grandriver/E+ via Getty Images

We previously covered Daqo New Energy (NYSE:NYSE:DQ) in December 2023, discussing why we maintained our Hold rating on the stock, with China’s accelerating solar panel installation likely to be negated by the stalling demand in the US and EU over the next few quarters.

While the stock might be rerated closer to its book value, we believed that there might be more pain in the near-to-intermediate term, due to the increasingly imbalanced global supply/ demand picture through 2024.

In this article, we shall discuss why we are upgrading DQ to a Buy, despite the declining spot prices, the growing pessimism surrounding Chinese-based ADS, and the (potentially) intensified solar tariffs on foreign made solar panels.

The stock is still trading way below its book value per share, thanks to the robust balance sheet and the management’s consistent share repurchases thus far.

Combined with the bullish support observed at the $17s and the long-term electrification story, DQ continues to offer a compelling investment thesis for value-oriented investors.

Volatile Spot Prices Still Pose A Risk To The DQ Investment Thesis

For now, with DQ set to report its FQ1’24 earnings on April 29, 2024, readers may want to take note of its ASPs and average cash costs since these are integral to its eventual gross profit margins, which have been notably declining to 18.3% by FQ4’23 (+4.3 points QoQ/ -59.1 YoY/ -4.6 from FY2019 levels of 22.9%).

Normalizing Polysilicon Prices

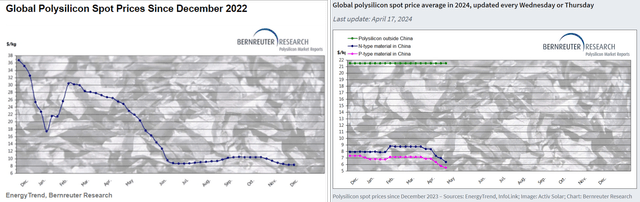

EnergyTrend, Activ Solar, Bernreuter Research

By April 17, 2024, the global polysilicon spot prices have further declined to $6.99 per kg (-15.7% from December 2023 levels of $8.30/ -74.1% YoY from $27.00/ -22.3% from 2019 averages of $9.00), as producers further lower prices to address the over supply issues.

For context, DQ reported FQ4’23 Average Selling Prices [ASP] of $7.97 per kg (+3.7% QoQ/ -78.6% YoY), with the decline naturally attributed to the commodity’s volatile spot prices after the hyper-pandemic supply tightness eased.

Silicon Over Supply Through 2026

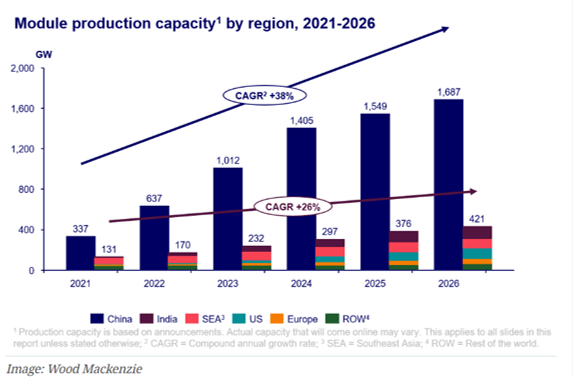

Wood Mackenzie

At the same time, with DQ still projecting FY2024 production of 290K MT of polysilicon (+46.5% YoY) at the midpoint, thanks to the ramp up of its manufacturing plants in Mongolia 5A/ 5B facilities and the global ramp up in production capacity through 2026, we expect the spot price headwinds to continue for a little longer.

While DQ has reported a moderating polysilicon average cash cost of $5.72 in FQ4’23 (+0.8% QoQ/ -15.6% YoY), partly aided by the growing capacity and improved operating scale, with the current spot prices continually declining and no floor in sight, readers may want to take note that a deterioration may potentially trigger the producer’s impacted top/ bottom lines from FQ2’24 onwards.

DQ’s Execution Remains Robust – Thanks To The Management’s Strong Focus On Profitable Growth

Even so, thanks to the hyper-pandemic profitability with FY2022 cash from operations of $2.46B (+290.4% YoY) and FY2023 cash from operations of $1.61B (-34.5% YoY), DQ is likely to remain well capitalized to weather the intermediate term uncertainties.

This is attributed to the robust cash/ others on balance sheet at $3.04B (-7.3% QoQ/ -13.6% YoY) in the latest quarter, with effectively zero financial debts.

For so long that DQ continues to generate positive profit margins and maintain an efficient operating expense as it does in FY2023 at $137.22M (-62.6% YoY), we believe that its electrification story remains robust here.

If anything, we do not expect the polysilicon spot prices to go below the producers’ cash costs, with a floor likely to occur in the near-term. Market analysts already expect “large-scale production shutdowns to occur and some manufacturers to carry out factory maintenance ahead of schedule,” to prevent further price reductions.

At the same time, DQ expects to “maintain its competitive advantage by enhancing the higher efficiency N-type technology while optimizing its cost structure through digital transformation,” naturally allowing it to command a decent profit margin.

The Consensus Forward Estimates

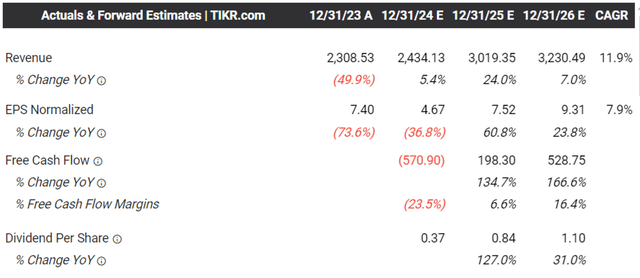

Tikr Terminal

The same has been observed in the consensus forward estimates, with DQ expected to generate a sustainable top/ bottom line expansion at a CAGR of +11.9%/ +7.9% through FY2026.

This is compared to the previous estimates of +18.9%/ +32.3% and the historical expansion at +39.1%/ +33.1% between FY2016 and FY2023, respectively, with the downgrade attributed to the volatile polysilicon spot prices instead of its fundamental performance.

As polysilicon increasingly becomes a commodity with volatile spot prices during the next-decade electrification trend, we expect DQ to be similarly volatile moving forward, especially given its Chinese ADS status.

DQ Valuations

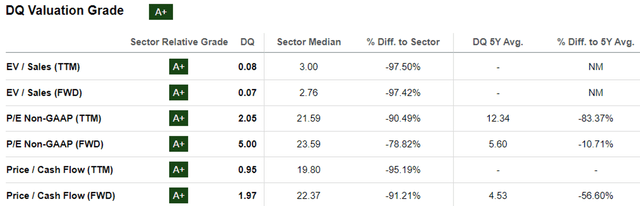

Seeking Alpha

Perhaps this is why DQ remains relatively discounted at FWD P/E valuations of 5.00x and FWD Price/ Cash Flow valuations of 1.97x.

This is compared to its silicon solar peers including LONGi at 10.96x/ NA, Canadian Solar Inc. (CSIQ) at 4.95x/ 1.44x, and its cadmium telluride solar peer, First Solar (FSLR) at 12.72x/ 12.34x, respectively.

While DQ has steadily risen from its all-time low valuations of 1.74x/ 0.95x in January 2023, it remains to be seen when market sentiments surrounding Chinese ADS may improve indeed.

With the geopolitical scene remaining volatile and the “new trade investigations into the US solar imports potentially leading to additional tariffs on foreign-made panels,” anyone whom chooses to dollar cost average here must also size their portfolios according to their risk appetite.

Interested readers may refer to my recent FSLR article here, for an in-depth discussion on the cadmium telluride utility solar investment thesis, which triggers the company’s fully booked backlog through 2026 and staggered deliveries through 2030.

So, Is DQ Stock A Buy, Sell, or Hold?

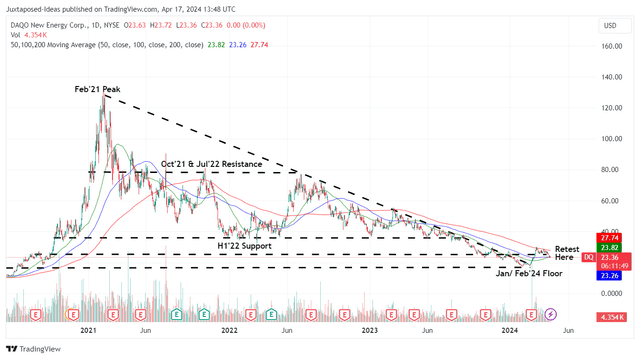

DQ 3Y Stock Price

Trading View

For now, DQ has already retraced dramatically by -85% between the February 2021 peak and the February 2024 floor, well underperforming the wider market at +26.4% and FSLR at +64.68 over the same time period.

Based on the FY2023 adj EPS of $5.62 multiplied with the discounted FWD P/E valuations of 5.00x, it is apparent that the stock is trading below our fair value estimates of $28.10.

Based on the consensus FY2026 adj EPS estimates of $9.31 and a similarly discounted P/E valuations, there seems to be an excellent near doubling potential to our long-term price target of $46.50 as well.

While DQ has yet to announce a dividend payout, readers may want to note that the board is set to deliberate a potential payout during the annual shareholder meeting in mid-April 2024, with a dividend announcement likely in the upcoming earnings call.

This is on top of the 8.14M or the equivalent 10.4% of its float retired over the last twelve months, demonstrating the management laser focus on robust shareholder returns thus far.

As a result of the relatively attractive risk/ reward ratio and the established bottom of $17s in February 2024, we are cautiously maintaining our Buy rating for the DQ stock, though with no specific entry point since it depends on individual investors’ dollar cost average and portfolio allocation.

However, with the stock trading way below its FQ4’23 book value per share of $72.35 (+13.1% QoQ/ +17.6% YoY), we believe that every dip looks tempting enough for value-oriented investors whom are patient enough for the eventual upward re-rating in its discounted valuations nearer to its peers.