Richard Drury

Two weeks ago, Fed Chair Jerome Powell let it be known that he had no confidence to cut rates with the present data, and last week’s inflation releases surely did not give him any reassurance that the inflation outlook was moving in the right direction. Numerous inflation reports keep surprising to the upside, and Powell has an FOMC press conference to deal with this week, on Wednesday, May 1st.

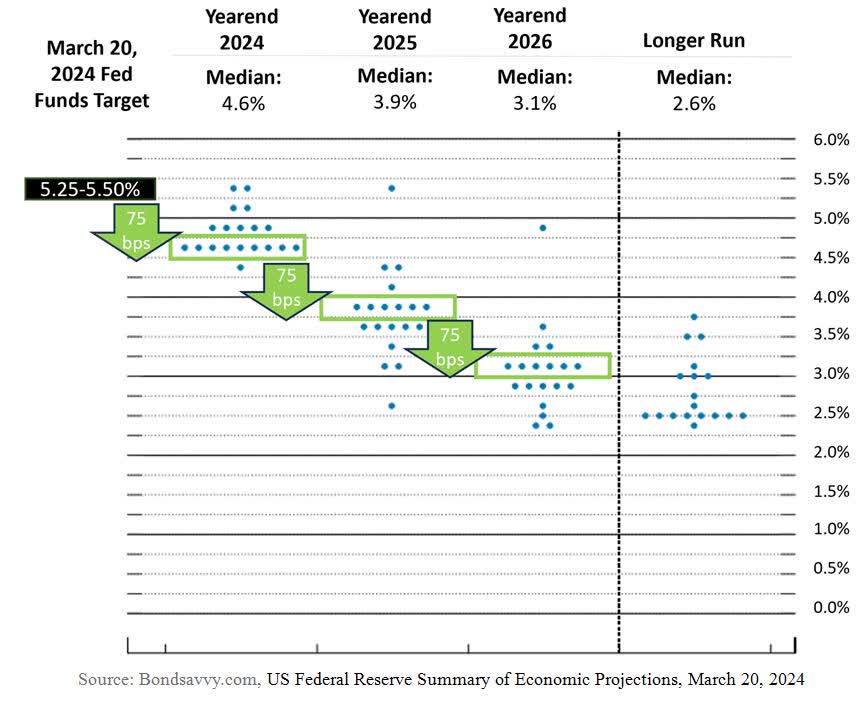

The year began with six rate cuts expected by Fed funds futures markets and other derivative instruments. The odds went down to 2 or 3 cuts by March (see the dot plot, below), and we must sincerely wonder where they will be at the end of this week, given that there is an election in November and that the closer to the election the Fed cuts rates, the more politically unpalatable it will be to seem to impact the election.

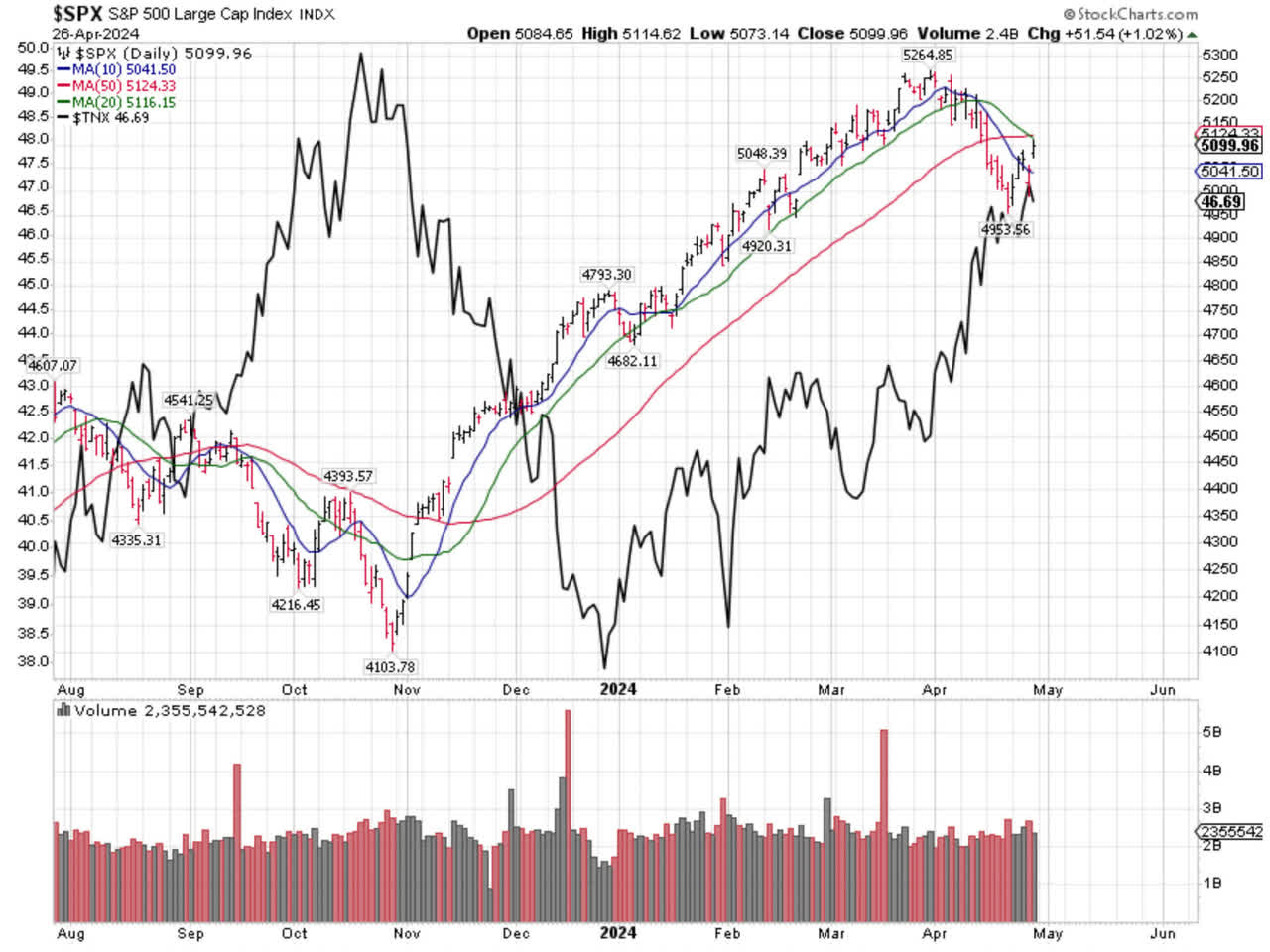

The 10-year Treasury yield went all the way up to 4.74% last week on the worse-than-expected inflation reports, but the stock market generally rebounded because of good earnings and the lack of escalation of hostilities between Israel and Iran, which investors hope is done for the moment. The decrease in the likelihood of a much bigger regional war in the Middle East is seen as a big positive for the market.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

There will likely be more fireworks this week with Jerome Powell’s FOMC press conference. The more rate cuts disappear from the dot plot (above) and the higher the 10-year Treasury yield goes, the less the stock market will like it. On the other hand, a decline in Treasury yields will likely fuel a market rebound.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

If the 10-year Treasury yield keeps marching towards 5%, the S&P 500 will likely decline, similar to what happened last summer, which is about 10%. As the rise of the 10-year Treasury yield accelerated in April, so did the decline in share prices. Needless to say, a lot is riding on this week’s FOMC press conference.

At one point in 2023, we saw the trend of the market reverse in the middle of the press conference, as Jerome Powell generally rolled back the statements in the press release as he clarified the written points. That trend sort of died down in 2024 as the Fed went on hold, waiting for an opportune time to cut rates, but given recent inflation reports, the likelihood for fireworks in both stocks and bonds is again rising.

I think good earnings reports will continue to be cheered by the stock market, but only if we see a topping for Treasury yields, which Powell can influence on Wednesday. Right now, I think he may delay the Fed rate cut closer to the election and possibly have only one before we know who the next President will be.

Disclaimer: Please click here for important disclosures located in the “About” section of the Navellier & Associates profile that accompany this article.

Disclosure: *Navellier may hold securities in one or more investment strategies offered to its clients.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.