Luis Alvarez

Sometimes, large custodians/brokers like Schwab want to own the product. They hope to keep their clients in their own funds as opposed to in other issuers’ products. So what do they do? They create their own branded exchange-traded funds, or ETFs, which don’t really differentiate much except in the name of the fund. That’s very much the story of the Schwab U.S. Broad Market ETF™ (NYSEARCA:SCHB),

SCHB is a product of Charles Schwab Asset Management. Launched in 2009, the SCHB seeks to track the total return of the Dow Jones U.S. Broad Stock Market Index. Designed to give investors a low-cost way to gain exposure to U.S. equities, SCHB offers diversified exposure to around 2,500 of the largest publicly traded U.S. companies, spanning across large-, mid-, and small-cap stocks.

Unpacking the Holdings: Digging Deeper into SCHB’s Portfolio

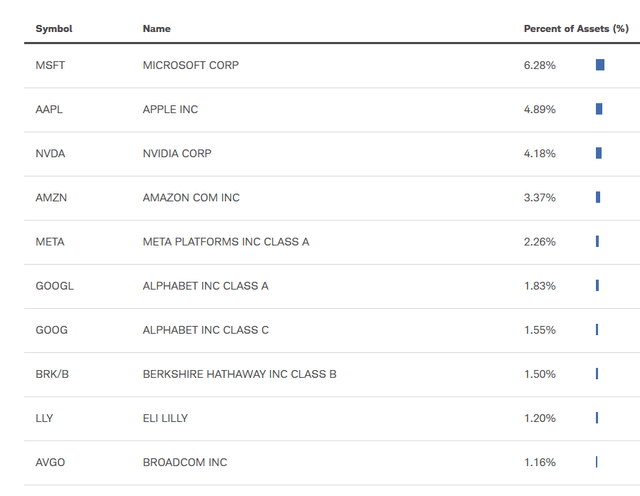

A closer look at SCHB’s holdings reveals a diversified portfolio, spread across multiple sectors, with the top 10 holdings being all the hits you’ve come to love momentum-wise that dominate large market-cap weighted averages.

These top ten holdings constitute approximately 28% of SCHB’s total portfolio, in line with other popular total market ETFs out there.

Sector Composition: Where Does SCHB Place Its Bets?

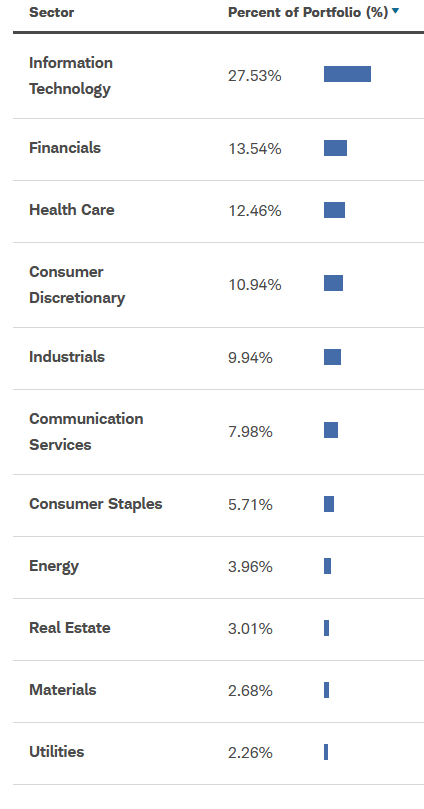

SCHB’s sector allocation is well-diversified, with its largest allocation in the Information Technology sector, followed by Financials and Healthcare.

schwabassetmanagement.com

My only real criticism is that Technology is such a large portion of the fund. I know that’s to be expected, but I worry about there being some mean reversion there, just given how outsized performance has been over the past year.

Peer Comparison: SCHB vs. Other Broad Market ETFs

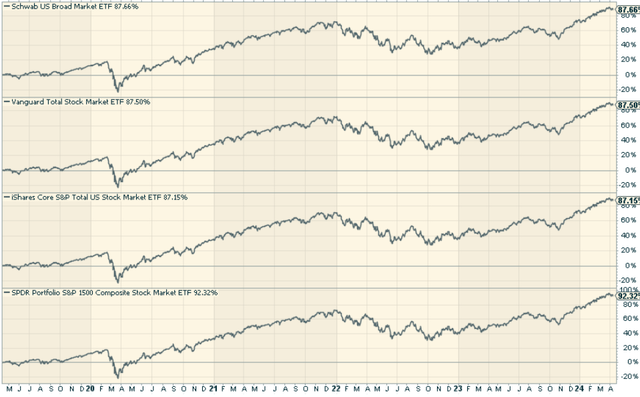

When comparing SCHB to other broad market ETFs, it’s good to consider similar funds like the Vanguard Total Stock Market Index Fund ETF (VTI), the iShares Core S&P Total U.S. Stock Market ETF (ITOT), and the SPDR Portfolio S&P 1500 Composite Stock Market ETF (SPTM).

In terms of expense ratio, all these ETFs come with an ultra-low expense ratio of 0.03%. The performance of all three funds has just about been in line for the last several years. No big surprises here whatsoever, and further adds to the point that there really isn’t much differentiation overall.

Pros and Cons: The Good, The Bad, and The Ugly

As with any investment, SCHB has its own set of pros and cons. On the positive side, SCHB offers a cheap and simple way to gain exposure to U.S. equities. With its diversified portfolio and low expense ratio, it can serve as a core holding in an investor’s portfolio.

However, the ETF does have some drawbacks. For one, it may underperform the S&P 500 Index (SP500) due to its broad exposure to the total stock market, which includes small-cap and mid-cap companies. Moreover, compared to other ETFs like VTI and SPTM, SCHB doesn’t look all that much different. In other words, there’s no discernible edge in choosing SCHB over any other total stock market proxy.

To Invest or Not to Invest: The Final Verdict

Schwab U.S. Broad Market ETF™, with its broad diversification and low expense ratio, is a viable option for investors seeking exposure to the U.S. stock market. However, there’s not much more to it than that.

There’s nothing inherently wrong with the fund at all, and it does its job well as a total stock market proxy. But there’s nothing special about it against nearly every other major core equity fund available. If you love Schwab, then certainly go with this fund as opposed to going with another issuer. I just don’t think it’s interesting enough to get anyone excited here.