Eoneren

Overview

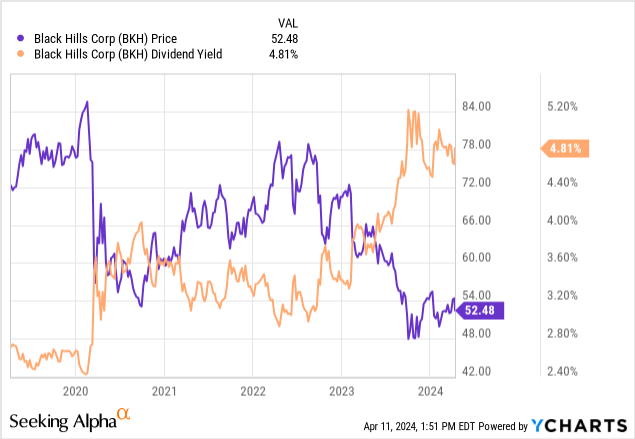

Black Hills Corporation (NYSE:BKH) is one of those quality dividend stocks that do not get enough attention. Perhaps the business sits in a ‘boring’ industry, so there isn’t an enormous amount of attention for it. However, BKH has always provided consistent growth, albeit slow at times, and has managed to reached dividend king status. The dividend yield is currently nearing 5% and the dividend has been increased for over 54 consecutive years. The 4-year average of the dividend yield sits closer to 3.7% and the drop in price has caused the yield to spike. I though this would be a good time to visit whether or not the current price of BKH serves as a good entry point for new investors looking to get a slice of some reliable income.

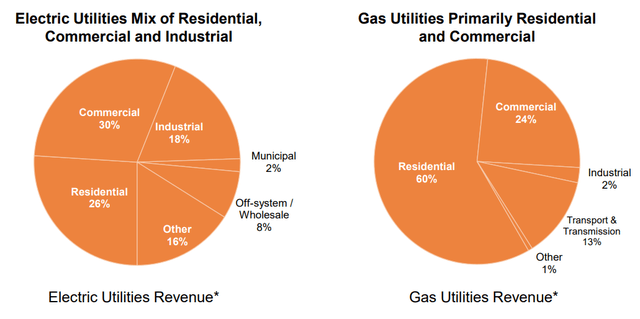

The Black Hills Corporation operates as a utility company that brings in most of their revenue from two main segments: Electric Utilities and Natural Gas. The company operates within the US throughout 8 states by providing the transmission, distribution, and generation of electric and gas utilities to the middle region of the country. South Dakota is where the company services the most business related to electric and Arkansas is where the majority of their gas business takes place.

There are many positive factors here with BKH and I think the stock has been negative impacted by the utility sector’s performance as a whole. BKH has successfully managed to increase liquidity and effectively manage cash during this unfavorable market cycle. Not only have they managed cash efficiently, but they’ve also continued to invest in future growth operations while simultaneously increasing their prices. I believe the company remains undervalued based on fundamentals and we have the opportunity to start a position in a dividend king at an attractive price.

Financials

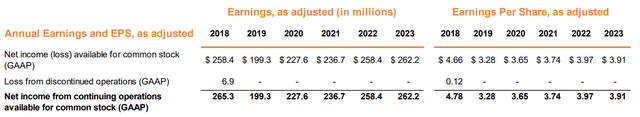

Black Hills reported their Q4 earnings in February and I think the results shows promise of growth due to an increased level of capital expenditure funding avenues of growth and the turn to more favorable market conditions eventually. Revenue for the quarter was down -25% YoY, amounting to $591.7M but this is overshadowed by the fact that EPS was reported at $1.17 per share and beat estimates. EPS results for the entire year came in at $3.91, which exceeds the estimated guidance range.

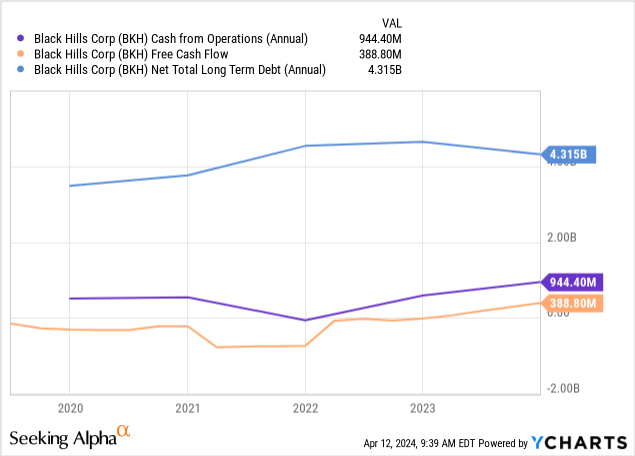

The high levels of inflation were something that BKH has had to deal with for the year but they managed to offset this with higher pricing rates and additional customer growth. You can tell when a company has successfully implemented pricing changes when the ending result in an increase in free cash flow alongside cash from operations. In addition, BKH has brought down their debt level from the prior year.

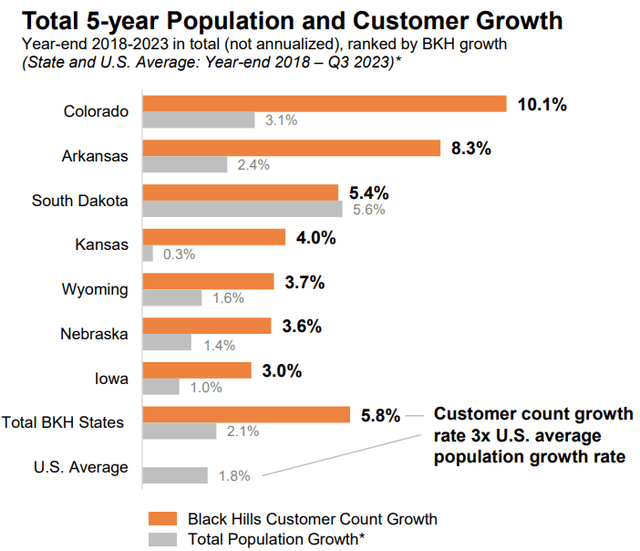

Changes in rates accounted for $0.58 worth of additional EPS growth while customer growth accounted for $0.06 worth of EPS growth. I will touch on this customer growth shortly, but I do think the pricing changes and customer growth are yet to see their full potential since I predict a population shift towards BKH’s areas of operation. We can see the consistent growth in net income and EPS since the pandemic ended. A growing net income and EPS during a time where the utilities sector underperforms is a strong testament to how well managed BKH is.

We can see that residential revenue from the gas segment is the largest slice of their revenue. We can also see that residential revenue accounts for 26% of the electric utilities segment. As the population growth in these areas commence, I predict that these slices of revenue will increase in size over time.

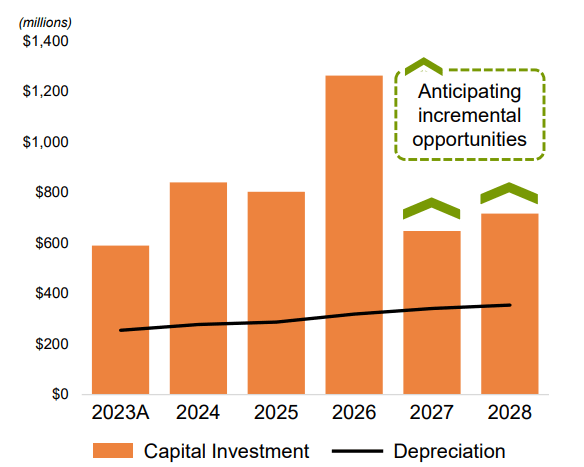

In terms of outlook, management has an expected long term EPS growth target between the range of 4 – 6%. BKH also plans to allocate approximately $4.3B through 2024 – 2028 in capital expenditures to contribute to future growth. Management has done a great job at laying out where these dollars will be allocated along the way.

First, there is an ongoing construction of Ready Wyoming 2060 mile electric transmission projected that will continue through 2025. Later on in 2026, these funds will go towards 100 MW renewable generation in South Dakota, aimed to be completed by mid 2026. These extra initiatives will ultimately grow revenues and increase profitability as they help better serve their customers.

BKH Q4 Presentation

We can see how their capital investment amounts spike in 2026 as they plan to take advantage of opportunities for growth. In my opinion, I feel there will be plenty of opportunity for growth because population is likely to continue growing at a faster rate in all of the areas they service. More population will directly translate to more demand which opens the door for increased opportunities for customer growth and operation expansion.

Catalyst – Population Growth

Sure, the regions that BKH operate in are cold and viewed as boring to people like me from densely packed city regions like NYC or Los Angeles. However, if housing is cheaper and jobs are available then people are likely to migrate there. Now, I could not locate any additional data to back my thesis here but let me make an attempt to convince you of this possibility by sharing a few relevant data points.

We can see the customer and population growth broken down by state above. While this data represents increases between 2018 and 2023, I think it’s very likely that we see these rates of population growth rise more aggressively given the current economic conditions. To start, let’s talk about how housing has become so incredibly out of reach for millions of people in medium to high cost of living cities. At the close of 2023, the median sale of a home in the northeast region of the US was $698,000. This is an insane increase of over 58% from the start of 2020 was the median home sale was only $441,000.

For reference, the current average monthly mortgage payment sits at $2,883 on a 30-year fixed mortgage. This is all while the median household income in the US is $74,580, before taxes. The math on this means that over the course of a year, the average family makes an average income of $74k and has to dish out an average annual amount of about $35k towards housing, 50% of their total gross income. This is even before we take the other major cost of living items into consideration.

As a result, this lifestyle of struggling is not sustainable in the long term. This housing crisis alone may cause these population growth numbers to spike in the middle region of the country. The pictures gets even worst when you consider the elevated interest rate environment we are in. The latest CPI report showed us that the costs for energy, food, shelter, and gas has risen.

If the economy ends up diving into a recession, I have no doubt that people will eventually take extreme measures to ensure their well-being, even if it means relocating to a less desirable and different part of the country. While the cost of living in this mid-region may also be elevated in relation to the norm, it can be seen as a cheaper alternative to the folks coming from states like California or New York.

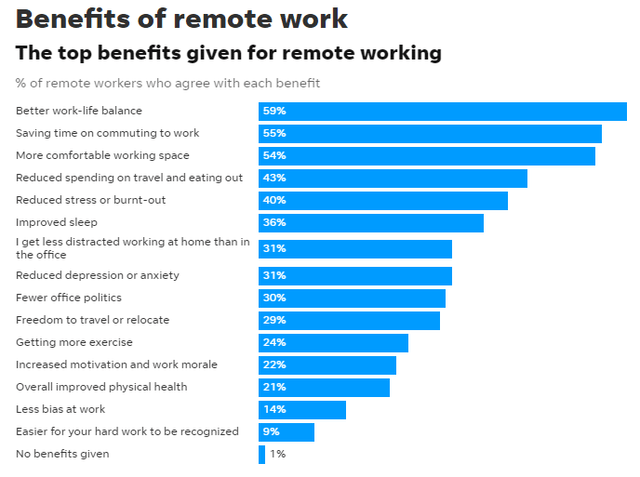

The enablement of remote work opens a lot of possibilities for families relocating. You can pull in a Manhattan salary while working remotely from South Dakota. Take a look at all of the most popular benefits that people agree are a part of remote work. A large majority of these benefits can be linked to how it saves us money.

For example, saving time on commuting also saves us money on transportation. Reduced spending on travel and eating out means less money spent on those expensive lunch outings with coworkers. Even taking it to the extreme, getting more exercise while working remote can directly translate to a lower healthcare bill. Therefore, the data shared here reinforces that possibility of a population spike in this region of the country.

The Risk Profile

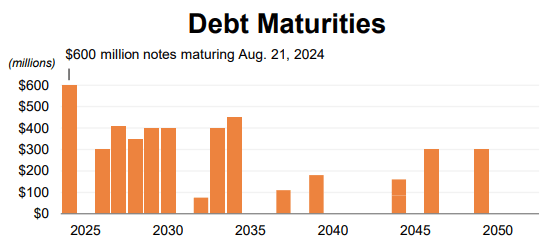

Black Hills does have $600M in notes maturing in August of this year. While the cash from operations totaling $944M can cover it, 2025 through 2030 is where a challenge lies. Manage has done great managing their cash so far but if market continues remain unfavorable towards utilities, it could hurt profitability and the debt may be troublesome as it chews into the profit margins. Management has not borrowed any additional funds since Q1 of 2023 which is great! This shows they are actively working to limit debt exposure and use cash in an efficient manner.

BKH Q4 Presentation

In terms of liquidity, they have access to $750M in revolving credit facility which will likely be access when the future debt maturities are due. There is also an additional $250M they can access through accordion feature with bank consent. The company has a net debt to capitalization of 55%, with debt levels consistently decreasing since 2022. Management has stated they have a long term target net debt to capitalization of 55%.

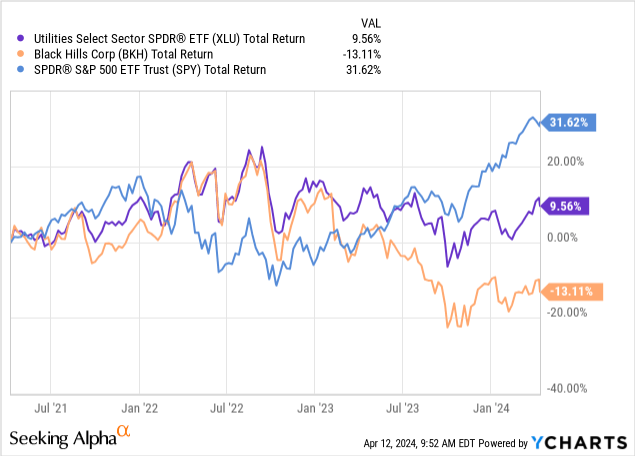

Since debt levels have come down consistently, their equity has increased simultaneously. Credit ratings are also stable with a BBB+ rating from S&P. However, risk still remains from the sector wide performance of utilities. The Utilities Sector (XLU) has lagged behind the S&P (SPY) in total return since the end of the pandemic. With inflation levels still higher than expected, according to the latest CPI report, the underperformance may lag on until the market cycle shifts. Therefore you may risk underperformance by entering here at these levels as there may be additional downside before things get better for utilities.

Dividend

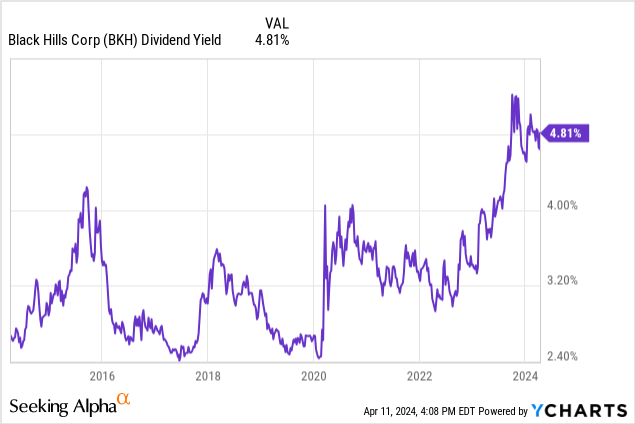

There’s statement that goes “the safest dividend is the one that was just raised”. Even with the headwinds that BKH has faced, they managed to increase the dividend by 4% in January, with a newly declared quarterly payment of $0.65 per share. The raise brings the dividend yield up to approximately 5%. The current payout ratio sits at 64% but this is at the higher end of management’s targeted range. The range laid out over the last earnings report was a payout ratio between 55 – 65%. BKH accumulates $945M in cash from operations to help support this dividend payout ratio.

We can see how the divided yield currently sits near a decade high. This presents an interesting opportunity to lock in a higher upfront yield from a dividend king that is known for growth and consistency. Speaking of growth, the dividend has bee raised for over 54 consecutive years. Over the last 5 year period, the dividend has grown at a CAGR (compound annual growth rate) of 5.2%. If we zoom out to a longer time horizon of 10 years, the dividend has grown at a similar CAGR of 5.14%. The dividend growth would likely be stronger if BKH had better EBITDA growth year over year.

Valuation

The price has come down nearly 28% over a five year timeline. Right before the drop of the pandemic, the price traded around an $85 per share mark in early 2020 and has never quite reached that peak ever since. In terms of valuation, there are some metrics that stand out at the moment. One of those being the current Price to Earnings ratio of 13.4x when the 5-year average P/E is 17.56x. For reference, the sector median P/E is 15.7x which may indicate undervaluation at this price range.

The average Wall St. price target sits at $61 per share, which represents a potential upside of 16%. The highest price target is $77 per share and the lowest sits at $53 per share. The current price sits below even the lowest price target so even Wall St realizes that the price has been disconnected from the fundamentals. However, I wanted to run my own dividend discount calculation to get an estimated fair value to compare this with as well.

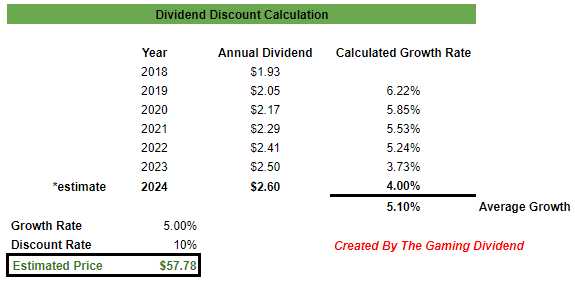

I first started by compiling together all of the annual dividend payout amounts dating back to 2018. Then I took the current quarterly distribution of $0.65 per share and multiplied it by four quarters to get an estimated 2024 payout of $2.60 per share. We can see that this results in dividend growth at an average rate of 5.10%. Management has a targeted EPS growth rate between 4 – 6%, so I chose to go with the middle of the road growth rate of 5%.

Author

As a result, I come to an estimated fair value of $57.78 per share. This represents a potential price upside of 10% from the current price level. When you combine this with an historically high dividend yield nearing 5%, you have the potential to capture a double digit upside of 15% should management reach all of their targeted growth metrics throughout the year. This is a nice positive because even if the price manages to only appreciate 5% over the course of 2024, the dividend yield would still provide you with a total return closer to that double digit mark. With these valuation metrics in mind, I rate BKH a Buy.

Takeaway

Black Hills Corporation (BKH) serves as a quality dividend king that is potentially under valued here and offers a double digit upside in price growth. Based on my dividend growth calculation, I estimate a fair stock value of $57.78 per share. Even though the sector has lagged behind the rest of the market, I believe we the company to be well run from a cash perspective. They are actively seeking growth while simultaneously eliminating debt. This leaves us with the opportunity to collect a historically high yield near 5% while we wait for the tides to turn more favorable.

I think there are many factors in play that can reinforce my prediction of large population growth in the areas that BKH operate. Between insane housing costs, high inflation, high interest rates, and the flexibility of remote work, I think there is a high possibility we see a large population of people migrate away from higher cost of living areas and into the mid-region of the US. As a result, BKH has a lot of potential growth ahead over the next decade. Therefore, I rate Black Hills Corp as a Buy.