The company might have the right person in place to lead the company into a new era of growth.

In 2020, data company Snowflake (SNOW -1.99%) went public in one of the hottest initial public offerings (IPO) of all time. The IPO priced at $120 per share, but the stock finished its first day of trading above $250 per share.

Now, approaching four years later, Snowflake stock is down about 40% from where it closed on day one. In short, it’s been a complete dud for early investors.

I wouldn’t blame Snowflake entirely for the poor performance of its stock because the business has excelled. Here’s how its financials have looked in each of its four complete fiscal years since its IPO.

| Metric | Fiscal 2021 | Fiscal 2022 | Fiscal 2023 | Fiscal 2024 |

|---|---|---|---|---|

| Product revenue growth | 120% | 106% | 70% | 38% |

| Free cash flow margin | (14%) | 7% | 24% | 28% |

Source: Snowflake’s press releases. Table by author.

Snowflake’s revenue is nearly five times higher now than when it went public, and it generates strong free cash flow. The stock fell during this time, nonetheless, because it was priced irrationally high at its peak.

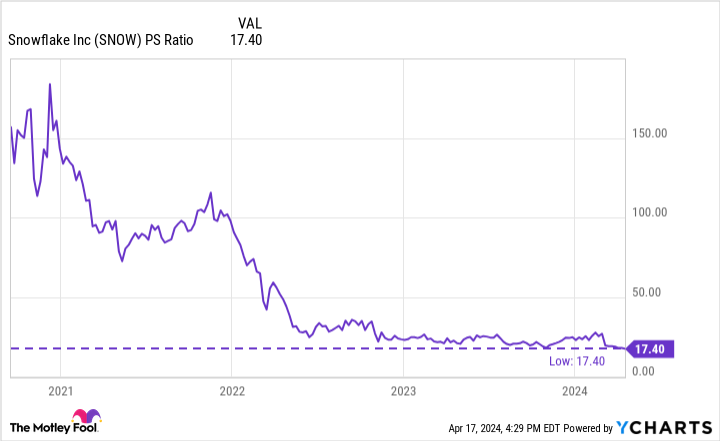

Indeed, at one point, Snowflake stock traded at over 100 times trailing sales. That sometimes happens with small companies, but Snowflake was already a large business at the time. In short, it’s hard to find upside when shares are that expensive. That said, the chart below shows it’s fallen to an all-time low valuation.

Data by YCharts.

With the stock still underperforming and valuation at a new low, it’s time to consider whether Snowflake stock is finally a buy.

Two reasons I’m still not sold on Snowflake

To be clear, a price-to-sales ratio of 17 doesn’t put Snowflake stock in value territory — it’s still trading at a premium price. The high price tag isn’t a deal-breaker in isolation, but it highlights the need for robust growth for an investment in this company to pay off.

That growth isn’t on tap in Snowflake’s fiscal 2025 (which started in February). The company only guided for 22% product revenue growth in the current year. And there are two reasons this gives me pause.

Snowflake is being celebrated as a top stock for the artificial-intelligence (AI) trend. After all, the company’s products and services deal with immense amounts of enterprise data, and AI makes use of large amounts of data. Therefore, Snowflake would appear to be a natural beneficiary of growth in this space.

However, the AI trend is already rolling, so there should be some noticeable benefit to Snowflake already. But the company just guided for its slowest year of growth ever. That’s the first reason I’m still not sold on Snowflake right now.

The other reason I’m not sold on Snowflake stock is related to management’s long-term outlook. Since it went public, the company has been targeting $10 billion in product revenue for fiscal 2029. However, its guidance for fiscal 2025 puts it below the pace it needs to reach this goal on time.

Management appears to have hinted at the possibility of falling short of its fiscal 2029 target too. Snowflake’s investor presentations have always included a reference to the fiscal 2029 outlook, but its most recent quarterly presentation quietly left this detail out.

Not all doom and gloom

Snowflake is a huge business, yet it’s still growing at a double-digit rate. That’s worth noting. The company isn’t falling apart — it’s just not growing as fast as I believe it needs to in order to justify its price.

Moreover, Snowflake’s slowing growth rate could improve. I noted my concern that the company doesn’t seem to be benefiting from AI yet, but perhaps that’s the real reason leadership has seen changes. Frank Slootman took Snowflake public, but he announced his retirement in February and handed the reins to Sridhar Ramaswamy, who was notably in charge of the company’s AI efforts.

In other words, this CEO transition could be tacit recognition that Snowflake has a golden opportunity with AI, and Ramaswamy is taking over to ensure the company can capitalize on it.

For his part, Ramaswamy seems convinced of Snowflake’s potential as he just bought $5 million of the stock.

Ramaswamy’s appointment and stock purchase don’t make Snowflake stock a buy on their own. But it’s enough reason to keep an eye on this business because future results could improve and put my concerns to rest.

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Snowflake. The Motley Fool has a disclosure policy.