Medical equipment maker Smith & Nephew has been rocked by a shareholder revolt over proposals to increase its chief executive’s pay to nearly £10million.

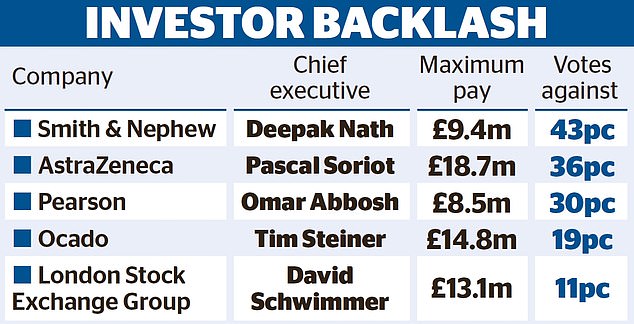

In what amounted to a bloody nose for the FTSE 100 firm, 43 per cent of its investors voted yesterday against raising Deepak Nath’s maximum earnings to £9.4million.

City advisory group ISS branded the increase ‘excessive’ ahead of yesterday’s vote and urged investors to block the deal.

US-based Nath is just the latest boss at a British firm to seek a higher salary – sparking a fresh backlash over fat cat pay.

It comes amid debate over whether FTSE chief executives are underpaid compared to their American counterparts.

Pay revolt: Some 43% of Smith and Nephew investors voted against raising chief exec Deepak Nath’s maximum earnings to £9.4m

Despite the revolt, Nath’s raise was approved at the annual general meeting in Watford as more than half of investors backed it.

The Texas-based boss will be paid up to £9.4million if all targets are met, which is an almost 30 per cent jump on his current package of £7.3million.

After the result was announced, the company said that it would ‘continue to engage with shareholders and proxy advisers and provide an update on further consultations within six months’.

The firm is keen to reduce turnover of top staff after having had four chief executives in five years.

Former boss Namal Nawana – also based in the US – stepped down from the role in 2019 after just 18 months amid a row over salary.

Yesterday, FTSE 250 telecoms firm Spirent – a takeover target – also faced a backlash over proposals to change its bonus structure to be more competitive in the US.

The policy was approved despite opposition from 43 per cent of its shareholders.

Spirent, which is listed in London, said that most of its operations and sales are based in America, where the majority of its executives including the chief executive live.

A string of company bosses are in line for bumper pay deals this year despite dissent among their shareholders.

This week Ocado shareholders approved a £15million maximum pay policy for the online supermarket’s boss Tim Steiner.

However more than 19 per cent of votes cast at the meeting opposed the increase.

Last week London Stock Exchange Group (LSEG) was given the go-ahead to double chief executive David Schwimmer’s maximum package from £6.25million to £13million.

Some 11 per cent of shareholders voted to block the rise amid concerns over the health of London’s stock market.

And AstraZeneca chief executive Pascal Soriot is in line for an £18.7million payday this year despite 36 per cent of shareholders voting against a £1.8million hike.

Meanwhile, Tesco plans to hand boss Ken Murphy a record-breaking £10million in 2024 –with investors set to vote on the proposal later this year.

Julia Hoggett, who leads the stock market division of LSEG, has said lower executive pay makes it harder for UK firms to attract top talent in comparison to American competitors.

In an update for investors ahead of the meeting, Smith & Nephew said revenue in the first quarter was £1.1million, up from £1.08million a year earlier.

Growth was driven by its orthopaedics, sports medicine and ear, nose and throat businesses, offsetting slower sales in its advanced wound management arm. Full-year growth is expected to be between 5 per cent to 6 per cent.