Althom

Earnings of First Commonwealth Financial Corporation (NYSE:FCF) will likely change very little this year. Subdued loan growth will likely help lift earnings, while a commiserate increase in expenses will restrain earnings growth. Meanwhile, the margin will likely remain unchanged from the end of last year. Overall, I’m expecting the company to report earnings of $1.54 per share for 2024, almost unchanged from last year. The year-end target price suggests a high upside from the current market price. Hence, I’m adopting a buy rating on First Commonwealth Financial Corporation.

Last Year’s Loan Growth Performance Can Be Repeated This Year

First Commonwealth Financial acquired Centric Financial Corporation in February 2023. Apart from this acquisition, the organic loan growth was also quite impressive last year. Including the acquisition, the loan portfolio grew by 17.4%, and excluding the acquisition (which added $949.2 million of loans), the loan portfolio grew by 4.9% in 2023.

Management mentioned in the last conference call that it expects loan growth to be in the “low to mid-single-digits” range. Considering the organic growth witnessed in 2023, management’s target for 2024 seems achievable.

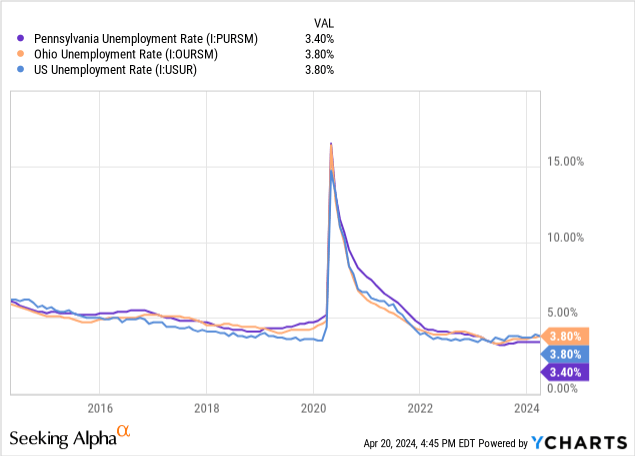

Another favorable factor is the regional business environment. FCF operates in Pennsylvania and Ohio, both of which currently have strong job markets signifying a robust operating environment. The unemployment rates of both states have improved relative to the national average in recent months, as shown below.

Considering these factors, I’m expecting the company to achieve a loan growth rate of 4.9% again in 2024. As there have been no M&A announcements so far, I’m not assuming any acquired growth this year.

Further, I’m expecting other balance sheet items to grow in line with loans. The following table shows my balance sheet estimates.

| Financial Position | FY19 | FY20 | FY21 | FY22 | FY23 | FY24E |

| Net Loans | 6,138 | 6,660 | 6,747 | 7,539 | 8,851 | 9,284 |

| Growth of Net Loans | NA | 8.5% | 1.3% | 11.7% | 17.4% | 4.9% |

| Other Earning Assets | 1,292 | 1,495 | 2,443 | 1,678 | 1,893 | 1,931 |

| Deposits | 6,678 | 7,439 | 7,982 | 8,005 | 9,192 | 9,642 |

| Borrowings and Sub-Debt | 436 | 351 | 321 | 554 | 785 | 800 |

| Common equity | 1,056 | 1,069 | 1,109 | 1,052 | 1,314 | 1,340 |

| Book Value Per Share ($) | 10.7 | 10.9 | 11.6 | 11.2 | 12.9 | 13.2 |

| Tangible BVPS ($) | 7.5 | 7.7 | 8.3 | 7.9 | 9.1 | 9.4 |

| Source: SEC Filings, Earnings Releases, Author’s Estimates(In USD million unless otherwise specified) | ||||||

Margin to Stabilize This Year

The average net interest margin was 23 basis points higher in 2024 compared to 2023, and 32 basis points higher in 2023 compared to 2022. As interest rates have peaked, and they’re likely to decline this year, I think the margin will no longer trend upward.

Approximately 51% of the total loan portfolio is variable, as mentioned in the last earnings presentation. Therefore, the average loan yield will be quick to re-price after every rate cut. Unfortunately, FCF’s deposits are also quick to re-price. Deposits with variable rates (i.e. interest-bearing-transaction and saving accounts) made up 60% of total deposits at the end of December 2023.

Management mentioned in the last conference call that for the first half of 2024, “the continued upward repricing of the loan portfolio is expected to roughly match the increase in the bank’s cost of funds.”

As a result, I’m expecting the margin to remain almost unchanged this year from the end of last year.

Expecting Earnings to Remain Unchanged

Apart from the balance sheet and net interest margin assumptions discussed above, I’ve used the following assumptions to arrive at my earnings estimate for 2024.

- I’m assuming non-interest expenses will grow in line with the revenue, so that the efficiency ratio remains almost unchanged this year. (Note: the efficiency ratio is calculated as non-interest expenses divided by the sum of net interest income and non-interest income). My non-interest expense estimate is also in line with management’s guidance. Management mentioned in the last conference call that it expects non-interest expenses to run at about $68 million to $69 million a quarter in 2024.

- I’m assuming the non-interest income will grow at the last five-year average this year.

- I’m expecting the provisions expense for loan losses to continue at last year’s rate. The last five-year average is not appropriate in this case because provisions were irregular because of the pandemic.

Based on the above assumptions, I’ve arrived at an earnings estimate of $1.54 per share for 2024, down 0.4% year-over-year. The following table shows my earnings estimate.

| Income Statement | FY19 | FY20 | FY21 | FY22 | FY23 | FY24E |

| Net interest income | 270 | 268 | 279 | 312 | 386 | 403 |

| Provision for loan losses | 15 | 57 | (1) | 21 | 15 | 16 |

| Non-interest income | 85 | 94 | 107 | 99 | 97 | 98 |

| Non-interest expense | 210 | 216 | 214 | 230 | 270 | 276 |

| Net income – Common Sh. | 105 | 73 | 138 | 128 | 157 | 156 |

| EPS – Diluted ($) | 1.07 | 0.75 | 1.44 | 1.37 | 1.54 | 1.54 |

| Source: SEC Filings, Earnings Releases, Author’s Estimates(In USD million unless otherwise specified) | ||||||

First Commonwealth is scheduled to announce its first-quarter results on April 24, 2024. Based on the assumptions discussed above, I’m expecting the company to announce earnings of $0.37 per share for the quarter.

Risks Appear Subdued

First Commonwealth’s risk level appears low. The following are the only major sources of risk, and they seem to be under control.

- Exposure to Office Loans – Office property loans accounted for 5.3% of the total loan portfolio at the end of last year, as mentioned in the presentation. In my opinion, this percentage isn’t high enough to be a source of concern.

- Uninsured Deposits – Total available liquidity was 2.2 times the uninsured or unsecured deposits at the end of December 2023, as mentioned in the presentation. Therefore, uninsured deposits do not present much of a threat to the company to remain in operation.

- Unrealized Losses – The unrealized mark-to-market losses on the Available-for-Sale securities portfolio totaled $125.6 million at the end of December 2023, which is just 10% of the total equity book value.

Adopting a Buy Rating

First Commonwealth is offering a dividend yield of 3.8% at the current quarterly dividend rate of $0.125 per share. The earnings and dividend estimates suggest a payout ratio of 33% for 2024, which is below the five-year average of 39%. Therefore, the dividend appears safe.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value First Commonwealth Financial. The stock has traded at an average P/TB ratio of 1.61 in the past, as shown below.

| FY19 | FY20 | FY21 | FY22 | FY23 | Average | |

| T. Book Value per Share ($) | 7.5 | 7.7 | 8.3 | 7.9 | 9.1 | |

| Average Market Price ($) | 13.4 | 9.6 | 14.1 | 14.5 | 13.4 | |

| Historical P/TB | 1.79x | 1.24x | 1.70x | 1.85x | 1.47x | 1.61x |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $9.40 gives a target price of $15.10 for the end of 2024. This price target implies a 14.3% upside from the April 19 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.41x | 1.51x | 1.61x | 1.71x | 1.81x |

| TBVPS – Dec 2024 ($) | 9.4 | 9.4 | 9.4 | 9.4 | 9.4 |

| Target Price ($) | 13.2 | 14.1 | 15.1 | 16.0 | 17.0 |

| Market Price ($) | 13.2 | 13.2 | 13.2 | 13.2 | 13.2 |

| Upside/(Downside) | 0.1% | 7.2% | 14.3% | 21.4% | 28.4% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 10.9x in the past, as shown below.

| FY19 | FY20 | FY21 | FY22 | FY23 | Average | |

| Earnings per Share ($) | 1.07 | 0.75 | 1.44 | 1.37 | 1.54 | |

| Average Market Price ($) | 13.4 | 9.6 | 14.1 | 14.5 | 13.4 | |

| Historical P/E | 12.5x | 12.7x | 9.8x | 10.7x | 8.7x | 10.9x |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $1.54 gives a target price of $16.70 for the end of 2024. This price target implies a 26.5% upside from the April 19 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 8.9x | 9.9x | 10.9x | 11.9x | 12.9x |

| EPS 2024 ($) | 1.54 | 1.54 | 1.54 | 1.54 | 1.54 |

| Target Price ($) | 13.6 | 15.2 | 16.7 | 18.2 | 19.8 |

| Market Price ($) | 13.2 | 13.2 | 13.2 | 13.2 | 13.2 |

| Upside/(Downside) | 3.3% | 14.9% | 26.5% | 38.2% | 49.8% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $15.90, which implies a 20.4% upside from the current market price. Adding the forward dividend yield gives a total expected return of 24.2%. Hence, I’m adopting a buy rating on First Commonwealth Financial Corporation.