Guido Mieth

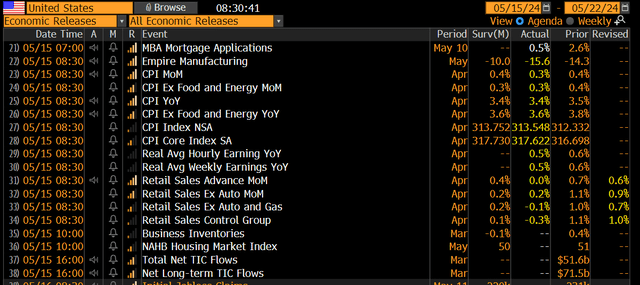

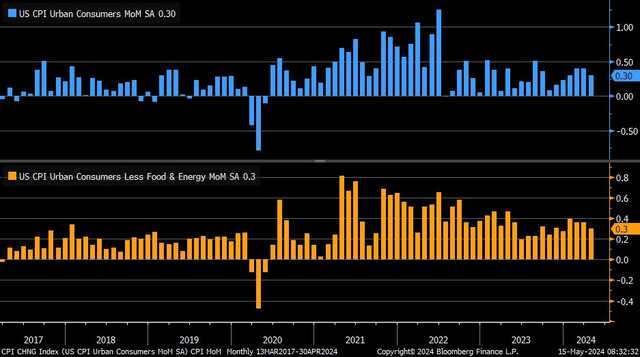

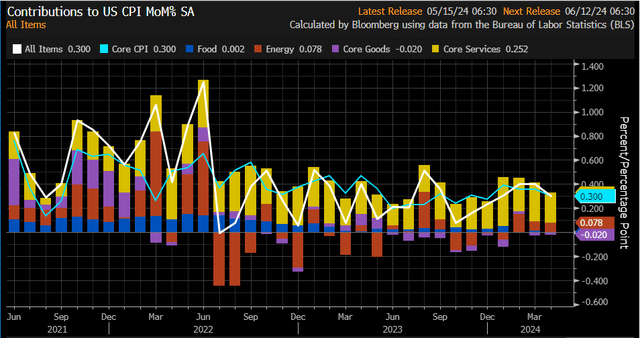

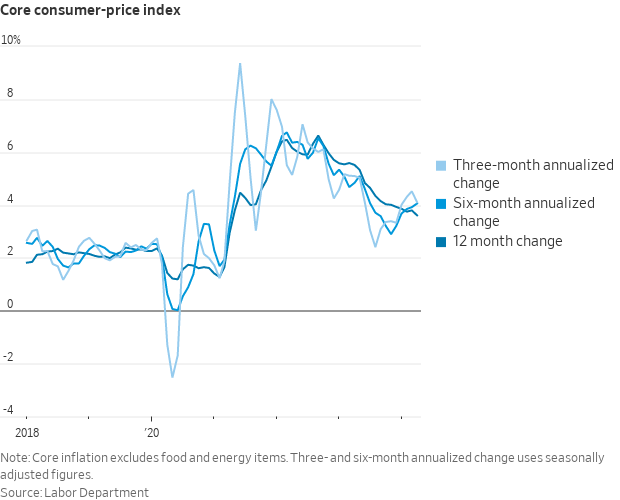

April Headline CPI verified at 0.3%, slightly below the 0.4% expectation. On a Core basis, the 0.3% print was right in line with what economists were expecting. On the year-over-year view, Headline CPI is now 3.4%, a tenth cooler than what was seen in March and in line with the consensus. The 3.6% year-over-year Core CPI rate, the lowest since April 2021, was very close to market estimates. This marks the 37th consecutive month with inflation above 3%.

Sequentially, the numbers were generally better than what was seen in March. Perhaps more importantly, this breaks a string of three straight significantly hotter-than-expected inflation readings at the consumer level.

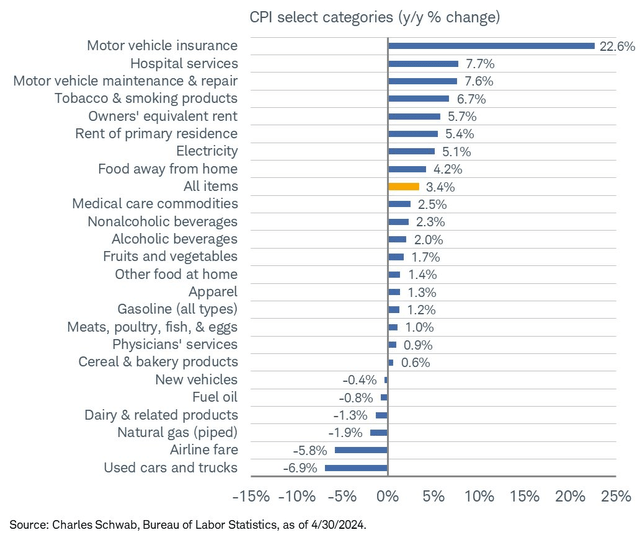

Core Services inflation, now at +5.3% from 12 months ago, held firm, though, so there is still some concern about underlying consumer price trends. But the so-called US Supercore CPI rate verified at 0.422%, the lowest of the year, down from 0.647% in March.

At the same time, the Retail Sales report was released for April. The headline figure was unchanged compared to March, much below the +0.7% consensus, and is now up 3% year-on-year. Ex-gas and autos, the monthly change was -0.1%, also weaker than expected. The Retail Sales Core Control group, a steadier measure, fell 0.3% sequentially, sharply below the +0.1% consensus.

April CPI Comes In Close to Estimates

Getting into the inflation nitty-gritty, April CPI was up just 29 basis points, so it was a small round-up. 3.36% was the Headline YoY CPI rate when taken out an extra decimal place, leading to a significant round-up in the reported rate.

The six-month annualized figure is 3.6%, the highest since July, while the three-month annualized rate is now 4.1%, down from 4.5% in March. Interestingly, prices for used vehicles fell 6.9% from April 2023, putting major downward pressure on CPI.

Short-Run Annualized CPI Measures Steady

WSJ

Headline & Core CPI Changes M/M

Contributions to CPI M/M

Motor Vehicle Insurance Remains Top of the Inflation Stack

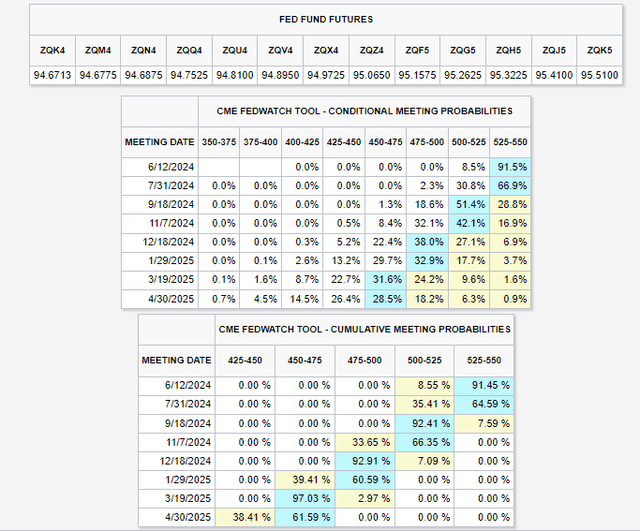

After all the data, market yields fell significantly to fresh lows going back to early April. The yield on the US 10-year Treasury note (US10Y) sank to 4.35%. Stocks loved the data deluge, which generally showed a cooling in both inflation and consumer spending activity. That puts the likelihood of a July rate cut even more in play. The Fed swaps market now prices in a faster pace of 2024 cuts.

A July Rate Cut Remains In Play, 40 Basis Points of Easing Priced into 2024

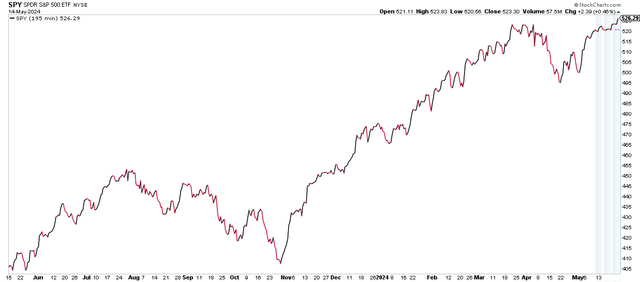

S&P 500 futures (SPX) rose about 0.5% after the pre-market data, while long-term Treasuries moved up sharply by more than 1% after being near the unchanged mark before the data hit the tape. Small caps ripped, too, rising 1.5% ahead of the Wall Street opening bell. Bitcoin continued its morning rally, now up close to 4%, while gold caught a bid – up 1% from 4 p.m. ET Tuesday. The S&P 500 is now set to open at what would be a fresh all-time closing high as the May market melt-up presses on.

S&P 500 ETF (SPY) Hits An All-Time High

Following this morning’s data, the Fed should feel encouraged that the trend of hotter-than-expected CPI reports from January through March has been broken. Weaker Retail Sales figures support that narrative. Moreover, Tuesday’s March PPI data, which some feared showed a significant acceleration in wholesale prices last month, seems to have been a red herring.

With the next FOMC meeting just four weeks away, we will get a PCE update later this month and then the May CPI release during the Fed’s two-day policy meeting, so a lot can still happen regarding rate-cut expectations.

The Bottom Line

April CPI data was a sigh of relief for the bulls and doves. The broadly in-line report broke a string of hot reports, while Retail Sales data for last month buttressed the tame consumer price prints. There is now a 35% chance of a July cut, per CME Fed Funds futures, with about 40 basis points of total easing expected in 2024. S&P 500 futures lifted close to record highs while yields dropped.