mohd izzuan

Written by Nick Ackerman, co-produced by Stanford Chemist.

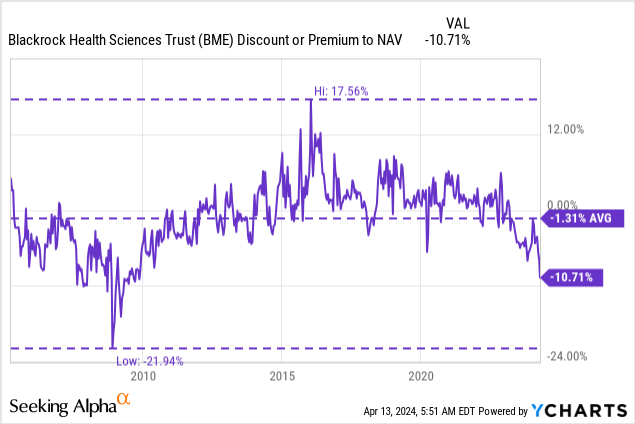

BlackRock Health Sciences (NYSE:BME) was a closed-end fund that had regularly enjoyed trading at premiums throughout most of the last decade. Over the last year, that began to change, and a discount started to open up. That includes our prior coverage, where the discount was pushing closer to 6%. Today, the discount has blown out even wider – to discount levels we haven’t seen since the Global Financial Crisis.

There has been some market volatility recently, as can be seen by the VIX, which is starting to show signs of life. However, as BME is a healthcare-focused fund that writes covered calls, it’s likely one of the more stable funds to consider in terms of its underlying portfolio. The fund targets an overwrite of 30 to 40%, with the last fact sheet showing the overwrite at nearly 34%.

Given the discount has opened up even further, and I thought it was a ‘Buy’ previously, I’d still be a buyer here.

BME Basics

- 1-Year Z-score: -3.17

- Discount: -10.71%

- Distribution Yield: 6.65%

- Expense Ratio: 1.07%

- Leverage: N/A

- Managed Assets: $590 million

- Structure: Perpetual

BME’s investment objective is “total return through a combination of income, current gains, and long-term capital appreciation.” They will attempt to achieve this by a pretty simple investment policy – “under normal market conditions, at least 80% of its assets in equity securities of companies engaged in the health sciences and related industries and equity derivatives with exposure to the health sciences industry.”

What’s Ailing BME?

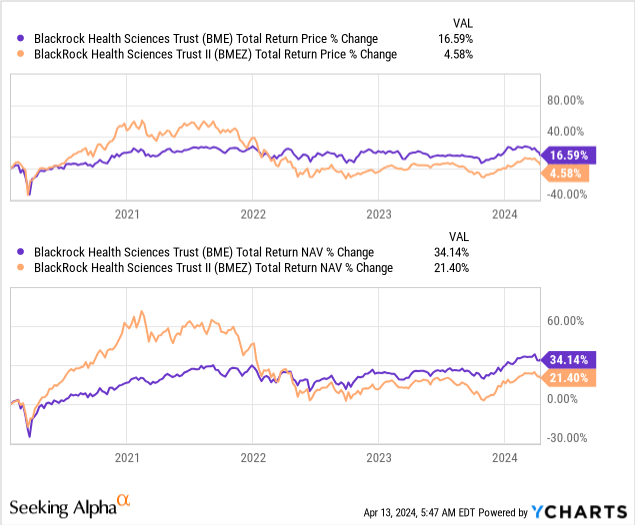

Being a healthcare fund and writing covered calls should make this fund relatively more stable. This is more traditional healthcare in the sense that it is larger and more mature players. There isn’t a heavy focus on biotech, which is something that its sister fund, BlackRock Health Sciences Term Trust (BMEZ), focuses on. That makes BMEZ much more volatile than BME. Of course, with more volatility comes more risks for substantial losses, but the potential is also for higher returns.

BMEZ has a relatively short history compared to BME, given BME’s inception goes back to 2005. BMEZ is also a term fund, while BME is perpetual. These are two funds we compared in more detail in the past.

That being said, at one point, BMEZ outperformed BME quite handily during the 2020/2021 speculative bull market run. During that period, you could throw money at anything speculative that made no profits, and it would work out.

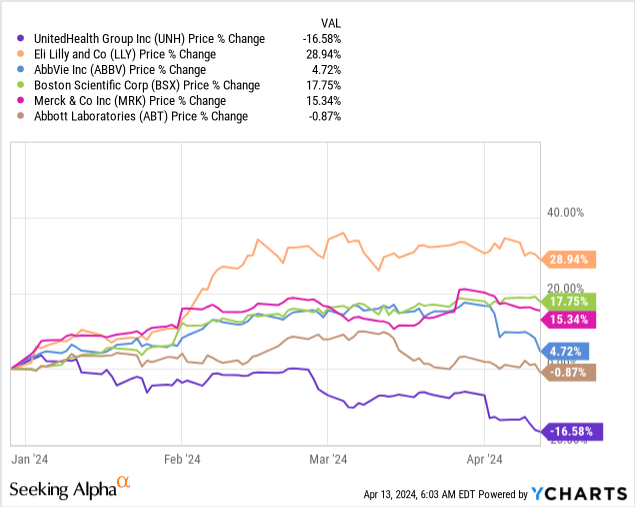

Ycharts

BME’s portfolio might not be invested in a ton of speculative names, but that doesn’t mean that there can’t be losses in BME’s portfolio. The NAV has been declining while the fund’s share price is dropping faster, so the fund is currently dropping to an extremely wide discount. The pace has been quite rapid, and that is what has pushed BME’s 1-year z-score to over -3, which indicates that it is quite oversold at this point.

For this fund, a double-digit discount is quite extreme, as this is an incredibly rare event overall. The fund has averaged only a shallow discount of about -1.3% over the fund’s entire life. A discount at this level hasn’t happened since going back to the Global Financial Crisis.

Ycharts

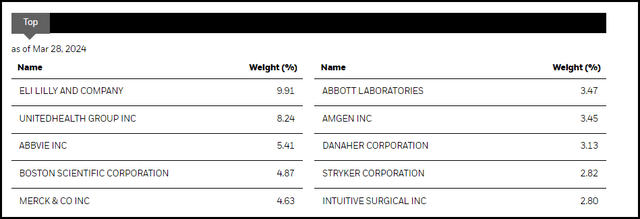

One of the names putting pressure on the NAV is UnitedHealth Group (UNH), which was BME’s largest holding and has now dropped to its second-largest holding. At the end of March, it was still a meaningful allocation, accounting for over 8% of the fund. That is a relatively heavy weight when compared to the next largest holding, AbbVie (ABBV) and its 5.4% weight.

BME Top Ten Holdings (BlackRock)

UNH has been facing several pressures that have been pushing its share price lower. In February, a cyberattack hit the company’s subsidiary, Change Healthcare. That company was only acquired by UNH in late 2022. Moody’s noted that it was a “credit negative” for the company, but never seemingly downgraded its credit, at least not at this point.

Shortly after that, the DOJ announced that it was launching an antitrust review of the company. More recently, it was noted that insiders were selling ahead of the DOJ probe being made public, which may have already been previously planned for sales. Either way, it is a terrible look for the three senior executives.

Finally, in early April, it was announced that Medicare Advantage payments were only getting a small payment increase of 3.7%. That hit shares of UNH, plus all the other major health insurance companies.

So, this company has been facing a number of bad news headwinds. Subsequently, the share price of the company has reacted quite appropriately and declined quite sharply on a YTD basis.

Below, we can see that for what UNH is failing; we have a positive performance from its peers who are also in BME’s top ten holdings. That’s one benefit of the diversified portfolio playing out.

Ycharts

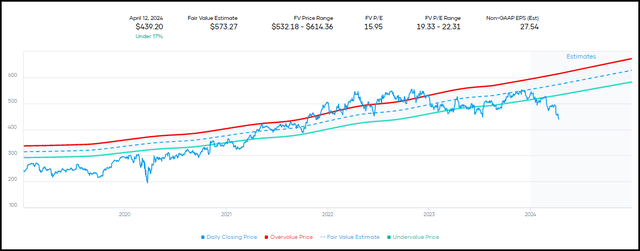

Interestingly, though, analysts are still expecting UNH to continue to see earnings growth going forward. The earnings revisions have moved lower more recently, but UNH is expected to still see EPS grow 9.6% this year, followed by 13.05% in 2025. Revenue is expected to grow by nearly 8% in the next two years.

So they are clearly expected to navigate through this tough period of time and with the price drop, the shares have just become cheaper.

UNH Fair Value Estimate (Portfolio Insight)

BME’s Distribution

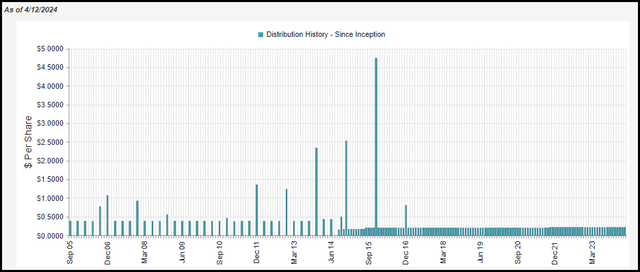

One of BME’s bragging points is that the fund has never cut its regular distribution since its inception. Only a handful of CEFs have been able to make that same claim, with an inception prior to the GFC.

BME Distribution History (CEFConnect)

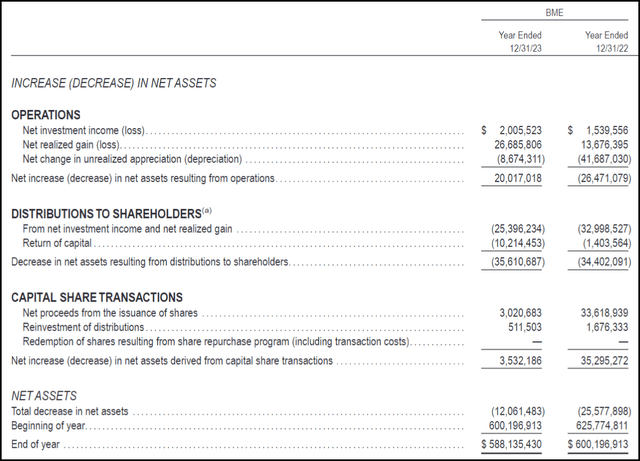

The fund will heavily rely on capital gains to fund its distribution. This is not unusual for an equity fund or one that writes covered calls. Net investment income coverage in 2023 came to just 5.63%.

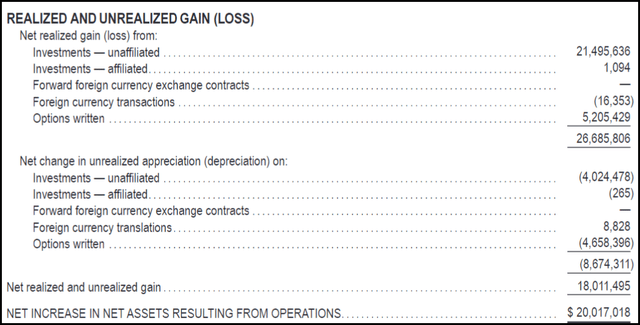

The covered call premiums helped to contribute $5.205 million in realized gains for the fund in 2023, which is quite a meaningful amount to contribute to the coverage of the payout.

BME Realized/Unrealized Gains/Losses (BlackRock)

However, with the NAV moving lower, it does suggest that capital gains could be harder to come by. If we are set for a market correction that lasts an extended period of time, then that is certainly a worry. With that being said, the fund’s current NAV rate is currently under 6%. That is nowhere near a red flag in terms of worrying about a payout cut.

In my opinion, that’s not even near a yellow flag zone where there should be any caution at all for a distribution cut. The fund has a lot of room to move lower, with unrealized appreciation in the portfolio at nearly $177 million at the end of 2023.

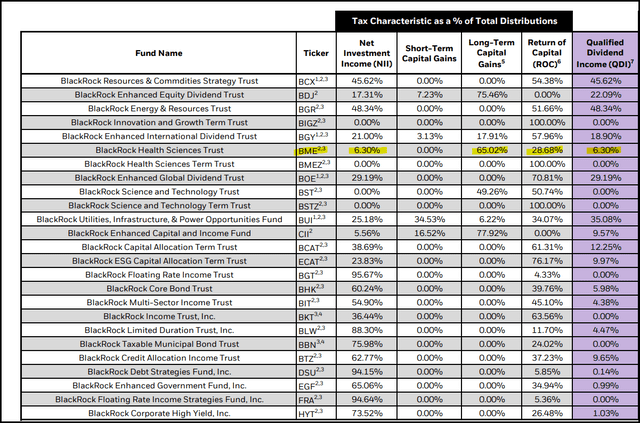

For tax purposes, the fund has generally characterized the distribution primarily as long-term capital gains and qualified dividends. That’s tax-friendly and makes it likely appropriate for holding in a taxable account.

BME Distribution Tax Classification 2023 (BlackRock (highlights from author))

For 2023, we even see some return of capital in the distribution, which can also be beneficial for deferring tax obligations as it reduces one’s cost basis. Some of the ROC was destructive in 2023 as healthcare didn’t perform the greatest, and that weakness also showed up in BME with a 3.5% total NAV return for the year.

That said, ROC is not a common classification in the fund’s distribution either, so over the long term, one probably shouldn’t rely on that tax-deferred component.

Conclusion

Being that it is a diversified healthcare portfolio and the fact that UNH should navigate through this difficult period combined with BME’s historically wide discount make BME an even more interesting opportunity now.