In an effort to level the playing field for young people, in the 2024 federal budget, the government is targeting Canada’s highest earners with new taxes in order to help offset billions in new spending to enhance the country’s housing supply and social supports.

Aiming to give Canadian millennials and Generation Z “a fair chance at a middle class life,” Deputy Prime Minister and Finance Minister Chrystia Freeland’s budget outlines how the Liberals plan to allocate $39.2 billion in net-new spending, while upholding the intended fiscal guardrails.

Framed as pursuing tax fairness, one of the main ways the Liberals are planning to bring in new revenue is by “asking” Canada’s very wealthiest to pay more, with Freeland saying it would be irresponsible to pass on more debt to future generations by ignoring the fiscal anchors Freeland tied government to last fall.

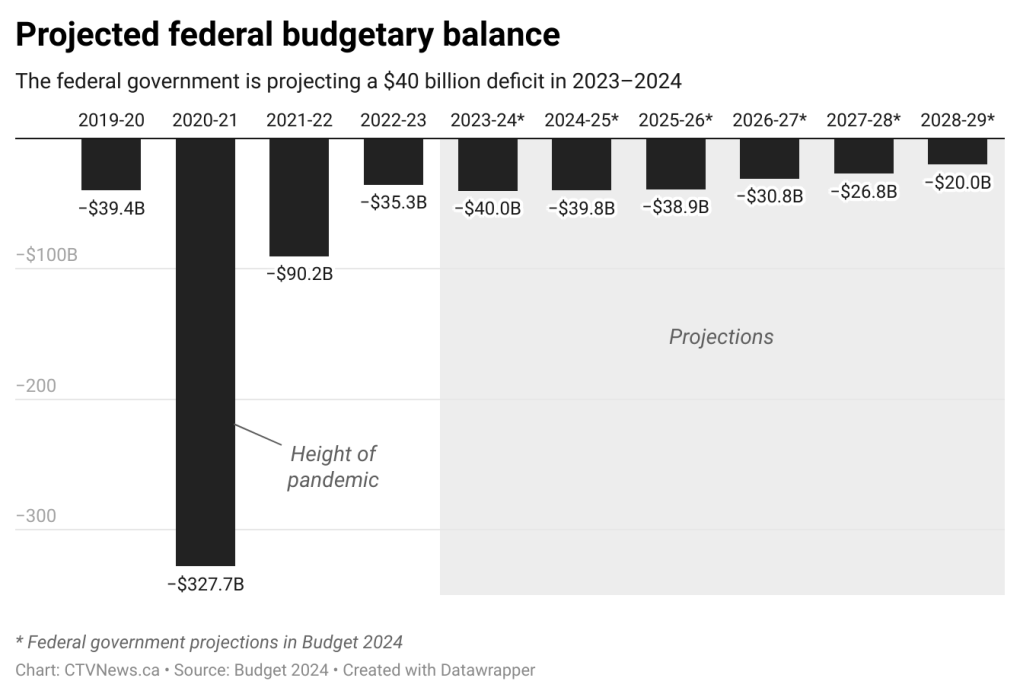

However, with still no projected budget balance and bigger deficits forecasted in every year ahead than was previously projected, the budget — titled “Fairness for Every Generation” — notes that federal public debt charges are on track to balloon to $64.3 billion in 2028-29.

Aside from the weeks long pre-budget blitz of expected new measures, the 2024 budget includes some additional offerings for small businesses and entrepreneurs – including through a new carbon rebate – and finally puts dollar figures on the first phase of national pharmacare, as well as the long-promised disability benefit.

Overall, the 2024 federal budget includes $52.9 billion in new spending plans – some of which is loan-based and reliant on provincial buy-in – as well as an estimated $20 billion in new tax revenue, including tobacco and vaping taxes.

According to the budget, the federal deficit is projected to be $39.8 billion in 2024-25, $38.9 billion in 2025-26, and declining over the three years following, to $20 billion by 2028-29.

Freeland did hit her target of maintaining the 2023-24 federal deficit at $40.1 billion, and will be lowering the debt-to-GDP ratio in the current fiscal year. She’s also standing firm on her plans to “refocus” $15.8 billion over five years and $4.8 billion ongoing in government spending.

“Our renewed focus today is unlocking the door to the middle class for millions of younger Canadians,” Freeland writes in the foreword to the budget, of which all 416 pages were tabled in the House of Commons on Tuesday.

“Because that is what you have earned, and that is what you deserve. And that is what your parents and grandparents want for you, too.”

Speaking with reporters inside the budget lockup, Freeland defended her new revenue plan as helping “make life cost less for millions,” while touting that the Canadian economy is outperforming expectations and on track to continue to improve in the year ahead.

Prime Minister Justin Trudeau, Deputy Prime Minister and Minister of Finance Chrystia Freeland and cabinet ministers pose for a photo before the tabling of the federal budget on Parliament Hill in Ottawa, on Tuesday, April 16, 2024. THE CANADIAN PRESS/Justin Tang

Prime Minister Justin Trudeau, Deputy Prime Minister and Minister of Finance Chrystia Freeland and cabinet ministers pose for a photo before the tabling of the federal budget on Parliament Hill in Ottawa, on Tuesday, April 16, 2024. THE CANADIAN PRESS/Justin Tang

Banking on this “soft landing” and for inflation to decline to close to two per cent by the end of the year, the finance minister said the federal government feels like now is the time to meet the moment with more investments to help spur competition and job growth, while maintaining low deficit- and net debt-to-GDP ratios.

However, some economists warn not enough is being done in this massive financial document, on the productivity side.

Fred O’Riordan, the national leader for tax policy at EY, told CTV News that in his view, it was the “missing element” of the budget. “There are very few measures that are designed to increase capital investment and enhance labour productivity.”

“Today’s budget contains few surprises… and the government’s projections for the deficit are largely in line with previous predictions,” said Canadian Chamber of Commerce CEO Perrin Beatty.

“Instead of using a revenue windfall to reduce the deficit more quickly, the government chose to use it along with changes to the capital gains tax, to fund this new spending. What’s still missing is a clear plan to promote productivity and restore economic growth in Canada.”

On Parliament Hill, Freeland’s fiscal roadmap received mixed reviews, with opposition parties largely decrying the missed opportunities and “box-checking politics” within it.

Wealthiest Canadians to be taxed more

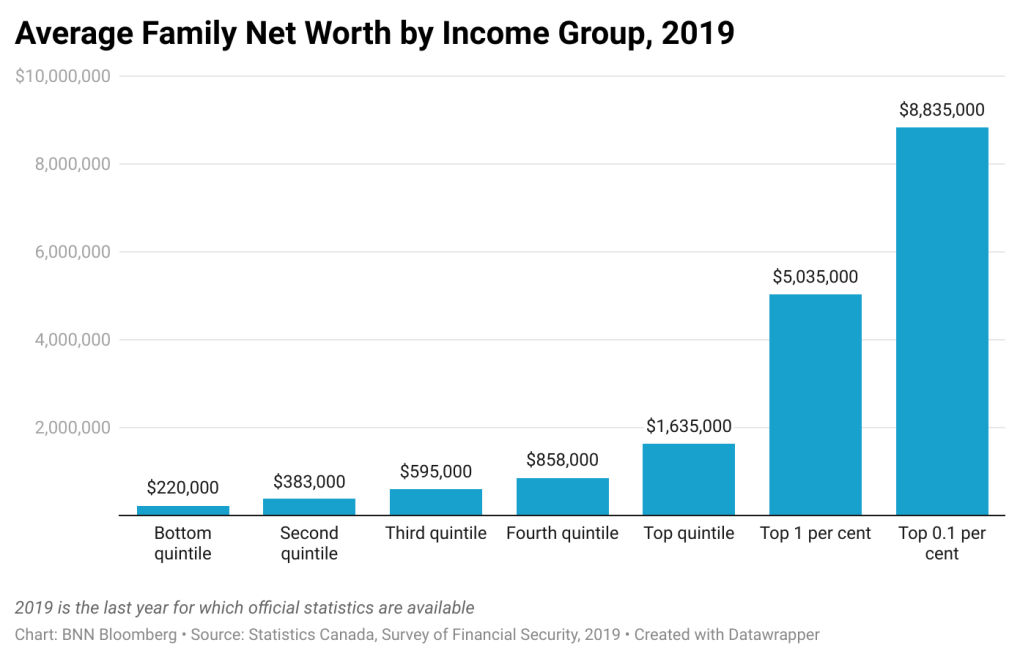

The most significant new component of Tuesday’s budget is a new revenue stream: an increase in taxes on capital gains for Canada’s highest earners, projected to rake in $19.3 billion over the next five years.

While not exactly the wealth tax or excess profit tax some had suspected, Freeland is targeting the wealthiest 0.13 per cent by increasing the capital gains inclusion rate — the portion of capital gains on which tax is paid – for individuals with more than $250,000 in capital gains in a year.

The rate will increase from one-half to two-thirds, and will also apply to all capital gains realized by corporations and trusts. This is expected to impact approximately 12 per cent of Canada’s corporations and Canadians with an average income of $1.42 million.

This tax change will apply to capital gains realized on, or after June 25, 2024.

The Liberals, who vowed to not raise taxes on Canada’s middle class, made a point of noting in the budget that this change will not impact 99.87 per cent of Canadians.

Freeland also said this increase to the capital gains inclusion rate is not expected to hinder Canada’s business competitiveness, as corporations in most other countries pay corporate income tax on 100 per cent of their capital gains.

Heading into budget day, economic experts had cautioned that more direct wealth or excess profit taxes could have run counter to the Liberals’ efforts to boost productivity, and growth, but opting to go this route is largely being characterized as a safer bet.

New details on housing, Gen Z pledges

Taking the premise that the best way to make home prices and rents more affordable is to quickly increase supply, the 2024 budget includes the comprehensive package of housing policy initiatives Prime Minister Justin Trudeau and his cabinet have been teasing out for weeks.

Promising to build 3.9 million homes by 2031, the housing strategy includes a bevy of measures and $8.5 billion in additional spending. Much of this spending is spread out over the years ahead.

Among the biggest ticket housing commitments are a $15-billion top-up to the Apartment Construction Loan Program; $6 billion for a Canada Housing Infrastructure Fund; as well as $1 billion in loans and $470 million in contributions for a new rental protection fund.

The 2024 budget also includes $400 million to top up the Housing Accelerator Fund by $400 million, plus $600 million for a series of new homebuilding innovation efforts aimed at scaling up modular and prefabricated homes.

It remains to be seen what the timeline will be for enacting the promised Canadian Renters’ Bill of Rights, and select other mortgage and rental rule reforms. Though, allowing 30-year mortgage amortizations for first-time homebuyers purchasing new builds, will be available starting Aug. 1, 2024.

Policy-wise, the budget offers more intel about plans to enact a “public lands for homes” strategy. According to the government, this initiative intends to “unlock 250,000 new homes” by converting unused office towers, parking lots, Canada Post and National Defence properties, into residential land.

Specifically, $1.1 billion is being earmarked over 10 years to convert 50 per cent of the federal government’s office space into housing, saving $3.9 billion over that same period of time. It remains to be seen what the pricing strategy will be for this federal effort to sell off, or re-zone, this land.

The first batch of five federal properties being leased to housing providers “immediately” are in Calgary, Edmonton, Ottawa, Toronto, and Montreal, amounting to 800 new homes.

Further, consultations are coming on a potential tax on residentially-zoned vacant land.

“I think what they are doing on land is quite smart. We have more Canada Posts in this country than we have Tim Hortons. So, that’s a lot of re-development opportunities,” said economist Mike Moffatt, who the Liberals have directly consulted in recent months on their housing plans.

While the Liberals are framing this overall major push on housing as helping younger Canadians, there are also a few specifically Generation Z and millennial-targeted measures, including creating more jobs through a $207.6 million Student Work Placement Program boost, and extending increased student grants and interest-free loans.

The federal government will also be updating the formula that is used by the Canada Student Financial Assistance Program to calculate housing costs when determining financial need, to reflect today’s higher housing costs. The budget estimates this will deliver more student aid to 79,000 students a year.

“We may look back on the 2024 budget as a game-changer,” Paul Kershaw, founder of Generation Squeeze told CTV News.

“This budget is saying ‘we have to acknowledge that hard work isn’t paying off for younger Canadians as it did for past generations… The first step in solving a problem, is acknowledging it.”

Next steps on social safety net efforts

There are a series of chapters within the 2024 federal budget focused on various efforts to expand elements that could be considered part of Canada’s social safety net.

Newly unveiled Tuesday, this includes $1.5 billion over five years to launch the new national universal pharmacare plan. The first phase, as pre-announced, will help cover diabetes and contraception medications starting this fiscal year.

“The preliminary coverage of diabetes and birth control drugs in this budget is another example of the Liberal-NDP supply confidence agreement bearing fruit… While this program is still limited in scope, it represents the most tangible steps towards universal pharmacare that we’ve ever seen in this country,” said Canadian Centre for Policy Alternatives senior economist David Macdonald.

And, the Liberals have finally put funding behind their long-promised Canada Disability Benefit: $6.1 billion over six years and $1.4 billion ongoing, seeing the first payments issued in July 2025.

This federal income supplement has been framed as a legacy social policy that will help hundreds of thousands of low-income, working-age people with disabilities, and is meant to supplement existing provincial and territorial benefits. The budget also vows coverage for the cost of medical forms required to apply for this financial assistance.

The budget also includes more than a dozen new initiatives connected to the Liberals’ longstanding commitment to Indigenous reconciliation.

Among them: a promise to spend $927 million over five years on new on-reserve income assistance; $1.8 billion to help Indigenous people exercise their jurisdiction; $5 billion in loan guarantees related to energy projects; and $1.3 million to advance the “Red Dress Alert” (similar to an Amber Alert) initiative.

Further, as pre-announced, the 2024 budget includes $1 billion over five years to fund a new national school food program intended to provide meals to 400,000 more kids.

It also earmarks $500 million for a new youth mental health fund; $1 billion in loans and $60 million in grants to build or renovate child-care centres; and $48 million to extend student loan forgiveness for early childhood educators.

Small business, research supports

Freeland’s plans include new measures meant to provide businesses more certainty when it comes to investing in Canada, including a series of incentives and supports to boost productivity.

As part of a new small business-focused package, the budget earmarks $200 million over two years, starting in 2026-27, to increase access to venture capital for “equity-deserving entrepreneurs,” and those outside of major hubs.

Further, the Liberals are promising a new “Canada Carbon Rebate for Small Businesses” that vows to rapidly return the proceeds from the federal pollution price from 2019-20 to 2023-24 to 600,000 businesses with fewer than 500 employees through a new refundable tax credit, estimated to cost $2.5 billion.

There’s talk of a new Canadian Entrepreneurs’ Incentive to provide a tax break, advancing work on regulatory “sandboxes,” further red tape reduction measures and acting on foreign credential recognition.

Further, $3.5 billion is being promised for strategic research infrastructure, investments in modernized facilities, including $2.4 billion for core research grants and to foster homegrown talent through improved scholarships and fellowships.

As expected, the budget also includes $2.4 billion to build capacity in artificial intelligence, largely for computing capabilities and technical infrastructure.

New spending on safety, defence, online harms

Lastly, the 2024 federal budget includes the pre-promised billions in defence spending over the long-term and volunteer firefighter and search and rescue tax credits.

Beyond this on the safety front, the government notes it plans to move ahead with “additional penalties under the Criminal Code for those who commit an auto-theft related offence,” and is earmarking $30.4 million for the buyback of assault-style firearms.

The budget also includes $273.6 million for Canada’s Action Plan on Combatting Hate, and $16 million to help “create a safer and more welcoming sport environment” for all athletes.

Related to the yet-to-be-passed online harms legislation, the federal government proposes to provide $52 million over five years, starting this year, to Canadian Heritage and the Royal Canadian Mounted Police to fulfill their obligations regarding protecting children, ensuring major online platforms are abiding by the coming new regulations, and to set up the promised Digital Safety Commission.

An additional $7.5 million will be going to the Public Health Agency of Canada to support the Kids Help Phone over the next three years, while Public Safety Canada is getting $2.5 million to support the Canadian Centre for Child Protection.

Political reaction to Freeland’s plans

Rising to respond to the budget in the House of Commons, Conservative Leader Pierre Poilievre echoed the demand he made in the morning, before having seen the document, for Trudeau to “please stop” his spending plans until a Conservative government can take over.

“Everything on which the prime minister spends gets worse and more costly. He has spent, and Canadians are broke,” Poilievre said. “This is not a government that gives people everything they want. It’s a government that takes everything they have.”

Conservative Leader Pierre Poilievre holds a press conference on Parliament Hill in Ottawa on Tuesday, April 16, 2024. THE CANADIAN PRESS/Sean Kilpatrick

Conservative Leader Pierre Poilievre holds a press conference on Parliament Hill in Ottawa on Tuesday, April 16, 2024. THE CANADIAN PRESS/Sean Kilpatrick

In an exchange during Tuesday’s post-budget debate, Freeland attempted to pin Poilievre down on whether he would show his “true colours” and come out and say that while framing himself as “being on the side of working people,” he opposes making those at the very top pay more.

It is expected that the Liberals’ effort to wedge the Conservatives on this point will continue in the days of priority debate ahead.

In an interview on CTV News Channel’s Power Play, NDP Leader Jagmeet Singh – as has become an annual tradition since the two-party confidence pact went into effect – wouldn’t say whether he will support this budget.

Singh said while there are a number of elements in the budget that his party fought for, he’s “got some concerns” that he wants addressed before the New Democrats can commit to supporting the spending plan.

“What about the fact that they have not addressed the gap in infrastructure and housing spending for Indigenous communities? Or the fact that people waited for a year and a half for the disability benefit, and it’s only $200, at a time when the cost of living is so high? What’s the plan to increase that? So I want to hear (a) response to those concerns,” Singh said.

The Bloc Quebecois, meanwhile, wrote in a press release that “the budget only serves Justin Trudeau” and the prime minister’s electoral goals.

Bloc Leader Yves-François Blanchet added in the release that the budget does not meet his party’s expectations when it comes to support for seniors or asylum seekers, and that it steps on Quebec’s provincial jurisdiction when it comes to issues like housing.

Green Party co-leader Elizabeth May called the budget “a prime example of box-checking politics, showcasing a series of half-measures that do not respond to the scale of the challenges Canadians are facing.”

“This budget looked like our dream budget, with so many mentions of our key demands on climate, housing and inequality, until we delved into the details,” May said in a statement. “This budget was an opportunity to start a systemic shift to rise to the challenges currently facing the country. The Liberals failed that test.”