Mystery lingers over whether some of Darktrace’s biggest shareholders are prepared to back its £4.2 billion takeover by America’s Thoma Bravo.

Founding investor Mike Lynch – currently on trial in the US over fraud claims related to executive search software firm Autonomy – has yet to comment.

And it is also tough to work out the position of the Darktrace Employee Benefit Trust – which includes an unspecified numbers of workers.

Mystery: Founding investor Mike Lynch – currently on trial in the US over fraud claims related to executive search software firm Autonomy – has yet to comment

The trust owns just under 8 per cent, or £337 million, of shares.

Darktrace has been unable to shed light on how the trust will go about deciding whether to back the deal.

A spokeswoman said it would be down to independent trustees and pointed The Mail on Sunday to Equiniti, which manages the trust.

Oops! A spokeswoman for Equiniti tells the Mail: ‘You need to ask the Darktrace team, this has nothing to do with Equiniti.’

No longer ‘down with the kids’

How do you know if you’re no longer ‘down with the kids’?

One way is to track Advertising Standards Authority rulings about whether adverts for controversial topics appeal to youngsters.

In March, the regulator said an ad for BetMGM with US comic Chris Rock was unlikely to be of ‘strong appeal’ to under-18s.

Last week it was TV presenter Emma Willis, who the ASA does not think will entice them to play the People’s Postcode Lottery.

Ouch.

‘Nurture’ UK expertise in space industry

We must nurture UK expertise in the space industry, so goes a recent piece on the Space News website.

It makes fair points, such as the need for the private sector and a top-notch talent pool.

But take a look at the author – one Shonnel Malani, the lead non-executive director at the UK Department for Science, Innovation and Technology.

He is also UK managing director of Advent International, the US private equity vulture that took over two of Britain’s top defence firms and then dismantled one (Cobham) within a couple of years.

Whispers is keen to hear more about what you consider ‘nurturing’ to look like, Shonnel.

Trouble at Petrofac

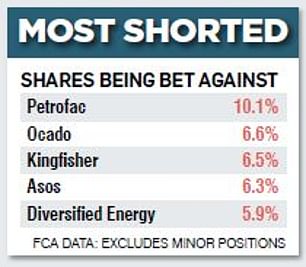

Petrofac suspended its shares last week after delaying its results and admitting it did not expect to make a debt payment on time.

Things have gone from bad to worse for the energy infrastructure builder, which was once worth £4 billion but is now a £55 million tiddler.

It has been the most-shorted stock in London for some time, with a record 11.5 per cent of its shares out on loan in January.

But three of the six hedge funds making bets against the firm might be kicking themselves.

They cut their short positions in late April – missing out on Petrofac’s latest nosedive before it stopped trading.

Contributor: John-Paul Ford Rojas