Tim Robberts/DigitalVision via Getty Images

Investment Thesis

(Note: all amounts in the article are in EUR. At the current exchange rate 1 EUR is approximately 1.07 USD.)

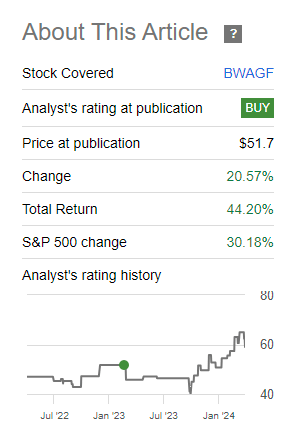

I covered BAWAG Group (OTCPK:BWAGF) about a year ago on Seeking Alpha and gave a Buy recommendation. Since then, BAWAG has returned around 44%, beating the S&P 500 index handsomely by around 1400bps.

Source: Seeking Alpha

BAWAG announced strong Q1 2024 results on April 29. The bank continues to show exceptional profitability and cost efficiency (the RoTE was 23.7% in Q1 2024 and the cost/income ratio only 32.9%), combined with a strong balance sheet and low risk cost (the NPL ratio was 1.0% and the risk cost ratio at 28bps).

The bank now has excess capital of 623mn. To put this in context: 623mn is around 14% of the current market capitalization. In previous years BAWAG has used its excess capital for share buybacks, but this year the money will go toward the acquisition of the Dutch digital bank Knab. Management says the acquisition will be 2-3 more accretive than share buybacks.

Even without share buybacks, investors can still enjoy a sizable dividend. I expect an increase of 5-10% for 2024, but the current dividend of EUR 5 per share already means a dividend yield of more than 8.7% at the current share price of 57 euros.

Therefore, I see enough reason to confirm my Buy recommendation despite the good returns over the last year.

Q1 2024 results

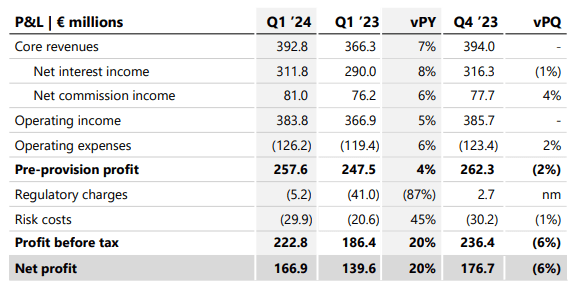

The bank released its Q1 2024 financial results on April 29, which were good across all aspects. Net profit increased to 167mn, up 20% YoY, resulting in EPS of 2.11 euros and a RoTE of 23.9%. The flip side here is that the bank trades at around 1.36 price/book ratio and 1.6 price/tangible book value. However, BAWAG has now achieved a RoTE above 20% for the last five quarters and, in my view, those ratios could be even higher.

Both net interest income and net commission income increased YoY by 8% and 4%. Driven by inflationary pressures, especially regarding personnel cost, operating expenses were up 6% YoY and 2% QoQ, but the cost/income ratio continues to be very low at 32.9%.

Those numbers show that BAWAG Group continues to be highly profitable and exceptionally cost-efficient:

Source: BAWAG Group

This does not mean the bank is taking on a lot of risk. Risk cost was higher YoY, but flat QoQ, and in absolute terms, risk costs are low. The NPL ratio was only 1% and the risk cost ratio was 28bps.

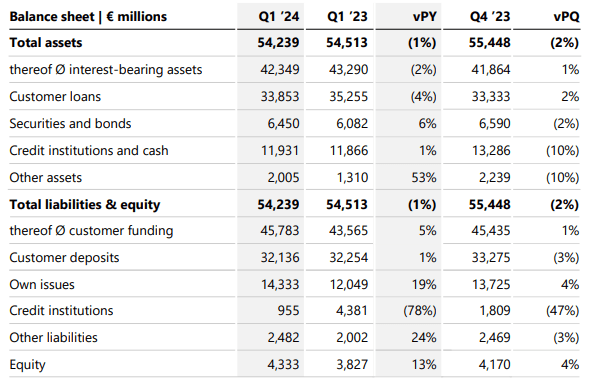

The CET1 ratio at the end of the quarter was 15.6%, which already includes a dividend accrual of 91mn for Q1 2024. The bank now has excess capital (versus its regulatory requirements) of 623mn. In previous years, BAWAG has used excess capital it has earned for share buybacks, but this time the capital will go towards M&A opportunities. A contract to buy the Dutch online bank Knab was signed in February (more on that later).

The bank’s funding is very stable. 96% of customer loans are customer-funded: 26.5bn of the 31.1bn customer deposits are in Retail & SME. They are spread across more than 2mn customers, and 80% are insured by a deposit guarantee scheme. The average deposit size is 12,000 euros.

Source: BAWAG Group

2024 targets and valuation

The bank confirmed its 2024 targets:

- Profit before tax > 920mn (versus 910mn in 2023),

- RoTE >20%, and

- Cost-income ratio <34%.

With the background of the Q1 financial results, I do find the targets conservative. I think a dividend increase of 5-10% from the 5 euros in 2023 is possible (the bank has one annual dividend payment). But even if the dividend stays the same, the dividend yield is almost 9% (8.77% exactly at the current share price). Together with a P/E ratio of 6.7 (based on quarterly EPS of 2.11 euros), this makes for a compelling valuation, in my view.

Knab acquisition

The pending Knab acquisition adds a growth aspect to the BAWAG Group equity story, which would otherwise be a value play, based on a safe high dividend yield and continuous share buybacks.

In February the bank announced the signing of a transaction to acquire 100% of the shares in Knab from ASR Nederland N.V. for 510mn euros, payable at closing – which is expected to happen in the second half of the year. As of H1 2023 (the most recent financial results available), Knab had 17.1bn of assets, which were primarily comprised of Dutch mortgages, and around 11.6bn of customer deposits. 56% of the mortgages were government-guaranteed. Knab’s book value was 784mn, meaning BAWAG is paying around 65% of the book value (per H1 last year).

The digital-only bank was founded under the name Aegon Bank in 2012 and is headquartered in Amsterdam. It specifically targets self-employed people and offers a wide range of products including current accounts, savings products, and mortgages.

Knab is profitable – in H1 2023 it generated a net profit of 64.5mn euros, up almost 300% YoY from 16.2mn in H1 2023. It was comfortably capitalized (I would say even over-capitalized) with a CET1 ratio of 23.2%.

When management announced the acquisition during the Q4 2023 earnings call, they said the deal would be P&L accretive from day one onward and contribute 150mn of pre-tax profit by 2026. So, the return on capital would be well above 20%, but we should remember that BAWAG Group had a RoTE of more than 23% in Q1 2024. So, this is in line with the bank’s “normal” profitability. Again, I think, this could be conservative as Knab had a pre-tax profit of 86.9mn in H1 2023. We do not have full-year results for 2023 though, and therefore I would see the 150mn profit contribution as the base case – to be reevaluated once we have more recent financial results.

Risks

BAWAG Group often uses the term “fortress, safe, and secure balance sheet” to describe its business approach. We can see the approach, for example, in an LCR of 217%, 11.9bn cash on hand, and a strong credit profile with an NPL ratio of 1.0%. Given these conservative numbers, the bank’s strong profitability with a RoTE of well over 20% is even more notable.

Austrian government accounts

There is one risk to the bank’s funding that investors need to be aware of, even if they agree with me that it has a low probability. We mentioned that 6.5bn of the bank’s customer funding is from the commercial and public sectors, with the majority from the public sector. A major reason for this is that the Austrian government holds practically all of its accounts with BAWAG Group, and has done so since before the Second World War. BAWAG Group is the result of a merger of two banks, BAWAG which previously was owned by the ÖGB, the Austrian Union, and Österreichische Postsparkasse, which the Austrian Government previously owned. There is a colorful history here, and I touched upon it in my initial article (for those who are interested). The bottom line is that both owners are gone now and so are the exceptionally strong ties the bank used to have to the Austrian government. At least theoretically, the business could go someplace else, and the Austrian government could do a tender. I consider this unlikely, though, as it would take years to execute, and it would mean a huge cost to the public sector – with little to gain. However, while the business itself is probably not very profitable (net commission income in the Corporates, Real Estate, and Public Sector altogether was just 8mn in Q1 2024), I assume around 10-15% of customer funds may be tied to it.

Interest rates are coming down

Banks, in general, have benefited from rising interest rates, and the benefits have been even higher for deposit-rich banks. BAWAG Group fills that description. So, when interest rates come down, we should expect to see an impact on net interest income. Everybody seems to agree currently that the ECB will do a first cut in June. If it does, that impact will start in H2. The relatively conservative management guidance for 2024 should take this into account, but if rates drop quicker than the market currently anticipates, the impact could be larger and more negative.

Conclusion

BAWAG Group is exceptionally profitable and cost-efficient and has a clean balance sheet and a purposefully low risk profile. The dividend yield of almost 9% makes it an excellent income play. The Knab acquisition, which should close in the second half of the year, adds a growth aspect.

Therefore, I reiterate my Buy recommendation despite the share price appreciation over the last year.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.