iantfoto/E+ via Getty Images

Introduction

Distribution Solutions Group (NASDAQ:DSGR) has quickly come up on the radar of more investors, and rightfully so. Run by CEO Bryan King, who has a lengthy investment management background, via a number of acquisitions in addition to their Lawson merger in 2022, the team has added a good amount of value to the business via M&A since their merger.

Adjusted for the stock split, the stock is up ~75% on a 1-year basis and is now beginning to trade at a level more appropriate for their future prospects. Still, I think investors can earn reasonable returns-on-capital at today’s share price of ~$35. Looking ahead, there are a number of internal opportunities, DSGR has to grow the business via cross-selling and the associative operating leverage. With a little potential help from a macro rebound in some verticals, we could see EBITDA grow materially over the coming few years.

Lawson: Positive Outlook

Lawson posted Q4 sales growth of 1% to reach $110M, all of which was organic. For those who are new, Lawson, which operates through different brands, is an MRO distributor in the U.S., distributing mostly fastening equipment, fluid power items, auto supplies, and then a tail of other various products their customers use. Those customers include manufacturers, auto repair shops, government/military and then a tail of others. Specifically, their auto repair business is tied to their Kent Auto business, which distributes products to aftermarket repair/collision shops.

As they noted on the call, their Kent Auto business grew as did their government/military business, but this was offset by declines in their core business, which refers to their non-strategic accounts. Full-year growth benefited from price, but that wasn’t attributed to Q4 growth, so if anything, we can probably think of it being a small contributor in Q4.

The auto business actually might have taken market share. If we look at LKQ Corp. (LKQ), their North America wholesale business posted mid-single-digit organic growth in Q4. However, Lawson isn’t entirely comparable to an LKQ, as LKQ sells more auto-specific parts whereas Kent Auto is selling tools used in the repair operations. To this end, seeing AutoZone (AZO) report roughly flat domestic same-store sales in Q2 FY24 and Advance Auto Parts (AAP) report a low-single-digit comparable store decrease in Q4 2023 suggests that perhaps Lawson is indeed outperforming the market today. On the call, too, they reported their Kent Auto business signing on new customers while also growing wallet share with their existing customers.

For the rest of their business, which is largely manufacturing and construction after government/military and auto, it’s not unreasonable to think that they’re battling macro headwinds. Fastenal (FAST) pointed out softening manufacturing business, and the manufacturing PMI was sub-50 up until the start of 2024. This was something Grainger (GWW) called out in mid-2023, too. If we turn to Wesco (WCC), they’re reporting declines in their construction exposure in Q4 2023.

With that context, let’s zoom out. Attractively, the Lawson business has consistently grown pre-COVID, growing high-single/low-double-digits per annum. While yes, there were acquisitions in both 2018 and 2019, neither of those contributions seem to have been big enough to really change that growth rate much. So, it looks to me like they run a competitive operation.

There’s some material ongoing internal change happening within Lawson that needs to be considered going forward (and which partly explains today’s results). As they noted on the Q3 call, they’ve been adding accounts reps and inside sales reps to their Lawson business throughout 2023. Understandably, then, this has resulted in more exposure driving more business they convert leads. Now, as pointed out, their net headcount was down year-over-year as the aforementioned additions reflect more reorganizing of their reps than additions.

It certainly has resulted in a more productive average sales rep, obviously. And they’re rolling out a new CRM in the first quarter of 2024 to increase efficiency. As Bryan laid out on the call, they’ve evolved from thinking they need to grow the business by adding more feet on the street to now focusing on growing wallet share, essentially. Because of this, they’ve reduced their sales force focus on those customers, and have instead shifted to adding support behind outside sales reps to start growing sales per customer. Consequently, I’m not surprised then to hear they’re growing wallet share at their auto accounts – this would be a natural consequence.

This conversation then dovetails into margins, obviously. In Q4, Lawson posted 11.3% segment EBITDA margins, up from 10.7% in the prior year. Contributing to this was an improvement in their operating leverage, not because units increased – evidently, they were consistent with last year – but because they took costs out – recall headcount being down, net.

Over time, there should be some natural margin leverage. As we addressed above, if it’s the case that they’ll be attempting to now grow sales per customer more so than by signing new customers, that should result in material leverage as you don’t really need to add any costs for that incremental sale. Yes, they’ve had to add some costs – inside sales support – to support this growth initiative, but that’s mostly behind us now, per my understanding. I.e., Q4 costs reflect that support/cost burden.

So, assuming today’s softness in certain verticals is indeed market related and not a competitive issue, to the extent then that they can start capturing increased sales per customer, today’s low-teens margins should grow. They’ve historically talked about high-20% incremental EBITDA margins for Lawson, which is also what they confirmed on the call, and this doesn’t at all appear unreasonable.

Lawson earns a mid-50% gross margin, so assuming those costs are variable (of which not all, but most, will be), and that they can leverage half of their opex base, which isn’t unreasonable considering that you don’t have to add a new salesperson or G&A cost to sell 10% more per customer, I can indeed see then posting mid-20% incremental EBITDA margins.

Today’s $110M in Q4 sales are lower than normalized given the fewer selling days in Q4, so this translates into something like $465M in annual run rate revenue. Adjusted for that, something like a 14% EBITDA margin would make sense. Should sales grow at ~6% on average, they’d be posting sales of ~$550M in FY26. If they earn an incremental 25% margin on that, that would imply EBITDA of ~$86M.

Gexpro Services: Temporal Headwinds

Their Gexpro segment is a little different from Lawson. Whereas Lawson is distributing various C-class MRO parts, Gexpro distributes manufacturing parts – think machining equipment, bolts, o-rings, etc. Via 2,800 supplies, they’re serving around 1,900 different customers – about ¾ of their sales are in the U.S. – with many of their customers being renewable energy tied manufacturers – think turbine and solar panel manufacturers – industrial power, transportation, and then a tail of other verticals. General Electric (GE), for instance, is one of their key customers, representing over 20% of sales per comments at their Investor Day, with their top 20 customers representing 75%.

Gexpro posted a revenue decline of ~7% to ~$92M, all of which was organic. Sales were down from lower project-based renewables demand and then their semiconductor vertical. The rest of their business increased over 6% with industrial power and non-project renewables business growing. Regarding the renewables vertical, the dichotomy tends to revolve around the value-added services – that is, the reduced project work refers to performing fewer value-added projects like kitting, for instance.

Consistent with their non-project work, in Q4, GE’s pointing to higher renewable energy sales from increased wind turbine sales after a soft 2022. Now, Gexpro is tied to production and not what GE delivers (recognized as a sale), so it’s not a perfect proxy, but it’s a good read. Notably, though, GE’s expecting renewable to see growth in 2024 per their Investor Day comments. Although, SP Global actually has solar panel demand declining in 2024.

As for their semiconductor vertical, where revenues were down 50% for the year, I’m not really seeing this in the public data. I’m seeing third-party reports that semiconductor sales were down during 2023, but that the second half of 2023 reported positive comps. Indeed, TSM reported sales down 1.5% in Q4 and NXP reported low-single-digit sales growth in Q4. So, maybe they’re losing some share, maybe not – it’s hard to tell.

They called out destocking in general, so that may be contributing to the outsized changes. The history of the business, however, would suggest share losses are probably unlikely. Not only do they provide end-to-end solutions to multinational companies like GE, which implicitly validate their competitiveness, but their customer retention is 98% (per comments at their Investor Day). Also, at their Investor Day, they provided an anecdotal example of a customer of theirs requesting more and more programs with Gexpro, which I wouldn’t find consistent with a structural ROI issue.

They also talked about the benefit from cross-selling into Resolux’s and Frontier’s customers, both acquired at the beginning of 2022. Resolux had 7 OEM customers that Gexpro didn’t have (3 at the time) so by combining them and adding Frontier, this (1) expanded their product breadth and (2) added new customers to cross-sell into. And they took advantage of them – their win rate for product packages nearly tripled thanks to this all-in-one value proposition (again, Investor Day data). So, it’s hard to think they’re losing market share – they should instead be taking market share today.

Margin-wise, they posted 9.5% segment EBITDA margins, down from 10.8% in the prior year. They called out pricing contributing to Gexpro’s growth in mid-2023, but nothing since then, so it’s unlikely there was any material headwind or tailwind here. We know, however, that operating leverage was a headwind with their unit volumes down – outside of product and transportations costs, there’s a good amount of labor utilization, both in terms of sales reps and in terms of technicians providing services. And then mix was a headwind too as their tech/semiconductor vertical, which carries higher margins as noted on the call, declined faster.

Looking ahead, there’s a similar margin growth opportunity here. We can see the leverage inherent in the business – they posted 11.3% margins on $104M in sales in Q3, for instance – but consider the aforementioned comments about offering larger packages to customers – to the extent they’re winning more of these than before – i.e., growing sales per customer – that should be capturing high incremental margins. And not only that, but mix should improve per what I think are more macro issues than competitive within their semiconductor vertical.

So, today’s $92M in sales translates into around $380M annually adjusted for Q4 seasonality and ~10% EBITDA margins. Maybe they see demand worsen a little further in 2024 – they’ve seen a material improvement in their renewables book-to-bill rate – but these are all GDP+ end-markets in terms of production, so post-trough growth should be closer to mid-single-digits. Then there should be some uplift from cross-selling. Running similar math as earlier, should they grow at 5% over the next 3 years, that’s FY26 sales of ~$440M. Gexpro earns just under 30% gross margins, so between natural labor utilization and improved mix, perhaps 20% incremental EBITDA margins are OK – under this scenario, they’d be posting sales/EBITDA of ~$440M/~$50M.

Over time then, if it’s just macro related, they should grow as the end-markets grow – these are all GDP+ growers. They could soften in the coming year (2024) and that is a near-term risk per the aforementioned GE outlook, but management, however, isn’t really pointing that right now, so it’s not really clear there’s imminent softening.

TestEquity: Near-Term Questions

TestEquity is similar to the other 2 segments in that they too serve as a distributor, but as one would infer from the name, they get more into test and measurement equipment and related supplies (among other ancillary products). They actually have their own line of test chambers manufactured in-house, which they’ll both sell and rent. They sell to a variety of manufacturing operations – aero, defense, semiconductors, electronics manufacturing, etc. – with 85% of sales generated in the U.S. Indeed, there’s overlap with manufacturers that Gexpro sells to. Aero & defense and electronics manufacturing represent about 60% of sales.

Q4 revenue increased over 80% to ~$191M, which included ~$97M of Hisco sales – excluding that, and organic sales were down ~11%. Unpacking this, there were certainly some market headwinds. First, they reported some destocking happening at their customers as noted earlier – something observed more broadly – so that’s exaggerating the comp.

But second, here too, there were probably some macro headwinds. Recall that this is higher-cost equipment – these are big, bulky machines in some cases; it’s not entirely MRO type of product that they sell within Lawson, although there is some. As such, there’s a degree of discretionary-ness in here such that if demand is weaker, they can defer purchases a la a consumer deferring a new car purchase when budgets tighten. To this end, this data speaks to global trends whereas most of their customers are U.S. based, but it’s not surprising to see that versus 2022, electronics manufacturing is indeed softer, so you can imagine some customers are deferring spend.

Now, per our work on AstroNova (ALOT), the aero & defense side of the business is seeing higher demand levels with total commercial plane production being higher, but that’s not what they’re reporting – they’re reporting softness here from equipment deferrals. I suppose there could be some deferrals from increased uncertainty in general, but they admit on the call to losing market share by not taking down prices to levels offered by their competitors who were liquidating excess inventory. They didn’t point out a specific product line or vertical behind this, but either way, it’s contributing to their sales decline.

Also, my sense is that it’s indeed a temporal problem. Unfortunately, it’s a bit hard to get any read on market share, structurally speaking, because there aren’t any good comps. But we can see that after posting sales growth in 2021, they posted organic growth of ~12% in 2022, so that wouldn’t be consistent with share loss. At their investor day too, they talked about having various customers pull them into other regions, something we’d unlikely see if they were losing share because of an inferior ROI.

Similar to the other segments, they should’ve been benefiting from cross-selling following the acquisitions completed in 2022. Similar to Gexpro, there’s not much opportunity to cross-sell TestEquity’s range of products into their other segments – maybe a little overlap with Gexpro – but there is some opportunity intra-segment. Indeed, this is something they’ve called out as happening.

Additionally, now that they’ve acquired Hisco (mid-2023), which provides fabrication services, specialty materials, repackaging solutions, etc. to manufacturers, they have more opportunity. Hisco effectively has filled out their product lineup for those customers, particularly the manufacturing phase, and even gives them more chemicals solutions that they can cross-sell into some of their other OEM customers who deal with chemicals.

And this’ll boost margins too. They posted 6.2% segment EBITDA margins, down from 9.9% in the prior year. It certainly could be that they brought their prices down a little to be more competitive, but evidently, they didn’t bring them down enough, hence the share loss, so it’s hard to infer there was too much impact here. And there might have been a mix headwind too as they called out fewer capital projects specifically and added Hisco (low-7% margins).

The bulk of the degradation, however, was from operating deleverage, which obviously resulted in less labor utilization via sales reps, service reps, back office staff, and warehousing fixed costs. Concurrently though, going forward, they’re starting to rationalize the two businesses which is going to result in duplicate cost elimination. They expect to eliminate ~$10M in annual costs, which only began in Q4.

All in all, today’s $191M amounts to ~$800M annually when adjusted for Q4 seasonality. If it’s true that today’s issues are macro-driven and not a competitive issue, considering the GDP+ nature of these verticals plus cross-selling opportunities, mid-single-digit sales growth is achievable here too. That would take that $800M to $925M by FY26. With a low-teens incremental EBITDA margin, cost eliminations, and mix improvements, I estimate they could be earning ~$75M in EBITDA by FY26.

Valuation: Compelling

We haven’t talked about capital allocation, but that’s a bright spot. None of this is too surprising either – the business is run by a team with an extensive background in the investment management business, so they know how to think about valuations. E.g., They paid just over 7x trailing EBITDA for their 2022 cohort of acquisitions, which per my math, works out to something like a 10-12x NOPAT multiple (after SBC, tax, and capex) given the relatively low capex intensity. Obviously, this is rather attractive considering the post-acquisition synergies we expect them to realize too, thus leading to low-teens+ IRR.

They just paid $267M for Hisco in mid-2023, which also came at an attractive multiple. On a trailing basis, they paid around 9x EBITDA, which amounts to something like 16x NOPAT by my math. And here again, they’re going to pick up a number of synergies, which are going to bring this multiple down materially.

There’s always the risk that an acquisition pans out poorly, but I think this risk is mute over time given a large enough sample of M&A. Assuming they can keep making acquisitions then going forward, they deserve a premium FCF multiple. What would constrain them here isn’t the number of targets, but those are willing to sell at attractive valuations.

The biggest risk, I think, to their valuation is just timing with respect to macro-related headwinds. I.e., Should present persist longer-than-expected, that’ll obviously bring down their intrinsic value. There’s also the possibility though that their present TestEquity competitive intensity is more structural rather temporal. And there’s also the execution risk – it’s not a guarantee that their internal salesforce or cross-selling initiatives are successful. Both of these are very unlikely, but risks nonetheless that one should be mindful of.

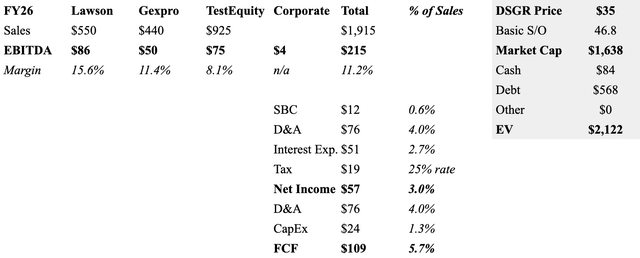

Added all up, per what I laid out earlier, here’s what I get:

Net then, they’re currently trading at ~15x my estimate of FY26 FCF.

How to value this? Well, if we assume that all cash goes to shareholders via dividends and repurchases, I would say something like a 20x FCF multiple is justifiable – that would imply long-term earnings growth of mid-single-digit which is seemingly achievable with their operating leverage.

However, DSGR breaks my typical valuation method of valuing businesses on organic growth because they’re going to keep pursuing M&A. To this end, though, if they can keep redeploying most of the FCF into M&A at the returns they’ve been achieving over time, a multiple higher than 20x FCF is warranted. E.g., if they post an average of $70M in cash annually or $210M over 3 years, and redeploy $200M in M&A at mid-teens IRR, they could certainly add something like $15-20M in FCF annually growing alongside the business. $17.5M at a 20x FCF multiple would amount to incremental $350M in value by FY26, not $210M.

So, the way I’m thinking about this one is to take what I think they’ll organically earn in FY26 – ~$109M – and ascribing a premium multiple that I think reflects their fundamental organic outlook plus likely M&A upside over time. To this end, then, a multiple between 20-25x – say, 22.5x – looks reasonable. 22.5x $109M gets me to a market cap of ~$2.45B – add in the cash generated in the interim of ~$200M thereabouts, and discount that sum back 3 periods gets me to a fair value today of ~$42/share.

Conclusion

Put together, DSGR offers a compelling opportunity today at their current prices. Once we get past some of the macro headwinds, and they start layering on internal sales rep growth and cross-selling, they should start to see more material growth. Coupled with their internal opportunities to grow margins and intelligent capital allocation deserving of a premium multiple, it’s conceivable that DSGR ends up a materially bigger business than today and worth a lot more.