Adam Gault

Thursday’s first-quarter GDP report delivered a one-two punch for markets: slower-than-expected growth and hotter-than-expected inflation. In reaction, stocks fell and US Treasury yields rose. At first glance, the risk-off response looks reasonable. But a closer look at the GDP numbers still leaves room for debate.

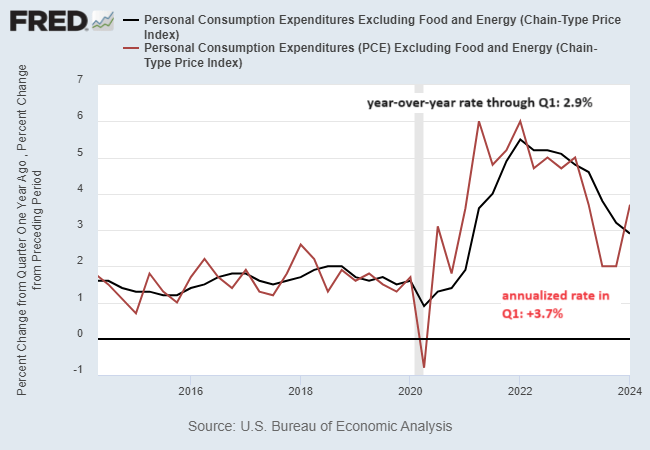

Let’s start with the offending data that sent markets into a tailspin: the personal consumption expenditures price index excluding volatile food and energy prices, a.k.a. core PCE, which is said to be the Federal Reserve’s preferred inflation metric. On an annualized basis in Q1, this metric turned up sharply, rising 3.7%, above expectations – news that sent markets into a tizzy (red line in the chart below).

But the same data on a year-over-year basis looks cooler. Notably, core PCE through Q1 eased to 2.9% from 3.2% in Q4. The Q1 print marks the lowest pace of inflation in three years.

More importantly, the year-over-year yardstick suggests that disinflation is still unfolding. The pushback, of course, is that the annualized measure of core PCE points to a sharp reflationary episode, which may signal that pricing pressure is set to heat up in the months ahead.

That leaves us with the key question: Which core PCE inflation is the more accurate version of what’s occurring? The answer, of course, is that no one really knows since the future is still unknowable. That said, I tend to favor the year-over-year trend, for core PCE and other economic time series. Why? It filters out some, perhaps a lot, of the noise.

This time could be different, of course, but history suggests that the annualized measure of core PCE has a habit of jumping around the 1-year trend. As such, it’s tempting to see the 1-year trend as the signal and the annualized quarterly measure as noise. There are caveats to this view, but for the most part, it tends to hold true.

Accordingly, I’ll change my view if and when the 1-year trend stops falling or, even worse, turns up. For the moment, neither of those conditions looks likely, although I’m watching the incoming numbers closely from a range of data sets for an early warning that my assumption is wrong.

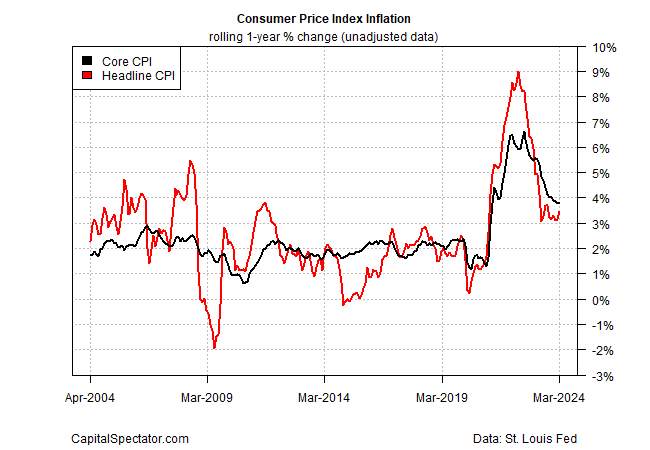

Keep in mind too that Thursday’s hot core PCE data for the annualized data in Q1 is old news. Recall that earlier this month we learned that consumer price inflation at the headline level turned up in March. But core CPI in year-over-year terms is still easing, albeit at a slower pace lately.

The bottom line: until the year-over-year rates of change in core PCE and core CPI flat line, or start rising, I still expect disinflation to continue. At what pace and how fast is open for debate, but in a binary framework that asks: Is disinflation continuing, I’m still in the “yes” camp.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.