Oil prices are being affected by geopolitical forces right now, which is exactly why investors will want to own these two energy leaders.

If you have $1,000 to invest and are looking at the energy sector, don’t go for broke by betting on big price gains. Instead, step back and consider the longer-term history of this inherently volatile sector.

What you really want to own are companies that have proved themselves capable of benefiting from the industry’s ups while handily surviving its downs. On that score, two of the best energy options today are ExxonMobil (XOM 1.15%) and Chevron (CVX 1.54%). Here’s why.

When oil went to zero

During the early days of the pandemic, there was massive uncertainty in the world. Countries basically shut down their economies in an effort to slow the spread of the illness.

The energy market, worried that there would be a massive drop in demand, reacted swiftly. Oil and natural gas prices fell. At one point, West Texas Intermediate prices, a key U.S. oil benchmark, actually fell below zero! There were technical reasons for this, but negative prices effectively meant that producers were paying people to take their oil.

In fairness, that’s not particularly common in the energy sector. But it does highlight the emotional swings that can take place in oil and natural gas markets.

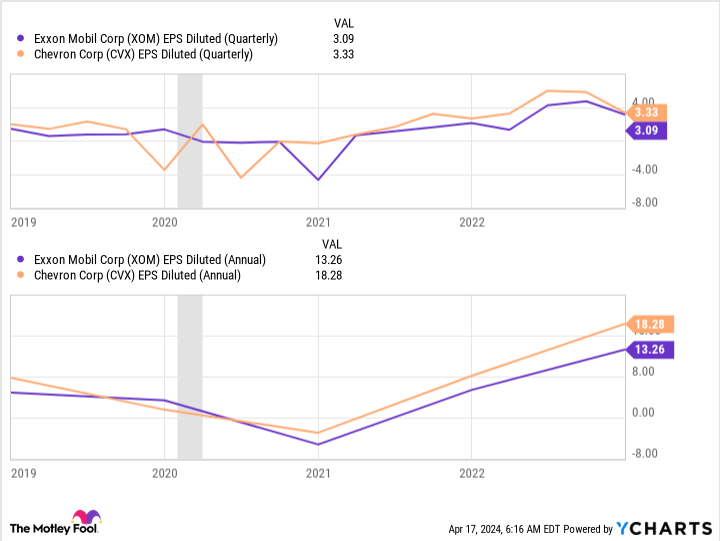

The really interesting thing about this period, however, is that ExxonMobil and Chevron both supported their dividends despite the financial headwinds they faced. The chart below shows their quarterly and annual earnings over the pandemic period.

XOM EPS diluted (quarterly) data by YCharts; EPS = earnings per share.

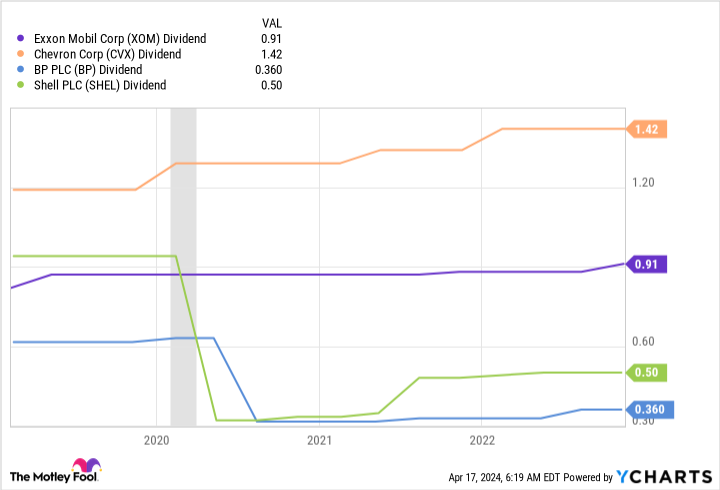

On a quarterly basis, you can see the volatility in their financial results. In the annual data, you can see that both Exxon and Chevron wound up losing money because of the turbulent energy markets. But, as noted, their dividends were not cut, unlike the case with peers BP (NYSE: BP) and Shell (NYSE: SHEL), which both ended up cutting their dividends.

XOM dividend data by YCharts.

What’s so special about Exxon and Chevron?

From a business basics point of view, Exxon and Chevron aren’t materially different from other integrated energy majors. Both have globally diversified businesses. Both have assets that span from the upstream (drilling) through the midstream (pipelines) and on to the downstream (chemicals and refining).

Each of these three industry niches have different revenue and profit dynamics, which work together to soften the industry’s peaks and valleys. For most investors, picking an integrated energy major is going to be the best choice in the sector.

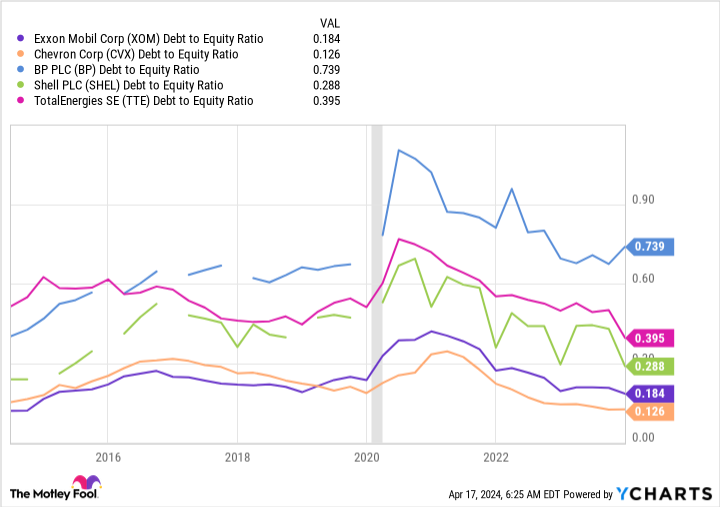

That said, Exxon and Chevron do have one important thing that separates them from the pack: incredibly strong balance sheets. The two have the lowest debt-to-equity ratios relative to their closest peers. Exxon’s debt-to-equity ratio is around an 0.18 multiple today, with Chevron coming in at an ever better 0.12.

XOM debt-to-equity ratio data by YCharts.

But look at the pandemic period on the graph above, and you will notice that all of the oil majors took on debt (which resulted in a rise in their debt-to-equity ratios) to survive that difficult stretch.

Exxon and Chevron had much more leeway on their balance sheets to do so, putting them in a stronger position to deal with the extreme adversity felt during that time span. That is what easily allowed them to continue supporting both their businesses and their dividends through the height of the pandemic.

And given that they still have industry-leading debt-to-equity ratios, they continue to be the best positioned to deal with future adversity when — and not if — it arrives.

You should probably go with Chevron today

It wouldn’t be a mistake for long-term investors to buy Exxon right now, which is the larger of the two companies and has a longer track record of annual dividend increases (42 years). For those who want the biggest and best, Exxon is probably the pick.

However, Chevron has increased its dividend annually for 37 years and currently has a nearly 4.2% dividend yield compared to Exxon’s 3.2%. Both should easily survive whatever the volatile energy market throws at them, but Chevron just looks cheaper right now.

So if you have $1,000 to invest and think the energy market is the place to put it to work, don’t think exclusively about upside potential. Think about balancing the upside you see against the downside that the historically cyclical industry will inevitably experience.

When you do that, the best option is to pick financially strong and diversified giants like Exxon and Chevron that have proved they can survive the industry’s volatility while still rewarding investors well for sticking around.