Douglas Rissing

Let’s build the story of the monetary tightening by the Federal Reserve in this way.

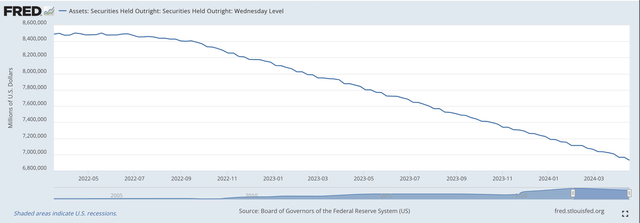

Since March 16, 2022, the Federal Reserve has overseen a reduction in its securities’ portfolio of $1,561 billion.

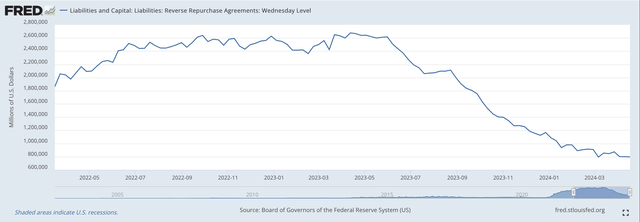

Since March 16, 2022, the Federal Reserve has overseen a reduction in the use of reverse repurchase agreements of $1,069 billion.

The difference between these two numbers is $492 billion.

Reserve Balances With Federal Reserve Banks, a proxy for the excess reserves in the banking system, actually have declined by $564 billion.

The difference is $72 billion.

My conclusion is that this difference is relatively minor in the picture of the Fed’s operations. Basically, for the past two years, the Fed has achieved the decline in the Federal Reserve balance sheet by allowing the securities it owned to run off, while this runoff was covered by the reduction in the amount of repurchase agreements that commercial banks entered into.

There was lots of other activity on the Fed’s balance sheet, but the effort to reduce the Fed’s securities portfolio by quantitative easing, as it now turns out, was accommodated within the commercial banks themselves.

In essence, the Federal Reserve was not putting the U.S. banking system under a lot of strain. Liquidity was available within the system to handle the reduction in the securities portfolio the Fed was trying to obtain.

Here is the picture of the decline in the Fed’s securities portfolio.

Securities Held Outright (Federal Reserve)

And, here is the picture of the decline in reverse repurchase agreements over the same period of time.

Reverse Repurchase Agreements (Federal Reserve)

The two charts don’t match up in timing. Commercial banks moved, at the start, to ensure that they had the liquidity needed to deal with the Fed’s quantitative tightening.

As the “tightening program” was managed, the Federal Reserve allowed the commercial banking system to “manage” its liquidity position by the use of the Fed’s “repo window.”

Finally, as the banking system worked its way through the patiently conducted “tightening” operation, the commercial banks, obviously, became comfortable with what was going on and began to reduce their usage of this facility.

Overall, as I mentioned above, the overall decline in the use of reverse repurchase agreements began to match, in amount, the decline in the Fed’s securities portfolio.

In fact, at this point, it looks as if the Federal Reserve has done a masterful job in carrying out the current thrust of its quantitative tightening program.

However, as I have to strongly emphasize, the Fed’s securities portfolio had grown to around $8.5 trillion by the beginning of 2022.

At this level, the commercial banking system had a massive amount of “cash on hand.”

In March of 2022, the U.S. commercial banking system held $3.8 trillion in cash assets. This was a huge amount.

In March of 2024, the total amount of cash assets held in the U.S. commercial Banking system was only $3.4 trillion. Not much of a drop after all the Federal Reserve quantitative tightening.

And, this is the situation that the Federal Reserve will now have to deal with.

This is the situation that has allowed the stock market to continue to rise to new historic highs in 2024.

The banking system, the financial markets, and the economy have lots and lots of money still hanging around.

The Federal Reserve has done, I think, a very, very good job…SO FAR!

The Federal Reserve has not done things excessively. The Federal Reserve has not shaken up markets. The Federal Reserve seems to have gained the trust of market participants.

But………..

there is still lots of cash out there, and it is being used to keep the economy going and to keep confidence up.

Still, there is an awful lot of money around, and sooner or later, these monies are going to have to be dealt with in one way or another.

The battle is not yet over.

Most discussions about monetary policy that are going on still have to do with the question of when is the Fed going to move its policy rate of interest…and, how many times will it follow up with even more moves.

The optimism over the Fed cutting rates and cutting them three or four times in 2024 has subsided and much of the discussion surrounds the question about whether or not the rate will be moved at all.

The balance for the future is going to be related to the fact that the banking system, financial markets, and the economy are flush with money.

So, we are a long way from a calm, stable environment where everything moves in a way that is expected.

There may be many more economic surprises over the next year or so.

Investors are still going to have to be somewhat cautious about the disturbances that might happen.

But, investors seem to feel comfortable with what the Federal Reserve has done over the past two years.

Investors need to watch what other investors are doing to see whether or not this confidence will continue.