Henrik5000

I don’t care what anyone says – bonds are far more attractive now than they have been in many many years. Investors wanted yield when there was none, and now don’t want yield when there is definitely more than some. Now to be clear – I’m bearish on credit spreads given how narrow they are, but do think there’s potential for active bond strategies to do well on a go-forward basis. If I’m right, funds like the JPMorgan Income ETF (NYSEARCA:JPIE) stand to benefit.

JPIE is a dynamic debt fund managed actively by JPMorgan. Launched on October 28, 2021, this ETF aims primarily to generate income, with secondary objectives of capital appreciation. The fund utilizes a flexible approach, making allocation shifts based on market fluctuations. Notably, JPIE seeks to provide an appealing monthly dividend to its investors.

JPIE Portfolio Composition

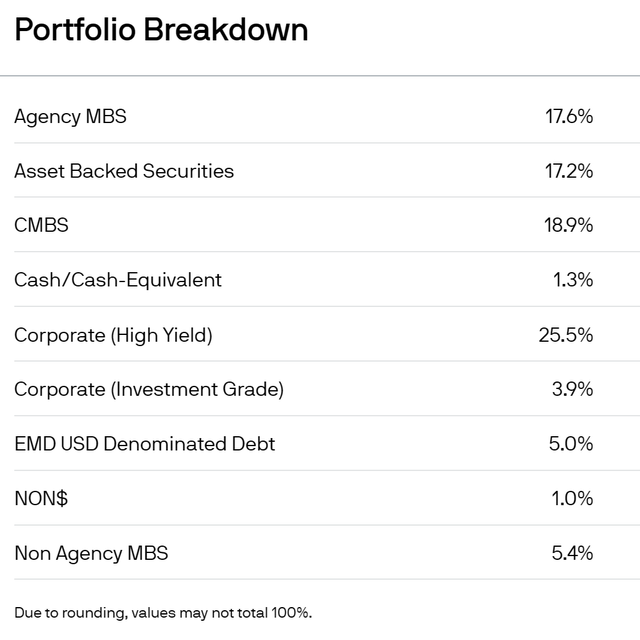

Unconstrained by a fixed investment mandate, JPIE’s portfolio composition reflects the current vision of the management team based on market conditions. The fund can invest in a wide array of debt securities, including corporate bonds, mortgage-backed securities (MBS), and emerging market debt. This flexibility allows JPIE to adapt to evolving market conditions and seek out the most attractive risk-adjusted income opportunities.

Currently, the fund has over 1,361 positions, with an average duration of 2.7 years. The duration is low, suggesting management wants less exposure to interest rate risk. I like to see that as concerns mount that the Fed may not be done with the interest rate hiking cycle. From an allocation perspective, about 25% of the fund is high yield, with CMBS and Agency MBS being the second and third largest allocations respectively.

jpmorgan.com

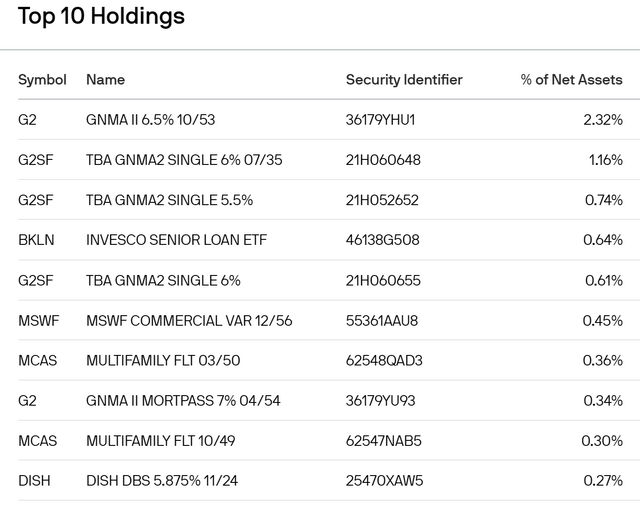

When we look at the holdings, no position makes up more than 2.32% of the portfolio. This is overall quite well diversified.

jpmorgan.com

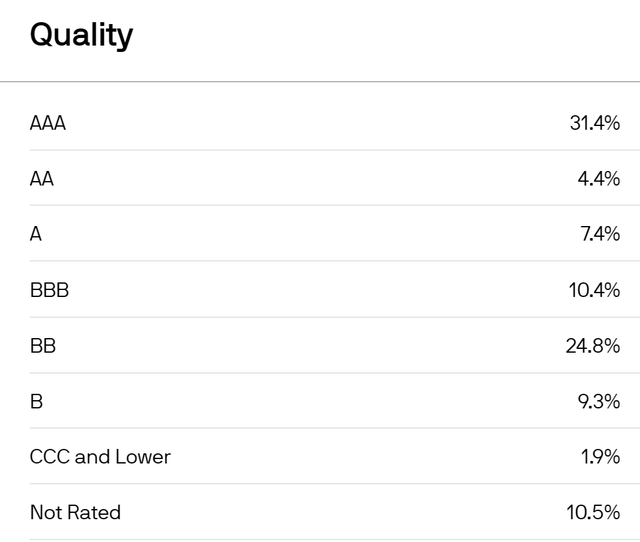

As to credit quality, BB takes the second largest allocation. I’m glad to see CCC and lower junk issues make up a small portion of the portfolio. If the active management is right in overall allocations, the BB ratings shouldn’t be an issue from a default risk perspective overall. It’s nicely balanced against high quality AAA and AA, allowing for the portfolio overall to be robust from an average credit rating perspective given management views on risk.

jpmorgan.com

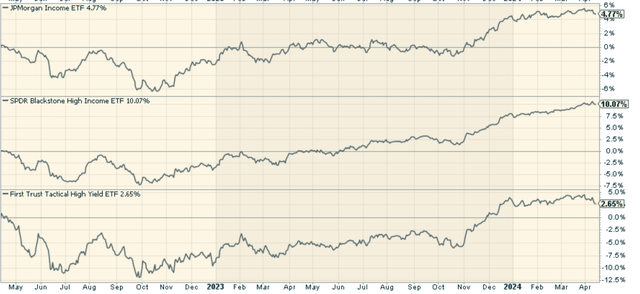

Peer Comparison

To contextualize JPIE’s performance and structure, it’s good to compare it with similar funds in the market. Two such funds are the SPDR® Blackstone High Income ETF (HYBL) and the First Trust Tactical High Yield ETF (HYLS). Compared to these funds, JPIE has the lowest expense ratio (0.41%). It also boasts a larger number of holdings offering greater diversification. JPIE has outperformed HYLS but underperformed HYBL, largely because HYBL has a far larger allocation to lower quality bond issues with meaningful credit risk.

stockcharts.com

Benefits and Risks of Investing in JPIE

Pros

-

Flexible Approach: JPIE’s investment approach allows it to adapt to changing market conditions and target high-potential debt securities.

-

Diversification: With a broad range of holdings across different sectors and credit ratings, JPIE provides investors with a well-diversified portfolio.

-

Attractive Yield: JPIE offers an attractive yield to maturity of 7.21%.

Cons

-

Credit Risk: The fund’s exposure to high-yield bonds increases its credit risk, which could lead to potential defaults and losses.

-

Interest Rate Risk: With a duration of 2.7 years, the fund is sensitive to changes in interest rates. An increase in rates could lead to a drop in the fund’s price (not by much overall though)

-

High Turnover: JPIE’s high turnover rate could lead to higher transaction costs, which could negatively impact the fund’s performance.

Conclusion

With its flexible investment approach, diversified portfolio, and attractive yield, JPMorgan Income ETF looks good for potential income and capital appreciation. It’s done well overall I’d say. The real test will be whenever credit spreads widen. If management can navigate through that with tactical shifts, it would cement this as one of the better active bond funds out there that can be flexible and respond before it’s too late.

Markets aren’t as efficient as conventional wisdom would have you believe. Gaps often appear between market signals and investor reactions that help give an indication of whether we are in a “risk-on” or “risk-off” environment.

The Lead-Lag Report can give you an edge in reading the market so you can make asset allocation decisions based on award winning research. I’ll give you the signals–it’s up to you to decide whether to go on offense (i.e., add exposure to risky assets such as stocks when risk is “on”) or play defense (i.e., lean toward more conservative assets such as bonds/cash when risk is “off”).