hapabapa

Investment Thesis

Netflix (NASDAQ:NFLX) delivered Q1 2024 results and the stock sold off. And why wouldn’t it? After all, the one thing that investors positively hate is uncertainty. Uncertainty comes a close second to bad news.

Netflix made clear their stance clear that starting in 2025 they would no longer be as transparent with their quarterly membership figures. That uncertainty weighed on the stock in a troubled market.

What’s more, this lack of transparency in its membership figures, when taken together with revenue guidance that reiterates that Netflix will not reach 20% CAGR on the top line, cements the argument that Netflix is no longer a growth stock.

Nevertheless, I argue that paying 24x forward free cash flow for Netflix is an attractive multiple to get involved in the stock.

In sum, I believe that in the coming few quarters, investors will look back to $581 per share as a cheap price for Netflix.

Rapid Recap

In my previous analysis, I said:

Netflix’s guidance for Q1 2024 provided investors with ample positive news. However, even as Netflix strives to describe that it has a “lot more room to grow”, the fact of the matter is that this is no longer a premium growth stock. But that’s not where the bull case is found.

The bull case for Netflix is that it’s already meaningfully free cash flow producing, and there is even more room to become a free cash flow machine.

Without any heroics, I estimate that Netflix is priced at 23x forward free cash flow. For what many consider to be the ultimate streaming provider, paying this valuation strikes me as a bargain.

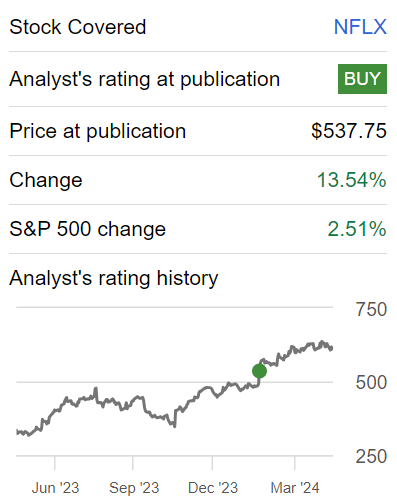

Since then, the stock has been on a tear. Not an Nvidia-like tear (NVDA), but it has delivered substantial outperformance relative to the S&P 500.

Author’s work on NFLX

Since my bullish analysis, last quarter, the stock was up 14% heading into this quarter, while the rest of the market is up less than 3%. What did investors expect? Did investors forget that stocks go down as well as up? Nonetheless, I stand by my contention. This stock is a bargain.

Netflix’s Big Change

Netflix announced that in 2025, it would be phasing out its membership numbers. As if that were what moved its share price higher, the stock sold-off.

Netflix’s decision to halt the reporting of quarterly membership figures reflects a strategic shift in how the company communicates its financial performance. By moving away from this traditional metric, Netflix aims to align its reporting with the evolving nature of its revenue model, which now encompasses various streams beyond mere subscriber numbers, such as advertising and additional member features. This decision underscores Netflix’s focus on prioritizing key metrics that better capture the overall health and success of its business, including revenue, operating income, net income, earnings per share, and free cash flow.

For investors, who were previously accustomed to gauging Netflix’s prospects on an increase in membership basis, this change was a shock. Investors craved transparency. But it was only natural that at some point its membership growth rates would start to moderate. Accordingly, I ardently declare that given a few weeks or at most a month, the market will in time get over this.

Moving beyond this, let’s delve into Netflix’s fundamentals.

Revenue Growth Rates Will Moderate, Then What?

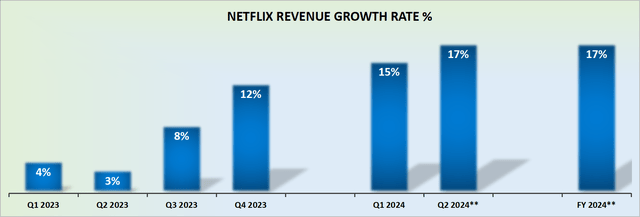

Netflix is no longer the premium growth company many investors got accustomed to in the past. Indeed, despite its Q2 2024 quarter being guided towards high-teen revenue growth rates, that’s likely to be as good as it’s going to get in the near term.

More specifically, investors should keep in mind that Q2 of the prior year was a very easy quarter to compare against. Also, and more pressingly, in the next several quarters after Q2 2024, Netflix will be up against steadily increasingly more challenging quarters.

That being said, Netflix’s guidance of around 13% to 15% revenue growth for 2024, more than likely implies that Netflix is hoping to reach 15% to 17% revenue growth rates in 2024.

Consequently, this must mean that despite the challenging comparable quarters with the prior year, Netflix must believe there’s further juice left in the tank and revenue drivers so that H2 2024 may in fact point to some better-than-expected revenue growth rates.

With that context in mind, let’s now turn our focus to its valuation.

NFLX Stock Valuation – 24x Forward Free Cash Flow

In my previous analysis, I said:

I believe that if we presume that in 2025 Netflix will deliver approximately $43 billion with 23% free cash flow margins, this leaves Netflix priced at 23x forward free cash flow. A figure that I believe many reasonable investors will recognize as being very attractive.

Not only do I today stand by that statement, but I’m reassured that my estimates are very much in the right ballpark. Here’s why.

Netflix has maintained that in 2024 it would see around $6 billion of free cash flow. However, given that last year Netflix already reported $7 billion of free cash flow, plus the fact in Q1 2024 delivered $2.2 billion of free cash flow, altogether this means that there’s a significant likelihood that Netflix could see $8 billion of free cash flow at some point in the next 12 months, as a forward run-rate. Note, that a forward run rate is an extrapolation estimate of the upcoming next 4 quarters.

On top of that, keep in mind that Netflix’s steady progression in increasing its profit margins gives credence to the idea that Netflix could reach in 2025 30% clean GAAP operating margins. This once again reaffirms my overall thesis.

All in all, I am confident that Netflix could see around $11 billion of free cash flow at some point in 2025, as a forward run rate. Therefore, although in 2024 Netflix’s free cash flows are not expected to be as strong as many investors would like, there’s a steady path for these free cash flows to reach $11 billion at some point in the coming year, as a forward run-rate.

The Bottom Line

I maintain a bullish stance on NFLX. Even as the change in membership disclosure may introduce some uncertainty. By prioritizing key metrics like revenue, operating income, net income, earnings per share, and free cash flow, Netflix aims to provide investors with a clearer understanding of its business dynamics.

Despite concerns about moderating revenue growth rates, Netflix’s current valuation of 24x forward free cash flow presents an attractive opportunity for investors.

In sum, I believe that the current share price of approximately $580 represents a compelling entry point for investors.