Maskot/DigitalVision via Getty Images

Founded in 2006, Zillow Group (NASDAQ:ZG) is an online real estate marketplace based in the US. Aside from its core brand, Zillow, ZG also owns StreetEasy and Trulia, a former competitor.

My first coverage of ZG was in 2019, when I gave the stock a sell rating due to underwhelming business fundamentals and outlook then. In particular, I considered the newly-launched Zillow Offers business at the time unattractive due to its lack of scalability. Today my call has been proven right, with ZG trading at $39, down almost -20% since my first publication. Moreover, ZG also finally ended up winding down Zillow Offers back in Q3 2022.

More recently, share performance has been rather volatile. ZG reached an all-time high of over $200 in 2021, but continued its decline into the current price level in the next few years. Over the past year, ZG is also down -6.7%.

I upgraded ZG to buy. My 1-year price target of $45 projects almost 16% upside. I believe ZG presents an attractive risk-reward. It is well-positioned to capture growth opportunities in the rental housing market due to its leading position as an online real estate marketplace player.

Financial Reviews

Upon exiting Zillow Offers, revenue growth has been within the negative territory since the last two years. Nonetheless, if we zoom in on a QoQ basis, it appears that revenue growth has actually accelerated since the last two quarters. In the most recent quarter, Q1 2024, ZG maintained that trend as it delivered a revenue of $529 million, an almost 13% YoY growth. This was an acceleration from that of last quarter when revenue growth was just under 9%. Overall, the recent performance here suggests that ZG may have been on a path to rebound.

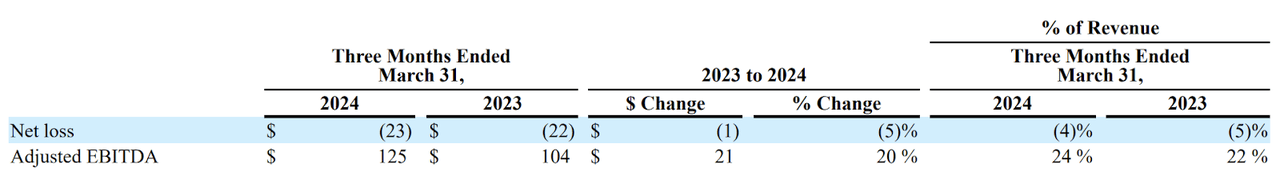

Furthermore, profitability has improved slightly on a non-GAAP basis, though ZG still maintained a steady low single-digit net loss margin as of Q1, which was due to the relatively high share-based compensation (SBC). On an adjusted EBITDA basis, margin actually expanded from 22% to 24% in Q1.

Cash flow generation and liquidity have been relatively steady. In Q1, ZG generated operating cash flow (OCF) of $80 million, slightly less than $93 million in Q1 last year. Liquidity improved slightly, with ZG ending the quarter with over $2.9 billion of cash and short-term investments, up 3.5% YoY, primarily driven by the increase in net borrowings and also proceeds from stock options exercise.

Catalyst

I believe the strength in the rental market may continue into FY 2024, benefiting ZG. ZG’s rental growth is driven by a combination of a few factors, in my opinion.

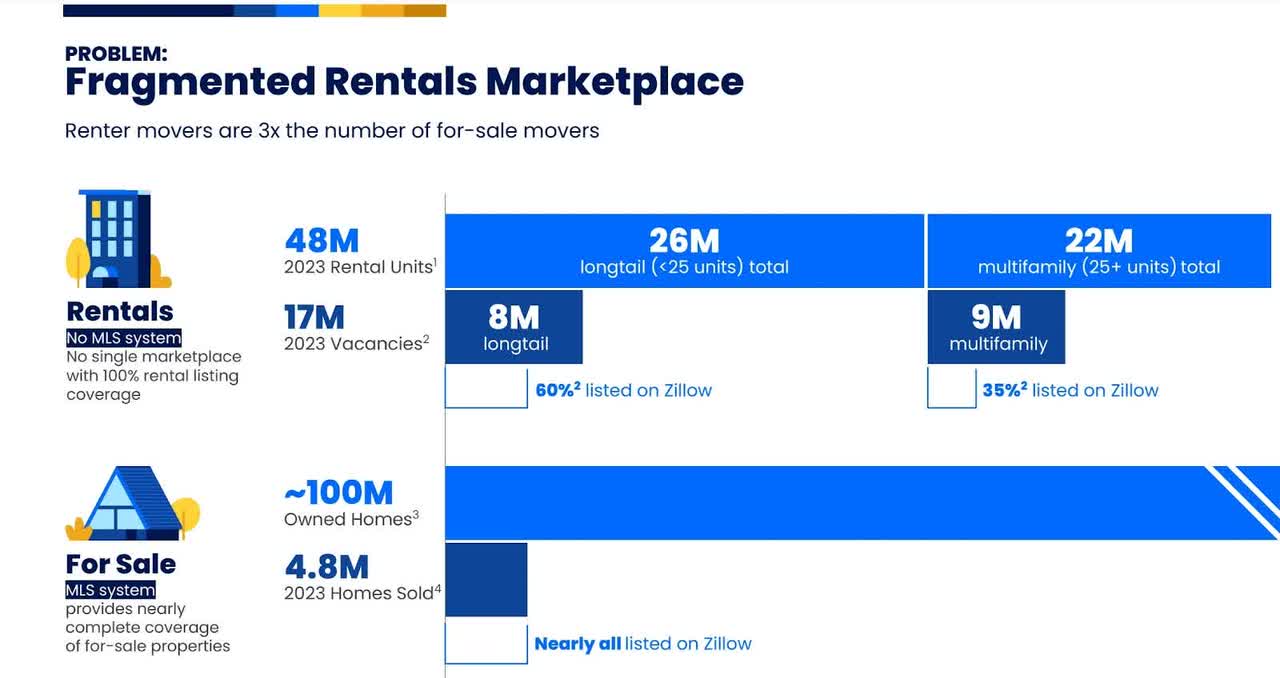

The first key growth driver would be the relatively large and underpenetrated rental market, as demonstrated by the high level of fragmentation. For instance, in 2023, there were only 4.8 million for-sale homes listed on the marketplace compared to an estimated 17 million of listed rental properties. However, the number of owned homes is over twice as much as rental units.

I believe this creates a solid business opportunity for ZG, which has already dominated the residential for-sale market and developed a strong brand reputation as a leading player. While almost all of the 4.8 homes sold in the US were already listed on Zillow, there were still many rental properties not yet listed on Zillow as of the end of last year, meaning that there is a lot of potential upside for ZG. For instance, only 35% of the 9 million multifamily rental properties were listed on Zillow last year.

Another key growth driver in the rental marketplace would be the relatively high turnover rate compared to the for-sale market. Since ZG generates rental revenue from the sales of advertising and other tools to property managers on a cost per-lead or impression basis, ZG should see higher revenue growth as more property managers list on Zillow.

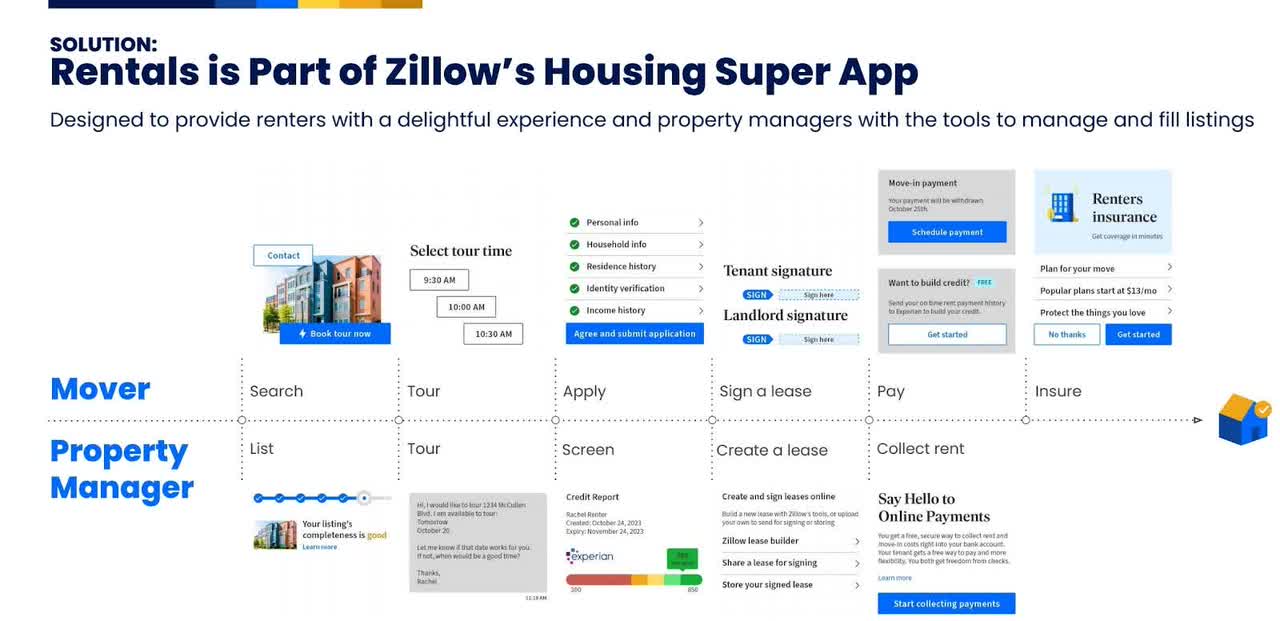

With only 1% share in the rental market, ZG is in a good position to capture more upside here. The main reason is because ZG is already a market leader in the real-estate marketplace with solid and predictable top-of-the-funnel traffic generation. As such, recent initiatives, such as the SuperApp, should help accumulate traffic into a consolidated view to drive continued conversion for ZG. Being in such a state already, user-centric feature development would then become an important conversion driver that is indicative of future revenue growth. In my opinion, ZG has also done relatively well here as of Q1, suggesting that its target of double-digit growth in FY 2024 is within reach. While the rental business should drive majority of that growth, ZG’s newly-launched feature in its residential business, Showcase Listing, presents a promising potential to unlock accelerated growth beyond high-single digits, as per the management’s comment:

We continue to be excited about Listing Showcase and the progress we are making across the country. Showcase listings drive higher engagement on Zillow compared to similar non-showcase listings, more views, more shares and more saves. But even more importantly, homes that list with Showcase are selling faster and for more money. Showcase listings typically sell for 2% more than similar non-showcase listings on Zillow, a bonus of $9,000 on the average home.

Source: Q1 earnings call.

Risk

Though the rental business may continue to experience growth into FY 2024, there is a risk that the for-sale residential market slows down further due to the lingering macro challenges. Residential still made up almost 75% of ZG’s business, and slowdown there may present a meaningful headwind for ZG. In recent times, the high-interest rate environment has resulted in low housing stock, which negatively impacted ZG’s residential revenue last year. As reported by Forbes, housing demand may continue to outpace supply into FY 2024:

With many homeowners “locked in” at ultra-low interest rates or unwilling to sell due to high home prices, demand continues to outpace housing supply—and likely will for a while—even as some homeowners may finally be forced to sell due to major life events such as divorce, job changes or a growing family.

Source: Forbes.

Though ZG saw a 9% growth in residential revenue in Q1, the residential revenue in Q1 was also helped by the revenue contribution from Follow Up Boss, which ZG acquired in December 2023. As such, it is quite unclear what the residential revenue growth would have actually been without accounting for additional revenue from the acquisition.

Valuation / Pricing

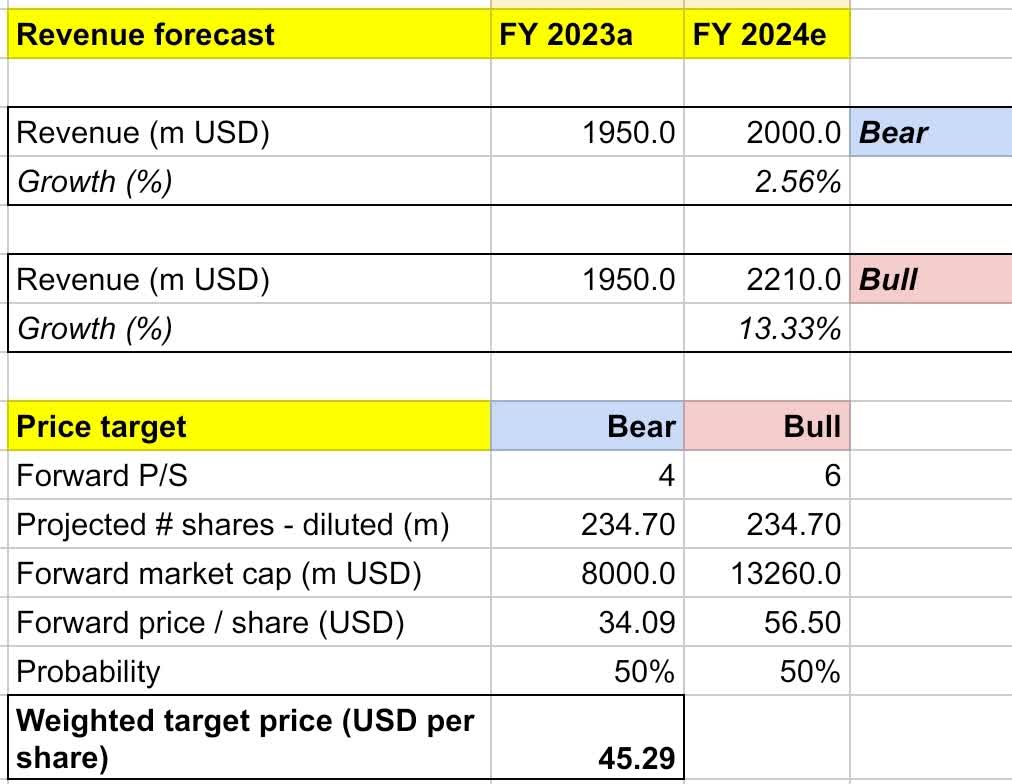

My target price for ZG is driven by the following assumptions for the bull vs bear scenarios of the FY 2024 projection:

-

Bull scenario (50% probability) assumptions – I expect revenue to grow 13.3% YoY to $2.21 billion, in line with the market’s estimates. I assume forward P/S to expand to 6x, implying a share price appreciation to $56 as ZG delivers a double-digit growth. This also means that ZG would revisit its YTD-high.

-

Bear scenario (50% probability) assumptions – ZG to deliver FY 2024 revenue of $34, a 2.6% growth, missing the low-end of the revenue guidance. I assign ZG a forward P/S of 4x, lower than where it is trading today, projecting a correction to $34 or a sideways price action into the FY.

own analysis

Consolidating all the information above into my model, I arrived at an FY 2024 weighted target price of $45.3 per share, projecting a 1-year upside of just under 16%. I assign the stock a buy rating.

My assumption of 50-50 for bull and bear scenarios is based on my belief that the current macro situation today still presents relatively high uncertainty, despite ZG’s strong rental performance. However, my conservative projection here appears to still yield an attractive return, in my opinion. In the projection, I lowered the bear case revenue estimate while also assumed a P/S expansion to 6x for bull scenario. It is possible for ZG to trade higher than 6x P/S, in my opinion, as it already saw a higher P/S multiple when it reached its YTD high.

Conclusion

ZG remains an attractive opportunity because of its leading position in the digital real-estate marketplace sector. Today, it generates strong traffic across its well-known brands, such as Zillow and Trulia. This enables ZG to continue gaining share in the large and relatively underpenetrated rental housing market. Risk remains moderate given the lingering unfavorable macro situation. However, the price remains attractive. My price target of $45 is conservative, yet still provides almost 16% upside. Having assigned the stock a sell rating in 2019, I now upgrade ZG to buy.