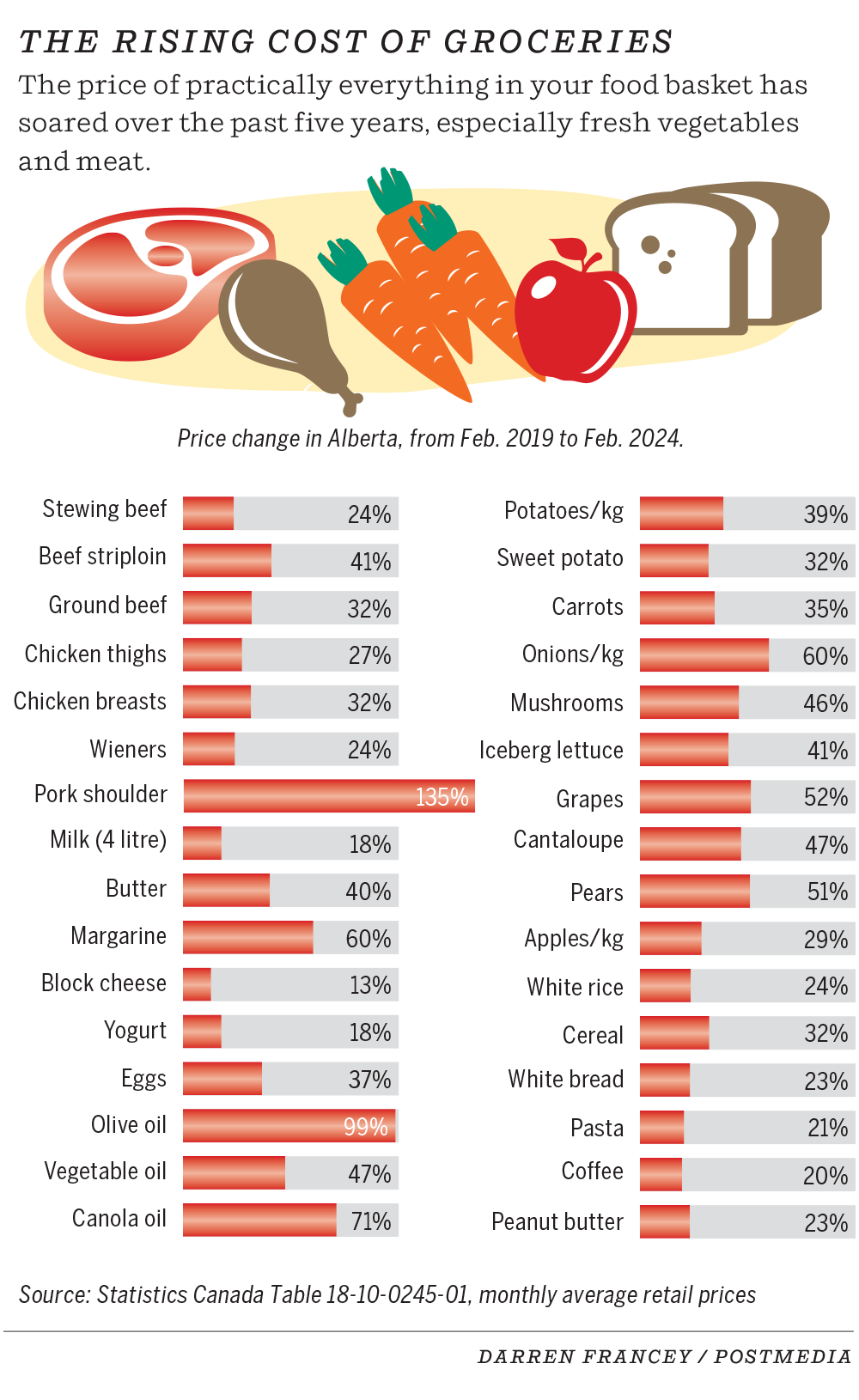

More than anything, Shlah says the cost of food continues to skyrocket for the family. Even as they bargain shop at Costco, Walmart and other low-priced grocery stores, costs have still doubled from $300 to nearly $600 a week in the past year alone.

“The biggest thing for us is definitely groceries, it’s gotten so expensive, we’ve had to cut back so much.”

While they used to buy beef, maybe bison at times, their only meat these days is chicken.

And because Shlah’s dad is diabetic, they are forced to buy a specialty Keto bread, which has also nearly doubled in price, going from $8 to $15 for a package of 10 wraps.

Advertisement 6

Article content

“My mom has tried to buy the special flour and make our own Keto bread, but it doesn’t work, it’s just not the same.”

Dog food, as well, has become especially expensive, jumping from $86 for two bulk bags every six to eight weeks, to as high as $106 to feed both pooches.

“It’s actually obscene what has happened to food prices. And you don’t even get the same amounts of food in packaging anymore either.”

Shlah says she’s seen evidence of “shrinkflation” in products like pasta, or mac and cheese, where a box might have 20 grams less than it did two years ago.

“So many things that used to be cheap just aren’t anymore — even no-name brands. I used to buy no name all the time, but now you’re getting less for the same prices.

“And it’s so frustrating. Because we have to buy these things, we just don’t have a choice.”

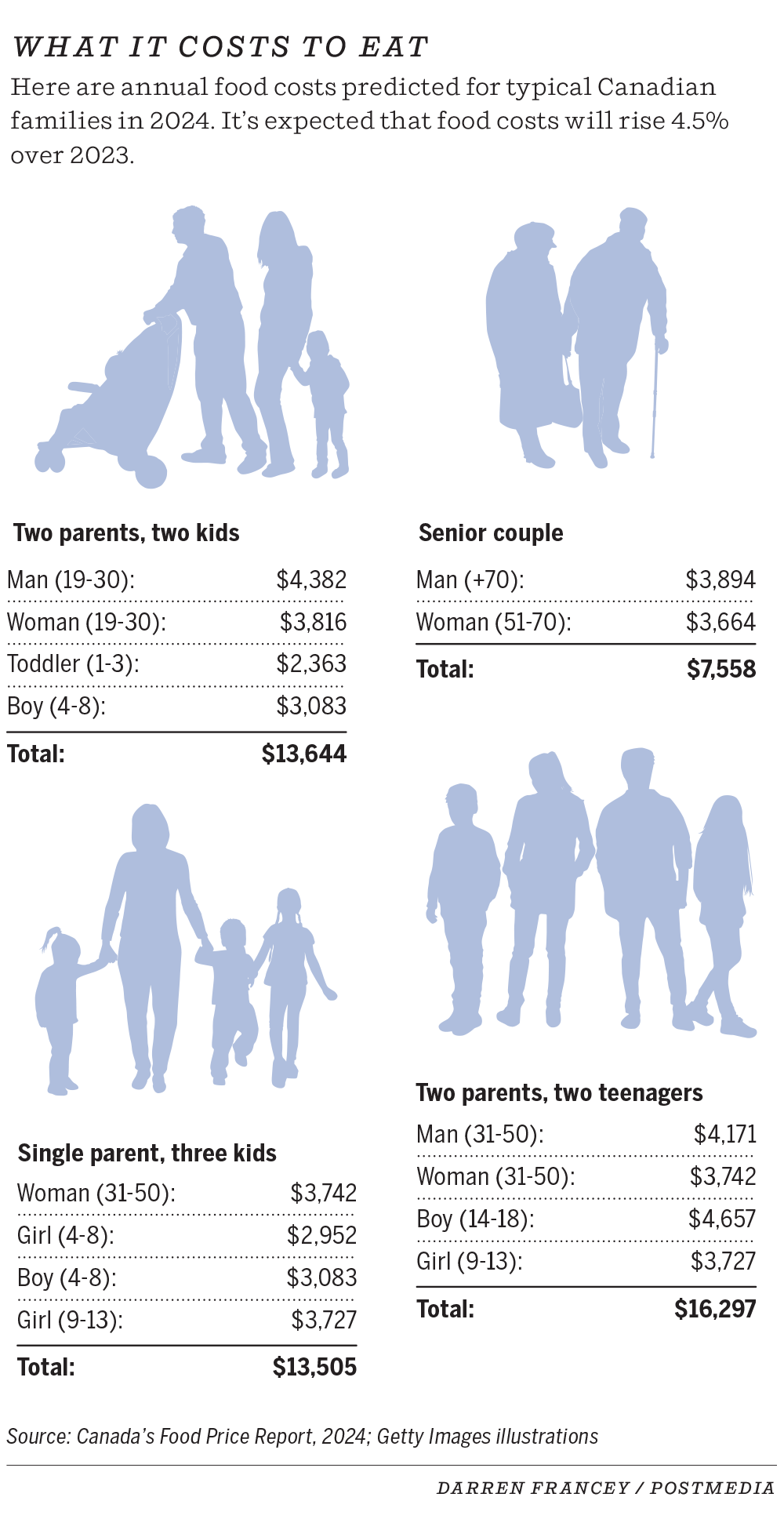

According to Canada’s Food Price Report 2024, inflation continues to force food prices up, and affordability remains a top concern for average Canadian families.

The report, developed annually by Dalhousie University’s Agri-Food Analytics Lab, is forecasting 2024 will see another overall increase in food prices between 2.5 and 4.5 per cent.

Advertisement 7

Article content

The average family of four is expected to spend $16,297.20 on food this year, the report says — an increase of up to $701.79 from last year, with the most significant increases ranging from five to seven per cent in the categories of bakery, meat and vegetables.

The report explained food prices will continue to be high this year, simply because last year was such an incredibly tumultuous year politically, environmentally, and economically. Canada saw unprecedented wildfires and flooding, while political conflict in Europe and the Middle East has impacted energy costs and commodity prices.

As a result, the report adds, Canadians are facing significant financial pressures, like rising food and housing costs, as well as increased personal debt.

“The year 2023 posed significant financial challenges for Canadian families, one of the toughest in recent memory,” said Dr. Sylvain Charlebois, project lead and director of the Agri-Food lab.

In Calgary alone, the report states one in five Calgarians cannot afford healthy food, with grocery prices expected to increase by another $700 annually this coming year.

Advertisement 8

Article content

Shlah says in order for her family to afford weekly groceries, they’ve had to stick to sale items in the produce section, while often avoiding beef and other luxury items.

“Even certain fruits and vegetables we don’t buy anymore because they’re just too expensive.”

The family also reduces costs by sharing two vehicles among the four of them — but they worry about the recent hike in gas costs after both the federal carbon tax and the provincial gas tax increased prices in early April.

“My mom drives the most out of all of us, just a little Honda Civic. She says she used to be able to fill the tank for like $35 to $40. Now it’s closer to $60.”

Middle-class families struggling to meet basic needs

With all of the financial challenges combined, Shlah says she can understand why average Canadians are becoming increasingly frustrated.

“Inflation wouldn’t be such a problem if we saw where the money was going, if the quality of what you were buying was getting better or if employees were getting paid more.

“But none of that is happening,” Shlah argues.

“So that’s why you see so much anger because it feels like this is not going anywhere, yet the CEOS are just fine, and they’re hoarding all the money.

Advertisement 9

Article content

“So it’s why we’re seeing all this saltiness, a lot of anger within Canada, and I think it’s valid.”

Meaghon Reid, CEO of Vibrant Communities Calgary, says that non-profit groups like hers are seeing the affordability crisis impacting more middle-income families than ever, adding that a recent report by Equifax Canada estimates half of Canadian families are now living pay-cheque to pay-cheque.

“What we’re really starting to see more of is an increasing number of people in the middle class, people who are used to being comfortable, now being unable to square the circle in terms of meeting their basic needs.”

Reid agrees many families with upcoming mortgage renewals are stressed, and many are already being forced to sell their homes and move into the rental market.

“And then those same families are failing to find anything reasonable or affordable in the rental market. It can be very scary.”

Still, Reid is optimistic the affordability crisis will eventually wane, “but it’s going to take a few years,” she said.

“At some point, inflation will level off and we know all the housing starts that are anticipated will eventually come. But it takes a while to build all of that.

Advertisement 10

Article content

“So we need to just do our best to keep people fed, keep people housed and keep wages indexed to the cost of food and shelter so we’re not always playing catch up.”

We know the rising costs of groceries, mortgages, rents and power are important issues for so many Calgarians trying to provide for their families. In our special series Squeezed: Navigating Calgary’s high cost of living, we take a deep look into the affordability crisis in Calgary. We’ve crunched numbers, combed through reports and talked to experts to find out how inflation is impacting our city, and what is being done to bring prices back to earth. But, most importantly, we spoke to real families who shared their stories and struggles with us. We hope you will join the conversation, as these stories roll out.

Tomorrow: Feeling the sting of Calgary’s cost of living? We have launched a survey to help you share your experiences

May 21 to 23 – Scrimping and Saving: Food Insecurity in Calgary

May 27 to 30 – Priced Out: The Rising Cost of Housing

June 3 to 4: The Cost of Doing Business

Article content