Art Wager

For the past decade, Texas Instruments (NASDAQ:TXN) has provided investors with a solid starting yield, massive dividend growth, and market beating returns with a 10-year return of 253%. These 3 factors have made TXN a favorite among dividend growth investors, including myself. It has also led to TXN being one of the top holdings of the popular dividend growth ETF, Schwab U.S. Dividend Equity ETF (SCHD). But there have been some recent announcements from the TXN management team regarding substantial investments in new manufacturing facilities have led some investors to be concerned about TXN’s ability to reproduce the same results they’ve seen over the past decade.

Capital Allocation

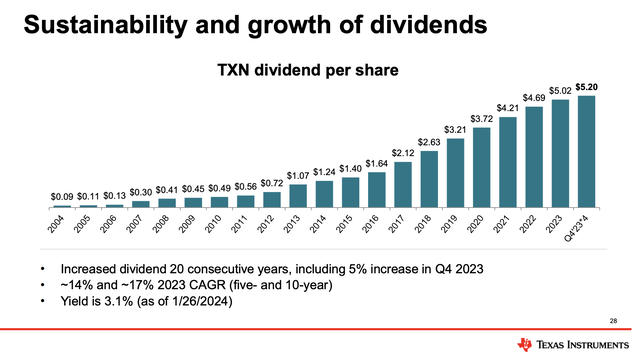

For the past 20 years, TXN has been known for management’s commitment to growing free cash flow per share, and using that free cash flow to reward shareholders through dividend growth and share buybacks. TXN saw above 11% annual growth in their free cash flow per share from 2004 to 2022. This led to TXN increasing their dividend payments from $0.09 to $4.69 per share during that time period.

TXN Investors Presentation Dividend Growth (TXN Investors Presentation)

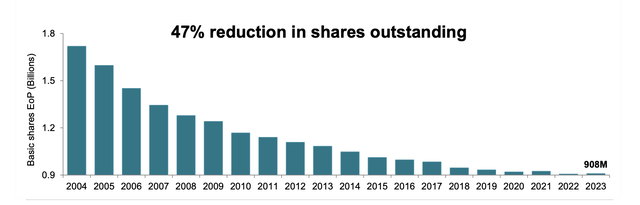

This also led to them reducing their share count by 47% starting from 2004 to 2023.

TXN Investors Presentation Share Buybacks (TXN Investors Presentation)

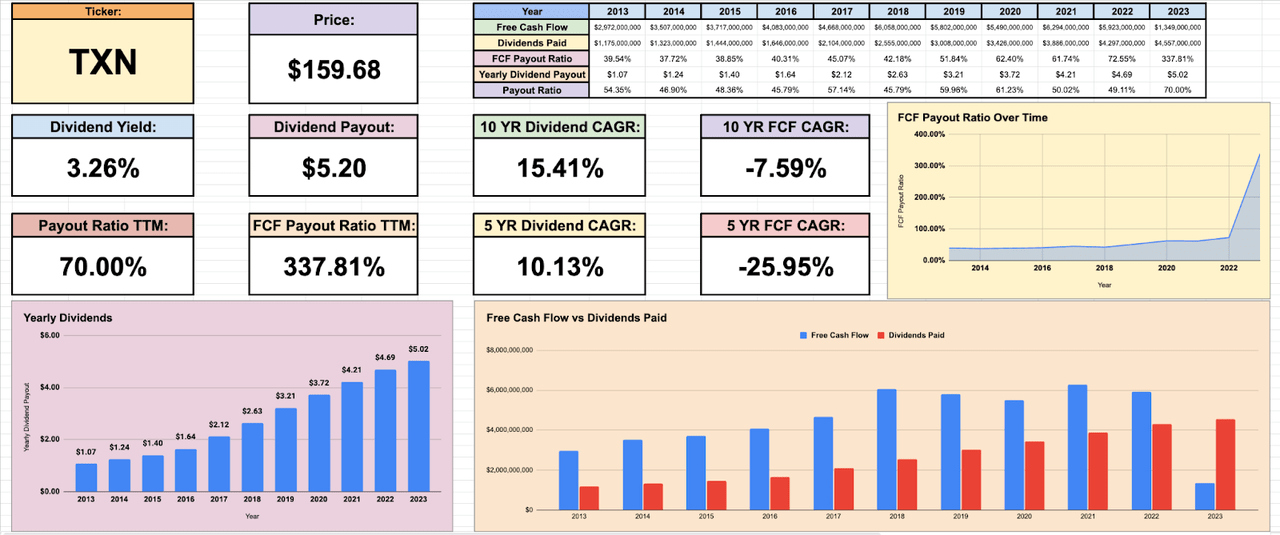

Dividend Breakdown

If we take a deeper dive into the dividend metrics of TXN, we can see the starting yield is currently sitting at 3.26% The dividend growth has been impressive over a 10 and 5-year time period, but it is clear it has started to slow over the past 5 years. And perhaps the biggest concern is the fact that for the first time in the past decade, TXN free cash flow did not cover their dividend in 2023. The free cash flow payout ratio came in at 337%.

TXN Dividend Metrics (Tickerdata.com)

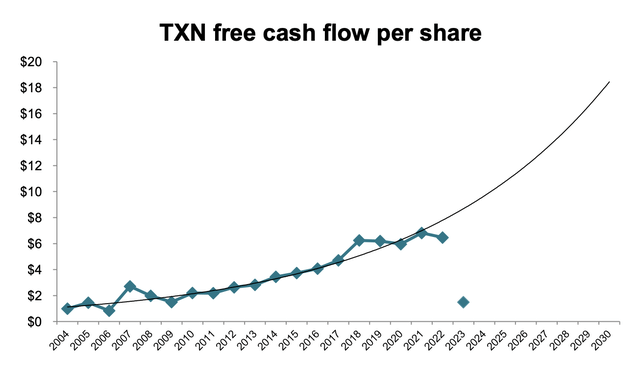

Unveiling The Short-Term Concerns

While TXN’s historical performance is extremely impressive and on paper it appears that trend is set to continue, there are a few short-term concerns with the company. The TXN management team has announced they are planning to build new manufacturing facilities. On the surface level, this doesn’t sound like bad news. But the problem is, this will greatly impact the company’s free cash flow per share over the next few years. Free cash flow per share for TXN has already seen a massive drop in 2023, and it’s likely there won’t be much improvement until these manufacturing facilities are complete.

TXN Investors Presentation FCF Growth (TXN Investors Presentation)

In fact, Dave Pahl (Vice President and Head of Investor Relations) stated in the Q3 2023 earnings call that these manufacturing facilities would likely put TXN capital expenditures at $5 billion annually through 2026. Analysts anticipate a dip in earnings per share as well in the near term, which has greatly hurt investor sentiment. Not to mention, the high historical dividend growth rates are likely to decrease dramatically over the next few years due to the anticipated decline in free cash flow. The high levels of capital expenditures are also likely to cause reduced share buybacks over the next few years.

The Payoff

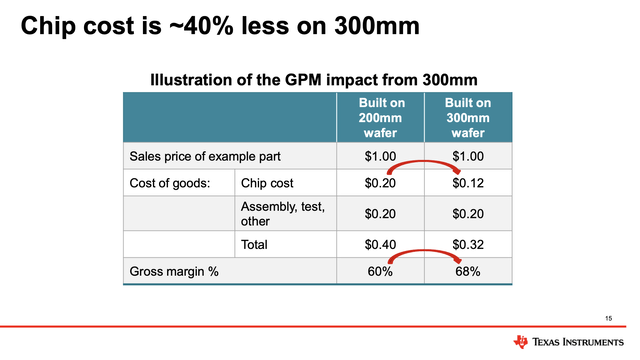

While the short-term outlook looks somewhat bleak due to the reduction in free cash flow per share, the payoff for TXN could be quite nice if all goes to plan. The new manufacturing facilities have the potential to unlock significant value. According to TXN’s investor presentation, these manufacturing facilities could lower chip production costs by 40%.

TXN Investors Presentation Chip Costs (TXN Investors Presentation)

This cost reduction will likely help increase profit margins and help create long-term growth for TXN. It’s also worth noting that I believe the Chips Act, an initiative incentivizing domestic chip production by the U.S. government, will help TXN’s prospects by offering incentivizing tax credits. It’s also worth noting that the management team for TXN has a strong track record of strategic capital management that rewards shareholders, while also achieving free cash flow per share growth.

Valuation

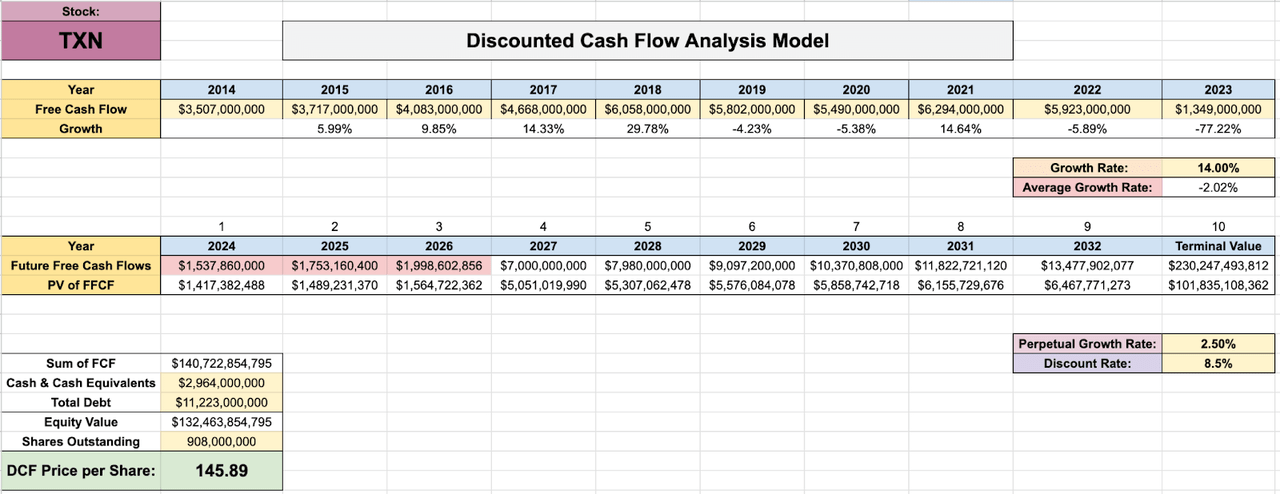

Texas Instruments’ discounted cash flow valuation is a unique scenario, as the free cash flow is expected to be quite low through 2026, and then spike back up to previous highs, with solid growth expectations past 2026. My discounted cash flow calculation led to an intrinsic value of $145.89, which is very close to the current trading price. It’s important to remember that the real value of the company will hinge on the effectiveness of the new manufacturing facilities.

TXN Discounted cash flow analysis (Tickerdata.com)

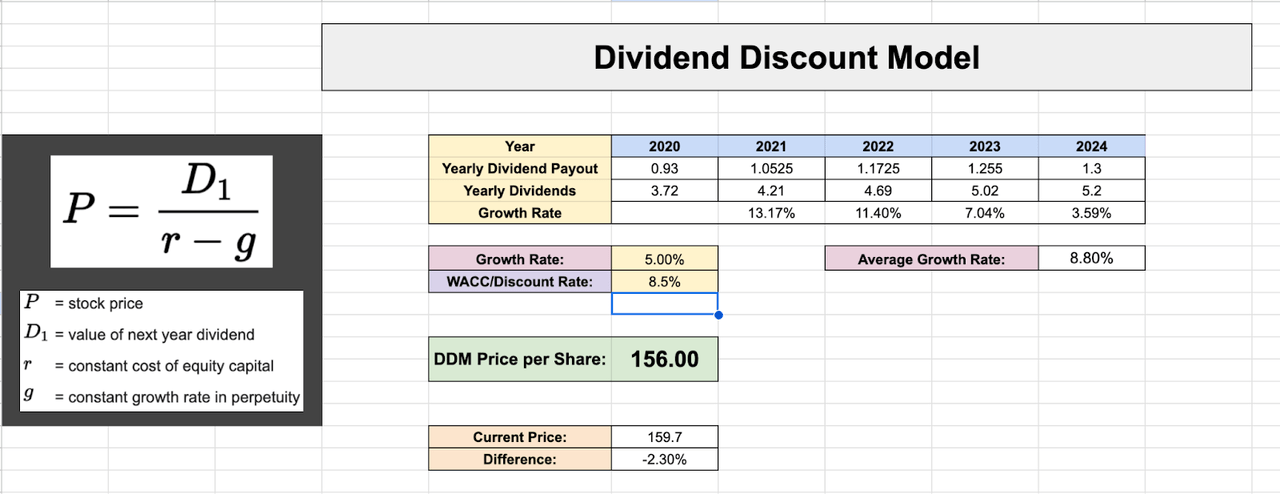

Our dividend discount model led to a fair value of $156.00, assuming a 5% dividend growth rate, as well as an 8.5% discount rate. Again, dividend growth will likely be low through 2026, and then we should see a spike back up in dividend growth rates.

TXN Dividend Discount Model (Tickerdata.com)

For The Long-Term Investor

For the long-term investor, an investment into TXN is simply a bet on a company with a phenomenal track record of growing free cash flow per share year over year, and it is also a sign of trust in management’s decision to invest over 5 billion a year on domestic manufacturing facilities. The short-term increase in capital expenditures is an investment into a brighter future for the company and shareholders.

For The Income-Focused Investor

For the investor looking to maximize immediate dividend income, TXN may not be the best option for you. While their track record is nearly flawless over the past 20 years, this increase in capital expenditures through 2026 could prove to be very harmful for the TXN dividend in the short term. Underlying metrics that have been historically strong for TXN, such as free cash flow per share, will likely be considerably lower over the next few years.

Risks

In my opinion, the best place to assess a company’s risks is by evaluating its Form 10-K. After reviewing this document, here are the main risks I believe investors need to be aware of:

-

TXN is susceptible to economic downturns, trade wars, and geopolitical instability. These factors could disrupt its supply chain.

-

The semiconductor industry is highly competitive. TXN faces competition from both established and emerging companies, including foreign-based manufacturers with lower production costs.

-

Rapid technological advancements could render TXN’s products obsolete if it fails to adapt and innovate. The company must continuously invest in research and development.

-

TXN relies heavily on its intellectual property (IP) to protect its technology and designs. Infringement or loss of key IP could significantly harm its business.

The Final Verdict

Ultimately, the success of TXN’s current strategy hinges on successful execution by management. The management team of TXN does have a proven track record of solid capital allocation. Over the short term, there are likely to continue to be headwinds for this company due to the high level of capital expenditures, but over the long run, these investments could put the company in a place that allows them to reward shareholder with the same high levels of capital appreciation and dividend growth that they have enjoyed over the past decade. As a current shareholder of TXN, I plan to hold my shares during this time, and closely monitor the progress of the new manufacturing facilities.