kasto80

For now, it’s a 5% dip

I warned on April 19th that

the S&P500 (SP500) is facing a 20% deep correction over the near term:

The S&P 500 faces a dangerous situation with three major events (a hawkish turn by the Fed, escalating geopolitical tensions, and upcoming earnings reports from mega-cap tech firms) colliding with bubble-like valuations.

As I will explain in this article, the risk of an imminent sharp 1987-like market crash for now is significantly reduced. The deeper 20% correction has been delayed. Fundamentally, this means that investors could get an opportunity to sell at higher prices. Tactically, this means that 1) short positions should be reduced; 2) or for more aggressive short term traders, the speculative opportunity is on the long side.

The recent drawdown stopped for now at 5%, making it a dip.

Why did the drawdown stop at 5%?

The recent dip in the S&P500 (SP500) was due to three major fundamental triggers:

- Interest rates were rising. The selloff started as the 10Y Treasury yield breached the 4.35% resistance level, and the 2Y yields were rising due to repricing of expected Fed cuts, possibly to zero in 2024. The common trigger was the strong labor market data, and hot inflation data.

- The geopolitical situation was escalating. Iran and Israel directly attacked each other, which increased the probability of the oil price shock.

- The mega-cap tech stocks were reporting earnings for Q1 2024, and the disappointing results by Meta (META) increased the risk that other mega-cap tech stocks could also disappoint.

Near term interest rates peak

However, recent developments suggest that interest rates might have peaked in the near term. Specifically, the much weaker labor market report for April suggests that the US economy is slowing down. Additionally, the ISM Services data now points to a contracting service sector. This caused a retreat in long-term interest rates.

Additionally, the Fed Chair Powell appeared to be dovish at the May post FOMC meeting press conference. The weaker economic data since suggests that the Fed could actually cut in September, or possibly even in June.

Thus, the major trigger behind the selloff is not turning positive – interest rates have peaked over the near term, and slightly falling.

Temporary de-escalating geopolitical situation

The recent dip reached the bottom exactly when Israel attacked Iran, as the retaliation for the previous attack of Iran on Israel.

With these attacks, Iran demonstrated the will to directly attack Israel if necessary, and Israel demonstrated the capability to destroy Iran’s nuclear capabilities if required. At this time, there is no expectation that there would be further imminent direct attacks between Iran and Israel.

As a result, the price of oil has peaked over the near term as the geopolitical premium is reduced – as the recent de-escalation significantly reduces in immanent 1974-like oil price shock.

Cloud, dividends and buybacks

The other key mega-cap tech companies did not disappoint in their earnings reports, like Meta.

It seems like the only growth engine behind the earnings growth is the cloud business, which was positive for Alphabet (GOOGL), Microsoft (MSFT) and Amazon (AMZN).

However, the major reason for a positive stock price reaction to the earnings report was the announcement of dividends and buybacks, especially for Apple (AAPL).

Technical considerations

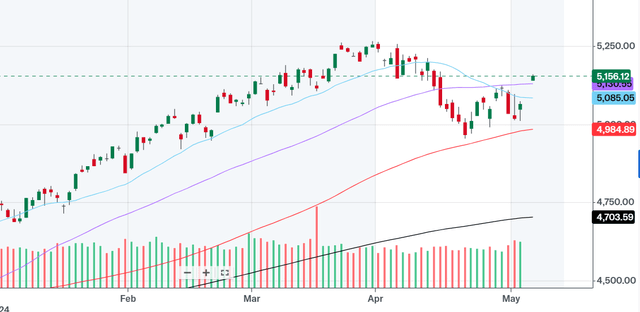

The recent selloff ended the low volatility uptrend that started in October 2023, where the S&P500 was closely tracking the 20dma support. With the 20dma breakdown, the S&P500 fell through the 50dma support, and stopped just above the key 100dma support. In fact, the overnight S&P500 futures price (SPX) action brought the price exactly to the 100dma support when Israel attacked Iran. That was the bottom.

Subsequently, the S&P500 gaped above the 20dma resistance on Friday when the May labor market report was released and interest rates fell. On Monday, the price gaped above the key 50dma resistance.

Yahoo

What’s coming next?

First, it’s important to look at the technicals. Most traders, and all quantitative programs make their decisions strictly based on charts.

So, the chart shows a clear 5% dip with a double bottom, with a higher low point – and the breakout above the 50dma resistance. Thus, these traders are now buyers.

The fundamental triggers behind the recent selloff have reversed, interest rates have peaked, oil has retreated, and mega-caps managed to pull through another earnings season.

Thus, at this point, the fundamental shorts are likely to be forced to cover by trend-followers jumping into the market above the 50dma resistance. As a tactical short-term strategy, as long as the S&P500 remains above 50dma the position should be neutral or long.

Implications

However, fundamentally, the correct position longer-term is to manage the short position, or to sell the rally.

Specifically, the weak labor market report, and the sub 50 reading on ISM services suggest that more weak economic data is coming – and this is ultimately not good for stock. If the data continues to deteriorate, the earnings growth will have to be revised lower.

Further, the recent weak data suggests that the recession is approaching, and with it the recessionary bear market. In this situation, the Fed will cut aggressively, but that’s actually negative for the stock market.

The soft landing is likely impossible. This would be a situation where the Fed cuts preemptively to avoid the recession. But we learned that this is not possible. If the Fed cuts prematurely at full employment inflation would spike again.

So, the possible short-term move higher for the S&P500 in hopes of soft-landing will be crushed again either by 1) recessionary economic data, or 2) higher inflation.

Consider also that the recent geopolitical de-escalation is only temporary. Iran will continue to fight via proxies, and Israel understands that it needs to deal directly with Iran. Also, Israel now needs to finish the Gaza war, and this could cause an immediate negative escalation.

Broadly, we are in an unfolding trend of de-globalization, which is stagflationary. Thus, a weakening economic data could be met with higher inflation, which is the worst-case scenario.

Overall, the S&P500 is likely to go higher over the near term with the renewed soft-landing hopes, and as long as the price stays above 50dma. However, this rally is for the short-term traders. Investors should be focused on an approaching recessionary bear market.

Next, we need to see if the weak labor market report translates into a cool CPI report – core CPI need to come at 0.2% MoM (expectation in 0.3% MoM).

Also, the next major trigger will be the Nvidia (NVDA) earnings, where weak guidance could trigger the AI-Bubble burst.