Michael Edwards/iStock Editorial via Getty Images

Elevator Pitch

I award a Hold rating to Jollibee Foods Corporation (OTCPK:JBFCF) [JFC:PM]. My prior update, published on December 19, 2023, reviewed the company’s Q3 2023 performance and touched on its overseas expansion plans.

My latest write-up focuses on the growth outlook for Jollibee Foods’ operations in both its home market, the Philippines, and international markets. The good thing is that JBFCF’s international growth plans are on track, as evidenced by its 2024 new store opening target. The bad thing is the company appears to be facing challenges in the Philippines judging by its most recent quarterly same store sales growth metric. Therefore, I have decided to revise my rating for Jollibee Foods to a Hold to reflect both the positives and negatives associated with the stock.

The company’s shares are listed in the Philippines and on the OTC (Over-The-Counter) market. The three-month average daily trading values for Jollibee’s Philippines-listed shares and OTC shares were $3 million and $0.01 million (source: S&P Capital IQ), respectively. Hong Kong’s Monex Boom Securities and Singapore’s OCBC Securities are among the international stockbrokers offering trading services for stocks listed in the Philippines.

Store Expansion Target

Jollibee Foods boasted a network of 6,885 stores at the end of 2023 as indicated in its investor presentation slides. The company opened 658 stores last year, and it aims to open a larger number of new stores in the 700-750 range this year.

At the company’s Q4 2023 earnings briefing, JBFCF disclosed that roughly 80% of the targeted 700-750 new store openings for 2024 will be located in overseas markets outside the Philippines (its home market).

I previously emphasized in my December 2023 article that “expansion in international markets is the major growth driver” for Jollibee Foods. My earlier update also drew attention to the company’s goal of having “its international businesses contribute half of its sales in a couple of years’ time.”

As such, I am impressed by JBFCF’s 2024 store opening target, which implies that the company expects to have more new stores this year as compared to last year. Furthermore, Jollibee Foods earned 38% of its fiscal 2023 revenue from international markets, so there is room for the company to increase its top-line contribution from overseas markets to the targeted 50% in time to come.

Jollibee Foods’ Two Key International Expansion Drivers

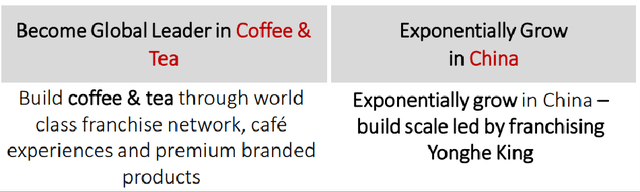

Jollibee Foods’ Investor Presentation Slides

Specifically, the coffee & tea business and the China market are the company’s major store network expansion and international growth drivers.

Approximately four in 10 of Jollibee Foods’ targeting new store openings for 2024 are expected to be contributed by JBFCF’s coffee & tea business. Jollibee Foods shared at its fourth quarter earnings call that its coffee & tea business has the “quickest payback” at “between two and three years.” This explains why the company is aiming to have the coffee & tea business account for about 40% of the company’s new stores for the current year.

On the other hand, China is the other key growth driver pertaining to JBFCF’s overseas expansion plans. Notably, the company’s store network growth in the Chinese market is mainly focused on franchised stores, rather than self-operated stores as per its management commentary at the Q4 results briefing. A heavier reliance on franchising for its Chinese market expansion implies that Jollibee Foods will require a relatively lower amount of capital to finance its growth in China.

In a nutshell, I have a positive view of Jollibee Foods’ 2024 store expansion goal and its international growth ambitions.

Growth Ceiling And Inflationary Pressures

JBFCF is still dependent on its home market, the Philippines, for the majority of its sales for now, even though it is expanding aggressively in international markets. As mentioned in the preceding section, overseas markets contributed much less than half, or 38% of the company’s FY 2023 top line.

There are two major concerns relating to the performance of Jollibee Foods’ operations in its home market.

The first concern is that JBFCF might be fast approaching the ceiling for growth in the Philippines.

At its most recent quarterly results briefing, Jollibee Foods acknowledged “we are quite saturated” in “Metro Manila” (the country’s capital region), implying that future growth in its home market will “come from market share” gains and “same-store sales growth” as opposed to new stores. This might be reflected in the company’s numbers. Notably, JBFCF’s same store sales growth for the Philippine market slowed from +13.0% in Q3 2023 to +5.4% for Q4 2023.

The second concern is that inflationary pressures in the Philippines might translate into lower sales and higher costs for Jollibee Foods’ operations in its home market.

The Philippines’ headline inflation rate went up from 3.4% in February 2024 to 3.7% in March this year. Also, a recent survey of the Philippines’ consumers conducted by WR Numero reported in the South China Morning Post indicated that 70% of “respondents” think that the country “should focus immediately on curbing rising commodity prices.”

It is reasonable to think a growing number of consumers in the Philippines might choose to eat at home rather than dine out, as inflation hurts their spending power. At the same time, Jollibee Foods’ operating expenses could rise due to inflationary cost pressures.

First Quarter Preview

JBFCF expects to announce the company’s Q1 2024 financial results on May 13 this year.

The sell side analysts are currently forecasting that Jollibee Foods’ normalized net profit will increase by +18% YoY to PHP2,436 million in the first quarter of this year as per S&P Capital IQ’s consensus data. As a comparison, JBFCF’s bottom line grew by +16% for full-year FY 2023.

I mentioned earlier in this article that JBFCF’s international growth plans are progressing well, although there are downside risks associated with its business operations in the Philippines. In that respect, the consensus Q1 2024 high-teens percentage earnings growth estimate in line with what it achieved in 2023 appears to be realistic.

In summary, my bet is on in-line first quarter earnings for Jollibee Foods.

Final Thoughts

I have a positive opinion about Jollibee Foods’ growth prospects in international markets. On the flip side, my concern lies with the negative impact of inflation and market saturation on its business in the Philippines. A mixed view of JBFCF as a potential investment candidate translates into a Hold rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.