xijian

Founded in 1991, RADCOM (NASDAQ:RDCM) is a company that provides a network quality assurance platform for telecommunication operators and communication service providers (CSP).

All-time share performance has been disappointing since going public in 1997 at a price of $45.5. The stock initially performed quite well, hitting all-time high of $78 during the dot-com boom in 2000. However, share price has plunged and has been trading under $20 price level for most of the time since then. RDCM has gained some momentum as of late despite the recent pullback. Over the past year, the stock had actually been up over 20% and reached $11.8 per share until April, when it ended up seeing a correction to $9 price level upon the news of its recently-appointed CEO, Guy Shemesh, stepping down. The stock remains at the same price level today, though the stock is still up over 18% YTD.

I rate RDCM a buy. My 1-year price target of $10.7 projects over 13% upside. I believe RDCM will continue to benefit from secular catalysts and a solid positioning in the 5G network monitoring market. The recent pullback also provides attractive entry point.

Financial Reviews

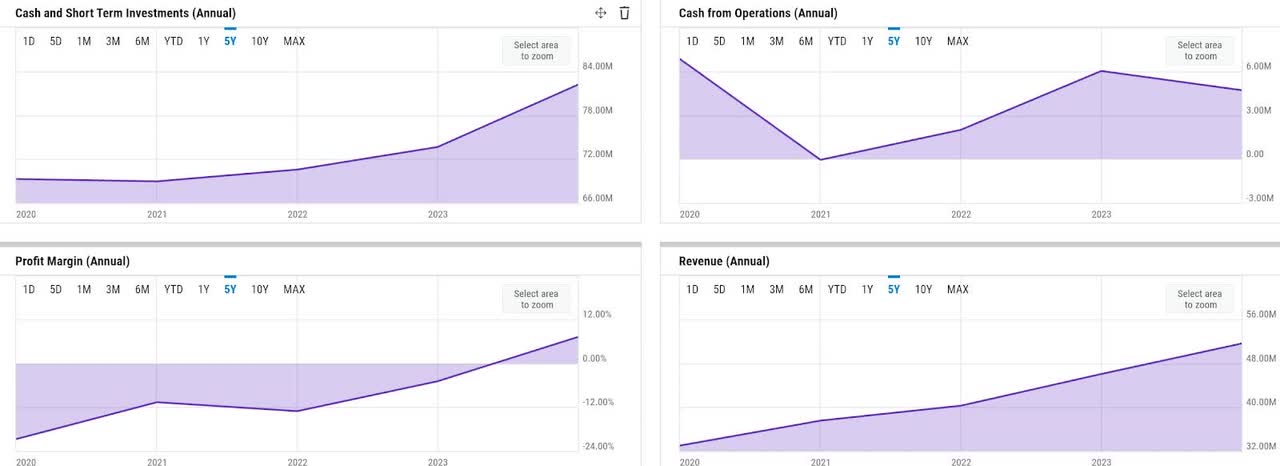

Fundamentals are relatively decent. Excluding 2021, when RDCM saw weakness in its LATAM business, revenue growth has been relatively steady above 12% in recent times. In FY 2023, RDCM delivered $51.6 million of revenue, an over 12% growth YoY. RDCM also reached breakeven in FY 2023, with GAAP net margin expanding to over 7% in FY 2023. Having been unprofitable every year for the past five years, the breakeven in FY 2023 would be a milestone year for RDCM.

Though operating cash flow (OCF) generation has declined to $4.7 million in FY 2023, it has overall been on an expansion since 2021. More importantly, RDCM appears to have demonstrated a good capability to sustain its own operations. RDCM’s liquidity has expanded over the past five years, and it has not once relied on external financing over the same period. In FY 2023, RDCM’s liquidity stood at over $82 million. Given the very minimal CAPEX needs every year, I would consider RDCM to be at a relatively solid liquidity position today.

Catalyst

I expect RDCM to continue to benefit from the secular 5G trends in 2024 and beyond. Overall, this will help increase demand for its offering. RDCM is well-positioned to capture this opportunity, in my opinion, due to its strong products and market-leading reputation it has gained through its success in landing blue-chip CSP clients.

In Q4 earnings call, the management indicated that RDCM will continue to embrace AI to enhance network monitoring quality to help deliver better 5G service assurance:

As they adopt next-generation cloud technology to optimize cost and roll out 5G, the current macroeconomic landscape presents new opportunity for RADCOM, a leading global cloud-native assurance solution. We continue to enhance our software with additional automation, analytics and intelligence and AI-based capabilities to bring value and expand use cases for our customers as the adoption of the 5G technology progress.

Source: Q4 earnings call.

Service assurance is a mission-critical activity for CSPs, since it serves as the basis for various key aspects of the core business, such as network efficiencies, SLA (service level agreement) compliance, or even monetization strategy, in my opinion. Given the rise of 5G adoption, many CSPs will need to focus on developing a new kind of service assurance capability that is different from the existing ones. As highlighted by an article by TMN, 5G service assurance needs to be more “contextual”:

Contextual service assurance in a 5G network refers to the ability to monitor a horizontal infrastructure running multiple service types that can be dynamically requested, scaled and terminated. This network will also handle such extremely large data volumes – both in terms of customer traffic and network signaling. Traditional service assurance tools and the manual oversight by engineers of the network in the operations center will be neither practical nor possible.

Source: TMN.

As such, I believe the AI integration should create value for RDCM not only because it helps improve operational efficiencies through monitoring cost reduction, but also due to its potentially stronger capability to automatically identify troubleshoot opportunities.

There is also a clear reason why CSPs would consider RDCM’s offerings as a platform of choice, in my view. RDCM remains as a leader in this space, in my view, given its track record of working with blue-chip CSPs around the world. AT&T, Dish, and Rakuten are RDCM’s customers today, while Vodafone has recently been added to the client base in FY 2023. Most recently just over the past week, Rakuten extended its multi-year partnership deal with RDCM, which speaks volume about RDCM’s competitive positioning in the space.

Risk

Though business risk may seem minimal, I see idiosyncratic risks, such as the recent management shakeup, to remain as a risk factor investors need to monitor. Just two months after RDCM announced the appointment of Guy Shemesh as CEO in the Q4 earnings call in January, Shemesh stepped down, citing “personal reasons”. Shortly after, RDCM saw almost a -10% pullback.

Though the exit motivation remains unclear and may not be made public, I believe there could be two potential risk factors that investors need to keep in mind before dipping in today. First off, if any, an abrupt exit at the executive level may potentially indicate bad culture that could lead to long-term underachievement. Secondly, the absence of a key leadership figure at the top could indicate a period of instability ahead.

Valuation / Pricing

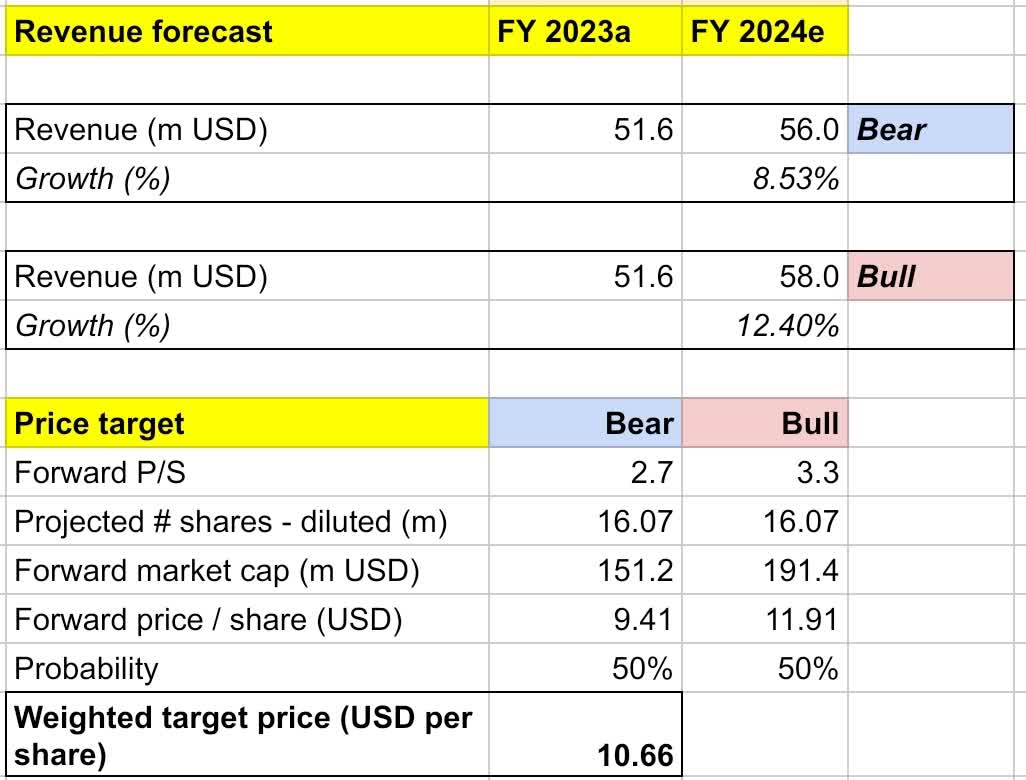

My target price for RDCM is driven by the following assumptions for the bull vs bear scenarios of the FY 2024 projection:

-

Bull scenario (50% probability) assumptions – I expect RDCM to achieve an FY 2024 revenue of $58 million, a 12.4% growth YoY, in line with the market’s estimate. I assume a forward P/S to expand to 3.3x, implying a share price appreciation to $11.9. In this scenario, I expect the market to value RDCM higher as it makes meaningful progress in the next few quarters, effectively demonstrating capability to still deliver outperformance even after the recent management shakeup.

-

Bear scenario (50% probability) assumptions – RDCM to deliver FY 2024 revenue of $56 million, an 8.5% YoY growth, missing the market’s estimate slightly. I assign RDCM a forward P/S of 2.7x, projecting a sideways price action around the $9 range, where it has been since the 10% pullback in April.

own analysis

Consolidating all the information above into my model, I arrived at an FY 2024 weighted target price of $10.7 per share, projecting an over 13% 1-year gain from the current price of $9.45. I would rate the stock a buy. I believe risk-reward remains quite attractive at present. I would also disclose that I applied a more conservative approach in my projection, assuming a 5% increase in share count, a lower bear-case estimate, and a 50-50 weighted probability despite seemingly attractive secular catalysts at present.

Conclusion

RDCM is a leading company in the 5G network monitoring software space. Its platform’s capability to deliver better 5G service assurance appears to be proven by its blue chip CSP client base, which includes AT&T, Dish, and Rakuten. Moreover, Rakuten’s recent renewals further validates RDCM’s solid competitive positioning. The management shakeup as of late has presented a bit of a potential downside risk, since it could lead to a period of instability. This has caused a pullback, which also resulted in a buying opportunity, in my view. At $9.45 today, the price remains attractive. I set a 1-year target price of $10.7, projecting over 13% upside. I rate the stock a buy.