Alistair Berg/DigitalVision via Getty Images

When it comes to investing, knowing when to sell is equally important to knowing what and when to buy. I have had my fair share of cases where I bought something, shares shoot up, and before I can sell it, shares plummet to a price below what they were trading at before I purchased them. That’s one of the worst feelings in the world. It’s necessary for investors to learn from lessons like that and to come to understand when it makes sense to exit an opportunity. One firm, for instance, that I am now turning more neutral on is Packaging Corporation of America (NYSE:PKG).

For those not familiar with the enterprise, it’s a major player in the packaging industry. The company produces about 4.53 million tons of containerboard, 60.5 billion square feet of corrugated product shipments, and 472,000 tons of uncoated free sheet paper from the 8 mills and 86 corrugated products plants that it has spread across North America. For a while now, I have been bullish on this space, including this particular player. And things have gone quite well. Since I last wrote about the firm in a bullish article published in June of 2022, shares have seen upside of 40.3%. That’s slightly better than the 39.5% rise seen by the S&P 500 over the same window of time. Even better is the comparison when looking at when I wrote about the business initially in April of 2022. In that article, I also rated the company a ‘buy’ to reflect my belief that shares should see upside that would outperform the broader market. Since then, the stock is up 32.2% compared to the 14.4% seen by the broader market.

Unfortunately, some of the fundamental data reported by the company is now coming in worse than it did the year prior. This is making shares more expensive. On an absolute basis, the stock is not exactly pricey. However, analysts are expecting the near future to result in even more pain for the business. While it is possible that the company could turn things around when it reports financial results for the first quarter of its 2024 fiscal year after the market closes on April 22nd, I would argue that, given its relative valuation and recent decline in profitability, it makes sense to downgrade the firm to a more modest ‘hold.’

The picture is worsening

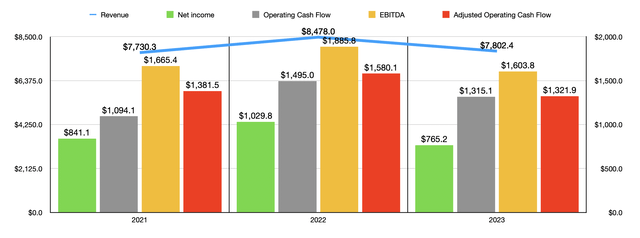

In the world of packaging, Packaging Corporation of America is a sizable player. Last year, the company generated $7.80 billion in revenue. While this does represent an increase over the $7.73 billion generated in 2021, it actually represents a meaningful decline from the $8.48 billion generated in 2022. The vast majority of that drop came from its Packaging segment, with revenue dropping 8.3% from $7.78 billion to $7.14 billion. Management attributes this decline to lower prices and product mix of about $397 million and lower volumes that hit revenue to the tune of $248 million. During 2023, the company’s domestic containerboard prices dropped by 10.5%, while export prices plunged a remarkable 29.7%. Volumes shipped also fell, but this decline was more modest. When it came to containerboard outside shipments, the decline was 1.1%. Meanwhile, total corrugated products shipments dropped 4.6%.

Honestly, I am not surprised by this. For a couple of years during the pandemic, packaging companies were able to significantly hike their prices. They benefited tremendously from this, with profits and cash flows rising nicely. But now, the shoe appears to be on the other foot. Unfortunately, this is having a negative impact on the company’s bottom line as well. Net income has dropped from $1.03 billion in 2022 to $765.2 million last year. Other profitability metrics followed a similar trajectory. Operating cash flow went from just under $1.50 billion to $1.32 billion. If we adjust for changes in working capital, we get a decline from $1.58 billion to $1.32 billion. Meanwhile, EBITDA also took a hit, dropping from $1.89 billion to $1.60 billion. If these declines, relative to the drop in sales, appear steep, this is what happens when price declines account for a sizable portion of any drop in revenue.

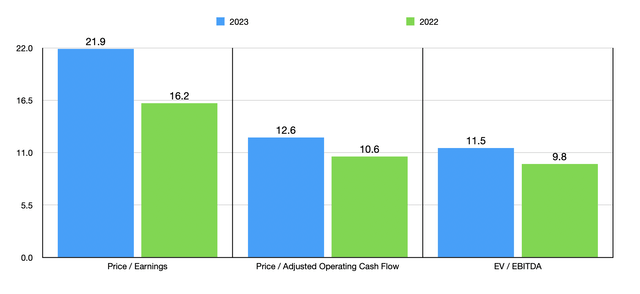

Even with this pain that the company has seen, shares don’t look outrageously priced on an absolute basis. Using the data from 2023, I was able to value the company as shown in the chart above. For context, you can also see it valued using the data from 2022. On a price to earnings basis, shares have gotten more expensive. The same is true when it comes to both the price to adjusted operating cash flow basis and the EV to EBITDA basis. I would call a price to earnings multiple of 21.9 quite lofty. But the other two profitability metrics look to be more or less in the fair value range. But then, in the table below, I decided to compare Packaging Corporation of America to five similar firms. When it came to both the price to earnings approach and the price to operating cash flow approach, it ended up being the most expensive of the group. And when we use the EV to EBITDA approach, three of the companies ended up cheaper, while another was tied with it.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Packaging Corporation of America | 21.9 | 12.6 | 11.5 |

| Sonoco Products Company (SON) | 12.0 | 6.5 | 7.8 |

| WestRock Company (WRK) | 9.5 | 6.9 | 64.3 |

| Graphic Packaging Holding Company (GPK) | 12.3 | 7.8 | 7.8 |

| Sealed Air Corp. (SEE) | 14.1 | 9.4 | 9.6 |

| Amcor plc (AMCR) | 20.8 | 9.9 | 11.5 |

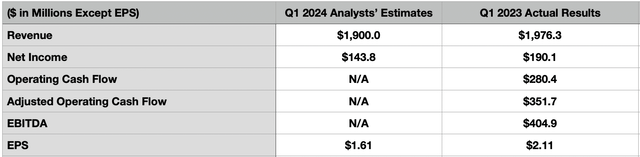

Of course, this picture can change when earnings come out. And as I stated already, the management team at the business is expected to announce financial results for the first quarter of the 2024 fiscal year after the market closes on April 22nd. However, expectations don’t appear to be all that high. Analysts are forecasting revenue, for instance, of $1.90 billion. If they turn out to be correct, this will represent a 3.9% drop from the $1.98 billion generated the same time of the 2023 fiscal year.

On the bottom line, there’s also the expectation of continued weakness. Earnings per share are forecasted to be $1.61. That’s down from the $2.11 that the company reported in the first quarter of 2023. If this turns out to be correct, it would translate to net profits falling from $190.1 million to $143.8 million. Unfortunately, we don’t have estimates when it comes to other profitability metrics. But in the table above, you can see operating cash flow, adjusted operating cash flow, and EBITDA for the first quarter of 2023. In all likelihood, if analysts are correct, these will also be lower this year.

It should be stated that analysts aren’t the only ones with dour expectations. Management did say that total corrugated product shipments, driven by strong demand and two additional operating days, should lead to results in the first quarter of 2024 being stronger than what they were in the final quarter of 2023. However, they anticipate containerboard volume dropping because of a prolonged outage at one of its mills and a scheduled maintenance outage at another. Prices and product mix should also help to some extent, since the company did initiate new price increases in January. But even with that, they expect containerboard prices to be flat. There are some other weaknesses, such as when it comes to wages because of seasonal timing related increases. But beyond saying that earnings in the first quarter will be lower than what they were in the final quarter of last year, management has not offered much in the way of guidance.

Takeaway

Based on the data provided, I believe that now is the time to consider looking elsewhere for opportunities. The ride higher for Packaging Corporation of America and its investors has been great. The stock has outperformed the broader market, even at a time when fundamentals have weakened. At some point, it might make sense to step back in. But that will only be if shares fall from here or if fundamentals pick up. Due to these thoughts on the matter, I have decided to downgrade the stock from a ‘buy’ to a ‘hold’.