Thomas Barwick

Investment action

Based on my current outlook and analysis of Darden Restaurants (NYSE:DRI), I recommend a hold rating. My review of DRI suggests a poor FY25 SSS performance ahead, given the inflationary environment that impacts consumer traffic and its cost base. Relative to Texas Roadhouse (TXRH), DRI performance is also relatively poorer, which is a cause for concern. Until DRI shows more positive SSS performance, I am going to stay on the sidelines.

Basic Information

DRI owns and operates full-service restaurants under multiple brands, and the primary brands are Olive Garden [OG] and LongHorn Steakhouse [LHS], which collectively represent ~70% of 3Q24 revenue. DRI also has a Fine Dining segment with two brands: The Capital Grille and Eddie V’s, which account for 13% of 3Q24 revenue. The remaining revenue contributions are from other brands.

Review

DRI share price has continued to fall since its last earnings results in late March, and I believe the share price is going to remain weak in the near term until results show a more solid turnaround momentum. My view is supported by two aspects of the business: (1) a poor sales outlook; and (2) margin compression.

Starting with the sales outlook, same store sales have turned -1% in 3Q24 vs. positive SSS over the past 6 quarters, with the largest brand, OG, down by 1.7%. Fine Dining and Other were both negative for the second consecutive quarter. It appears that macro pressure has finally sunk its teeth into DRI’s performance, where weak spending from low-income consumers has dragged down overall performance. The revised FY24 same-store-sales [SSS] guide of 1.5%–2% from 2.5%–3% prior also implies that the weak performance momentum has sipped into 4Q24 (as the implied 4Q24 SSS performance is -0.5% to 1%). The timing of management’s guidance is perhaps the greatest hint that 4Q24 is unlikely to see an improvement because the earnings call was held on March 21, which gave management about 1 month of 4Q24 data already.

The worrisome part is that the weak sales performance seemed to stem from poor traffic instead of pricing. We can estimate how much volume has declined by deducting the reported pricing growth from the total SSS. In this case, using management’s comment that pricing grew ~3.5%, it implies that 3Q24 traffic is down 4.5% (-1% SSS – 3.5% pricing growth). This is in line with management’s comment that they have taken share from the industry, which saw a -6.5% traffic decline (management noted OG traffic was down 3.8%, and they beat the industry benchmark by 270 bps). It is true that this is considered a market share gain, but I don’t think this calls for celebration because, compared to TXRH, which saw 9.9% 4Q23 (end in Dec) SSS growth (5.1% from traffic), DRI 2Q24 (ends in Nov) and 3Q24 (ends in Feb) performance screens very negatively (despite pricing below inflation rates). My guess is that DRI has executed very poorly on its value strategy (low-income consumer transactions are noted to be much lower vs. 3Q23), but this is not verifiable at this point, which is going to cause an overhang on the stock. Moreover, with inflation staying stickier than expected, this is going to continue putting pressure on the lower-income consumer group, a headwind for DRI.

DRI could pull the lever of opening more stores to drive top line growth, but that option seemed to have faced its limits, as management basically guided down on the number of stores opening in FY25 (45–50 vs. FY24’s 50–55), highlighting persisting construction and capex cost inflation headwinds. Build-out capacity has also faced constraints, as seen from starts and completions taking longer due to developer delays and financing issues, utilities, permitting, and occupancy certificates, among others. Of all the reasons, financing issues at the developer end are a big wild card that could deteriorate if the Fed does not cut rates (which is increasingly likely given the inflation and hot US economy data).

Shareholders of DRI would take comfort in learning that DRI store margins actually improved sequentially and annually to 20.6% despite the soft SSS performance. However, I expect margins to compress in the coming quarters given the management’s plan to underprice inflation (in line with their value strategy) by 100–150 bps in 4Q24. This comes at a time when DRI’s costs are still under inflationary pressure. For instance, beef is still in undersupply, which pushes the price up, and labor costs are still growing at mid-single digits. Another key reason for DRI margin expansion is that the company has pulled back on marketing expenses, with 3Q24 spending just 1.1% of revenue, which is well below the pre-Covid rate of ~3% vs. sales. This could be one of the reasons for the poorer performance vs. TXRH, and if so, DRI would need to ramp up this spend to catch up, which is going to pressure margins.

Valuation

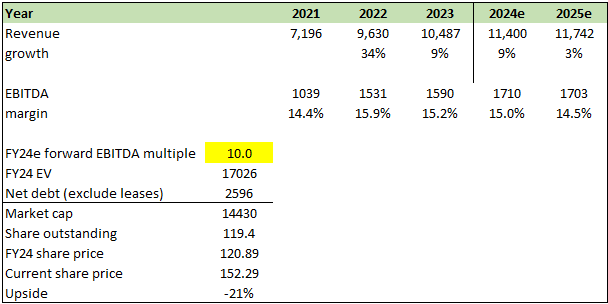

Author’s work

I believe DRI will see growth decline in FY25 (note FY24 should meet guidance as we are already 3 quarters in and management has 1 month of 4Q24 data) given the inflationary environment that should continue to impact lower-income consumers and slower store build ability given the industry constraints. I assumed 3% growth in FY25, driven by ~3% growth (4% food away from home inflation – 100 bps underprice strategy) and 2% store growth (guided for 45 to 50 in FY25), offset by 2% in traffic decline (giving the benefit of doubt that an ongoing value strategy would see some form of recovery). Lower top-line growth, combined with inflationary cost pressure and the need for more marketing spending, should cause margins to compress. With the poor outlook, I assumed DRI would trade at 10x forward EBITDA, slightly below its historical average multiple.

Risk

Further downside risk is if DRI’s poor relative performance widens against TXRH, which could really suggest poor execution on the pricing strategy front. In that case, SSS could come in lower than expected, putting more pressure on margins. This is not going to sit well with investors, as they could easily invest in TXRH for similar exposure to the restaurant industry, putting more pressure on the stock. Upside risk is that the DRI pricing strategy enables it to gain more traffic share, much more than the industry traffic decline, resulting in net positive traffic growth which would push SSS back to positive growth. Also, if food away from home inflation comes down faster in the coming months, it would also provide a lift to industry and DRI traffic, boosting SSS growth.

Final thoughts

My recommendation is a neutral rating for DRI, as it faces a challenging near future due to a combination of factors. Inflationary pressures are hurting consumer spending, leading to declining traffic and potentially negative SSS performance. Margins are also likely to compress as DRI struggles to keep pace with rising costs while maintaining its value strategy. While DRI saw improved store margins in the last quarter, this might not hold due to underpricing inflation and potential increases in marketing spend. Considering these factors and the potential for further downside risk, a hold rating is recommended for DRI until a clearer picture of SSS turnaround emerges.