syahrir maulana

IWO strategy

iShares Russell 2000 Growth ETF (NYSEARCA:IWO) started investing operations on 07/24/2000 and tracks the Russell 2000 Growth Index. It has 1065 holdings, a 30-day SEC yield of 0.50% and an expense ratio of 0.24%. It is a direct competitor to Vanguard Russell 2000 Growth ETF (VTWG), which tracks the same index. Despite a higher fee, IWO shows a marginally higher 10-year return, pointing to a lower tracking error. Moreover, it also has more assets under management and much higher dollar trading volumes, as reported in the table below.

|

IWO |

VTWG |

|

|

Inception |

7/24/2000 |

9/20/2010 |

|

Expense Ratio |

0.24% |

0.15% |

|

AUM |

$10.44B |

$1.19B |

|

Avg Daily Volume |

$145.85M |

$5.31M |

|

10 Year Price Return |

88.09% |

87.87% |

As described by FTSE Russell, the underlying index selects stocks in the Russell 2000 index with:

- higher price-to-book ratios,

- higher projected 2-year earnings growth based on I/B/E/S database,

- higher sales per share historical 5-year growth.

The fund’s turnover rate in the most recent fiscal year was 35%. This article will use as a benchmark the parent index Russell 2000, represented by iShares Russell 2000 ETF (IWM).

IWO portfolio

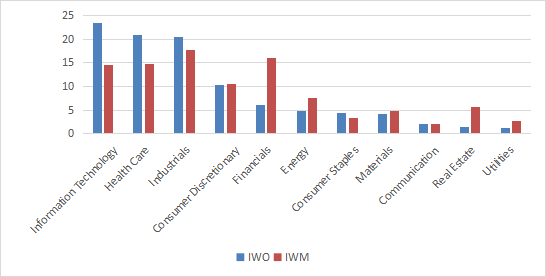

The heaviest sector in the portfolio is technology (23.5% of asset value), followed by healthcare (21%) and industrials (20.5%). Other sectors are below 11% Compared to the parent index, IWO significantly overweights technology and healthcare. It underweights mostly financials, real estate and utilities.

IWO sector breakdown in % (Chart: author; data: iShares)

The top 10 holdings, listed in the next table with growth metrics, represent 9.6% of asset value. The top name weighs 3%, so the portfolio is well-diversified and risks related to individual companies are low.

|

Ticker |

Name |

Weight% |

EPSgrowth %TTM |

EPSgrowth %5Y |

SalesGrowth %TTM |

SalesGrowth %5Y |

|

Super Micro Computer, Inc. |

3.00 |

21.66 |

66.82 |

39.22 |

16.21 |

|

|

MicroStrategy, Inc. |

1.44 |

121.69 |

68.04 |

-0.60 |

-0.06 |

|

|

Comfort Systems USA, Inc. |

0.85 |

32.10 |

24.57 |

25.76 |

18.99 |

|

|

e.l.f. Beauty, Inc. |

0.70 |

164.60 |

10.33 |

79.24 |

16.49 |

|

|

Weatherford International plc |

0.66 |

1696.63 |

14.89 |

18.56 |

-2.22 |

|

|

Simpson Manufacturing Co., Inc. |

0.65 |

6.68 |

24.88 |

4.62 |

15.46 |

|

|

Onto Innovation, Inc. |

0.59 |

-45.28 |

7.12 |

-18.83 |

24.41 |

|

|

Applied Industrial Technologies, Inc. |

0.58 |

22.38 |

19.62 |

7.15 |

7.50 |

|

|

ChampionX Corp. |

0.57 |

109.61 |

5.66 |

-1.25 |

25.27 |

|

|

HealthEquity, Inc. |

0.57 |

306.22 |

-11.29 |

16.00 |

28.33 |

Fundamentals

IWO is more expensive than the benchmark regarding valuation ratios and has better growth metrics, in line with the underlying index description. As reported in the next table, the gap in cash flow growth rate is quite impressive, although this factor is not taken into account by the methodology.

|

IWO |

IWM |

|

|

P/E TTM |

21.63 |

15 |

|

Price/Book |

4.07 |

1.95 |

|

Price/Sales |

1.82 |

1.23 |

|

Price/Cash Flow |

12.88 |

8.94 |

|

Earnings growth |

23.37% |

20.05% |

|

Sales growth % |

8.04% |

5.43% |

|

Cash flow growth % |

23.27% |

11.80% |

Data source: Fidelity

Performance

Since 8/1/2000 IWO has lagged its parent index by 1.5% in annualized return, as reported in the next table. It also shows a slightly higher volatility, measured as standard deviation of monthly returns.

|

Total Return |

Annual.Return |

Drawdown |

Sharpe ratio |

Volatility |

|

|

IWO |

278.42% |

5.77% |

-60.13% |

0.29 |

21.71% |

|

IWM |

427.23% |

7.26% |

-59.05% |

0.37 |

20.16% |

However, IWO is a bit ahead of the benchmark over the last 10 years:

IWO vs IWM, last 10 years (Seeking Alpha)

IWO vs competitors

The next table compares characteristics of IWO and five small-cap growth ETFs implementing various methodologies:

- Vanguard Small Cap Growth ETF (VBK)

- Vanguard S&P Small-Cap 600 Growth Index Fund ETF (VIOG)

- iShares Morningstar Small-Cap Growth ETF (ISCG)

- First Trust Small Cap Growth AlphaDEX Fund (FYC)

- Janus Henderson Small Cap Growth Alpha ETF (JSML)

|

IWO |

VBK |

VIOG |

ISCG |

FYC |

JSML |

|

|

Inception |

7/24/2000 |

1/26/2004 |

9/7/2010 |

6/28/2004 |

4/19/2011 |

2/23/2016 |

|

Expense Ratio |

0.24% |

0.07% |

0.15% |

0.06% |

0.70% |

0.30% |

|

AUM |

$10.44B |

$35.58B |

$798.38M |

$522.28M |

$250.51M |

$201.16M |

|

Avg Daily Volume |

$145.85M |

$81.21M |

$5.63M |

$2.04M |

$999.04K |

$862.64K |

|

Holdings |

1065 |

622 |

349 |

1004 |

265 |

201 |

|

Top 10 |

9.60% |

8.08% |

10.61% |

5.55% |

7.38% |

26.29% |

|

Turnover |

35.00% |

19.00% |

45.00% |

52.00% |

140.00% |

105.00% |

IWO is the most liquid fund of this group in dollar volume, and the second largest in assets under management behind VBK. Its fee is significantly higher than VBK and ISCG.

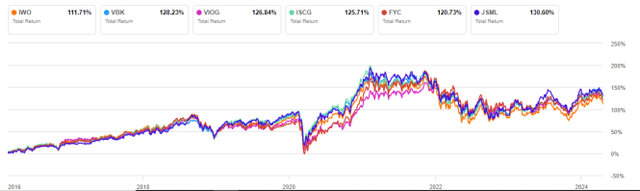

The next chart compares total returns, starting on 2/29/2016 to match all inception dates. IWO is the worst performer.

IWO vs competitors, since 2/29/2016 (Seeking Alpha)

Over the last 12 months, IWO is second to last:

IWO vs competitors, trailing 12 months (Seeking Alpha)

Takeaway

iShares Russell 2000 Growth ETF (IWO) holds 1000+ stocks of the Russell 2000 Index with relative high growth and valuation metrics. The portfolio is well diversified across sectors and holdings. The fund has underperformed the Russell 2000 benchmark since inception and performance since 2016 is underwhelming compared to peers, which makes it quite unattractive in its category.