JHVEPhoto

Elevator Pitch

I continue to award a Buy investment rating to Thomson Reuters Corporation (NYSE:TRI) (TSX:TRI:CA).

My prior February 11, 2024 write-up reviewed TRI’s results for the final quarter of 2023. The current update analyzes Thomson Reuters’ most recent quarterly financial numbers and the company’s forward-looking guidance.

The company’s first quarter bottom line beat expectations and it raised its full-year top line growth guidance. As such, there are good reasons to remain bullish on Thomson Reuters.

Q1 Earnings Were A Positive Surprise

On May 2, 2024 prior to trading hours, TRI published a press release disclosing its Q1 2024 results.

Thomson Reuters registered a meaningful +16.6% bottom line beat for the latest quarter. The company’s actual first normalized EPS quarter amounting to $1.11 was substantially better than the analysts’ consensus forecast of $0.95. Specifically, normalized EPS for TRI increased by +30.5% YoY and +13.3% QoQ in the first quarter of the current year.

Top line growth acceleration and profitability improvement were the two most important earnings growth drivers for TRI in Q1 2024.

The company’s YoY organic revenue expansion improved from +7% in the final quarter of last year to +9% for the first quarter of this year. In particular, the Tax & Accounting Professionals segment was the key outperformer boasting an organic revenue growth rate of +14% for Q1 2024. In its earnings press release, Thomson Reuters indicated that the “Latin America business and UltraTax (tax preparation software)” performed well in the recent quarter which had a positive impact on the performance of its Tax & Accounting Professionals segment.

On the other hand, Thomson Reuters’ normalized EBITDA margin improved by +390 basis points YoY from 38.8% for Q1 2023 to 42.7% in Q1 2024. It is worth noting that TRI’s actual Q1 2024 normalized EBITDA margin also beat the consensus estimate of 39.5% (source: S&P Capital IQ) by +320 basis points. TRI highlighted at its Q1 2024 earnings briefing that “strong revenue flow through boosted margins.” In other words, Thomson Reuters’ overall profitability was boosted by a favorable top line mix, as its highest margin segment Tax & Accounting Professionals grew the fastest (+14% organic growth) in the recent quarter.

TRI’s stock price jumped by +7.6% on May 2, the date of its earnings release. This was likely attributable to both good results, and favorable guidance detailed in the subsequent section.

2024 Top Line Guidance Revision Has Positive Read-Throughs For Mid-Term Growth Expectations

As part of its quarterly results announcement, Thomson Reuters offered an update on the company’s full-year prospects. In specific terms, TRI lifted the mid-point of its FY 2024 top line expansion guidance from 6.50% to 6.75%. This also means that TRI’s revenue growth is projected to accelerate significantly from the +3% top line increase it delivered last year.

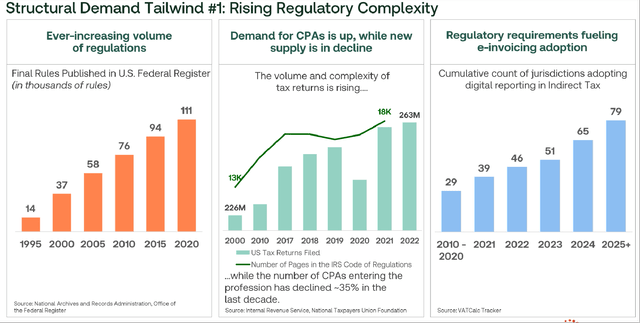

At its earlier Investor Day on March 12, 2024, TRI outlined the company’s goal of achieving a yearly revenue expansion rate in the +6.5%-8.0% range for the FY 2025-2026 time frame. In particular, the company sees “regulatory complexity” as a major driver of its top line growth prospects for the medium term as highlighted in the chart below.

Regulatory Compliance Growth Driver For Thomson Reuters

Thomson Reuters’ March 12, 2024 Investor Day Presentation Slides

An example of an increase in regulatory requirements for businesses is the Corporate Transparency Act. According to a January 2024 article published by law firm Norton Rose Fulbright, the “Corporate Transparency Act took effect January 1, 2024 requiring certain companies to submit beneficial ownership information reports to the Financial Crimes Enforcement Network.”

Thomson Reuters stressed at the latest quarterly results briefing that “it’s not an option for corporations or their advisers to just add more headcount to cope with that (regulatory compliance) burden.” At its March 12 Investor Day (transcript taken from S&P Capital IQ), TRI also emphasized that it is “uniquely positioned to help corporations and institutions navigate this rise in regulatory complexity, and we have a growing conviction that it will provide a long-term demand tailwind for our businesses.”

TRI’s upward revision of its FY 2024 revenue expansion guidance to +6.75% falls within its +6.5%-8.0% intermediate term top line growth target. This suggests that the company is confident on capitalizing on growth opportunities associated with “regulatory complexity” in the mid term.

Risk Factors To Consider

Readers do need to take into account two downside risks when they evaluate Thomson Reuters as a potential investment candidate.

One risk is that companies cut or defer certain spending, if economic conditions turn for the worse. When the economy is bad, businesses have no choice but to reduce all kinds of expenditures across the board. In other words, a decrease in demand for business services resulting from macroeconomic challenges will likely hurt TRI’s performance.

Another risk is that TRI’s future profitability falls short of expectations due to an unfavorable revenue mix. As mentioned earlier in this article, the faster revenue growth for its highest-margin Tax & Accounting Professional segment played a key role in Thomson Reuters’ earnings beat for the recent quarter. In subsequent quarters, TRI’s overall profitability could possibly be weaker than expected, if it generates a higher sales contribution from lower-margin services or segments.

Concluding Thoughts

A beat-and-raise quarter in Q1 2024 means that TRI continues to perform very well. More importantly, the company is a beneficiary of a key growth trend in the form of increased “regulatory complexity.” Therefore, my Buy rating for Thomson Reuters stays intact.