Uranium Energy made an aggressive bet on uranium prices that has worked out well, but it is still a very high-risk investment choice.

Stock investors usually have some financial goal in mind. A frequent one is to become a millionaire. Sometimes these investors get so locked into the idea of finding that one stock that will make them “rich,” preferably as quickly as possible, that it blinds people to the inherent risk of investing.

If you’re looking at Uranium Energy‘s (UEC -1.22%) big stock run over the past year and thinking that it could mint some new millionaires (including you), you need to stop. Selling uranium has a long history of being a tough business.

Uranium Energy makes a wise choice

Uranium Energy sells uranium. What’s notable is that, at this point, the company doesn’t mine for the nuclear fuel at the moment. Instead, management made what looks like a genius move, at least in hindsight, to ink agreements to buy uranium while it was priced near historic lows. It now has a large stockpile of the fuel that it can sell at a profit, since uranium prices have increased notably since it started buying.

Image source: Getty Images.

The decision to buy uranium while others were, effectively, selling makes Uranium Energy’s management team look extremely good. The profits it makes from this activity can be used to fund its capital investments in actual uranium mines. In a big-picture sense, it has found a way to self-fund its own growth. It is hoping to reopen a mine in August, which, at that point, would be its only operating mine asset. But it has a handful of mine projects spread across North and South America, so there is a larger development opportunity ahead. Assuming Uranium Energy can get all of those mines up and running it will be a big player in the uranium space.

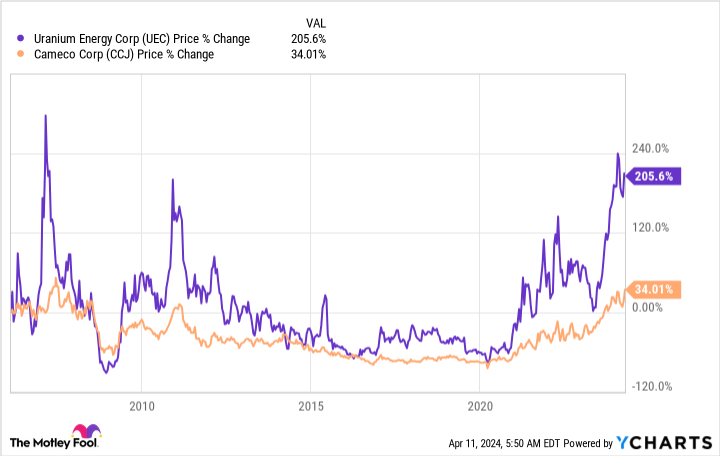

Based on this backstory, it is understandable that some investors might see Uranium Energy as a diamond in the rough — a stock that could turn a small investment into a huge one. Indeed, over the past year, the stock has gained a huge 151%. But step back for just one second before you jump aboard with dreams of becoming a millionaire.

What happened to uranium?

The first big issue to consider is that uranium is a commodity. Just like other commodities its price can be very volatile. There are a lot of reasons to like the outlook for the uranium market, most notably that nuclear power doesn’t emit carbon. In other words, it can provide clean baseload power to supplement variable renewable energy sources like solar and wind. In a world that is shifting away from carbon-based fuels, that backstory is attractive.

The problem is that nuclear power has a bad image. It is often viewed as dangerous. First off, the radiation involved bothers people. But the really big problem is that accidents at nuclear power plants are usually large, newsworthy events. Think Chernobyl or, more recently, Fukushima. Fukushima is a great example of what can happen to the uranium market after headline-grabbing bad news.

The price of uranium, which had been starting to climb, plunged after the 2011 event, falling toward all-time lows. Countries around the world began to question whether or not nuclear power was worth the risk. Germany actually decided to start shutting down its reactors. It took more than a decade for uranium prices to recover to their 2011 levels. The shares of companies that mine uranium, meanwhile, followed the price of the nuclear fuel lower.

To be fair, that drop in uranium prices is what Uranium Energy took advantage of to build its low-cost uranium stockpile. But investors shouldn’t buy the stock thinking that the future is only going to see the stock price climb. If history is any guide, that isn’t going to be the case. And, frankly, it won’t take another nuclear plant accident to push uranium prices lower. As noted, uranium is a commodity, so supply and demand dynamics alone will likely keep the price of the nuclear fuel volatile. That, in turn, will result in volatile share prices for uranium stocks like Uranium Energy.

Is Uranium Energy a millionaire maker?

At the end of the day, Uranium Energy’s story is interesting. Perhaps it is even attractive, for those willing to take on more aggressive investments. But you shouldn’t view this as a way to get rich quick or even as a singular way to reach a seven-figure nest egg. The inherent volatility of commodities, and the added risks associated with the uranium market, suggest that Uranium Energy is a high-risk investment that will be prone to dramatic stock price swings. Maybe, as part of a much more diversified portfolio, it could help you become a millionaire, but taken alone there’s also the very real risk that it could leave you broke.