Hinterhaus Productions

monday.com (NASDAQ:MNDY) is an Israeli company providing cloud-based no-code / low-code platform aimed towards team project management.

Since going public in 2021 at a price of $189, share performance has been underwhelming. Briefly after reaching an all-time high of $379 towards the end of 2021, MNDY saw a gradual decline and hit the bottom at around $81 in November 2022, before regaining upward momentum. The momentum continues as of today. MDNY is currently trading at $185, up almost 43% over the past year, though still down -2% since IPO.

I give MNDY a buy rating for now. My 1-year price target of $210 projects an over 17% upside. MNDY remains a top player among the competitive landscape, and is poised to do well due to its effective self-serve customer acquisition strategy. Furthermore, subscription price increase may also present a growth and margin expansion opportunity.

Financial Reviews

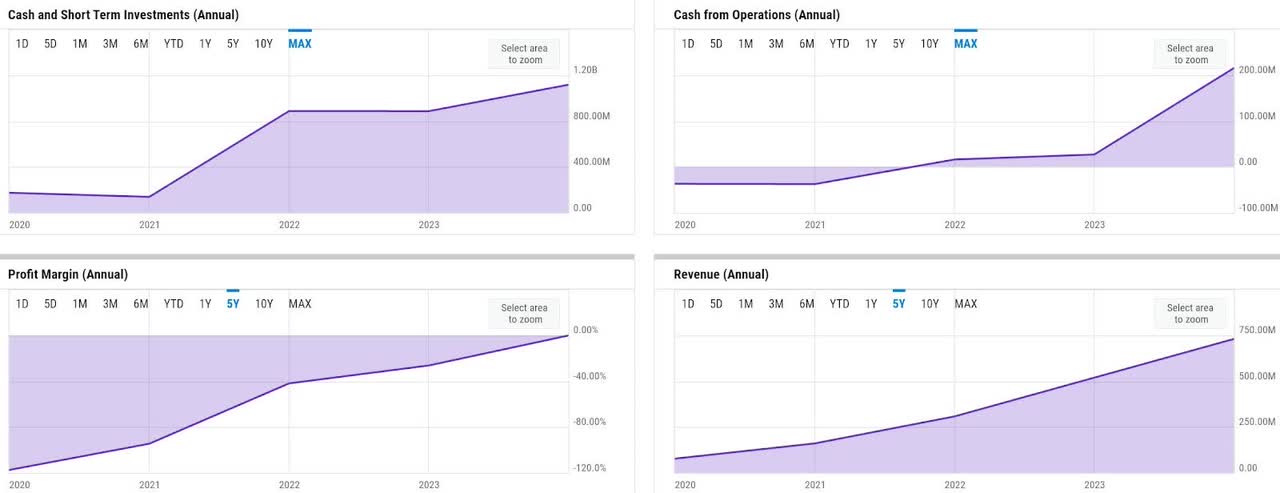

Fundamentals have been improving across the board. Revenue growth has continued to normalize steadily from 91% at the time of IPO to above 40% YoY as of FY 2023. For a company with an annual revenue of over $729 million as of FY 2023, I think that being able to grow above 40% YoY is quite impressive. Moreover, MNDY seems to have done so while also expanding GAAP profitability and operating cash flow (OCF). At -0.26% net loss margin in FY 2023, MDNY pretty much reached a breakeven point. The massive improvement in net profitability has enabled MNDY to deliver an outsized record-high OCF of over $215 million for the FY, an increase of almost 8x from the prior year.

Eventually, the strength in OCF generation has resulted in robust liquidity, especially with the other uses of cash being modest. MNDY ended FY 2023 with over $1 billion of cash and short-term investments, with no debt.

Catalysts

I believe MNDY remains well-positioned to capture secular growth opportunities in the no-code / low-code application development. The TAM of no-code / low-code is estimated to be around $30 billion by Grand View Research today, and it is also projected to more than triple to over $100 billion by 2030.

Mostly, the trend is driven by the increasing need by “citizen developers” to build “quick-and-dirty” business applications that sufficiently address basic functionalities, such as project tracker, performance insights, or form submission platform, without relying too much on software developers. Consequently, a no-code / low-code platform should theoretically promise two key benefits – it offers increased productivity through faster development time and also offers a leaner way to launch internal tools through needing fewer developer headcounts.

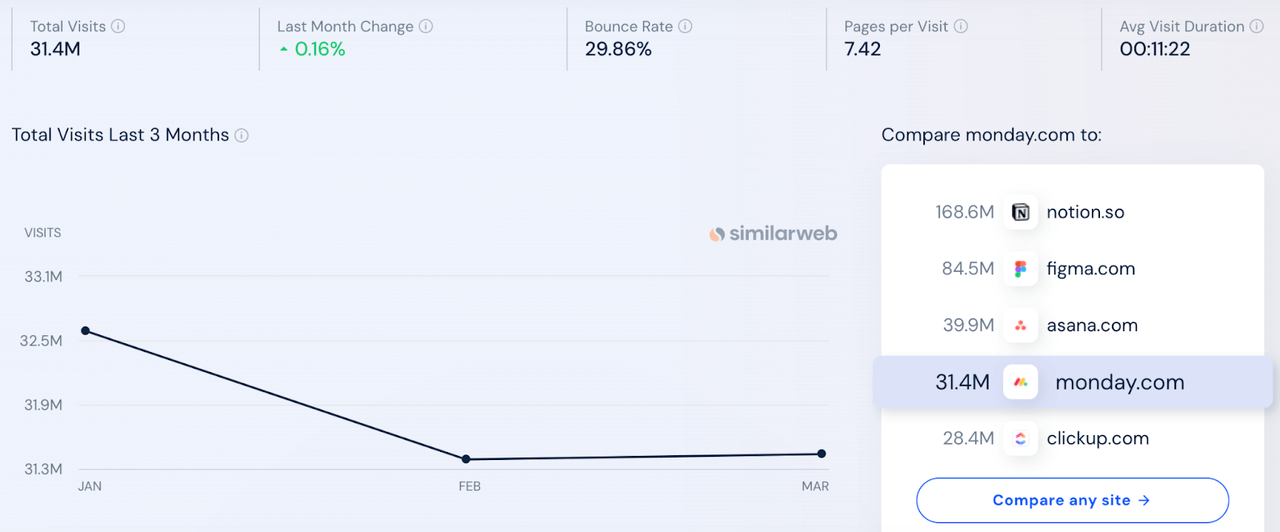

Though the space has gotten a little crowded as of late with similar players addressing different verticals like Notion, Asana, or Clickup, Monday’s market position remains strong, in my view.

Since the early popularity of the no-code / low-code trend has been driven by adoptions of individuals, SMBs, and mid-market businesses, the competitors in the space often apply a self-serve go-to market strategy, where they rely on strong digital presence to drive traffic and conversions. Unsurprisingly, Notion, whose customer base are mostly individuals and SMBs, is in the top spot when it comes to traffic generation. What is interesting to me is that MNDY’s traffic is quite close to that of Asana, a competitor that is well-known due to its leading project management tool, rather than its low-code / no-code platform. Figma, in the meantime, is more of a collaborative design app. As such, I would consider MNDY to still be the second-largest market leader after Notion in the no-code / low-code space.

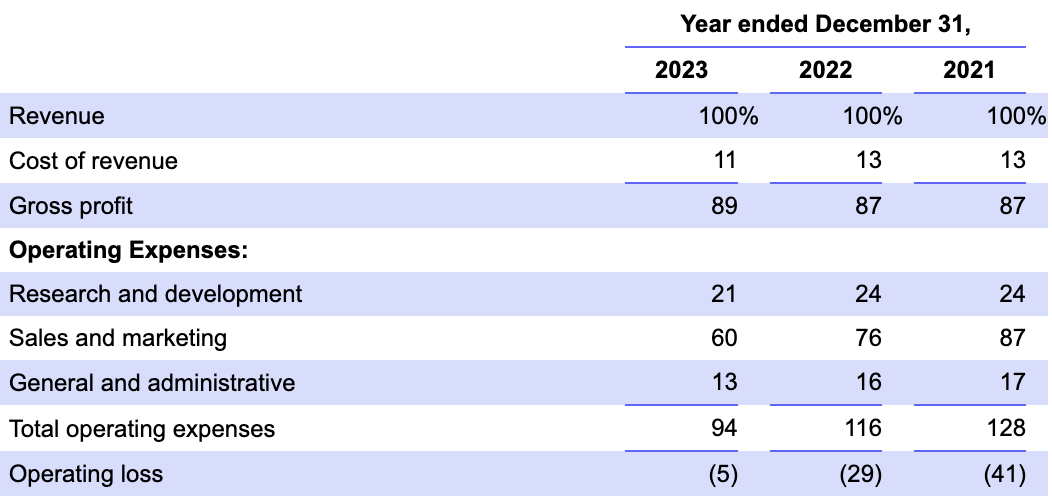

20F

Furthermore, the fact that revenue growth was still above 40% while sales and marketing (S&M) expenses as % of revenue continued to go down over the last two years also demonstrates solid go-to market strategy and resilience amid lingering macro weakness.

The management has also commented about the positive results from A/B testing on the subscription price increase, which suggests that MNDY may continue to both maintain solid top-line growth and drive down S&M as a percentage of revenue.

Risk

Risk remains minimal. One thing I would be cautious about is the fact that the price increase initiative MNDY is about to do will actually be the first one done on existing customers in the history of the company so far, as commented by the management:

Again, this is the first time we ever done a price increase to our existing base. We – in the past, we’ve done it to new customers. So we also try to be cautious here and we’re still learning. I would say that so far from what we see, reactions from customers were good. We didn’t see anything we didn’t expect. Everything was in line with our model. So we remain very optimistic.

Source: Q4 earnings call.

Therefore, there is definitely a risk of elevated churn here, though I imagine it would mostly happen within the smaller customer segments. It is also important to note that MNDY will also execute the price increase initiative earlier than expected, in midst of lingering macro weakness, which the management expects to only soften up in the second half of 2024.

Valuation / Pricing

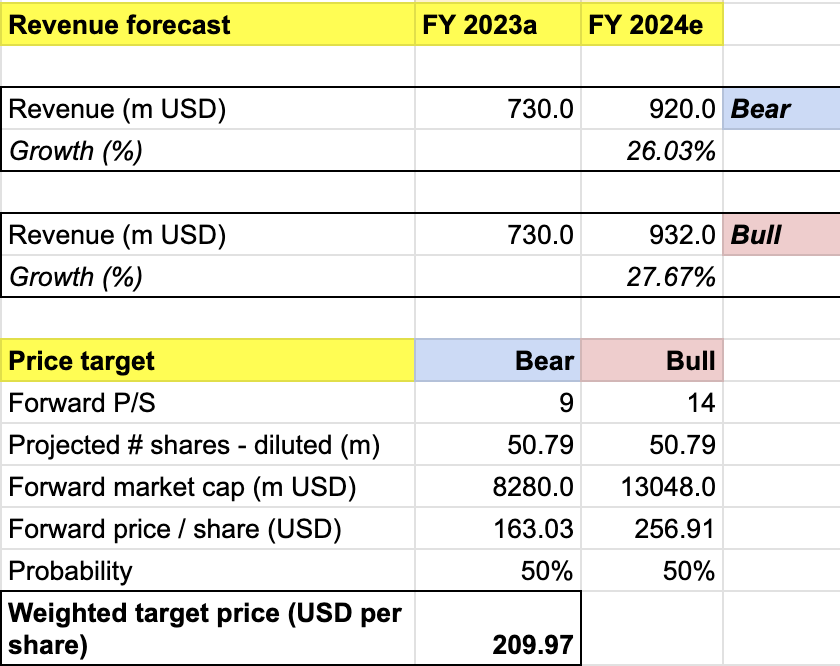

My target price for MNDY is driven by the following assumptions for the bull vs bear scenarios of the FY 2024 projection:

-

Bull scenario (50% probability) assumptions – I expect revenue to grow 28% YoY to $932 million, in line with the company’s guidance. I assume a forward P/S to expand slightly to 14x, implying a share price appreciation to $257.

-

Bear scenario (50% probability) assumptions – MNDY to deliver FY 2024 revenue of $920 million, missing the low-end revenue guidance by $6 million, a 26% YoY growth. I assign MNDY a forward P/S of 9x, a contraction that projects correction to $163.

own analysis

Consolidating all the information above into my model, I arrived at an FY 2024 weighted target price of $210 per share, projecting an over 17% 1-year gain from the current price of $179. I would rate the stock a buy.

Overall, MNDY presents a highly attractive opportunity, since my conservative projection still yields a 17% upside. For instance, I have lowered the bear-case revenue estimate by $6 million, which is a relatively sizable miss for a cloud software company like MNDY with higher degree revenue visibility. I also assume a 9x P/S for the bear scenario, which is a 1-year low. Nonetheless, while I believe it could be unlikely for MNDY to revisit that level again, I still assigned a 50-50 weighted probability in my projection.

Conclusion

MNDY is a no-code / low-code platform that helps businesses build custom work applications. I expect MNDY to remain as one of the leading players in the space, due to the strong brand reputation that enables an effective self-serve go-to market strategy. The price increase initiative may yield another positive result in FY 2024, but also comes with risk. Overall, my price target analysis suggests that risk-reward remains attractive, with a 1-year 17% upside despite conservative assumptions. I rate MNDY a buy.