hapabapa/iStock Editorial via Getty Images

iShares S&P Mid-Cap 400 Growth ETF (NYSEARCA:IJK) was launched by BlackRock, Inc. on July 24, 2000 and is managed by BlackRock Fund Advisors. Since its inception, it has accumulated around $9.3 billion, and that places it near the top among similar options out there.

That’s not the only thing that places it near the top, though. After we go through the methodology, the case for mid-cap growth equities, the fund’s allocations, and its performance, you will understand that IJK can be a good addition to a diversified portfolio either as a core holding or satellite. That being said, if you are looking for similar exposure, there is one slightly better option to consider.

Methodology

First, let’s understand the approach of IJK. As this is a passive fund (it attempts to track the performance of an underlying index), we need to take a look at the methodology of the S&P MidCap 400 Growth Index. From the name, it is already evident that its job is to measure the performance of mid-cap growth stocks.

Here’s the selection/management process of the underlying index:

- It uses the S&P MidCap 400 as its available universe (Parent Index) which has stocks with a market cap between $4.6 billion and $12.7 billion.

- The underlying index will select stocks from the Parent Index that have exhibited strong growth based on a) momentum, b) the 3-year EPS growth in relation to the last price per share, and c) the 3-year revenue per share growth rate.

- The underlying index does not have a sector concentration limit, it market-cap weighs the constituents, and rebalances quarterly.

Neither too simple nor too sophisticated. Now, there are two components here, mid-cap and growth, that I would like to comment on. First, mid-cap is a range that, in theory at least, strikes the balance between stability and growth potential; mid-cap stocks can be more stable than small-cap ones because they often represent more mature businesses, and they have more growth potential than large-cap stocks because the latter often exhibit a slower pace of market share expansion exactly due to their more mature state.

As for the component of growth, this is usually seen through the lens of its seemingly opposite, which is that of value. It makes sense to tilt toward growth during a bull market that you believe will persist. As such, growth characteristics might best be pursued by aggressive investors who have a good reason to be so.

For these reasons, I see the exposure to a combination of mid-cap and growth as a very aggressive approach if pursued in isolation from a diversified portfolio. However, it has its place in a diversified all-weather portfolio, and it can boost its overall returns over time.

Allocations

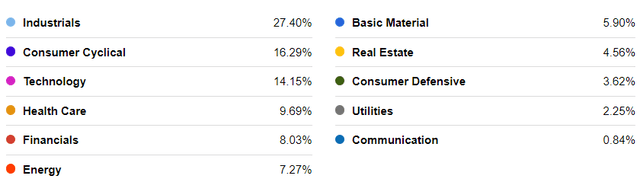

The portfolio of IJK is currently concentrated in the Industrials sector:

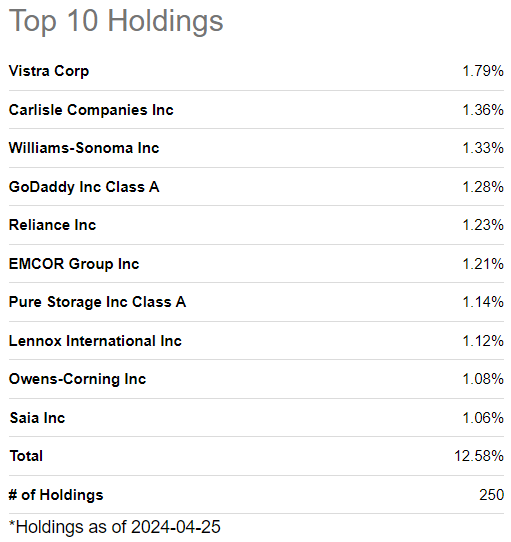

However, with 250 holdings and none of them receiving a weight of more than 2%, it seems adequately diversified:

Seeking Alpha

Moreover, the top 10 holdings account for 12.6% of the portfolio, which doesn’t reflect a large reliance on the big names as other market-cap-weighted indices often do.

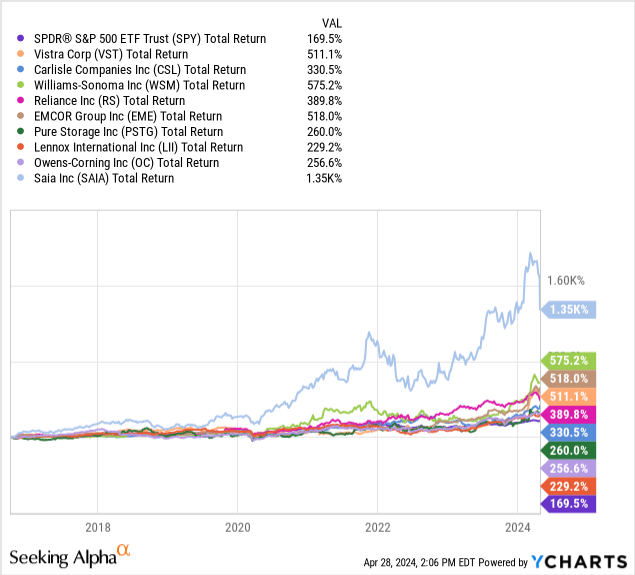

Last, those 10 holdings have outperformed the broad market by a very large margin in the past:

Performance & Cost

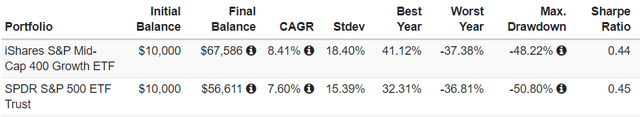

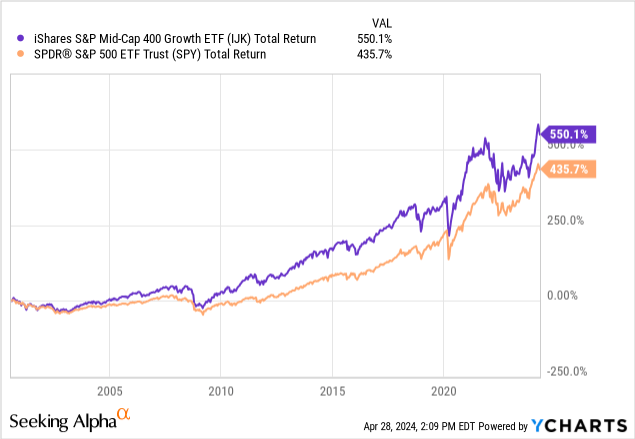

Unsurprisingly, IJK has been outperforming large-cap stocks since its inception:

What I didn’t expect was to see the ETF achieving those returns without much higher volatility and drawdowns, making it equal to SPY on a risk-adjusted basis:

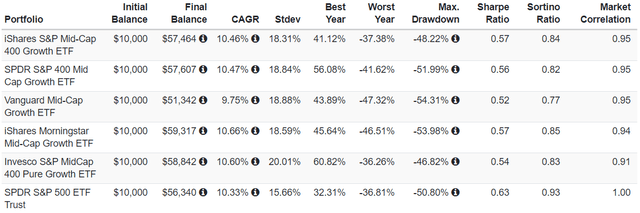

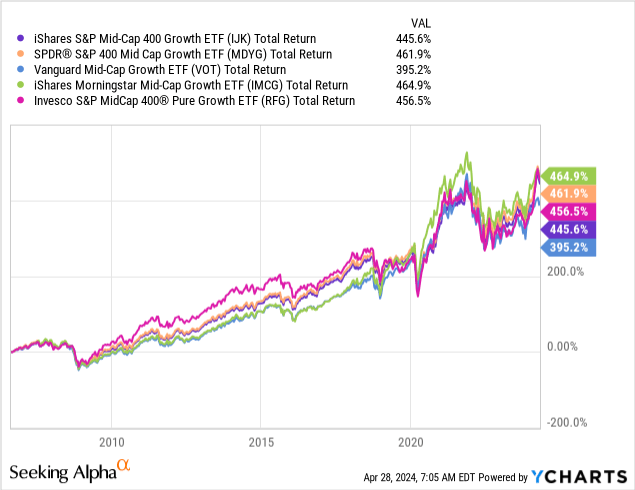

Additionally, a comparison with other competing ETFs reveals that during a period of more than 15 years, its underperformance is not as significant as to justify the preference of another fund over it:

Also note that on a risk-adjusted basis, no competitor outperformed it as represented by its Sharpe:

That being said, investors should take into account the fees charged here. On an absolute basis, I believe that the ETF’s expense ratio of 0.17% is reasonable considering the value it can offer. However, the iShares Morningstar Mid-Cap Growth ETF (IMCG), which outperformed all of the above funds when it came to total returns, only charges 0.06%, making it more attractive.

Risks

The risks associated with holding IJK in your portfolio are the same as with many other ETFs.

Without a cap on sector concentration, you might be overexposed to a particular sector from time to time and that can make the ride a bit more volatile.

Also, the underlying index market cap weighs the constituents and though there’s no particular concentration right now, the approach may result in some of a specific stock at some point; again, this can cause additional volatility that equal-weighting or at least concentration limits can avoid.

Verdict

All in all, IJK is a buy for investors looking to diversify, those who want to construct a satellite portfolio, and everyone who is searching for a way to outperform the market in the long run. As for the short term, it can position portfolios for market-beating returns if interest rates go down from their current peak, but there might be less aggressive ways to do that (i.e., a more diversified portfolio with mid-cap stocks but without the growth criteria).

Investors may also want to consider Morningstar’s IMCG that I mentioned above; it outperformed IJK and charges a far lower expense ratio.

What do you think? Do you own this ETF or something similar you want to let me know about? Leave a comment below and I’ll get back to you soon. Thank you for reading!